U.S. Heat Treating Market Size, Share, Trends, Industry Analysis Report

By Material (Steel, Cast iron, and Others), By Process, By Equipment, By End-User Industry, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6227

- Base Year: 2024

- Historical Data: 2020-2023

Overview

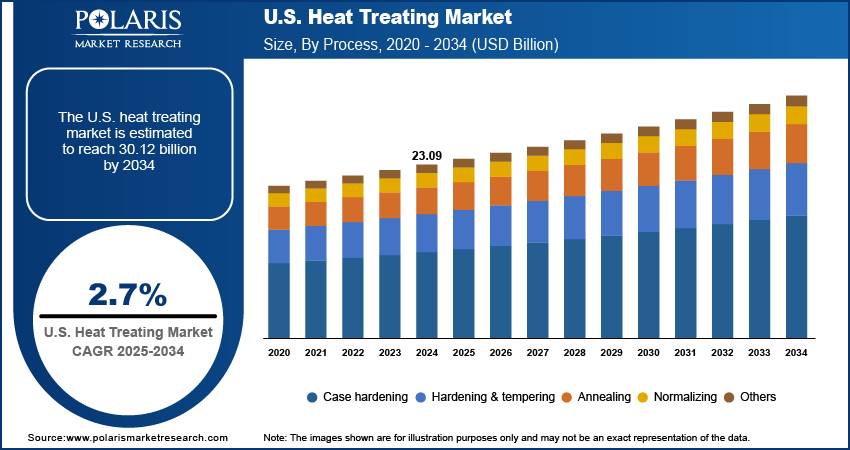

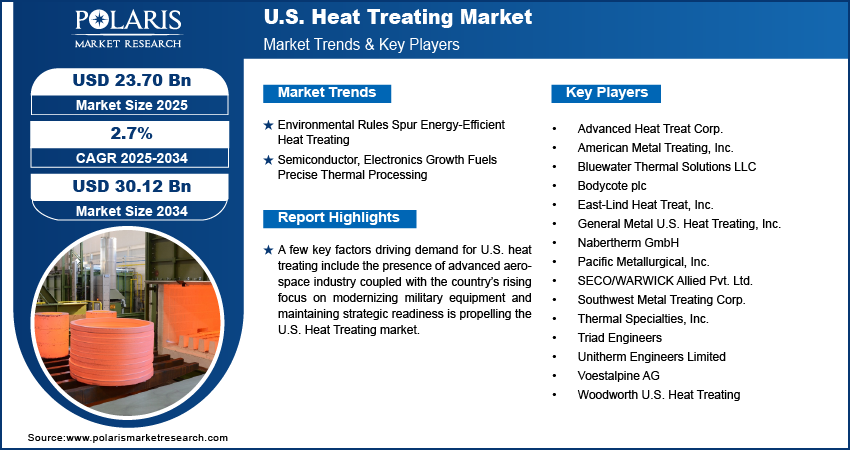

The U.S. heat-treating market size was valued at USD 23.09 billion in 2024, growing at a CAGR of 2.7% from 2025 to 2034. Key factors driving demand for U.S. heat treating include strict environmental regulations coupled with the expansion of the semiconductor and electronics manufacturing industry.

Key Insights

- The steel segment held the largest market share in 2024, fueled by widespread application across various industries, including automotive, construction, and heavy machinery.

- The hardening & tempering segment accounted for the highest share in 2024, owing to its capability to greatly enhance the strength and toughness of metal components used in essential applications.

Industry Dynamics

- Strict environmental regulations in the U.S. are propelling the adoption of energy-efficient heat treating technologies, boosting the market growth.

- Expansion of semiconductor and electronics manufacturing is driving increased demand for precise thermal processing to meet high-quality standards.

- Automation and AI integration are creating market opportunities by enhancing process control, efficiency, and predictive maintenance in heat treating operations.

- High capital investment required for advanced heat treating equipment continues to restrain market expansion among smaller manufacturers.

