Version Control Systems Market Share, Size, Trends, Industry Analysis Report

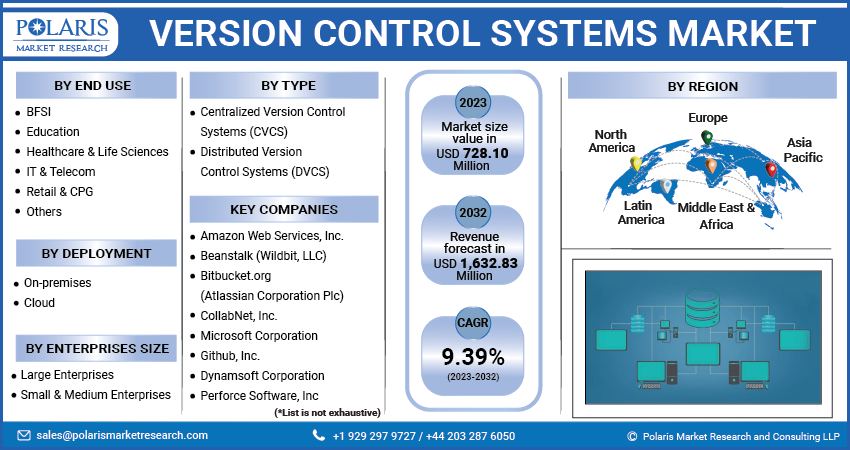

By Type (Centralized Version Control Systems (CVCS) and Distributed Version Control Systems (DVCS)); By Deployment; By Enterprise Size; By End Use; By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 115

- Format: PDF

- Report ID: PM3664

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

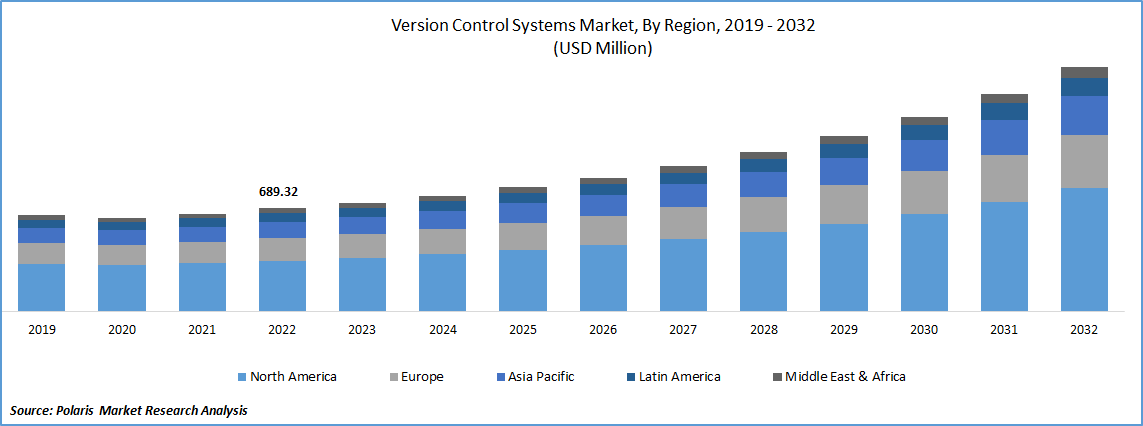

The global version control systems market was valued at USD 689.32 million in 2022 and is expected to grow at a CAGR of 9.39% during the forecast period.

Version control systems have a wide range of applications and uses across various industries and domains. It is primarily used for versioning and managing code in software development projects. It enables collaboration among developers by providing a centralized repository where team members can share, access, and modifies code. The systems facilitate branching, which allows developers to create separate code branches for different features, bug fixes, or experimental work.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic has forced organizations worldwide to adopt remote work arrangements to ensure the safety of their employees. This shift highlighted the need for robust collaboration tools, including version control systems, to enable remote developers to work together effectively. These solutions played a crucial role in facilitating remote collaboration, version control, and code sharing during the pandemic. With remote work becoming the norm, organizations increasingly relied on cloud-based version control systems solutions. The pandemic also accelerated the pace of digital transformation across industries which further improved demand for version control systems worldwide.

Moreover, the pandemic highlighted the importance of business continuity and resilience. Organizations recognized the need to have robust version control and backup mechanisms in place to safeguard it’s codebase and ensure business continuity, even in times of disruption. Version control systems played a critical role in maintaining code integrity, preserving development progress, and facilitating the recovery process in case of unforeseen events.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising number of financial institutions are driving the market growth

With locations around the nation, banks and other financial institutions can leverage this capability to provide customers cutting-edge services. A growing number of financial organisations, including Goldman Sachs, J.P. Morgan Chase, & others, are working with solution providers to use version control systems solutions in their banking processes. Growing adoption of version control systems solutions in the BFSI sector is heavily augmenting the growth of market across the world.

Escalating software development practices is another aspect helping the market to grow with rapid pace. The demand for version control systems is fuelled by the growing number of software development projects across various industries. For instance, currently, there are 26.9 million software developers worldwide. There are 4.3 million people in the US. Enterprise application development projects account for 84.7% of all software development projects. Business automation (53.6%) and e-commerce (38.50%) come next. Version control systems enable teams to collaborate efficiently, manage code changes, and track project progress, which are essential for successful software development practices. This is further heightening the growth of global market with significant growth rate.

