U.S. Packaged Wastewater Treatment Market Size, Share, & Industry Analysis Report

By Technology (Extended Aeration, Moving Bed Biofilm Reactor), By System Type, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5896

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

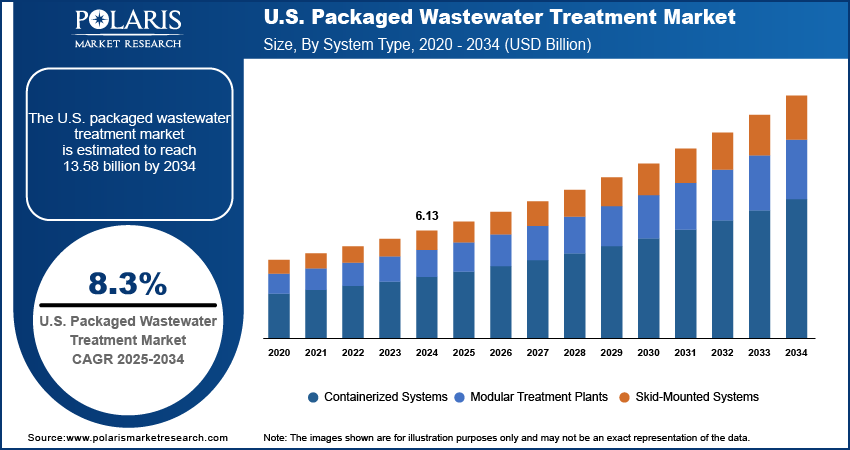

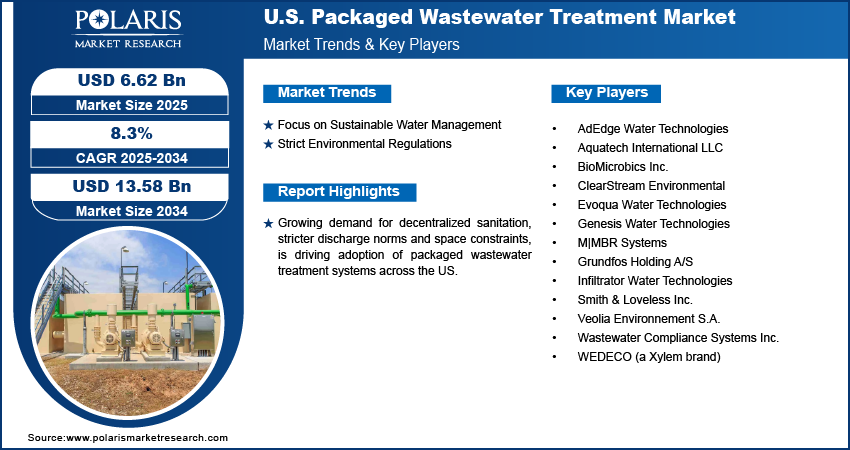

The U.S. packaged wastewater treatment market size was valued at USD 6.13 billion in 2024, growing at a CAGR of 8.3% from 2025–2034. Focus on sustainable water management and compliance with strict environmental regulations is driving the demand for packaged wastewater treatment systems across the country.

U.S. packaged wastewater treatment systems are used to manage wastewater in decentralized locations such as small towns, industrial sites, and remote facilities. These systems combine key treatment stages within a single modular setup, allowing for quick installation and minimal land use. Advanced features such as automated controls, energy-efficient components, and real-time monitoring tools are improving system efficiency and helping meet discharge standards. Technologies including membrane bioreactors and enhanced aeration units are further supporting regulatory compliance.

Manufacturers in the U.S. are focusing on standardized components, remote diagnostics, and simplified maintenance to support broader deployment. The inclusion of odor control systems, corrosion-resistant materials, and noise-reduction features reflects growing attention to environmental and safety requirements. These systems offer a flexible and reliable solution for areas with limited access to central treatment infrastructure, supporting diverse applications across industrial, commercial, and residential sectors.

To Understand More About this Research: Request a Free Sample Report

Expanding public infrastructure projects and strategic urban planning are creating favorable conditions for the adoption of water and wastewater treatment equipment across the U.S. These systems are incorporated into residential, institutional, and mixed-use developments due to their compact design, fast deployment, and suitability for areas lacking access to centralized networks. For instance, in October 2024, Newterra launched a PFAS pilot system to help customers address contamination challenges and develop effective water treatment solutions. Developers and municipal bodies are selecting systems that require minimal land, can be phased into larger construction plans to meet with project timelines for new housing, commercial hubs, and transit-oriented zones.

Rising interest in prefabricated systems and standardized modules is helping reduce installation time while streamlining procurement and approvals. Manufacturers are offering integrated layouts with built-in controls that simplify operations for public utilities and private operators. In large-scale developments and PPP-led infrastructure models, these systems support cost-effective rollout, scalable capacity, and predictable performance. Their role is also expanding in infrastructure planning aimed at emergency readiness, where decentralized systems serve as reliable backup solutions for critical service areas. These developments are contributing to the broader integration of packaged wastewater systems into modern infrastructure frameworks across the country.