Market Statistics

- 2024 Market Size: USD 23.09 Billion

- 2034 Projected Market Size: USD 30.12 Billion

- CAGR (2025–2034): 2.7%

AI Impact on U.S. Heat Treating Market

- AI optimizes heat treatment cycles in real-time, adjusting temperatures and durations to cut energy use while ensuring consistent metal properties.

- Predictive algorithms forecast equipment failures before they occur, minimizing unplanned downtime and extending furnace lifespan for cost savings.

- Automated vision systems inspect heat-treated parts, catching defects early to reduce scrap rates and improve quality control.

- AI simulates new heat treatment recipes digitally, slashing development time for advanced alloys and specialized industrial applications.

The U.S. heat treating market plays a crucial role within the country’s advanced manufacturing and materials engineering sectors, providing vital thermal processing services that enhance the mechanical performance, durability, and reliability of metals and alloys. Service providers deliver a wide range of heat treatment solutions including hardening, tempering, annealing, and carburizing, catering to the stringent requirements of industries such as aerospace, automotive, defense, and heavy equipment manufacturing. The market benefits from ongoing efforts to improve component lifespan, wear resistance, and structural integrity while optimizing production efficiency and cost control.

The market in the U.S. is fueled by the advanced aerospace industry, that demands high-precision heat-treated components for critical applications including jet engines, aircraft landing gear, and structural airframe parts. According to the Aerospace Industry Association, the U.S. aerospace and defense sector reached a major milestone in 2023, generating over USD 955 billion in sales, marking a 7.1 percent increase from the previous year. This expansion is fueling the need for sophisticated heat treatment processes that ensure compliance with rigorous quality and safety standards. The rising focus on lightweight materials and performance optimization is further driving the adoption of innovative thermal processing technologies across the U.S. manufacturing landscape.

The country’s rising focus on modernizing military equipment and maintaining strategic readiness is propelling the U.S. Heat Treating market. According to the Stockholm International Peace Research Institute (SIPRI), U.S. military spending increased by 5.7 percent in 2024 compared to 2023, reaching USD 997 billion. This surge in investment are supporting programs that require heat-treated parts for armored vehicles, aircraft, naval vessels, and critical infrastructure. These applications necessitate thermal processes that improve material strength and wear resistance while complying with stringent quality requirements.

Drivers & Opportunities

Strict Environmental Regulations Encouraging Adoption of Energy-Efficient U.S. Heat Treating Technologies: Regulatory frameworks enforced by the Environmental Protection Agency (EPA) and state-level agencies are pushing U.S. Heat Treating providers to adopt cleaner, energy-efficient equipment and processes. Compliance with emissions standards and waste reduction policies is driving investment in electrically heated furnaces, optimized thermal cycles, and sustainable manufacturing practices. This enhances operational efficiency and positions service providers to meet evolving environmental expectations.

Expansion of Semiconductor and Electronics Manufacturing Increasing Need for Precise Thermal Processing: The U.S. semiconductor and electronics sectors are experiencing robust growth, necessitating precision heat treatment solutions such as annealing, stress relieving, and controlled atmosphere processing. As per the Semiconductor Industry Association (SIA), U.S. semiconductor industry investment in research and development (R&D) reached USD 62.7 billion in 2024. This amount reflects an approximate 5.7% increase in R&D spending compared to 2023. Advanced thermal technologies that maintain uniformity and tight tolerances are becoming crucial to ensuring component reliability and performance, thereby accelerating market adoption of specialized heat treatment services.