Report Segmentation

The market is primarily segmented based on type, deployment, enterprises size, end use, and region.

|

By Type |

By Deployment |

By Enterprises Size |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Centralised version control systems (CVCS) segment is dominating the market in 2022

In fiscal year 2022, the centralised version control systems (CVCS) segment is anticipated to record the largest market share. They have been around for a long time and are well-known among developers. The segment was considered as the traditional approach to version control and was widely adopted before the emergence of Distributed Version Control Systems (DVCS) like Git. Many organizations established their workflows and infrastructure around CVCS, making it the default choice for version control. Furthermore, CVCS solutions often have extensive integrations with other development tools, such as issue trackers, project management software, and build systems. These integrations make it easier to manage the development lifecycle and maintain a centralized workflow within the organization.

By Deployment Analysis

On-premises reflecting greater growth prospect during forecast period

In 2022, the on-premises segment held the largest global share in terms of volume and value. Organizations with legacy systems or specific tool chains may have established on-premises version control solutions that integrate with their existing infrastructure. Migrating to a cloud-based solution or adopting a different deployment model could require significant changes and investments in reconfiguring the tool chain and integrations. In addition to this, by hosting version control systems on-premises, organizations can have direct control over the infrastructure, hardware, and software configurations. This level of control can be appealing to companies that have specific IT requirements, customization needs, or restrictions on utilizing cloud-based services.

By Enterprises Size Analysis

Large enterprises segment is leading the global market in 2022

Large enterprises segment is expected to garner the largest revenue in the global market as they typically have extensive codebases, multiple development teams, and complex projects. They require version control systems solutions that can handle large repositories, support concurrent development, and enable efficient collaboration among distributed teams. Version control systems system with robust scalability and performance capabilities are often preferred in such environments.

Additionally, large enterprises often have specific requirements for their version control systems, such as advanced access controls, fine-grained permissions management, audit trails, and integration capabilities with other enterprise systems. Version control systems solutions that cater to these enterprise-grade features can align better with the needs of large organizations. Compliance and security, integration with enterprise tool chain, vendor support & services, and many other benefits are making the segment dominant in the global market.

By End-Use Analysis

IT and telecom divisions segment held largest share of the global revenue in 2022

IT and telecom divisions segment is dominating the global market in the fiscal year 2022. The IT and Telecom industries heavily rely on software development for building applications, websites, systems, and other digital products. Version control is a fundamental requirement for managing code changes, collaborating effectively, and ensuring software quality. Thus, these industries have a significant demand for version control systems solutions. Moreover, these sectors have embraced agile methodologies and DevOps practices to enhance development speed, quality, and collaboration. These systems play a crucial role in facilitating these practices by enabling continuous integration, continuous delivery, and automated testing.

Regional Insights

North America is accounting the largest share in the global market in 2022

In the fiscal year 2022, North America is expected to lead the global market. The rising demand for specialised version control systems across many industrial verticals is to blame for this. Furthermore, the country's expanding internet and smartphone use also contribute to market expansion. For example, there were almost 90% internet users in the United States. These aspects are broadening the revenue in the region with a significant market share and are poised to maintain its supremacy in the upcoming years.

Asia Pacific is projected to grow with the fastest CAGR during the forecast period. Major economies in South Asia and the Pacific, notably India and Australia, have seen a sharp rise in the need for centralised and distributed version control systems, opening up significant opportunities for the market. Additionally, the use of version control systems in the BFSI and IT & telecom industries have steadily increased in Asian countries. For example, there were around 1166.84 million telephones in India. The banking industry in India is well-capitalized and regulated. The combined assets of the public and private banking sectors were respectively USD 1,594.51 billion and USD 925.05 billion in 2022. These are improving the demand for version control systems in this region and further broadening the market.

Key Market Players & Competitive Insights

The version control systems market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

The global version control systems market involves:

- Amazon Web Services

- APAChe Software Foundation

- Beanstalk

- Bitbucket.org

- CollabNet, Inc.

- Dynamsoft Corporation

- Github, Inc.

- Microsoft Corporation

- Perforce Software

- Others

Version Control Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 728.10 million |

|

Revenue forecast in 2032 |

USD 1,632.83 million |

|

CAGR |

9.39% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Deployment, By Enterprise Size, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Amazon Web Services, Inc., Beanstalk (Wildbit, LLC), Bitbucket.org (Atlassian Corporation Plc), CollabNet, Inc., Microsoft Corporation, Github, Inc., Dynamsoft Corporation, Perforce Software, Inc., APAChe Software Foundation, and others |

FAQ's

The global version control systems market size is expected to reach USD 1,632.83 million by 2032.

Key players in the version control systems market are Amazon Web Services, Inc., Beanstalk (Wildbit, LLC), Bitbucket.org (Atlassian Corporation Plc), CollabNet, Inc.

North America contribute notably towards the global version control systems market.

The global version control systems market is expected to grow at a CAGR of 9.39% during the forecast period.

The version control systems market report covering key segments are type, deployment, enterprises size, end use, and region.