Industry Dynamics

Focus on Sustainable Water Management

Growing emphasis on smart water management practices across the U.S. is driving the demand for packaged wastewater treatment systems. As water scarcity becomes a concern in regions affected by drought and population growth, decentralized systems are explored as viable solutions for water recycling and reuse. These systems help reduce the environmental burden on central plants by treating wastewater on-site and allowing for safe discharge or reuse in irrigation, industrial processes, or flushing. This localized approach supports long-term water conservation goals without the need for large infrastructure investments.

Public and private stakeholders are prioritizing technologies that enhance resource efficiency and reduce the carbon footprint of water treatment operations. In August 2024, the U.S. Department of Commerce granted USD 4 million to Independence, Oregon, to upgrade its wastewater plant, aiming to boost disaster resilience, support 250 jobs, and attract USD 25 million in private investment. Packaged systems equipped with energy-efficient components, low-sludge generation mechanisms, and minimal chemical usage to comply with sustainability targets set by municipalities and corporations. Their ability to operate independently, combined with modular scalability, makes them suitable for projects aiming to meet environmental performance benchmarks. As more utilities adopt circular water practices, the role of compact, self-contained treatment solutions is expected to expand further across the U.S. market.

Strict Environmental Regulations

Strict environmental regulations in the U.S. are a key factor driving the adoption of packaged wastewater treatment systems. Agencies such as the Environmental Protection Agency (EPA) set stringent discharge limits for pollutants, nutrients, and total suspended solids, requiring advanced treatment capabilities even in smaller facilities. As per the EPA, coal plant wastewater is affecting drinking water for 42 million people in the U.S. Thus, a new rule implemented by EPA aims to stop 660 million pounds of pollutants from entering U.S. waters annually. Packaged systems are engineered to meet these regulatory standards through integrated processes that ensure consistent effluent quality. This is particularly important for installations in environmentally sensitive areas or near water bodies where untreated or partially treated wastewater poses ecological risks.

State-level compliance requirements further reinforce the need for reliable, decentralized treatment options. In many cases, these regulations apply to new developments, industrial parks, and remote communities without access to municipal treatment infrastructure. By incorporating advanced filtration, nutrient removal, and real-time monitoring, packaged systems help operators maintain compliance without extensive oversight. Their proven performance and ability to meet evolving environmental expectations position them as a preferred solution for projects where regulatory adherence is a priority from the outset.

Segmental Insights

Technology Analysis

The segmentation, based on technology includes, extended aeration, moving bed biofilm reactor (MBBR), reverse osmosis (RO), Membrane Bioreactor (MBR), sequential batch reactor (SBR), membrane aerated biofilm reactor (MABR), and other technology. The extended aeration segment is projected to grow substantially by 2034. This growth is attributed to its widespread use is attributed to its simple operation, robust performance in treating variable loads, and low sludge production. This method is well-suited for small to mid-sized communities and industrial units requiring consistent biological treatment without complex configurations. Its compatibility with existing regulations and ease of maintenance continue to support its dominance in municipal and rural installations across the country.

The membrane bioreactor segment is projected to grow at a robust pace in the coming years, due to its ability to produce high-quality effluent within compact footprints. Increasing adoption in urban developments, commercial complexes, and industrial zones is driving demand for MBR systems, especially where land availability is limited and discharge standards are strict. The integration of membrane filtration with biological processes supports advanced nutrient removal and reuse applications, making MBRs a preferred choice for future-ready decentralized treatment solutions.

System Type Analysis

The segmentation, based on system type includes, modular treatment plants, containerized systems, and skid-mounted systems. The modular treatment plants segment accounted for second largest revenue share in 2024, due to their flexibility, scalability, and suitability for phased infrastructure development. These systems are commonly selected for municipal projects and large-scale developments requiring on-site treatment with potential for future expansion. Their ease of integration with different treatment technologies and ability to accommodate growing wastewater volumes makes them a dependable choice for various public and private sector applications.

The containerized systems segment is projected to grow at a significant pace during the assessment phase, as developers and utilities seek compact, mobile solutions that require minimal installation time. Their plug-and-play design and reduced land requirements are well-suited for remote locations, emergency deployments, and temporary treatment needs. Increasing interest from industrial and commercial sectors for flexible and relocatable systems is further accelerating demand for containerized packaged units.