Segmental Insights

Material Analysis

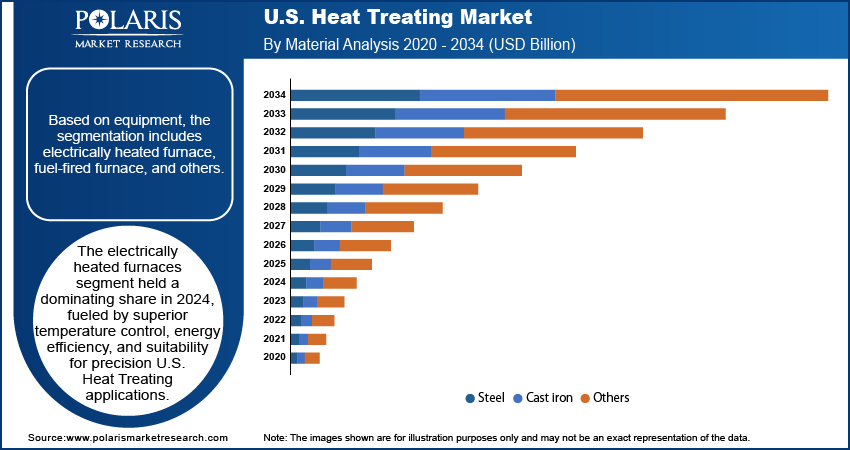

Based on material, the segmentation includes steel, cast iron, and others. Steel accounted for the largest revenue share in 2024, driven by its extensive use across diverse industries such as automotive, construction, and heavy machinery. The high demand for heat-treated steel components with enhanced hardness, strength, and wear resistance supports the segment’s dominance. Advanced steel grades requiring specialized thermal processes for improved mechanical properties continue to propel the segment’s growth.

Cast iron is projected to register the fastest CAGR during the forecast period, fueled by its growing application in engine blocks, pipes, and heavy-duty components that benefit from improved surface hardness and fatigue resistance through heat treatment. The segment’s growth is supported by technological advancements in U.S. Heat Treating techniques tailored to cast iron’s unique metallurgical characteristics, enabling better performance and longevity in demanding environments.

Process Analysis

The process segmentation includes case hardening, hardening & tempering, annealing, normalizing, and others. Hardening & tempering dominated the market in 2024, owing to their ability to significantly improve strength and toughness in metal parts used in critical applications. This process is widely adopted in sectors requiring components that withstand mechanical stress and impact, such as automotive and aerospace manufacturing. The combination of hardening and tempering enhances fatigue resistance and durability, reinforcing the segment’s leading position.

Case hardening is expected to grow at the fastest rate over the forecast period due to rising demand for surface hardening techniques that improve wear resistance without compromising the core toughness of components. Industries such as gears, bearings, and fasteners are increasingly relying on case hardening to extend service life and maintain dimensional stability, driving the adoption of this process.

Equipment Analysis

Based on equipment, the segmentation covers electrically heated furnaces, fuel-fired furnaces, and others. Electrically heated furnaces held the largest market share in 2024, supported by superior temperature control, energy efficiency, and suitability for precision U.S. Heat Treating applications. These furnaces are preferred in industries with stringent quality requirements, including aerospace and electronics, where process consistency is critical. The growing emphasis on automation and integration with digital monitoring systems further strengthens the segment’s dominance.

Fuel-fired furnaces are projected to witness the fastest growth during the forecast period, driven by widespread use in heavy industrial sectors and regions where fuel availability and cost advantages favor their operation. These furnaces are commonly applied in large-scale U.S. Heat Treating operations for heavy and bulky components, such as those used in construction and metalworking industries, sustaining demand for fuel-fired solutions.

End-User Industry Analysis

The end-user industry segmentation includes automotive, aerospace, construction, energy, and others. Automotive accounted for the largest revenue share in 2024, owing to the sector’s extensive use of heat-treated components in engine parts, transmissions, and chassis systems. The demand for lightweight yet durable materials and the ongoing shift towards electric vehicles are propelling the adoption of advanced heat treatment processes to meet evolving performance standards.

Aerospace is anticipated to register the fastest CAGR during the forecast period, propelled by the expansion of aircraft manufacturing and the stringent quality requirements for heat-treated parts in engines, landing gear, and structural components. The need for precise thermal processing to ensure safety, fatigue resistance, and compliance with industry standards is intensifying demand for specialized U.S. Heat Treating services in this sector.

