US Healthcare/Hospital Food Services Market Size, Share, Trends, Industry Analysis Report

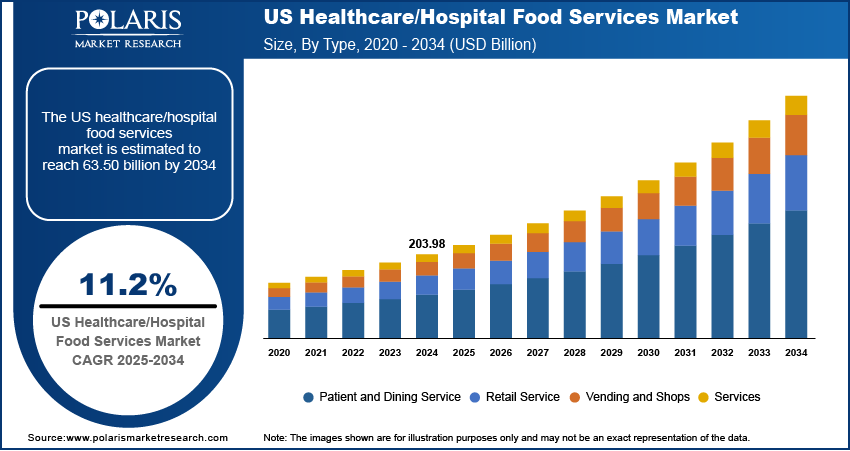

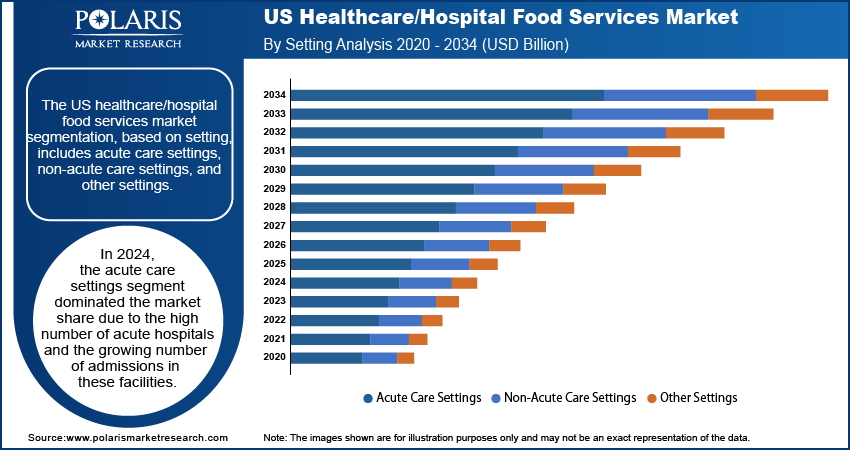

: By Type (Patient and Dining Service, Retail Service, Vending and Shops, and Other Services) and Settings – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM5619

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The US healthcare/hospital food services market size was valued at USD 22.05 billion in 2024, exhibiting a CAGR of 11.2% during 2025–2034. The market is driven by patient-centered care, rising chronic diseases, increasing hospital admissions, and technology improving meal accuracy and efficiency.

Key Insights

- Patient and dining services are growing fastest due to personalized nutrition and meal plans tailored for chronic disease patients.

- Acute care settings dominate because of many hospitals and high admission rates requiring continuous medical and nutritional support.

Industry Dynamics

- Patient-centered care emphasizes nutritious, appealing meals to improve recovery and satisfaction, boosting demand for quality hospital food services.

- Rising chronic diseases require specialized diets, increasing demand for tailored meal options within healthcare facilities.

- Growing hospital admissions raise the volume of meals needed, encouraging expansion and innovation in hospital food service operations.

- High costs of implementing advanced food service technology may limit adoption in some healthcare facilities, restricting market growth.

