U.S. Corrugated Plastic Sheets Market Size, Share, Trends, & Industry Analysis By Material Type (Polyethylene (PE), Polypropylene (PP), and Other Material Types), By Thickness, By End Use, and By Country– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5951

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

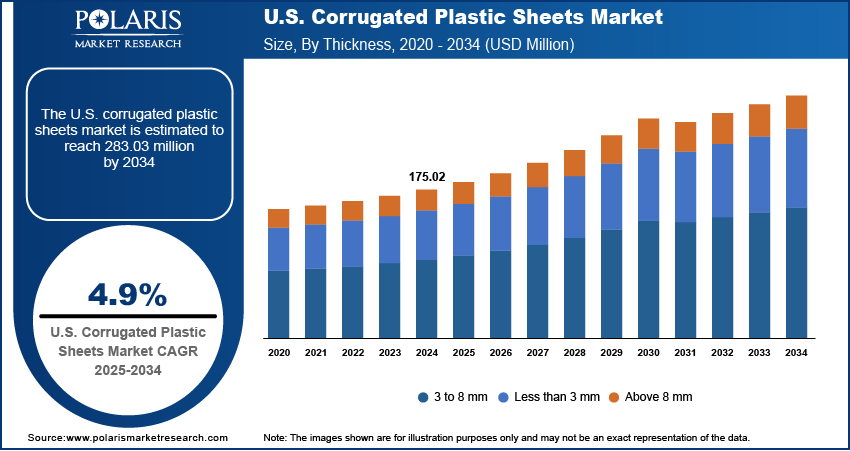

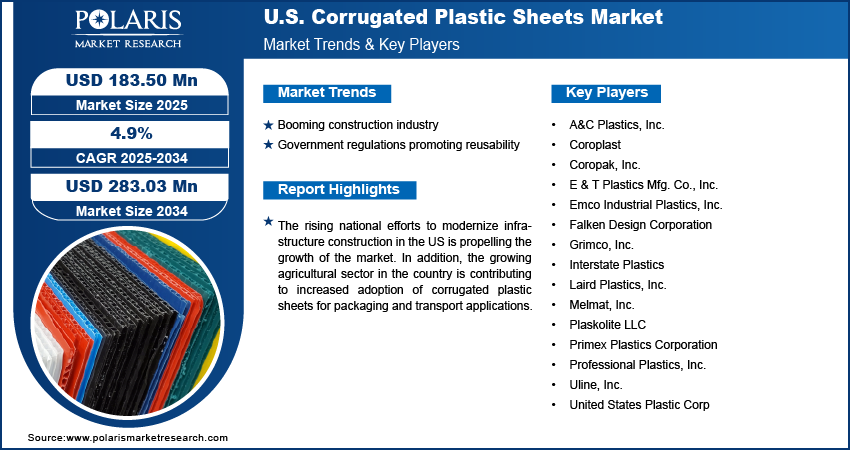

The US corrugated plastic sheets market size was valued at USD 175.02 million in 2024, growing at a CAGR of 4.9% during 2025–2034. Growth in E-commerce and retail logistics along with emphasis on sustainable packaging is fueling the market growth.

The US corrugated plastic sheets market plays a significant role in the broader North American polymer-based sheet industry, with growing applications across packaging, construction, agriculture, and display signage. These sheets, typically manufactured from polypropylene (PP) or polyethylene (PE), feature a twin-wall or fluted structure that delivers excellent strength-to-weight ratio and reusability. Their resistance to water, chemicals, and impact makes them a preferred choice for temporary protection, reusable containers, and advertising displays across commercial and industrial settings.

In the US, corrugated plastic sheets are commonly fabricated into custom-fit packaging components, including totes, bins, and dividers, widely used in automated warehousing and material handling operations. In construction and real estate development, the sheets are used for protecting surfaces during remodeling or build-outs. Additionally, their compatibility with printing and die-cutting processes supports their widespread use in point-of-sale displays, political signs, and outdoor advertisements. Growing emphasis on recyclability, customization, and material performance is driving the use of corrugated plastic sheets as a cost-effective and durable solution across a wide range of end-use sectors in the US market.

