Wall Art Market Share, Size, Trends, Industry Analysis Report

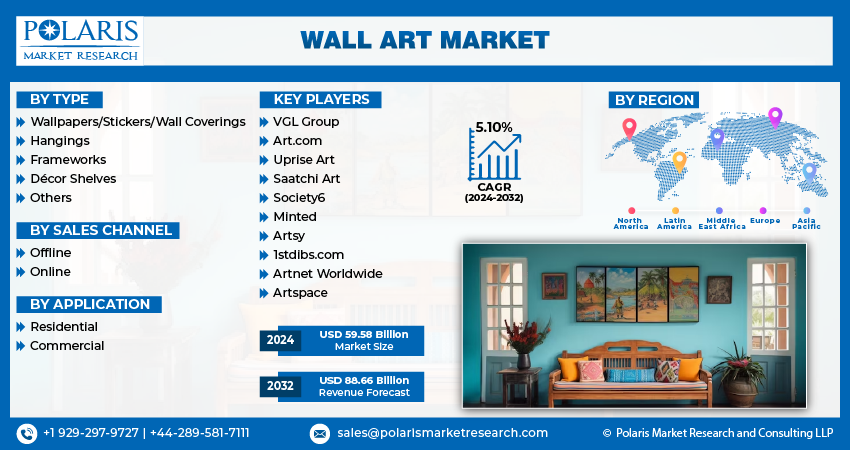

By Type (Wallpapers/Stickers/Wall Coverings, Hangings, Frameworks, Décor Shelves), By Sales Channel, By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3610

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

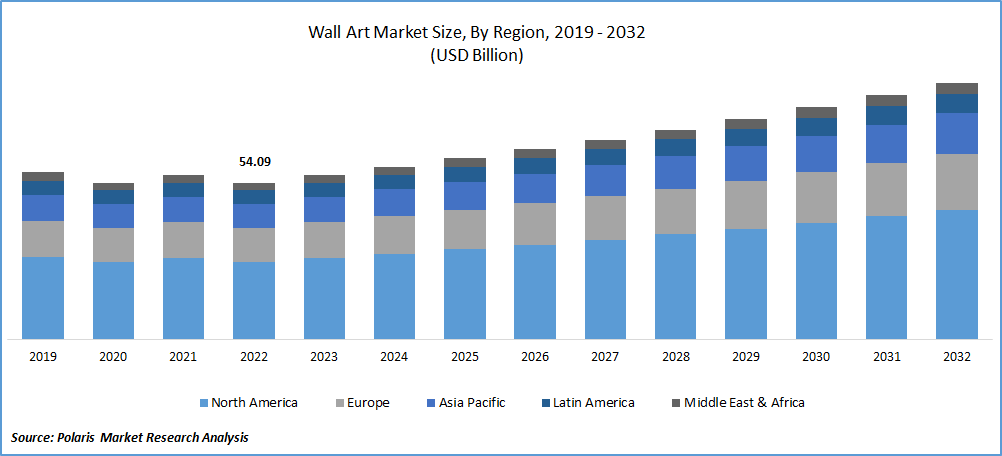

The global wall art market was valued at USD 56.76 billion in 2023 and is expected to grow at a CAGR of 5.10% during the forecast period. The demand for ready-to-install home décor products is driving growth in the market, along with the increasing penetration of e-commerce sales and residential construction activities worldwide. Online platforms provide customers with a convenient and extensive range of wall art options, contributing to the expansion of the market. Residential construction activities worldwide have also significantly driven the market's growth, particularly in emerging economies where urbanization and rising disposable incomes have increased demand for interior decorations, including wall art, to personalize and enhance living spaces.

To Understand More About this Research: Request a Free Sample Report

The interior design industry is constantly evolving, influenced by changing lifestyles, cultural influences, technological advancements, and design innovations. Consumers' preferences for wall art are also influenced by these trends, and businesses operating in the industry must closely monitor and understand them to stay competitive and meet market demands. The trend toward minimalism in interior design has significantly impacted the demand for wall art, with consumers preferring simplistic and understated art pieces that complement this style. Additionally, the presence of a growing number of artisans in the market is expanding the array of choices available to consumers, allowing businesses to offer a more customized product line that sets them apart from competitors.

Consumers are also becoming increasingly conscious of the environmental impact of their purchases and actively seeking sustainable products. Major players in the industry are integrating sustainable materials, including bamboo, organic cotton, and natural fibers, into their product offerings to minimize their environmental impact. IKEA, for example, has embraced sustainability within its wall art products by incorporating bamboo and recycled materials and promoting sustainable cotton production methods through the "Better Cotton Initiative." These environmentally conscious endeavors are poised to drive increased sales in the years ahead.

