US Flavors and Fragrances Market Size, Share, Trends, Industry Analysis Report

: By Product (Natural and Aroma Chemicals) and By Application – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 126

- Format: PDF

- Report ID: PM4813

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

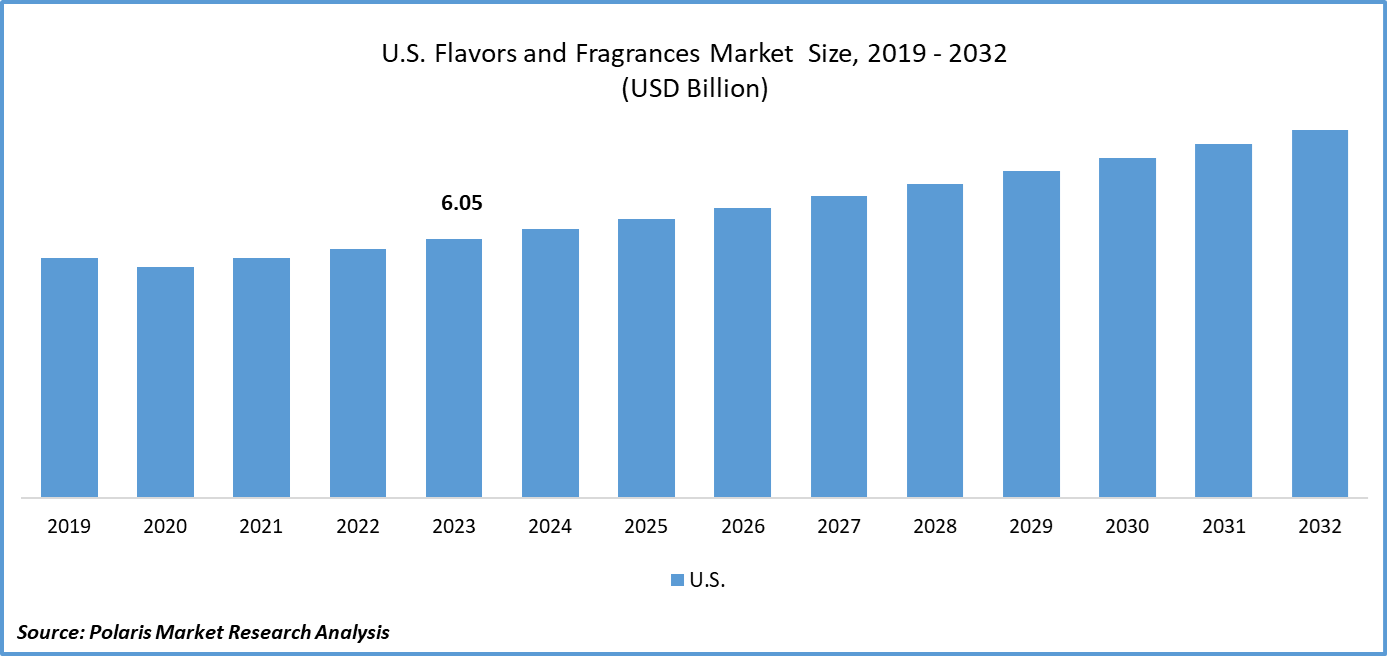

The US flavors and fragrances market size was valued at USD 5.99 billion in 2024, growing at a CAGR of 3.5% during 2025–2034. The market growth is primarily driven by the growing consumer preference for organic, plant-based products.

Key Insights

- The natural segment led the market in 2024. The segment’s dominance is primarily attributed to the increased demand for organic and botanical inputs across food and personal care applications.

- The flavors segment dominated the market in 2024. The ongoing expansion of the processed food and functional beverage sectors contributes to the segment’s leading market share.

- The fragrances segment is projected to witness rapid growth, driven by the significant rise in demand for wellness-driven home care and personal care products.

Industry Dynamics

- The rising consumer expenditure on wellness, beauty, and personal grooming is significantly contributing to the market growth.

- Increased consumer preference for biodegradable and sustainably sourced ingredients is reshaping product development strategies and fueling market expansion.

- Growing consumer preference towards natural and clean label ingredients is creating several market opportunities.

- Stringent regulatory compliance may present market challenges.

Market Statistics

2024 Market Size: USD 5.99 billion

2034 Projected Market Size: USD 8.43 billion

CAGR (2025-2034): 3.5 %

To Understand More About this Research:Request a Free Sample Report

The US flavors and fragrances market refers to the industry involved in the development, production, and commercialization of flavoring agents and aromatic compounds used to enhance the sensory appeal of food, beverages, personal care products, cosmetics, household goods, and pharmaceuticals. This market encompasses both natural and synthetic ingredients and plays a critical role in product differentiation and consumer brand perception across a wide range of consumer-packaged goods.

