Virus Filtration Market Share, Size, Trends, Industry Analysis Report

By Product Type (Consumables, Instruments, Services, Others); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1014

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

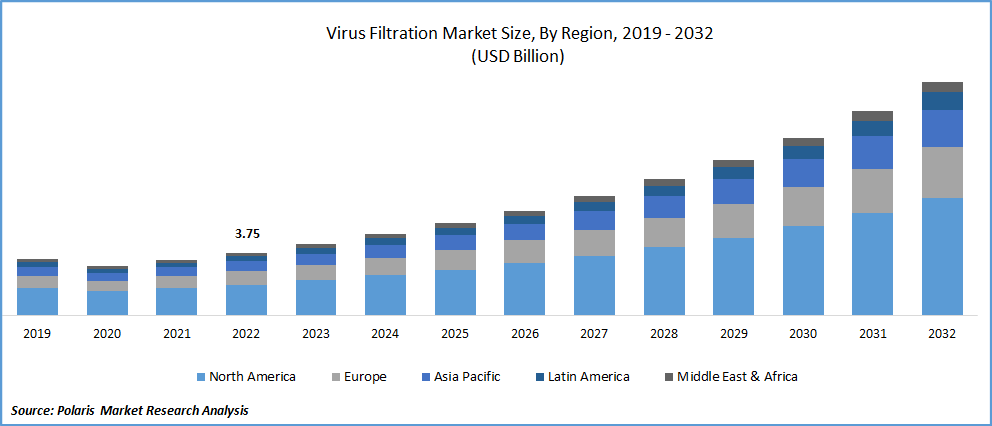

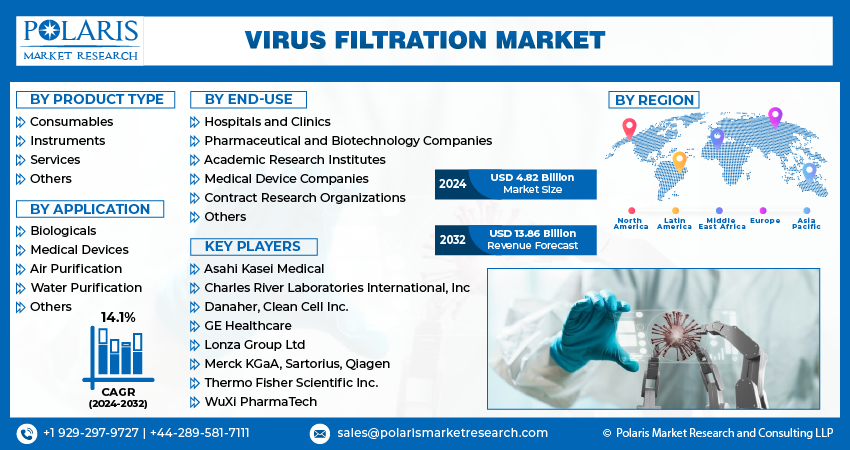

The global virus filtration market was valued at USD 4.25 billion in 2023 and is expected to grow at a CAGR of 14.1% during the forecast period. The increasing prevalence of chronic illnesses such as cancer, diabetes, and immune system disorders is anticipated to propel the demand for virus filtration method. According to the International Agency for Cancer Research, the number of new cancer cases worldwide was approximately 14.1 million, and this figure is projected to reach 21.7 million by 2030. As a result, there is a growing need for therapeutic biologics to treat these chronic conditions, fueling demand for virus filtration products for research and development and other applications.

Know more about this report: Request for sample pages

Viruses are small transferable contagious undesired particles or agents, especially in pharmaceutical production, which must be removed for drug sterility. Filtration removes viruses, with benefits such as minimal damage and easy operability to the products. Virus filtration is usually completed at the end of any method's purification and refining step. Virus filters act as a defensive barrier or medium for bioreactors by filtering media and buffer solutions.

Furthermore, each biopharmaceutical is distinct, making it extremely challenging to replicate the original prescription. Even a slight variation in the protein structure can lead to changes in the drug's effectiveness, quality, and safety. Consequently, it is crucial to use filtration products like chromatography reagents and kits with great care to prevent any changes in protein structure or denaturation of proteins that can affect the demand for these products.

The surge in COVID-19 cases has increased the demand for vaccines and therapeutics, leading to a rise in demand for virus filtration products. This has highlighted the importance of virus filtration in ensuring the safety and efficacy of biological drugs and vaccines, leading to increased adoption of virus filtration technologies. However, disruptions in supply chain and logistics due to the pandemic have affected the production and delivery of virus filtration products, causing shortages in some regions.

Industry Dynamics

Growth Drivers

The increasing prevalence of chronic diseases like cancer, diabetes, and immune system disorders require the development and production of biologics, which drive the demand for virus filtration products for research and development. The rising need for therapeutics biologics for treatment has led to the development of virus filtration products that ensure the safety and efficacy of these drugs.

