U.S. Healthcare Staffing and Scheduling Software Market Size, Share, Trends, Industry Analysis Report

By Product Type, By Deployment Model, By Specialty, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6316

- Base Year: 2024

- Historical Data: 2020-2023

Overview

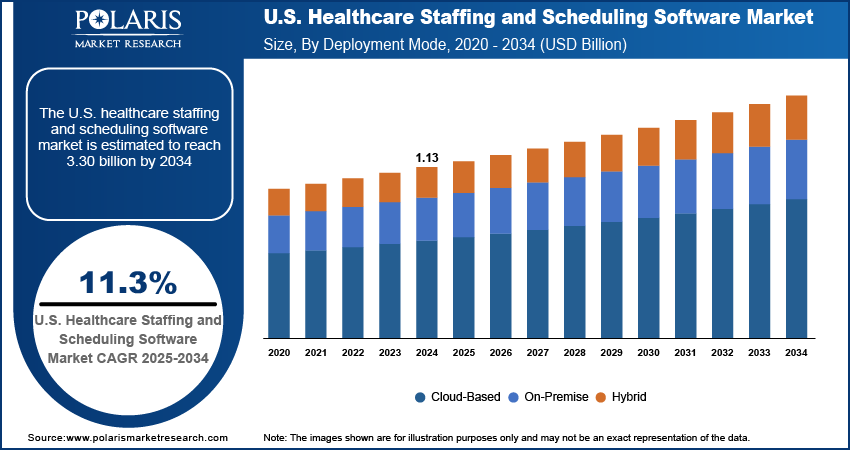

The U.S. healthcare staffing and scheduling software market size was valued at USD 1.13 billion in 2024, growing at a CAGR of 11.3% from 2025 to 2034. Key factors driving demand for U.S. healthcare staffing and scheduling software include rising labor costs coupled with surging healthcare expenditure and focus on operational efficiency.

Key Insights

- The care provider scheduling segment held the largest market share in 2024, propelled by rising need for efficient workforce allocation, streamlined shift management, and accurate overtime tracking within hospitals and healthcare networks.

- The primary care segment accounted for the highest share in 2024, supported by high patient volumes, need for efficient appointment coordination, and workforce optimization in general healthcare services.

Industry Dynamics

- Rising labor costs are driving demand for cost-efficient workforce management solutions that enable healthcare providers to optimize scheduling, reduce overtime expenses, and improve financial sustainability.

- Surging healthcare expenditure and growing emphasis on operational efficiency are strengthening adoption of advanced scheduling platforms across hospitals, clinics, and diagnostic centers to streamline processes and improve patient care delivery.

- Integration of AI-driven predictive analytics is creating market opportunities, enabling healthcare organizations to forecast staffing needs, automate scheduling workflows, and enhance workforce flexibility while minimizing administrative workload.

- High initial implementation and integration costs remain a restraint for smaller healthcare facilities where budget constraints limit investment in sophisticated scheduling technologies.

Market Statistics

- 2024 Market Size: USD 1.13 Billion

- 2034 Projected Market Size: USD 3.30 Billion

- CAGR (2025–2034): 11.3%

The U.S. healthcare staffing and scheduling software are digital platforms that enable healthcare providers to streamline staff allocation, ensure accurate shift scheduling, and comply with strict labor regulations while reducing administrative inefficiencies. Cloud-based deployment, mobile-enabled accessibility, and AI-driven scheduling tools are enhancing the scalability and real-time adaptability of these systems. Healthcare staffing and scheduling solutions enable effective workforce management, allowing institutions to overcome staffing shortages, optimize resource allocation, and enhance patient care delivery across diverse clinical settings.

Adoption of healthcare staffing and scheduling software in the U.S. is accelerating with the rapid expansion of telehealth, remote patient monitoring, and virtual care models that require flexible and adaptive workforce planning. The shift toward digital healthcare ecosystems is driving demand for intelligent platforms capable of managing complex staffing requirements across in-person and virtual environments. Advanced features such as predictive analytics, integration with electronic health record (EHR) systems, and mobile-first interfaces are enabling hospitals, outpatient clinics, and telehealth providers to reduce scheduling conflicts and ensure timely patient care. The rising emphasis on digital workforce management continues to strengthen the adoption of healthcare staffing and scheduling solutions across the US healthcare system.

The increasing prevalence of chronic diseases is driving higher patient volumes across healthcare facilities in the US, accelerating the need for optimized staff allocation and efficient workforce management. Intelligent staffing and scheduling platforms support in automating shift assignments, balancing staff workloads, and ensuring timely patient care. According to the US Centers for Disease Control and Prevention (CDC), six in ten Americans are living with at least one chronic condition, while four in ten suffer from two or more chronic diseases, creating sustained demand for healthcare services. This growth is fueling the adoption of U.S. Healthcare Staffing and Scheduling Software, enabling healthcare providers to enhance operational efficiency and manage patient care more effectively.