The demand for corrugated plastic sheets is increasing in US construction projects due to the country’s continued focus on infrastructure renewal. Federal and state-level investment in roads, transit systems, housing, and public facilities led to a growing need for reliable, temporary protective materials that withstand rugged jobsite conditions. According to the American Institute of Architects Commercial, construction spending is projected to rise by 1.7% in 2025, followed by a stronger increase of 4.2% in 2026. These sheets are commonly used for floor protection, concrete formwork, and wall coverings during construction and renovation activities. Moisture resistance, high strength, and ease of handling position corrugated plastic sheets as a practical choice for fast-paced construction settings where durability and reusability are essential.

The US agricultural sector is adopting corrugated plastic sheets and related products such as bins, trays, and containers to improve the efficiency and safety of fresh produce handling and transportation. Expanding and increasingly automated farming operations are driving demand for packaging materials that offer lightweight construction, moisture resistance, and reliable protection for perishable goods during storage and transport. Corrugated plastic bins offer durability and reusability, supporting short-haul and long-distance transport of fruits, vegetables, and other farm products.

Industry Dynamics

Growth in E-commerce and Retail Logistics

The rapid expansion of e-commerce in the US is significantly driving demand for durable and green packaging solutions such as corrugated plastic sheets. According to the US Census Bureau, retail e-commerce sales in the country totaled USD 288.8 million in the third quarter of 2024, reflecting a 2.2% increase from the previous quarter and a 7.5% rise compared to Q3 2023. This surge in online transactions is pushing logistics providers and retailers to adopt returnable packaging formats that withstand repeated handling and long-distance shipping. Corrugated plastic sheets are increasingly used in bins, sleeves, dividers, and product protection inserts for warehouse storage and last-mile delivery, supporting better handling efficiency and cost control.

The strength, water resistance, and lightweight nature of corrugated plastic packaging offer operational advantages over single-use cardboard and foam materials. These sheets are compatible with automated packaging lines and are easy to sanitize, making them suitable for omnichannel fulfillment centers. Additionally, reusable corrugated plastic solutions reduce packaging waste, lower total cost of ownership, and improve inventory turnover rates by enabling more consistent and damage-free deliveries. Retailers aiming to streamline supply chains and reduce environmental impact are contributing to strong demand for durable, customizable packaging options such as corrugated plastic sheets across the U.S. e-commerce sector.

Emphasis on Sustainable Packaging

Growing awareness around environmental impact along with increasing regulatory pressure are propelling US businesses to transition from single-use to sustainable packaging solutions. For instance, in April 2024, four states California, Maine, Oregon, and Colorado passed Extended Producer Responsibility (EPR) legislation for packaging, marking a shift toward enforceable sustainability practices. Additional states, including New York, Minnesota, and Tennessee, are actively developing similar regulatory frameworks. These EPR laws are designed to hold producers accountable for the entire lifecycle of packaging materials, pushing companies to adopt recyclable and reusable alternatives such as corrugated plastic sheets. Industries aiming to reduce waste and to meet with environmental, social, and governance (ESG) goals are increasingly choosing these sheets for reusable, durable, and recyclable properties.

Additionally, the shift toward circular economy models is further accelerating the use of corrugated plastic materials. Businesses across sectors ranging from automotive and agriculture to logistics and retail are incorporating corrugated plastic into returnable transit packaging (RTP) systems to minimize packaging turnover and improve supply chain sustainability. These sheets are reused hundreds of times without losing structural integrity and are fully recyclable at the end of lifecycle, reducing the environmental burden associated with traditional packaging. The rising demand for corrugated plastic sheets reflects growing pressure on brands and manufacturers to meet sustainability expectations while maintaining operational efficiency and long-term environmental goals.

