U.S. mHealth Apps Market Size, Share, Trends, Industry Analysis Report

By Type (Medical Apps, Fitness Apps), By Platform – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5900

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

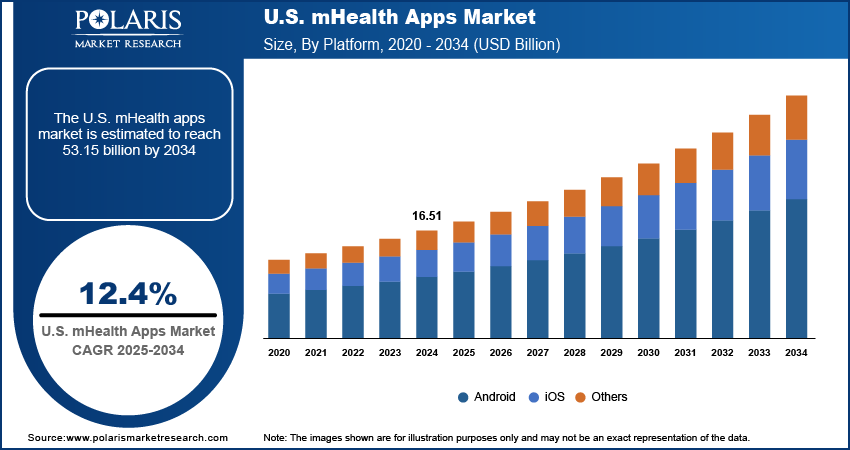

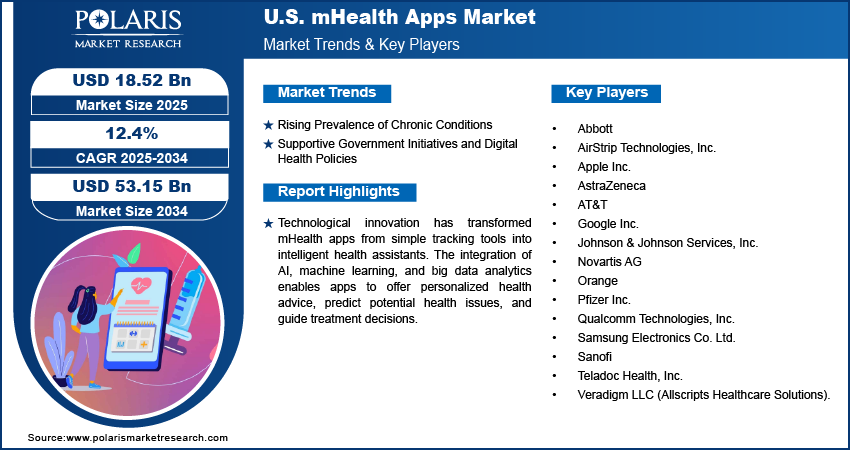

The U.S. mHealth apps market size was valued at USD 16.51 billion in 2024, growing at a CAGR of 12.4% from 2025 to 2034. The market growth is driven by growing prevalence of chronic conditions, and supportive government initiatives and digital health policies.

An mHealth app is a mobile application designed to support medical and public health practices through smartphones or tablets. It enables users to access healthcare services, track health data, manage conditions, and communicate with providers remotely.

The widespread use of smartphones in the U.S. provides a strong foundation for mHealth app adoption. Most Americans own a smartphone, and digital literacy is high across all age groups. This accessibility enables users to easily download, navigate, and benefit from health-related apps to monitor vital signs, manage prescriptions, and book virtual appointments. App developers reach a broad audience with younger and older demographics both embracing mobile technology. The convenience of having personal health tools is driving the U.S. mHealth apps market growth.