Drivers & Opportunities

Rising Labor Costs Driving Demand for Cost-Efficient Workforce Management: Growing labor expenses in the U.S. healthcare sector are significantly increasing the demand for cost-effective staffing and scheduling software. Advanced workforce management platforms help reduce labor costs by automating scheduling processes, enhancing staff productivity, and minimizing overtime expenditures. As per the American Hospital Association data, hospital labor costs surged by over 20% per patient between 2019 and 2022, highlighting the urgent need for technology-driven scheduling solutions. This growing financial strain is pushing healthcare institutions to adopt intelligent platforms that improve operational efficiency and support long-term financial sustainability.

Surging Healthcare Expenditure and Focus on Operational Efficiency Strengthening Market Growth: The rapid increase in healthcare spending, combined with the sector’s strong emphasis on operational efficiency, is further driving adoption of staffing and scheduling solutions in the U.S. According to the Centers for Medicare & Medicaid Services, U.S. healthcare expenditure rose by 7.5% in 2023 compared to the previous year, reaching USD 4.9 trillion and accounting for 17.6% of the nation’s GDP. This significant spending growth is accelerating the demand for intelligent scheduling software that enhances staff productivity, reduces costs, and ensures compliance with labor regulations across hospitals, clinics, and telehealth facilities.

Segmental Insights

By Product Type

Based on product type, the U.S. healthcare staffing and scheduling software market is segmented into patient scheduling, care provider scheduling, and others. The care provider scheduling segment accounted for the largest share in 2024, driven by growing demand for efficient workforce allocation, shift management, and overtime tracking across hospitals and healthcare systems. These solutions streamline staff utilization, reduce administrative burden, and improve care delivery outcomes.

The patient scheduling segment is projected to witness the fastest growth during the forecast period, supported by rising demand for digital appointment booking, integration with telehealth platforms, and patient-centric care models. This segment enables efficient appointment coordination, reduces no-shows, and enhances patient satisfaction across hospitals, clinics, and telehealth providers.

By Deployment Model

Based on deployment model, the market is categorized into cloud-based, on-premise, and hybrid solutions. The cloud-based segment dominated the market in 2024, driven by scalability, lower upfront investment, and ease of integration with electronic health record (EHR) systems and telehealth platforms. Healthcare providers are increasingly adopting cloud-based scheduling tools to ensure real-time access, multi-location support, and seamless data sharing.

The hybrid deployment model is expected to register significant growth during the forecast period, due to it’s balance between data security of on-premise systems and flexibility of cloud platforms. This model is gaining traction among mid- to large-scale healthcare organizations aiming to optimize costs while maintaining compliance with strict regulatory requirements.

By Specialty

Based on specialty, the U.S. healthcare staffing and scheduling software market is segmented into primary care, dentistry, behavioral and mental health, and others. The primary care segment held the largest share in 2024, supported by high patient volumes, need for efficient appointment coordination, and workforce optimization in general healthcare services.

The behavioral and mental health segment is projected to experience robust growth during the forecast period, fueled by rising awareness of mental health care, expansion of specialized facilities, and increasing adoption of digital scheduling solutions to manage therapy sessions and care provider availability.

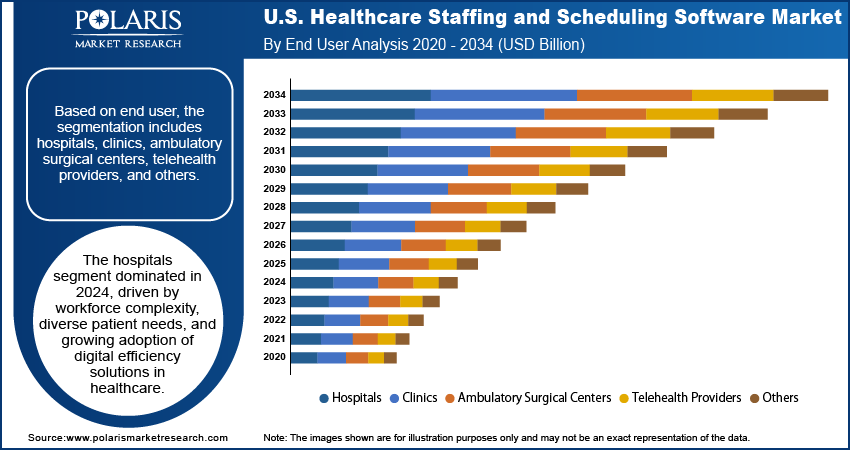

By End User

Based on end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, telehealth providers, and others. The hospitals segment accounted for the largest share in 2024, driven by high workforce complexity, diverse patient care requirements, and growing demand for digital tools that improve efficiency in large-scale healthcare facilities.