Market Statistics

2024 Market Size: USD 22.05 billion

2034 Projected Market Size: USD 63.50 billion

CAGR (2025–2034): 11.2%

To Understand More About this Research:Request a Free Sample Report

Healthcare or hospital food services provide nutritious meals to patients, staff, and visitors within healthcare settings. These services are designed to meet dietary needs, promote recovery, and ensure proper nutrition for various health conditions.

The US healthcare system has been moving toward patient-centered care, which focuses on improving the overall experience for patients, including their nutrition. The quality of food served in hospitals is viewed as an essential aspect of recovery. Hospitals recognize that a positive meal experience enhances patient satisfaction and recovery rates. This realization has led to an increased focus on providing better food options and offering diverse, appealing, and nutritious meals. Healthcare providers are prioritizing patient comfort and recovery, prompting hospitals to invest more in food services to align with these patient-centered care trends, thereby driving the healthcare food service market growth.

Technology is playing a major role in improving hospital food services. Hospitals now deliver more accurate and efficient meal services with tools such as automated meal ordering systems, digital menus, and artificial Intelligence-powered nutrition trackers. These systems help reduce human error, speed up service, and ensure that each patient gets the right meal according to their health needs. Kitchen operations have also become more organized through digital inventory and waste tracking. Foodservice becomes faster, safer, and more cost-effective as hospitals adopt these tech solutions.

Market Dynamics

Rising Prevalence of Chronic Disease

Chronic diseases such as diabetes, heart disease, and obesity are becoming more common in the US, and this is having a direct impact on hospital food services. According to the Centers for Disease Control, 38.4 million people in the US have diabetes, representing 11.6% of the total US population. Patients suffering from these conditions require carefully controlled diets such as low-sugar or low-sodium meals to manage their health. Additionally, rising cases of drug-induced disease, due to rising consumption of drugs such as diabetes drugs, are driving the demand for meal services as an alternative. Consequently, hospitals need to offer special meal options tailored to different health concerns. This demand for disease-specific diets is encouraging healthcare facilities to improve their food services. Thus, the rising prevalence of chronic diseases fuels the US healthcare/hospital food services market expansion.

Increasing Hospital Admissions

Hospital admissions across the US are increasing significantly, driving demand for healthcare food services. According to the American Hospital Association, in 2023, 31,967,073 hospital admissions were recorded in community hospitals alone across the US. Factors such as an aging population, higher prevalence of chronic illnesses, and greater access to healthcare under insurance programs have led to more patients requiring interactive patient care. Each admitted patient needs regular, nutritionally balanced meals that support treatment and recovery. Hospital food service operations expand and improve to meet demand as hospitals experience more patient inflow. This rise in hospital admissions increases the volume of meals needed and pushes the need for more efficient, scalable, and patient-focused food service solutions, thereby driving the US healthcare/hospital food services market opportunity.

Segment Analysis

Market Assessment by Type Outlook

The market segmentation, based on type, includes patient and dining service, retail service, vending and shops, and other services. The patient and dining service segment is expected to witness the fastest growth during the forecast period due to hospitals' increasing focus on improving patient satisfaction and recovery through personalized nutrition and nutrition consulting services. Customized meal plans that cater to individual dietary needs have become essential, especially with the rising prevalence of chronic diseases requiring specialized diets. Additionally, the convenience of room service and restrictions on outside food have further propelled this segment's growth. Investments in food service equipment and diverse dining options are expected to continue driving the patient and dining services segment forward as hospitals strive to improve patient experiences, thereby driving the segmental growth.

Market Evaluation by Setting Outlook

The market segmentation, based on setting, includes acute care settings, non-acute care settings, other settings. The acute care settings segment dominated the US healthcare/hospital food services market share in 2024 due to the high number of acute hospitals and the growing number of admissions in these facilities. Acute care hospitals, including general hospitals, trauma centers, and specialty medical institutions, treat patients suffering from serious, urgent, and life-threatening conditions that require round-the-clock medical attention and structured nutritional support, thereby driving the segmental growth.

