Vending Cups Market Share, Size, Trends, Industry Analysis Report

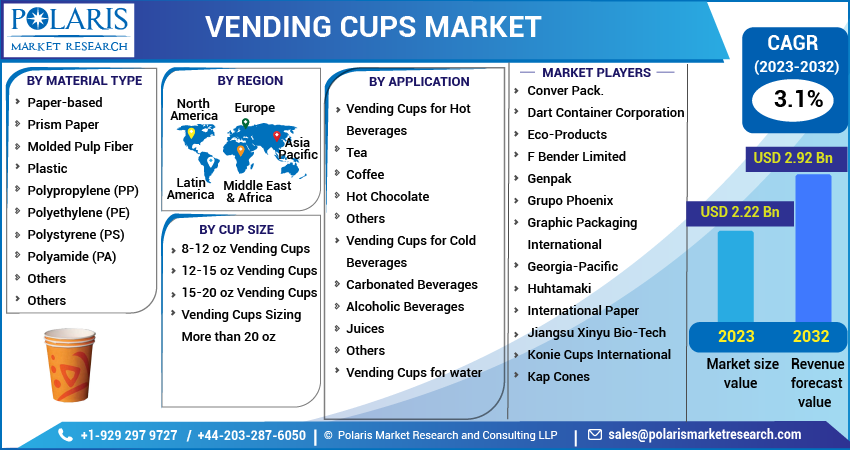

By Material Type (Paper-Based, Plastics, and Others); By Cup Size; By Application (Vending Cups for Hot Beverages, Vending Cups for Cold Beverages, Vending Cups for water); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3559

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

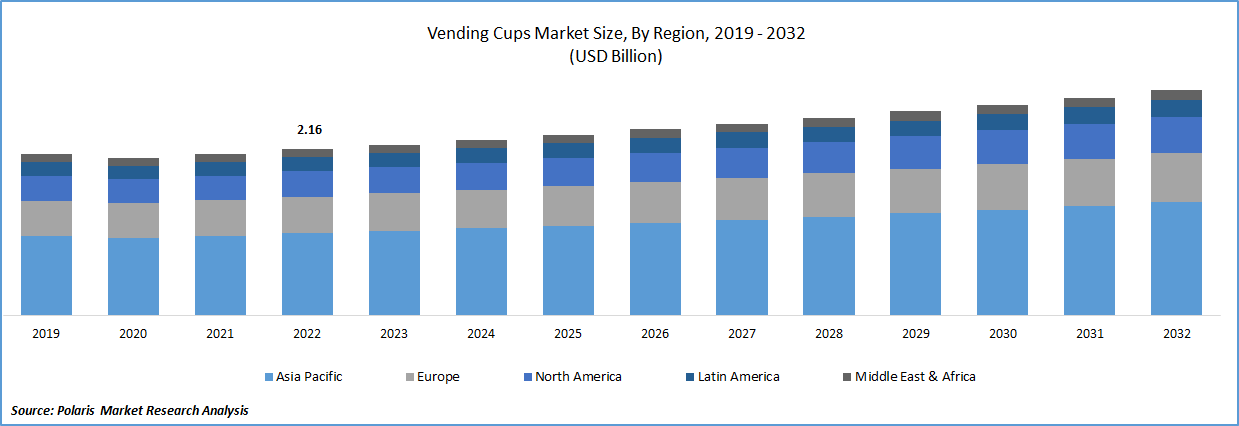

The global vending cups market was valued at USD 2.16 billion in 2022 and is expected to grow at a CAGR of 3.1% during the forecast period. Standard disposable cups cannot function well in a vending machine without becoming jammed. Vending cups must be manufactured with precision. Compared to regular water cooler cups, vending cups are more expensive and have a smaller production tolerance. Vending cups feature a firm grip, are portable, recyclable, and have positive environmental effects. Manufacturers are aiming for better printability and consumer convenience as vending cups have grown in popularity. The need for vending cups has increased recently because of the rising popularity of bottled beverages, coffee, and tea in public spaces. Increased knowledge of hygienic food products and the advantages of vending cups are two additional reasons predicted to fuel product growth during the projection period.