Industry Dynamics

Growth Drivers

Consumers have a growing desire for a diverse range of products that allow them to add a personal touch to their living spaces. The COVID-19 pandemic has also intensified the emphasis on home remodeling and repairs, resulting in increased sales of wall art products. The real estate sector's rapid growth and the expanding residential and personal space market, encompassing apartments, houses, and more, have significantly contributed to the overall market expansion. Furthermore, the pandemic-induced lockdowns have spurred a rise in the Do-It-Yourself (DIY) trend in home improvement projects, leading to an increased demand for wall art. With people spending more time at home, there has been a greater inclination towards enhancing living spaces and engaging in creative endeavors. As a result, DIY enthusiasts have shown increased interest in selecting and installing wall art to personalize their homes.

As per the statistics published by the American Housing Survey by the U.S. Census Bureau in 2022, homeowners in the United States completed approximately 53 million DIY projects. These DIY projects accounted for 39% of all home improvement endeavors and represented 20% of the total spending during the survey period. These findings highlight DIY projects' significant role in the home improvement industry, making it crucial for key players in this field to target DIY enthusiasts specifically.

Report Segmentation

The market is primarily segmented based on type, sales channel, application, and region.

|

By Type |

By Sales Channel |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Wall paper segment accounted for the largest market share in 2022

The wallpaper segment accounted for the largest market share in 2022. Traditionally, demand for wall coverings has been higher in Europe & Asia compared to America. However, notable growth has been observed in the U.S. market, as demonstrated by a 50% increase in online searches related to wallpapers in the 12 months leading up to March 2020. Younger consumers have been introduced to wallpapers through social media platforms and have recognized their potential for easily personalizing living spaces.

The wall hangings segment is anticipated to be the fastest-growing segment, with a healthy CAGR over the study period. Woven wall hangings have gained considerable popularity as a versatile form of wall art, combining traditional weaving techniques with modern elements. These wall hangings are crafted using natural fibers such as wool, cotton, or linen and offer customization options in colors, textures, and patterns. A prime example can be found in the product range offered by West Elm, a well-established brand in the market. West Elm provides a wide selection of woven wall hangings meticulously made from natural fibers like cotton, wool, and jute. These hangings feature contemporary designs and captivating textures, catering to diverse aesthetic preferences. Moreover, West Elm offers a range of sizes and styles to accommodate individual preferences and requirements.

North America region dominated the global market in 2022

North America region dominated the global market with considerable revenue share in 2022. The increasing prevalence of homeownership in the United States plays a vital role in propelling the wall art market within the country.

Preliminary data from the Census Bureau also highlights a notable upsurge in the number of homeowners, with approximately 1.3 million new homeowners recorded between 2014 and the first quarter of 2021, aligning with the average yearly gains observed from 2016 to 2019. This favorable housing landscape sets a promising stage for the flourishing growth of the wall art market.

The Asia Pacific region will likely emerge as the fastest-growing region, with a significant growth rate during the forecast period. The region has seen a notable rise in the demand for wall art, propelled by the growth of the real estate sector, evolving lifestyle trends, and the flourishing hospitality industry. An example of a company capitalizing on the expanding Indian market is IDECORWALA.COM. This online platform is strategically positioned with its profound industry expertise, well-established e-commerce platform, efficient last-mile delivery, installation services, and a dedicated customer help desk.

IDECORWALA.COM offers an extensive range of interior décor products and caters to customers, hotels, and commercial establishments. Such initiatives present key players with opportunities to broaden their product portfolios and meet industries' specific requirements.

Competitive Insight

Some of the major players operating in the global market include VGL Group, Art.com, Uprise Art, Saatchi Art, Society6, Minted, Artsy, 1stdibs.com, Artnet Worldwide, and Artspace.

Recent Developments

- In April 2023, Uprise Art announced a forthcoming exhibition titled "Universe, Understood." The show will feature the collections of artists Evi & David Esquivel. In this joint showcase, both artists intend to explore personal narratives & symbolism with their artwork, employing vibrant abstraction, poetic expression, & a touch of humor.

- In March 2023, Saatchi Art collaborated with SuperRare, to introduce a collection of 10 distinct digital artworks created by renowned artists.

Wall Art Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 59.58 billion |

|

Revenue forecast in 2032 |

USD 88.66 billion |

|

CAGR |

5.10% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Sales Channel, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

VGL Group, Art.com, Uprise Art, Saatchi Art, Society6, Minted, Artsy, 1stdibs.com, Artnet Worldwide, and Artspace. |

FAQ's

The global wall art market size is expected to reach USD 88.66 billion by 2032.

Top market players in the Wall Art Market are VGL Group, Art.com, Uprise Art, Saatchi Art, Society6, Minted, Artsy, 1stdibs.com, Artnet Worldwide.

North America contribute notably towards the global Wall Art Market.

The global wall art market expected to grow at a CAGR of 5.1% during the forecast period.

The Wall Art Market report covering key are type, sales channel, application, and region.