To Understand More About this Research: Request a Free Sample Report

Wearable devices such as the Apple Watch, Fitbit, and Garmin are widely popular in the U.S. and are used alongside mHealth apps to offer real-time health tracking. These devices collect key metrics such as heart rate, oxygen saturation, activity levels, and sleep quality, which sync with apps to provide personalized health feedback. The integration of wearable data into centralized platforms such as Apple Health or Google Fit improves user experience and promotes consistent app engagement. This real-time insight empowers users to take immediate action, improving health outcomes. The strong wearable technology ecosystem in the U.S. significantly boosts mHealth app relevance and daily usage, thereby driving its adoption in the country.

Industry Dynamics

Rising Prevalence of Chronic Disease

The U.S. is witnessing the rising prevalence of various chronic conditions such as diabetes, obesity, and cardiovascular diseases. According to the American Heart Association, the country recorded 931,578 deaths due to cardiovascular diseases in 2021. This alarming prevalence has increased demand for digital tools that support self-care and disease management. mHealth apps allow patients to monitor vital signs, log medication intake, track diet and exercise, and stay connected with healthcare providers. These features empower users to manage their conditions more effectively between doctor visits. These apps play a vital role in improving patient outcomes, reducing hospital admissions, and cutting costs as healthcare providers encourage proactive health behaviors, thereby driving the U.S. mHealth apps market growth.

Supportive Government Initiatives and Digital Health Policies

The U.S. government has actively supported digital health innovation through clear regulatory policies and funding programs. Agencies such as the U.S. Food & Drug Administration (FDA) have established guidelines for mobile medical apps, while HIPAA regulations ensure user data privacy and security. Additionally, CMS reimbursement policies for remote patient monitoring devices and telehealth visits have encouraged broader adoption. These regulatory efforts provide a safe and legally sound environment for developers, patients, and healthcare systems to adopt mHealth apps. Government support, combined with growing public trust in digital tools, accelerates the U.S. mHealth apps market expansion by reducing uncertainty and encouraging investments in new app-based health technologies across the country.

Segmental Insights

Type Analysis

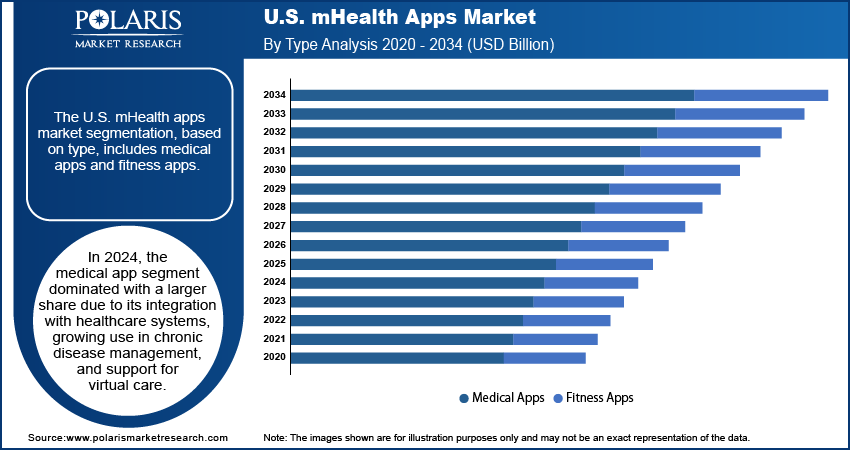

The U.S. mHealth apps market segmentation, based on type, includes medical app and fitness app. In 2024, the medical app segment dominated with a larger share due to their integration with healthcare systems, growing use in chronic disease management, and support for virtual care. These apps enable users to access electronic health records (EHRs), schedule telehealth appointments, track medications, and receive reminders. Providers and insurers increasingly recommend these tools to improve patient outcomes and reduce costs. The U.S. healthcare system’s shift toward value-based care and remote monitoring has made medical apps an essential part of care delivery, thereby driving the segment growth.