Also, the growing adoption of single-use technologies in bioprocessing has increased the demand for disposable virus filtration products that offer several benefits, such as the reduced risk of cross-contamination, lower cleaning and validation costs, and increased flexibility and scalability. Using single-use technologies has also increased the efficiency and speed of virus filtration processes.

The increasing investment in research and development activities in the pharmaceutical and biotech industries also drives the demand for virus filtration products. The need for effective and safe biologic drugs and vaccines that require virus filtration during their production has further boosted the demand. The demand for advanced biologic therapies, such as gene and cell therapies, is also driving the growth of the virus filtration market. The stringent regulatory requirements for the safety and efficacy of biological drugs and vaccines have created a demand for virus filtration products that ensure the quality and purity of these products.

Report Segmentation

The market is primarily segmented based on product type, application, end-use, and region.

|

By Product Type |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Instrument Segment Anticipated to Grow at Fastest Rate over the Forecast Period

The instruments segment is expected to grow fastest in the coming years due to increasing demand for biological therapeutics for treating chronic illnesses. Leading biopharmaceutical companies such as Amgen Inc. and Pfizer Inc. have introduced filtration and chromatography systems for research and development as well as the production of biologics. Therefore, as the demand for biologics continues to grow, there will be a corresponding increase in the demand for virus filtration instruments.

Biologicals Segment has Accounted for Highest Revenue Share in the Market

The biologicals segment has captured the highest revenue share in the market and is expected to continue to grow at the fastest rate during the forecast period. Due to the increasing prevalence of chronic diseases such as cancer, diabetes, and blood disorders. The demand for biologics, which are used for treating such chronic illnesses, has been rising rapidly. This has led to a surge in demand for virus filtration products, which are essential for ensuring the safety and efficacy of biologics.

The medical devices segment is expected to grow at a lucrative rate in the coming years. Due to manufacturers' introduction of advanced virus-clearance products. These products are designed to ensure the safety of medical devices by eliminating any virus particles that may be present. With the increasing prevalence of infectious diseases and the rising demand for medical devices. The introduction of new and innovative virus filtration products for medical devices is expected to drive the growth of this segment.

Pharmaceutical and Biotechnology Companies’ Segment is Anticipated to Hold Largest Share

Pharmaceutical and biotechnology companies segment is expected to hold the largest share of the virus filtration market, owing to the high demand for virus filtration in biologics and vaccines. Contract research organizations (CROs) also contribute significantly to the market growth, offering virus filtration services to pharmaceutical companies and academic and research institutes.

The academic and research institutes segment is expected to grow over the projected period due to virus filtration in various research studies to isolate and study viruses and purify proteins and other biomolecules. Medical device companies also use virus filtration to produce medical devices and equipment.

North America Dominated the Global Market in 2022

North America has dominated the market and is expected to hold the largest share of the overall market. This is due to the region's increasing investments and many local pharmaceutical companies. The United States has the largest market share among North American countries. Various initiatives, including collaborations among key regional players, further propel the market's expansion. For instance, in July 2022, Pall Corporation collaborated with EverGrain to offer a filtering solution for their new plant-based protein facility in St. Louis, Missouri. The facility employs the Pall Membralox Microfiltration System to concentrate on upcycling the brewer's saved grains. This results in high-quality functional protein, now used in other food products, replacing animal feed. These collaborations are expected to stimulate the growth of advanced products in the region, thereby boosting the market growth.

Competitive Insight

Some of the major players operating in the global market include Asahi Kasei Medical, Charles River Laboratories International, Inc, Danaher, Clean Cell Inc., GE Healthcare, Lonza Group Ltd, Merck KGaA, Sartorius, Qiagen, Thermo Fisher Scientific Inc., and WuXi PharmaTech.

Recent Developments

- In October 2022, PathoQuest has opened a new factory in Wayne, Pennsylvania. The facility spans 7000 square feet (650 square meters) and has already begun accepting new customers from around North America and the world. This will allow for the testing of groundbreaking biologics in the industry.

- In July 2022, Agilitech has launched a versatile single-use platform for virus filtration in bioprocessing. This system is designed for single-use and is highly efficient in filtering viruses.

Virus Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.82 billion |

|

Revenue forecast in 2032 |

USD 13.86 billion |

|

CAGR |

14.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Asahi Kasei Medical, Charles River Laboratories International, Inc, Danaher, Clean Cell Inc., GE Healthcare, Lonza Group Ltd, Merck KGaA, Sartorius, Qiagen, Thermo Fisher Scientific Inc., and WuXi PharmaTech. |

FAQ's

The global virus filtration market size is expected to reach USD 13.86 billion by 2032.

Key players in the virus filtration market are Asahi Kasei Medical, Charles River Laboratories International, Inc, Danaher, Clean Cell Inc., GE Healthcare, Lonza Group Ltd, Merck KGaA, Sartorius, Qiagen.

North America contribute notably towards the global virus filtration market.

The global virus filtration market expected to grow at a CAGR of 14.0% during the forecast period.

The virus filtration market report covering key segments are product type, application, end-use, and region.