Segmental Insights

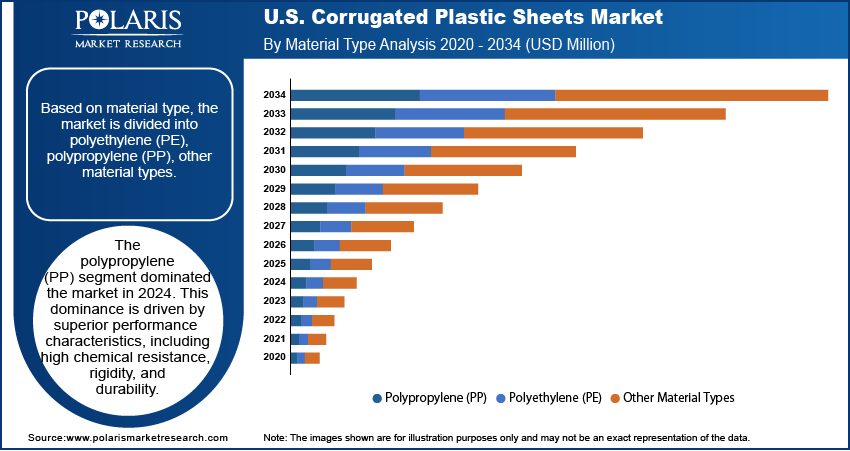

Material Type Analysis

The segmentation, based on material type includes, polyethylene (PE), polypropylene (PP), other material types. The polypropylene (PP) segment dominated the market in 2024. This dominance is driven by superior performance characteristics, including high chemical resistance, rigidity, and durability. These properties make it ideal for demanding applications in packaging, automotive parts, agricultural trays, and construction protection. Polypropylene corrugated sheets are widely used in returnable transit packaging (RTP) and point-of-sale displays due to high strength-to-weight ratio and weather resistance. These attributes help industries lower transportation costs while maintaining structural stability, leading to broad usage across multiple industrial supply chains.

The polyethylene (PE) segment is anticipated to register the fastest growth during the forecast period. PE corrugated sheets are known for flexibility, impact resistance, and cost-effectiveness, making it ideal for lightweight packaging, protective surface covers, and signage in indoor and outdoor environments. The softer texture of PE corrugated sheets makes them ideal for delicate handling in agricultural use and temporary construction setups. Recyclable composition and alignment with broader sustainability goals are propelling a shift from single-use options toward PE-based reusable solutions. Rising demand for eco-friendly, lightweight, and multipurpose plastic sheets is further accelerating PE adoption across developed and emerging markets.

Thickness Analysis

The segmentation, based on thickness includes, less than 3 mm, 3 to 8 mm, and above 8 mm. The 3 to 8 mm segment dominated the market, in 2024, owing to its optimal balance between flexibility and rigidity. Corrugated plastic sheets in this thickness range are extensively used for returnable packaging boxes, warehouse partitions, layer pads, and floor protection in construction. These sheets offer a suitable combination of strength and manageability, making them cost-effective and easy to transport. Industries such as food and beverage, electronics, and logistics prefer this thickness as it provides sufficient durability to protect products during handling and transit without adding unnecessary weight.

The above 8 mm segment is projected to grow at the fastest pace during the forecast period. Sheets in this category are increasingly used in demanding applications such as heavy-duty protective barriers, structural panels in construction, and reusable bins for high-load materials. The added thickness enhances impact strength, rigidity, and weather resistance, making it suitable for outdoor and industrial environments where durability is essential. Construction and industrial users are turning to these thicker sheets as alternatives to plywood or metal panels, particularly in temporary structures, concrete formwork, and safety partitions. The ability to reuse them multiple times, combined with low maintenance and long service life, is accelerating the market growth.

End Use Analysis

The segmentation, based on, end use includes, packaging, logistics & transportation, building & construction, agriculture & allied products, and other end uses. The packaging segment accounted for substantial market share in 2024. This dominance is due to the rising need for moisture-resistant, impact-tolerant, and reusable packaging materials across industries such as pharmaceuticals, electronics, food and beverage, and industrial manufacturing. Corrugated plastic sheets are used to create custom-fit packaging solutions such as boxes, trays, sleeves, and dividers, offering enhanced protection and efficiency during product transport and storage. In addition, the growing demand for sustainable packaging alternatives is pushing manufacturers to adopt corrugated plastic solutions that reduce waste and operating costs. For instance, Nestlé aims to design over 95% of its plastic packaging for recycling by the end of 2025, with the goal of reaching 100% recyclable or reusable packaging. The company also plans to cut its use of virgin plastic by one-third within the same timeframe.