End User Analysis

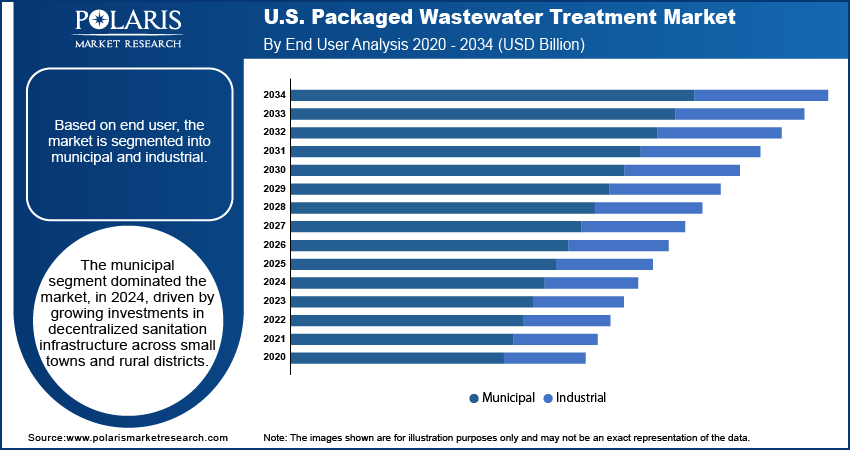

The segmentation, based on end user includes, municipal and industrial The municipal segment dominated the market, in 2024, driven by growing investments in decentralized sanitation infrastructure across small towns and rural districts. Public utilities are adopting packaged systems to expand service coverage without the delays and costs of large-scale plant construction. These systems help municipalities meet compliance goals while addressing the treatment needs of expanding communities and residential zones.

The industrial segment is estimated to hold a substantial market share in 2034, driven by rising environmental accountability and discharge regulations across sectors such as food processing, chemicals, and manufacturing. In October 2024, Veolia and New Orleans launched the city's first digital control center to modernize and optimize wastewater treatment operations in the U.S. Industries are increasingly turning to packaged systems to manage wastewater on-site, reduce operational risks, and avoid penalties. The ability to tailor treatment configurations to specific industrial effluent types is pushing broader adoption among U.S.-based enterprises prioritizing efficiency and compliance.

Key Players & Competitive Analysis Report

The packaged wastewater treatment industry is highly competitive, driven by rising demand for decentralized systems across municipal, industrial, and commercial applications. Key players are focusing on modular layouts, compact plant designs, and industrial automation and control systems controls to meet project timelines, reduce installation complexity, and ensure regulatory compliance. Emphasis on energy efficiency, low-sludge operation, and real-time monitoring is driving the development of solutions that address space limitations and varied wastewater loads. These advancements are helping manufacturers meet growing infrastructure needs while offering flexible and cost-effective treatment options.

Key companies in the packaged wastewater treatment industry include Smith & Loveless Inc., Aquatech International LLC, BioMicrobics Inc., Genesis Water Technologies, Evoqua Water Technologies, ClearStream Environmental, WEDECO (a Xylem brand), Grundfos Holding A/S, Infiltrator Water Technologies, M|MBR Systems, Wastewater Compliance Systems Inc., Veolia Environnement S.A., and AdEdge Water Technologies.

Key Players

- AdEdge Water Technologies

- Aquatech International LLC

- BioMicrobics Inc.

- ClearStream Environmental

- Evoqua Water Technologies

- Genesis Water Technologies

- M|MBR Systems

- Grundfos Holding A/S

- Infiltrator Water Technologies

- Smith & Loveless Inc.

- Veolia Environnement S.A.

- Wastewater Compliance Systems Inc.

- WEDECO (a Xylem brand)

Industry Developments

June 2025: Veolia North America launched one of the country’s largest PFAS treatment facilities in Ridgewood, New Jersey. The plant is designed to remove harmful “forever chemicals” from drinking water, ensuring compliance with state and federal water quality standards. This new facility reflects Veolia’s commitment to advanced water treatment technologies and protecting public health.

June 2025: Grundfos announced to acquire Newterra to strengthen its water and wastewater treatment capabilities. The acquisition supports Grundfos’ strategy to expand its presence in the decentralized water treatment market.

October 2024: Infiltrator Water Technologies acquired Orenco Systems to strengthen its position in decentralized wastewater treatment. The move enhances Infiltrator’s product offerings and expands its footprint in advanced wastewater solutions across North America.

U.S. Packaged Wastewater Treatment Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Membrane Aerated Biofilm Reactor (MABR)

- Other Technology

By System Type Outlook (Revenue, USD Billion, 2020–2034)

- Modular Treatment Plants

- Containerized Systems

- Skid-Mounted Systems

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Municipal

- Industrial

- Chemical and Pharma

- Oil and Gas

- Food, Pulp, and Paper

- Metal and Mining

- Power Generation

- Others

U.S. Packaged Wastewater Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.13 Billion |

|

Market Size in 2025 |

USD 6.62 Billion |

|

Revenue Forecast by 2034 |

USD 13.58 Billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 6.13 billion in 2024 and is projected to grow to USD 13.58 billion by 2034.

The U.S. market is projected to register a CAGR of 8.3% during the forecast period.

A few of the key players in the market are Smith & Loveless Inc., Aquatech International LLC, BioMicrobics Inc., Genesis Water Technologies, Evoqua Water Technologies, ClearStream Environmental, WEDECO (a Xylem brand), Newterra, Orenco Systems Inc., M|MBR Systems, Wastewater Compliance Systems Inc., and AdEdge Water Technologies.

The modular treatment plants segment dominated the market share in 2024, due to their scalable structure, quick setup, and suitability for phased infrastructure needs.

The containerized systems segment is projected to grow at a significant pace during the assessment phase.