To Understand More About this Research: Request a Free Sample Report

Further, paper cups are disposable and can be used to drink soup, tea, coffee, soft drinks, and other items. These cups are covered with polyethylene, the most common plastic resin, which improves their functionality and durability by preventing the reduced moisture from absorbing and retaining flavor. Customers usually use paper cups to save time and effort because of their busy schedules and hectic lifestyles. After use, these cups don't need to be washed; they may be thrown away right away. The demand for paper cups has been impacted by the global trend towards ready-to-eat food and services.

A large section of the world's population leads a hectic lifestyle, which increases demand for straightforward goods like paper cups. The market for paper cup carriers is expected to be significantly impacted by the global beverage industry, which is growing and becoming more dynamic. Some well-known companies are providing a variety of paper cup carriers to fulfill the increased demand for beverages to be sipped on the go in different regions. In August 2021, On the Indian Ocean island of Mauritius, United Exports, a global producer and distributor of blueberries, introduced recycled paper cups for its OZblu brand of blueberries. Similar to many other island countries, Mauritius has suffered greatly from land and marine pollution brought on by single-use plastics. The government has responded by taking significant steps to lessen the quantity of plastic debris that enters landfills or the nation's pristine maritime environment.

The COVID-19 pandemic outbreak has posed extraordinary difficulties for several nations and generated a serious dilemma for the paper cup industry. Additionally, it has seriously disrupted supply chains and the packaging industry, leading to shortages and an increase in the price of raw materials. Paper cup production was significantly reduced as a result, and the packaging businesses experienced delays in receiving orders.

Additionally, the demand for paper cups has decreased as a result of the closure of quick service restaurants (QSRs) and other food service industries. In addition, food service companies opted for more environmentally friendly packaging alternatives such as fiber-based, compostable, recyclable, and reusable cups, which restrained the market's expansion.

For Specific Research Requirements, Speak to Research Analyst

Industry Dynamics

Growth Drivers

More people throughout the world become aware of environmental challenges, so there is an increasing trend towards using ecologically friendly and biodegradable items. The major players are also focusing on the launches of vending cups that are biodegradable that is boosting the growth of the vending cups market over the forecast period. For instance, in December 2021, Tea Time Group expanded its efforts to increase the number of clients it serves by introducing 100 percent biodegradable paper cups. The company has started providing consumers with hygienic disposable cups that are natural, compostable, and safe.

Also, in January 2020, KLIX Eco Cup, a new recyclable and biodegradable product from Lavazza Professional, is made from paper that comes from forests that are responsibly managed. Therefore, the increasing biodegradable products demand as well as support by the major players for it are the factors driving the market growth rapidly.

Additionally, it has become more common to order beverages for delivery to homes for takeaway. Similarly to this, it appears that there is a large need for cup carriers that are both fashionable and strong. Therefore, it is projected that rising demand for beverage consumption on the go will propel the market's growth rate. Consumers' changing purchasing habits are significantly influenced by their growing awareness of the harmful consequences that plastics have on the environment. As a result of present developments, a potential opportunity for market expansion has emerged.

Report Segmentation

The market is primarily segmented based on material type, cup size, application, and region.

|

By Material Type |

By Cup Size |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The polypropylene (PP) segment is expected to witness the fastest growth over the forecast period

Polypropylene, often known as PP, is a translucent mat material that can be made in white, black color of your choosing. In August 2022, Berry's Beverage Systems introduced vending cups made entirely of polypropylene (PP), making it simpler to recycle the cups after each use. Berry was able to produce the mono-material cups due to continued innovation in its production methods, making their recycling a reality in areas with the necessary infrastructure in place for PP.

Vending cups for the hot beverages segment accounted for the largest market share in 2022

The demand for vending cups is fueled by an increase in the consumption of high-end hot beverages at retail establishments, institutional services, workplaces, coffee shops, and other locations. However, inexpensive and superior alternatives in plastic and paper have presented several challenges for vending cups recently. In March 2023, the revolutionary phade paper cup, developed by WinCup, Inc., is a cutting-edge replacement for conventional paper cups, which, unbeknownst to most consumers, are coated in plastic made from fossil fuels to hold beverages and can't be recycled or composted. Because of phade, the first paper cup ever coated with PHA (polyhydroxyalkanoate), a novel new biopolymer produced by the fermentation of canola oil and which is both marine and industrially compostable, paper cups for hot beverages can now be truly sustainable.