The telehealth providers segment is expected to grow at the fastest pace over the forecast period, supported by the rising adoption of virtual care models, remote consultations, and patient-centric scheduling platforms. These solutions enable seamless appointment booking, real-time coordination, and scalability, making them integral to modern digital healthcare ecosystems.

Key Players & Competitive Analysis

The U.S. healthcare staffing and scheduling software market is highly competitive, with leading players such as AdvancedMD, Inc., AMN Healthcare Services, Inc., and Oracle America, Inc. driving growth through advanced workforce management platforms, integration with healthcare information systems, and strategic digital transformation initiatives across hospitals and clinics. Oracle America, Inc. emphasizes the development of cloud-based workforce solutions seamlessly integrated with enterprise resource planning (ERP) and electronic health record (EHR) systems, improving scheduling precision and administrative efficiency. AMN Healthcare Services, Inc. focuses on digital staffing solutions and mobile-enabled scheduling platforms designed to mitigate nurse shortages and enhance workforce productivity, while AdvancedMD, Inc. expands its footprint by providing cloud-based practice management and staffing solutions tailored for healthcare organizations of varying sizes.

The market is experiencing strong adoption of intelligent scheduling platforms across hospitals, long-term care centers, specialty clinics, and telehealth providers, supported by the rising demand to streamline staff allocation, reduce labor costs, and ensure compliance with labor regulations. Companies are increasingly introducing AI-powered predictive scheduling systems, mobile-first workforce applications, and real-time integration with EHR platforms to optimize staff utilization and enhance patient care delivery. Strategic partnerships with healthcare providers, digital health companies, and technology firms are accelerating adoption, while continuous investments in automation, analytics, and workforce optimization tools are further strengthening market growth.

Prominent companies operating in the U.S. Healthcare Staffing and Scheduling Software market include AdvancedMD, Inc., American Medical Software, Inc., AMN Healthcare Services, Inc., Aya Healthcare, Inc., Bullhorn, Inc., Caspio, Inc., Connecteam, Inc., Infor, Inc., Kyruus Health, Inc., Oracle America, Inc., QGenda, LLC, Q-nomy Inc., RLDatix North America, Inc., ShiftMed, LLC, and Workday, Inc.

Key Players

- AdvancedMD, Inc.

- American Medical Software, Inc.

- AMN Healthcare Services, Inc.

- Aya Healthcare, Inc.

- Bullhorn, Inc.

- Caspio, Inc.

- Connecteam, Inc.

- Infor, Inc.

- Kyruus Health, Inc.

- Oracle America, Inc.

- QGenda, LLC

- Q-nomy Inc.

- RLDatix North America, Inc.

- ShiftMed, LLC

- Workday, Inc.

U.S. Healthcare Staffing and Scheduling Software Industry Developments

February 2025, MyMichigan Health implemented QGenda, LLC’s credentialing technology, resulting in marked improvements in both operational efficiency and patient access. The unified system reduced the time required for credentialing and enabled quicker, more effective provider placement.

May 2024, QGenda broadened its credentialing service offerings to meet the rising needs of healthcare institutions moving away from outdated systems. This initiative aimed to streamline credentialing procedures, speed up provider enrollment, and enhance overall workflow efficiency.

April 2024, SnapCare finalized its acquisition of Medecipher, incorporating its AI-powered staff scheduling capabilities into SnapCare’s healthcare staffing marketplace. This move was designed to improve workforce efficiency and ensure more precise clinician-to-patient alignment.

September 2023, ShiftMed and Hennepin Healthcare introduced an on-demand W-2 workforce solution. This partnership was intended to improve staffing flexibility and efficiency while offering healthcare workers in Minneapolis adaptable employment opportunities.

U.S. Healthcare Staffing and Scheduling Software Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Patient Scheduling

- Care Provider Scheduling

- Others

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premise

- Hybrid

By Specialty Outlook (Revenue, USD Billion, 2020–2034)

- Primary Care

- Dentistry

- Behavioral and Mental Health

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Telehealth Providers

- Others

U.S. Healthcare Staffing and Scheduling Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.82 Billion |

|

Market Size in 2025 |

USD 1.91 Billion |

|

Revenue Forecast by 2034 |

USD 3.01 Billion |

|

CAGR |

11.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 1.82 billion in 2024 and is projected to grow to USD 3.01 billion by 2034.

The market is projected to register a CAGR of 11.3% during the forecast period.

A few of the key players in the market are AdvancedMD, Inc., American Medical Software, Inc., AMN Healthcare Services, Inc., Aya Healthcare, Inc., Bullhorn, Inc., Caspio, Inc., Connecteam, Inc., Infor, Inc., Kyruus Health, Inc., Oracle America, Inc., QGenda, LLC, Q-nomy Inc., RLDatix North America, Inc., ShiftMed, LLC, and Workday, Inc.

The care provider scheduling segment dominated the market revenue share in 2024.

The hybrid deployment segment is projected to witness the fastest growth during the forecast period.