US Biomarkers Market Size, Share, Trends, & Industry Analysis By Type, (Safety US Biomarkers, Efficacy US Biomarkers, and Validation US Biomarkers), By Research Area, By Technology, By Disease Indication, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5964

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

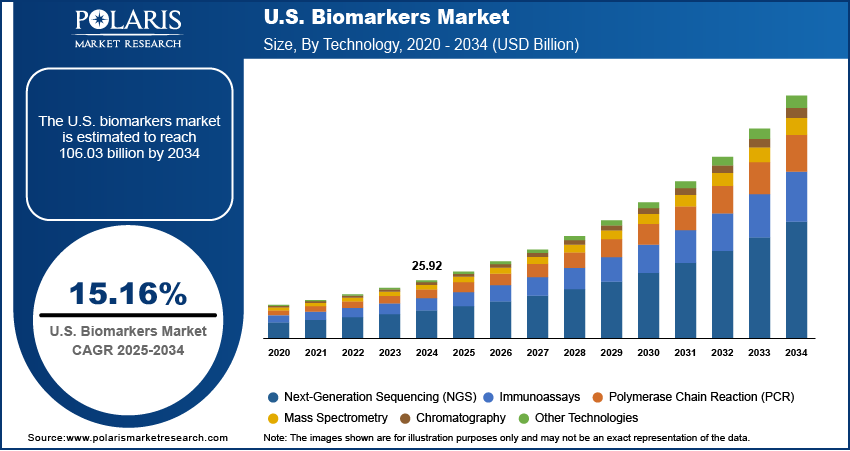

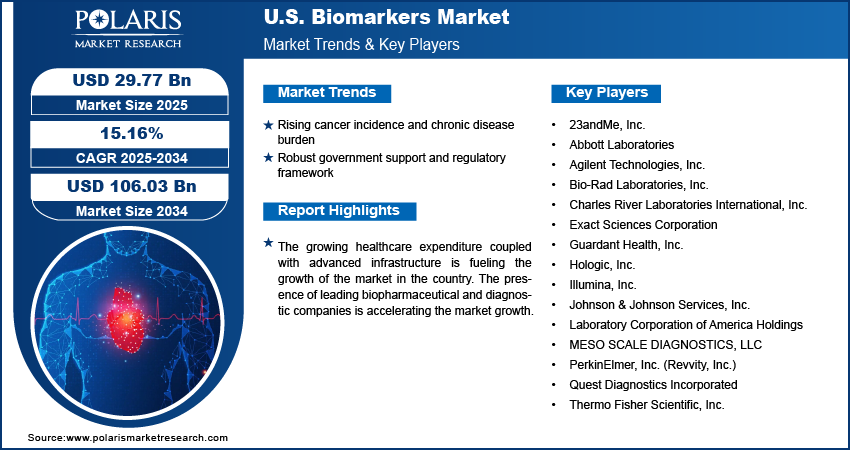

The US biomarkers market size was valued at USD 25.92 billion in 2024, growing at a CAGR of 15.16% from 2025–2034. Rising cancer incidence and chronic disease burden coupled with robust government support and regulatory framework is driving the market growth.

Biomarkers in the US are widely used across clinical diagnostics, therapeutic monitoring, and biomedical research. These biological indicators ranging from proteins and genes to metabolites are essential tools for identifying physiological and pathological conditions in routine medical practice and specialized applications. The country’s healthcare ecosystem supports large-scale utilization of biomarkers for a variety of diseases, including oncology, cardiology, infectious diseases, and neurological disorders.

Biomarkers in the US are collected from biological specimens such as blood, urine, tissue, and cerebrospinal fluid, and are processed using advanced laboratory platforms. The applications span across hospitals, diagnostic laboratories, research institutions, and pharmaceutical settings. Integration of biomarker testing into clinical workflows is becoming increasingly standardized, supporting disease classification, prognosis assessment, and therapy monitoring. In addition to diagnostics, biomarkers are also central to drug discovery and translational medicine initiatives in the US, where it assists researchers in understanding disease biology and evaluating therapeutic efficacy. This wide-ranging utility boost the role as an integral component of the country’s evolving medical and research infrastructure.

To Understand More About this Research: Request a Free Sample Report

The growing healthcare expenditure coupled with advanced infrastructure is fueling the growth of the market in the country. The Centers for Medicare & Medicaid Services reported that US healthcare spending rose by 7.5% in 2023, totaling USD 4.9 trillion equivalent to approximately USD 14,570 per person. The vast network of advanced hospitals, reference laboratories, academic medical centers, and public health institutions collectively support the widespread adoption of biomarker-based technologies. These institutions house sophisticated diagnostic platforms, biobanking facilities, and analytical tools required for processing and interpreting biomarker data at scale. This advancement enables clinical laboratories to perform detailed biomarker testing for early diagnosis, disease staging, and monitoring treatment effectiveness across various conditions.