Increasing consumer preference for organic, plant-based, and non-GMO products is driving the demand for natural flavors and essential oil-based fragrances. For instance, according to the Plant Based Foods Association, ∼ 66% of the US population actively incorporates plant-based foods into their diets. Furthermore, a significant 77% of consumers prioritize sustainability as a critical factor in their food selection process. Notably, 52% of the population perceives plant-based dishes as nutritionally superior to their meat-based counterparts. Technological advancements in encapsulation and controlled-release fragrance systems are enhancing product performance and consumer appeal.

The incorporation of functional ingredients such as botanicals and adaptogens in both flavors and fragrances is gaining popularity. Furthermore, brands are investing in unique scent and taste profiles to build stronger emotional connections and differentiate their products market expansion.

Market Dynamics

Rising Consumer Expenditure

Rising consumer expenditure on beauty, wellness, and personal grooming is significantly contributing to the US flavors and fragrances market growth. For instance, the US Bureau of Labor Statistics reported that the average annual expenditures for consumer units in 2023 reached USD 77,280, reflecting a 5.9% increase compared to the previous year, 2022. The increasing demand for high-performance personal care products such as perfumes, skincare, and haircare items is driving the adoption of sophisticated and long-lasting fragrance formulations. Brands are focusing on olfactory branding and sensory appeal to create signature scents that resonate with consumer identity and lifestyle preferences. The integration of mood-enhancing and therapeutic fragrances in self-care routines is also fueling market expansion. Customization, premiumization, and demand for multifunctional products are encouraging fragrance manufacturers to innovate and deliver unique scent profiles that elevate user experience, further strengthening their role in the evolving personal care segment.

Rising Sustainability Initiatives

Growing preference for biodegradable, eco-friendly, and sustainably sourced ingredients is reshaping product development strategies across the industry. Manufacturers are investing in green chemistry, renewable raw materials, and circular production processes to align with sustainability goals. These initiatives are reducing environmental impact and enhancing brand value and consumer trust. As regulatory scrutiny intensifies and ethical sourcing becomes a competitive advantage, sustainable innovation is expected to play a pivotal role in long-term market expansion and product differentiation.

Segment Insights

Market Breakdown by Product

Based on product, the market is segmented into natural and aroma chemicals. The natural segment accounted for a larger market share in 2024 due to the surge in demand for botanical and organic inputs across food, beverage, and personal care applications. Increased consumer scrutiny of ingredient labels, coupled with a pronounced shift toward wellness-oriented consumption, has accelerated the use of essential oils, plant extracts, and fermentation-derived compounds. Regulatory alignment with FDA GRAS guidelines and heightened interest in ethically sourced raw materials have also bolstered natural product integration.

The aroma chemicals segment is projected to experience the highest CAGR in the coming years. Innovation in synthetic biology, cost-efficiency in large-scale production, and the ability to tailor precise olfactory profiles are contributing to its growth. Additionally, increased use of aroma chemicals in industrial and fine fragrance applications, where performance consistency and thermal stability are critical, is expected to amplify segment momentum.

Market Breakdown by Application

In terms of application, the market is segmented into flavors and fragrances. The flavors segment held the largest market share in 2024 due to the ongoing expansion of the processed food and functional beverage sectors. Rising consumer preference for experiential eating and the proliferation of plant-based alternatives have created strong demand for authentic, region-specific, and clean-label flavor solutions. Advanced encapsulation technologies and flavor masking agents are supporting product development in segments such as protein-based beverages and nutraceuticals, reinforcing the segment’s commercial dominance.

The fragrances segment is projected to grow at a rapid pace during the forecast period owing to a sharp increase in demand for wellness-driven personal care and home care products. The emergence of emotional wellness as a purchase driver, along with technological advancements in fragrance delivery systems, such as skin-adaptive formulations and long-lasting microcapsules, is fueling adoption. The fragrance sector is also benefiting from premiumization trends and consumer interest in artisanal and signature scents.

Key Players and Competitive Insights

The competitive landscape of the US flavors and fragrances market is characterized by dynamic industry analysis focused on innovation-driven growth and strategic positioning. Market participants are actively pursuing market expansion strategies through a blend of joint ventures, strategic alliances, and mergers and acquisitions, aiming to enhance their capabilities in natural ingredient sourcing, sustainable formulation, and proprietary flavor and fragrance technologies. The sector has witnessed a sharp increase in product launches, particularly in clean-label and wellness-oriented formulations, reflecting a shift toward consumer-centric innovation. Post-merger integration initiatives are being carefully executed to align R&D, streamline supply chains, and scale up production for customized solutions across various end-use sectors such as food, beverage, cosmetics, and personal care. Technology advancements, including biotech-enabled aroma molecules, AI-assisted sensory profiling, and green chemistry, are reinforcing the competitive edge of firms focused on next-generation product development. A growing emphasis on olfactory branding, experiential consumption, and eco-conscious product portfolios is further intensifying competition. The US flavors and fragrances market is evolving rapidly, driven by consumer sophistication, regulatory compliance, and rising demand for differentiated, high-performance flavor and fragrance compounds, prompting companies to recalibrate their go-to-market models and value chain integration strategies.