Key Players & Competitive Analysis Report

The US healthcare/hospital food services market trends are constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the market are ARAMARK; AVI Foodsystem, INC; Compass Group PLC; ELIOR Group; Healthcare Services Group; ISS World; Metz Culinary Management; Performance Food Group; SODEXO; and Whitsons Culinary Group.

Compass Group PLC, founded in 1941, is a British multinational company operating in the contract food and support services sector. Headquartered in Chertsey, England, it is a large food service provider globally and a constituent of the FTSE 100 Index. Its core business is food services, which account for 86% of its revenue. It also provides support services such as cleaning, reception management, and facilities maintenance. The company serves a wide range of sectors, including Business & Industry (where it provides corporate dining and catering), Healthcare & Senior Living (delivering nutritional meals to hospitals and elder care facilities), Education (offering dining solutions for schools and universities), Sports & Leisure (managing food services at major venues), and Defense, Offshore & Remote (where it supports military bases, mining camps, and offshore platforms). The business model includes three contract structures: cost-plus, fixed-price, and profit-and-loss sharing. Each accounts for roughly one-third of its contracts. Compass Group operates across three primary regions—North America, its largest market; Europe, including the UK and Ireland; and Asia Pacific, covering countries in Asia and Oceania. Its global reach spans approximately 33 countries.

Healthcare Services Group, Inc. (HCSG), established in 1976 and located in Bensalem, Pennsylvania, provides management, administrative, and operational services to healthcare facilities across the US. The company focuses on supporting housekeeping, laundry, linen, facility maintenance, and dietary service departments in nursing homes, retirement communities, rehabilitation centers, and hospitals. HCSG operates through two segments—Housekeeping and Dietary. The housekeeping segment handles cleaning, disinfecting, and sanitizing resident rooms and common areas and manages the laundering and processing of linens, uniforms, personal clothing, and other fabric items. The Dietary segment provides food purchasing, meal preparation, and dietitian services, developing menus tailored to meet residents' dietary needs, along with on-site management and clinical consulting services. HCSG's operations are concentrated within the US, where it delivers services nationwide through a network of strategically located offices. This allows the company to serve various healthcare providers, including long-term care facilities, post-acute care facilities, and hospitals.

List of Key Companies

- ARAMARK

- AVI Foodsystem, INC

- Compass Group PLC

- ELIOR Group

- Healthcare Services Group

- ISS World

- Metz Culinary Management

- Performance Food Group

- SODEXO

- Whitsons Culinary Group

US Healthcare/Hospital Food Services Industry Development

In October 2023, Aramark Refreshments announced the acquisition of Heathland Hospitality Group, whose chef-driven dining services and client-focused approach were integrated to enhance Aramark’s portfolio and expand its presence in the corporate and healthcare sectors.

US Healthcare/Hospital Food Services Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Patient and Dining Service

- Retail Service

- Vending and Shops

- Other Services

By Settings Outlook (Revenue USD Billion, 2020–2034)

- Acute Care Settings

- Non-Acute Care Settings

- Other Settings

US Healthcare/Hospital Food Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.05 billion |

|

Market Size Value in 2025 |

USD 24.47 billion |

|

Revenue Forecast by 2034 |

USD 63.50 billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 22.05 billion in 2024 and is projected to grow to USD 63.50 billion by 2034.

The market is projected to register a CAGR of 11.2% during the forecast period.

A few key players in the market are ARAMARK; AVI Foodsystem, INC; Compass Group PLC; ELIOR Group; Healthcare Services Group; ISS World; Metz Culinary Management; Performance Food Group; SODEXO; and Whitsons Culinary Group.

The acute care settings segment dominated the market in 2024 due to the high number of acute hospitals and the growing number of admissions in these facilities.

The patient and dining service segment is expected to witness fastest growth during the forecast period due to hospitals' increasing focus on improving patient satisfaction and recovery through personalized nutrition