In addition, the presence of leading biopharmaceutical and diagnostic services companies is further accelerating the market growth. These organizations are actively investing in biomarker discovery, validation, and integration into drug development pipelines. Biomarkers are used by these firms to improve clinical trial design, identify suitable patient populations, and monitor therapeutic response, particularly in complex disease areas such as oncology, autoimmune disorders, and rare diseases. The industry-wide shift toward precision medicine driven the development of an increasing range of companion diagnostics and molecular assays built on validated US biomarkers.

Industry Dynamics

Rising Cancer Incidence and Chronic Disease Burden

The increasing incidence of cancer, cardiovascular conditions, and neurodegenerative disorders in the US is propelling the demand for biomarker-based diagnostics and screening solutions. Cancer remains one of the leading causes of mortality in the country, with a significant number of new cases reported each year. The National Cancer Institute estimates that in 2025, approximately 2,041,910 new cancer cases will be diagnosed in the US, and 618,120 individuals are expected to lose their lives to the disease. Biomarkers are widely used in oncology to support early detection, classify tumor types, and monitor therapeutic outcomes. Additionally, chronic illnesses such as diabetes, Alzheimer’s disease, and heart disease require long-term monitoring and risk assessment, making biomarkers essential tools in patient management and disease progression tracking.

The growing complexity of chronic diseases in the US led to a shift toward more personalized and preventive healthcare models. Biomarkers are crucial in enabling clinicians to stratify patients based on molecular signatures and deliver more targeted therapies. The clinical use of protein, genomic, and imaging US Biomarkers is expanding as healthcare providers seek to reduce diagnostic uncertainty and improve treatment efficiency. This rising disease cases, combined with increasing awareness among clinicians and patients, is fueling the importance of biomarkers in delivering precise, timely, and individualized medical care across a wide range of chronic health conditions.

Robust Government Support and Regulatory Framework

Government initiatives and supportive regulatory structures are increasing the adoption of biomarkers across the healthcare ecosystem in the US Programs such as the Precision Medicine Initiative are pushing the integration of biomarkers into national healthcare strategies, pushing the development of personalized treatments tailored to individual genetic and molecular profiles. For example, the US Food and Drug Administration’s (FDA) Fit-for-Purpose (FFP) Initiative provides a regulatory pathway to support the application of emerging drug development tools (DDTs) in defined contexts within drug development programs.

In addition to regulatory support coupled with federal funding from agencies such as the National Institutes of Health (NIH) is further fueling biomarker-related research and infrastructure development. Public-private partnerships, government-supported clinical studies, and population-level genomics projects are propelling a strong foundation for the widespread adoption of biomarker technologies. These initiatives facilitate innovation and ensure that biomarker assays meet rigorous safety, efficacy, and quality standards. The alignment of policy, research funding, and regulatory clarity provides a highly favorable environment for biomarker commercialization and clinical integration across the US.

Segmental Insights

Type Analysis

The segmentation, based on type includes, safety biomarkers, efficacy biomarkers, and validation biomarkers. The efficacy biomarkers segment is projected to grow at a robust pace by 2034. This dominance is attributed to the increasing use of efficacy biomarkers in evaluating drug responses during clinical trials and monitoring therapeutic outcomes in real-world settings. These biomarkers are particularly valuable in oncology and immunology, determining treatment effectiveness, guiding dose adjustments, and minimizing adverse effects. Pharmaceutical companies are incorporating efficacy biomarkers to enhance clinical trial design, reduce attrition rates, and improve regulatory submission outcomes, making it a central component in drug development strategies.

The validation biomarkers segment is projected to grow at the fastest pace during the forecast period. This growth is driven by the need for reproducible, accurate, and standardized biomarker data in clinical and regulatory settings. Growing importance on data reliability from healthcare providers and regulatory agencies is boosting increased demand for validated biomarkers in areas such as oncology, cardiology, and rare diseases. Validation biomarkers help in confirming the consistency and accuracy of diagnostic results, ensuring to meet clinical and regulatory requirements, thus expanding the adoption across global healthcare markets.