The fitness app segment is expected to experience significant growth during the forecast period, due to rising health awareness and preventive wellness trends. These apps offer personalized workout plans, activity tracking, nutrition guidance, and integration with wearable devices such as Apple Watch and Fitbit. The demand for accessible digital fitness tools is expected to surge as Americans increasingly focus on fitness and lifestyle management. Post-COVID-19-pandemic lifestyle shifts, including home workouts and hybrid fitness models, have also contributed to this growth. The younger users are prioritizing wellness and digital convenience, thereby driving the segment growth.

Platform Analysis

The U.S. mHealth apps market segmentation, based on platform, includes Android, iOS, and others. The iOS segment held the largest share in 2024 due to Apple’s strong presence and its integrated health ecosystem. Apple Health, combined with the popularity of the Apple Watch, enables seamless data syncing and user-friendly interfaces. The developers in the U.S. further tend to launch healthcare apps first on iOS due to higher monetization potential and a more secure platform. iOS has become the preferred platform for both consumers and healthcare providers in the U.S. due to a large iPhone user base, thereby driving the segment growth.

The Android segment is expected to experience significant growth during the forecast period, driven by its wider affordability and accessibility across diverse demographics. Android is gaining popularity due to increased app availability, improved security features, and better integration with Google Fit and wearable devices. Android’s open ecosystem allows more developers to create customizable and scalable solutions for public health initiatives, chronic disease management, and fitness tracking. The healthcare providers are aiming to reach broader populations, including Medicaid and lower-income groups, which is driving the segment growth.

Key Players and Competitive Analysis

The U.S. mHealth apps market is highly competitive, with key players spanning across technology, telecommunications, and pharmaceuticals. Tech giants such as Apple, Google, and Samsung dominate through their integrated health ecosystems and wearable device connectivity. Apple Health, Google Fit, and Samsung’s health platforms serve millions of users globally, enabling real-time health tracking and personalized insights. Pharmaceutical companies such as Pfizer, AstraZeneca, Novartis, and Sanofi are increasingly investing in digital therapeutics and mobile platforms to support patient adherence and chronic disease management. Healthcare innovators such as Teladoc Health, Veradigm (Allscripts), and AirStrip Technologies are transforming virtual care and clinical data access. Telecom firms such as AT&T and Orange play a supportive role by enabling secure health data transmission and remote access. Qualcomm contributes through health-centric chipsets and wireless technologies. These players are actively forming partnerships, launching AI-driven solutions, and focusing on regulatory-compliant platforms to maintain their edge in this rapidly evolving digital health landscape.

Key Players

- Abbott

- AirStrip Technologies, Inc.

- Apple Inc.

- AstraZeneca

- AT&T

- Google Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Orange

- Pfizer Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Sanofi

- Teladoc Health, Inc.

- Veradigm LLC (Allscripts Healthcare Solutions)

Industry Development

In October 2023, Cedars-Sinai and K Health launched the Cedars-Sinai Connect app, offering AI-powered virtual care access for patients across California. The app enabled 24/7 access to urgent and primary care, integrating patient data into existing health records for seamless treatment.

U.S. mHealth Apps Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Medical Apps

- Women's Health

- Chronic Disease Management Apps

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Other

- Fitness Apps

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Android

- iOS

- Others

U.S. mHealth Apps Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 16.51 Billion |

|

Market Size in 2025 |

USD 18.52 Billion |

|

Revenue Forecast by 2034 |

USD 53.15 Billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.51 billion in 2024 and is projected to grow to USD 53.15 billion by 2034.

The global market is projected to register a CAGR of 12.4% during the forecast period.

A few of the key players in the market are Abbott; AirStrip Technologies, Inc.; Apple Inc.; AstraZeneca; AT&T; Google Inc.; Johnson & Johnson Services, Inc.; Novartis AG; Orange; Pfizer Inc.; Qualcomm Technologies, Inc.; Samsung Electronics Co. Ltd.; Sanofi; Teladoc Health, Inc.; and Veradigm LLC (Allscripts Healthcare Solutions).

The medical app segment dominated the market share in 2024.

The Android segment is expected to witness the significant growth during the forecast period.