Furthermore, in May 2019, New plant-based water cups from Eden Springs are completely compostable and biodegradable and can be used for both cold and hot liquids. The new Eden Bio cup comes in 205ml sizes and has a plant-based inner biopolymer lining that keeps the cup tightly sealed and warm. Therefore, these advanced vending cup launches for hot beverages are the major factor propelling the segmental growth.

The 15-20oz vending cups sector is expected to hold the significant revenue share

Vending cups of all sizes are in demand for various events and festivals. But the medium size which is 15-20oz vending cups is in high demand. For this, the key players are also focusing on the launches of medium-size biodegradable cups that are boosting the growth of the market. In August 2022, for festivals and live sporting events, Seal Packaging introduced the first paper cups with the UKCA mark of certification. The cups are said to be certified home-compostable, recyclable, repulpable, biodegradable, and free of PLA and PE by Seal Packaging. The cups come in sizes of 10oz, 20oz, and 22oz. They claim to be the only paper cups for 10oz and 20oz that have the UKCA mark recognized, and they have the "Flustix No Plastic" certification from Din Certco. These developments are driving the growth of the market.

The demand in Asia-Pacific is expected to witness significant growth

In terms of revenue and market share, the paper cup market is dominated by Asia-Pacific. This is a result of the rising demand for paper cups. China is also the world leader in the production and use of disposable paper cups. Due to the ease with which disposable paper cups may be made, China controls the Asia-Pacific paper cup market. The government of India announced a ban on the use of single-use plastics, which became effective on July 1, 2022. Increasing consumer knowledge of the damaging impacts of plastics on the environment is important for purchase decisions.

The largest vending cup market in the Asia Pacific area is predicted to be China, followed by India. One of the most popular alternatives to plastic packaging is maize starch. To build an eco-friendly company image, the top online meal delivery services are also converting to packaging made of maize starch. Regarding the installation of beverage vending machines, Asia Pacific is likewise anticipated to expand at a double-digit rate.

An increasing number of events, sporting activities like football and cricket, social gatherings, and a growth in the consumption of beverages consumed on the go in the region would cause the market to dominate the global industry. One of the major causes fueling the need for vending cups in the United States is the growing food service sector, as this sector uses vending cups most frequently.

Competitive Insight

Some of the major players operating in the global market include Conver Pack., Dart Container Corporation, Eco-Products, F Bender Limited, Genpak, Grupo Phoenix, Graphic Packaging International, Georgia-Pacific, Huhtamaki, International Paper, Jiangsu Xinyu Bio-Tech, Konie Cups International, and Kap Cones.

Recent Developments

- In December 2021, International Paper announced plans to erect a cutting-edge corrugated packaging facility. 150 people will work for the institution as a whole.

- In September 2021, Grupo Phoenix completed the acquisition of the Tekni-Plex, enabling market-focused innovations, particularly in the food & beverage industry.

Vending Cups Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.22 billion |

|

Revenue Forecast in 2032 |

USD 2.92 billion |

|

CAGR |

3.1% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Material Type, By Cup Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Conver Pack., Dart Container Corporation, Eco-Products, F Bender Limited, Genpak, Grupo Phoenix, Graphic Packaging International, Georgia-Pacific, Huhtamaki, International Paper, Jiangsu Xinyu Bio-Tech, Konie Cups International, and Kap Cones |

FAQ's

The global vending cups market size is expected to reach USD 2.92 billion by 2032.

Key players in the vending cups market are Dart Container Corporation, Eco-Products, F Bender Limited, Genpak, Grupo Phoenix.

Asia-Pacific contribute notably towards the global vending cups market.

The global vending cups market is expected to grow at a CAGR of 3.1% during the forecast period.

The vending cups market report covering key segments are material type, cup size, application, and region.