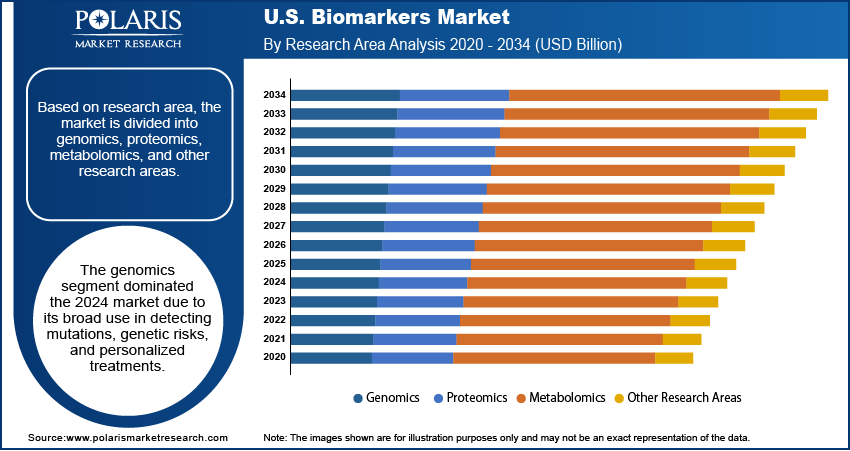

Research Area Analysis

The segmentation, based on research area includes, genomics, proteomics, metabolomics, and other research areas. The genomics segment dominated the market, in 2024. This dominance is attributed to the widespread use in identifying genetic predispositions, detecting mutations, and tailoring therapies in oncology, cardiology, and rare diseases. Genomic biomarkers are integral to precision medicine for guiding clinicians in making data-driven treatment decisions. The increasing use of gene panels, next-generation sequencing, and genome-wide association studies propelled the adoption of genomics in disease risk stratification and targeted therapeutic approaches. For instance, in March 2025, Bio‑Techne launched the AmplideX Nanopore Carrier Plus Kit, a nanopore-based gene panel that resolves 11 carrier screening genes previously difficult to analyze via short-read sequencing.

The proteomics segment is expected to exhibit the fastest growth rate during the forecast period. This rapid expansion is due to the rising adoption of protein-based biomarkers in clinical diagnostics and therapeutic monitoring. Advances in technologies such as mass spectrometry and protein microarrays enabled deeper insights into protein expression, structure, and interactions, which are vital for understanding disease mechanisms. Proteomic biomarkers are increasingly explored for diseases with complex pathophysiology, such as Alzheimer’s, autoimmune disorders, and cancers, driving new developments for diagnostic innovation.

Technology Analysis

The segmentation, based on technology includes, immunoassays, next-generation sequencing (NGS), polymerase chain reaction (PCR), mass spectrometry, chromatography, other technologies. The immunoassays segment accounted for substantial share in 2024 due to the it’s high sensitivity, ease of implementation, and cost-effectiveness position immunoassays as the preferred technology for detecting specific proteins and antibodies in clinical settings. Immunoassays are widely applied in the diagnosis of infectious diseases, cancer, cardiovascular conditions, and autoimmune disorders. The technology is well-suited for point-of-care diagnostics and scalable for large population health programs, maintaining a strong presence in hospital laboratories and decentralized testing settings.

The next-generation sequencing (NGS) segment is projected to witness the fastest growth during the assessment period. The rapid adoption of NGS is driven by its ability to generate detailed genomic data, enabling identification of novel biomarkers and comprehensive disease profiling. NGS is transformative in oncology, rare diseases, and pharmacogenomics, where it supports personalized treatment planning. Its integration into clinical workflows is accelerated by falling sequencing costs, expanding genomic databases, and increasing awareness among healthcare providers of its diagnostic potential.

Disease Indication Analysis

The segmentation, based on disease indication includes, cancer, infectious disease, immunological disorders, neurological disorders, cardiovascular disorders, and other disease indications. The cancer segment dominated the market, in 2024. This dominance is attributed to the high global incidence of cancer and the increasing reliance on biomarker-guided diagnosis and therapy selection. Biomarkers are now essential in stratifying cancer patients, predicting responses to immunotherapies, and monitoring minimal residual disease. In clinical practice, cancer biomarkers such as HER2, BRCA1/2, and PD-L1 become standard tools for treatment planning. The expanding role in companion diagnostics is boosting the importance in delivering personalized oncology care.

The neurological disorders segment is projected to expand at the fastest CAGR during the forecast period. Growing prevalence of neurodegenerative diseases such as Alzheimer’s and Parkinson’s, along with increasing research into early diagnostic strategies, is driving demand for reliable neurological biomarkers. According to the Alzheimer’s Association, more than 7 million Americans are currently living with Alzheimer’s disease, a figure expected to approach 13 million by 2050. These biomarkers offer significant promise in tracking disease progression and predicting therapeutic response, particularly through cerebrospinal fluid analysis, neuroimaging, and blood-based assays. Rising global investment in brain health and neuro-research is further accelerating the segment growth.