Key Players & Competitive Analysis

The U.S. heat treating market is highly competitive, with leading players such as Advanced Heat Treat Corp., American Metal Treating, Inc., Bluewater Thermal Solutions LLC, and Bodycote plc dominating due to advanced thermal processing technologies, extensive service capabilities, and strong customer relationships across key industrial sectors. Advanced Heat Treat Corp. distinguishes itself with precision-controlled thermal solutions optimized for aerospace and defense applications requiring stringent quality standards. American Metal Treating, Inc. leverages a broad footprint of facilities combined with technical expertise to serve diverse industries including automotive, energy, and heavy machinery. Bluewater Thermal Solutions LLC focuses on energy-efficient processes and equipment modernization, addressing growing environmental regulations and operational cost pressures. Bodycote plc, a U.S. Heat Treating leader with extensive U.S. operations, offers comprehensive services spanning case hardening, carburizing, and nitriding to meet varied client requirements.

The market is witnessing increased adoption of digital automation, real-time process monitoring, and environmentally sustainable heat treatment technologies, driven by regulatory compliance and efficiency goals. Companies are investing in furnace upgrades, advanced control systems, and clean energy solutions to enhance process precision, reduce emissions, and improve throughput. Strategic initiatives such as mergers, acquisitions, and expansion into emerging regional markets continue to shape competitive dynamics, enabling service providers to broaden their portfolios and better address growing demand from aerospace, automotive, semiconductor, and defense industries. The presence of specialized firms focusing on niche thermal processes and customer-specific solutions further intensifies competition across the U.S. Heat Treating landscape.

Prominent companies in the U.S. market include American Metal Treating, Inc., Bluewater Thermal Solutions LLC, East-Lind Heat Treat, Inc., General Metal U.S. Heat Treating, Inc., Nabertherm GmbH, Pacific Metallurgical, Inc., SECO/WARWICK Allied Pvt. Ltd., Southwest Metal Treating Corp., Thermal Specialties, Inc., Triad Engineers, Unitherm Engineers Limited, Voestalpine AG , and Woodworth U.S. Heat Treating.

Key Players

- Advanced Heat Treat Corp.

- American Metal Treating, Inc.

- Bluewater Thermal Solutions LLC

- Bodycote plc

- East-Lind Heat Treat, Inc.

- General Metal U.S. Heat Treating, Inc.

- Nabertherm GmbH

- Pacific Metallurgical, Inc.

- SECO/WARWICK Allied Pvt. Ltd.

- Southwest Metal Treating Corp.

- Thermal Specialties, Inc.

- Triad Engineers

- Unitherm Engineers Limited

- Voestalpine AG

- Woodworth U.S. Heat Treating

U.S. Heat Treating Industry Developments

U.S. Heat Treating Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Steel

- Cast iron

- Others

By Process Outlook (Revenue, USD Billion, 2020–2034)

- Case hardening

- Hardening & tempering

- Annealing

- Normalizing

- Others

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Electrically heated furnace

- Fuel-fired furnace

- Others

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace

- Construction

- Energy

- Others

U.S. Heat Treating Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 23.09 Billion |

|

Market Size in 2025 |

USD 23.70 Billion |

|

Revenue Forecast by 2034 |

USD 30.12 Billion |

|

CAGR |

2.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 23.09 billion in 2024 and is projected to grow to USD 30.12 billion by 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

A few of the key players in the market are American Metal Treating, Inc., Bluewater Thermal Solutions LLC, East-Lind Heat Treat, Inc., General Metal U.S. Heat Treating, Inc., Nabertherm GmbH, Pacific Metallurgical, Inc., SECO/WARWICK Allied Pvt. Ltd., Southwest Metal Treating Corp., Thermal Specialties, Inc., Triad Engineers, Unitherm Engineers Limited, Voestalpine AG, and Woodworth U.S. Heat Treating.

The steel segment dominated the market revenue share in 2024.

The case hardening segment is projected to witness the fastest growth during the forecast period.