A few major players in the market are Alpha Aromatics; Archer-Daniels-Midland Company; BASF SE; dōTERRA International; Elevance Renewable Sciences, Inc.; International Flavors & Fragrances Inc.; Ungerer & Company; Vigon International, Inc.; and Young Living Essential Oils.

Alpha Aromatics, engaged in the development and manufacturing of fragrances, operates as an international company based in Pittsburgh, Pennsylvania. The company specializes in creating organic, natural, and designer fragrance compositions tailored for a broad array of applications, including fine perfumes, personal care products, candles, diffusers, home fragrances, and odor neutralizers. Its product portfolio encompasses both natural and synthetic aroma ingredients, allowing for the formulation of distinctive scents suited to current consumer trends. The company provides fine fragrances and natural perfume creations, air fresheners for household use, essential and massage oils, and ingredients for perfume and beauty products. In addition to fragrances for candles and diffusers, Alpha Aromatics develops specialized odor control products, utilizing technologies such as the Metazene molecular odor counteractant. The company offers a suite of services that includes scent branding, fragrance system diffusion for ambient spaces, in-house package design, graphics, and marketing support, as well as sourcing for filling and packaging finished products in varying quantities. Alpha Aromatics serves private label manufacturers, custom packaging companies, and toll blenders, supporting both small and large-scale production needs. With a history spanning over seven decades, Alpha Aromatics maintains a presence that reaches international markets, supplying scents to respected brands and adapting its offerings to diverse regional requirements and preferences.

International Flavors & Fragrances Inc. is engaged in the creation and supply of products across texture, taste, scent, enzymes, nutrition cultures, soy proteins, and probiotics categories. Headquartered in New York City, IFF operates globally, with manufacturing facilities and laboratories in 44 countries. The company’s specialty lies in its diversified business segments: Scent, Health & Biosciences, Nourishand Pharma Solutions. The Nourish segment delivers natural and plant-based specialty food ingredients, flavor compounds, savory solutions, and natural food protection ingredients. In contrast, the Scent segment focuses on fragrance compounds for fine fragrances, consumer products, and personal care applications. IFF’s product portfolio includes synthetic and natural fragrance ingredients, cosmetic active ingredients, botanicals, and delivery systems for cosmetic and personal care lines. The Health & Biosciences segment develops enzymes, food cultures, probiotics, and specialty ingredients, and the Pharma Solutions segment supplies cellulosic and seaweed-based pharmaceutical excipients. IFF provides services to manufacturers of perfumes, cosmetics, hair and personal care products, soaps, detergents, cleaning and hygiene products, food and beverages, dietary supplements, and pharmaceutical excipients.

List of Key Companies

- Alpha Aromatics

- Archer-Daniels-Midland Company

- BASF SE

- dōTERRA International

- Elevance Renewable Sciences, Inc.

- International Flavors & Fragrances Inc.

- Ungerer & Company

- Vigon International, Inc.

- Young Living Essential Oils

US Flavors and Fragrances Industry Developments

February 2025: IFF announced a strategic expansion of its Cedar Rapids, Iowa facility aimed at capitalizing on the growing market for healthy snacks both domestically and internationally.

January 2023: IFF launched CHOOZIT VINTAGE flavors in Canada and the US to help cheddar cheese producers prevent undesirable flavor changes during aging.

US Flavors and Fragrances Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Natural

- Essential Oils

- Oleoresins

- Others

- Aroma Chemicals

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Flavors

- Fragrances

US Flavors and Fragrances Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.99 billion |

|

Market Size Value in 2025 |

USD 6.19 billion |

|

Revenue Forecast by 2034 |

USD 8.43 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 5.99 billion in 2024 and is projected to grow to USD 8.43 billion by 2034.

The market is projected to register a CAGR of 3.5% during the forecast period.

A few key players in the market are Alpha Aromatics; Archer-Daniels-Midland Company; BASF SE; d?TERRA International; Elevance Renewable Sciences, Inc.; International Flavors & Fragrances Inc.; Ungerer & Company; Vigon International, Inc.; and Young Living Essential Oils.

The natural segment accounted for a larger market share in 2024 due to the surge in demand for botanical and organic inputs across food, beverage, and personal care applications.

The flavors segment held the largest market share in 2024 due to the ongoing expansion of the processed food and functional beverage sectors.