Application Analysis

The segmentation, based on application includes, clinical diagnostics, drug discovery & development, personalized medicine, clinical research, and other application. The clinical diagnostics segment accounted for significant share in 2024. This dominance is attributed to the growing incorporation of biomarkers into routine diagnostics for conditions such as cardiovascular diseases, infectious diseases, and cancer. Clinicians are increasingly utilizing biomarker-based tests to guide diagnostic accuracy, enable early detection, and support risk assessment. The shift toward proactive and preventive care models is expanding the use of biomarkers in diagnostics across hospital and outpatient settings.

The personalized medicine segment is expected to witness the fastest growth over the forecast period. The rise of precision healthcare approaches and targeted therapy protocols is fueling demand for biomarkers that match treatments to individual patient profiles. In oncology, biomarkers are essential in determining eligibility for immunotherapy and molecular-targeted drugs. The growth is further fueled by strong regulatory backing, rising patient awareness, and the expanding portfolio of biomarker-based companion diagnostics that enable more tailored clinical decisions.

Key Players & Competitive Analysis Report

The US biomarkers market is marked by strong competition, fueled by rapid advancements in molecular diagnostics, an expanding focus on precision medicine, and rising demand for early disease detection across therapeutic areas. Companies are intensifying efforts to enhance their biomarker capabilities through new assay development, digital integration, and investments in AI-powered analytics. Strategic collaborations with academic institutions, pharmaceutical firms, and healthcare systems are shaping the innovation landscape and accelerating biomarker adoption in clinical workflows. The market is also witnessing increased activity in companion diagnostics, liquid biopsy technologies, and next-generation sequencing tools, supporting more individualized and real-time therapeutic approaches. Major players are actively developing disease-specific biomarker panels for oncology, cardiology, infectious diseases, and neurological conditions.

Prominent players operating in the US biomarkers market include 23andMe, Inc., Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Charles River Laboratories International, Inc., Exact Sciences Corporation, Guardant Health, Inc., Hologic, Inc., Illumina, Inc., Johnson & Johnson Services, Inc., Laboratory Corporation of America Holdings, Meso Scale Diagnostics, LLC, PerkinElmer, Inc. (Revvity, Inc.), Quest Diagnostics Incorporated, and Thermo Fisher Scientific, Inc.

Key Players

- 23andMe, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories International, Inc.

- Exact Sciences Corporation

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Johnson & Johnson Services, Inc.

- Laboratory Corporation of America Holdings

- Meso Scale Diagnostics, LLC

- PerkinElmer, Inc. (Revvity, Inc.)

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc.

Industry Developments

June 2025: Columbia University launched the Center for Innovation in Imaging Biomarkers and Integrated Diagnostics (CIMBID). The multidisciplinary center combines AI, biomedical imaging, and data science to develop novel imaging biomarkers and accelerate translation into clinical practice.

May 2025: The University of Houston secured a USD 3 million grant from the Cancer Prevention and Research Institute of Texas (CPRIT) to develop a cancer immunotherapy biomarker core facility specializing in advanced proteomic screening technologies. This initiative strengthened the US biomarkers industry by accelerating the discovery of protein-based biomarkers for cancer immunotherapy applications.

November 2024: Perspectum awarded a US FDA Drug Development Tool grant of approximately USD 250,000 to evaluate a novel non-invasive MRI biomarker aimed at monitoring primary sclerosing cholangitis in rare disease drug development.

US Biomarkers Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Safety US Biomarkers

- Efficacy US Biomarkers

- Validation US Biomarkers

By Research Area Outlook (Revenue, USD Billion, 2020–2034)

- Genomics

- Proteomics

- Metabolomics

- Other Research Areas

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Immunoassays

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Mass Spectrometry

- Chromatography

- Other Technologies

By Disease Indication Outlook (Revenue, USD Billion, 2020–2034)

- Cancer

- Infectious Disease

- Immunological Disorders

- Neurological Disorders

- Cardiovascular Disorders

- Other Disease Indications

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Clinical Research

- Other Application

US Biomarkers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 25.92 Billion |

|

Market Size in 2025 |

USD 29.77 Billion |

|

Revenue Forecast by 2034 |

USD 106.03 Billion |

|

CAGR |

15.16% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The US market size was valued at USD 25.92 billion in 2024 and is projected to grow to USD 106.03 billion by 2034.

The US market is projected to register a CAGR of 15.16% during the forecast period.

A few of the key players in the market are 23andMe, Inc., Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Charles River Laboratories International, Inc., Exact Sciences Corporation, Guardant Health, Inc., Hologic, Inc., Illumina, Inc., Johnson & Johnson Services, Inc., Laboratory Corporation of America Holdings.

The genomics segment dominated the market, in 2024.

The next-generation sequencing (NGS) segment is projected to witness the fastest growth during the assessment period.