The building & construction segment is forecasted to grow at the fastest rate over the coming years. Corrugated plastic sheets are increasingly used for applications such as temporary floor protection, formwork liners, insulation backing, and wall partitions on construction sites. The sheets’ lightweight nature, resistance to moisture and chemicals, and ease of installation make them a preferred choice among contractors and site managers looking for reliable and cost-efficient materials. Increasing investments in infrastructure, urban development, and renovation projects are driving demand for building materials that offer reusability and safety. According to the World Bank, private participation in infrastructure (PPI) investments reached USD 86.0 million in 2023, accounting for 0.2% of the combined GDP of all low- and middle-income countries.

Key Players & Competitive Analysis Report

The U.S. corrugated plastic sheets market is moderately consolidated, with several key players competing on the basis of product durability, reusability, customization options, and supply chain efficiency. Leading manufacturers are focusing on expanding the regional presence, improving distribution networks, and investing in product innovation to meet the growing demand from industries such as packaging, construction, agriculture, and retail logistics. The increasing preference for recyclable and reusable materials is prompting companies to introduce corrugated plastic solutions that to meet with sustainability goals and regulatory compliance, under extended producer responsibility (EPR) frameworks. Companies are also forming partnerships with packaging distributors, agricultural suppliers, and construction material retailers to strengthen their end-market reach.

Prominent companies operating in the U.S. corrugated plastic sheets market include A&C Plastics, Inc., Coroplast, Coropak, Inc., E & T Plastics Mfg. Co., Inc., Emco Industrial Plastics, Inc., Falken Design Corporation, Grimco, Inc., Interstate Plastics, Laird Plastics, Inc., Melmat, Inc., Plaskolite LLC, Primex Plastics Corporation, Professional Plastics, Inc., Uline, Inc., United States Plastic Corp.

Key Players

- A&C Plastics, Inc.

- Coroplast

- Coropak, Inc.

- E & T Plastics Mfg. Co., Inc.

- Emco Industrial Plastics, Inc.

- Falken Design Corporation

- Grimco, Inc.

- Interstate Plastics

- Laird Plastics, Inc.

- Melmat, Inc.

- Plaskolite LLC

- Primex Plastics Corporation

- Professional Plastics, Inc.

- Uline, Inc.

- United States Plastic Corp.

Industry Developments

December 2024: Inteplast Group completed the acquisition of CoolSeal USA, a polypropylene corrugated sheet and box manufacturer based in Perrysburg, Ohio. This move strengthens Inteplast’s sustainable packaging portfolio and underscores its commitment to environmentally responsible manufacturing and circular economy initiatives.

US Corrugated Plastic Sheets Market Segmentation

By Material Type Outlook (Revenue, USD Million, 2020–2034)

- Polyethylene (PE)

- Polypropylene (PP)

- Other Material Types

By Thickness Outlook (Revenue, USD Million, 2020–2034)

- Less than 3 mm

- 3 to 8 mm

- Above 8 mm

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Packaging

- Logistics & Transportation

- Building & Construction

- Agriculture & Allied Products

- Other End Uses

US Corrugated Plastic Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 175.02 Million |

|

Market Size in 2025 |

USD 183.50 Million |

|

Revenue Forecast by 2034 |

USD 283.03 Million |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The US market size was valued at USD 175.02 million in 2024 and is projected to grow to USD 283.03 million by 2034.

The US market is projected to register a CAGR of 4.9% during the forecast period.

A few of the key players in the market are A&C Plastics, Inc., Coroplast, Coropak, Inc., E & T Plastics Mfg. Co., Inc., Emco Industrial Plastics, Inc., Falken Design Corporation, Grimco, Inc., Interstate Plastics, Laird Plastics, Inc., Melmat, Inc., Plaskolite LLC, Primex Plastics Corporation, Professional Plastics, Inc., Uline, Inc., United States Plastic Corp.

The polypropylene (PP) segment dominated the market in 2024.

The above 8 mm segment is projected to grow at the fastest pace during the forecast period.