Anti-counterfeit Packaging Market Size, Share, Trends, & Industry Analysis Report

By Technology (Mass Encoding, RFID), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM2311

- Base Year: 2024

- Historical Data: 2020 - 2023

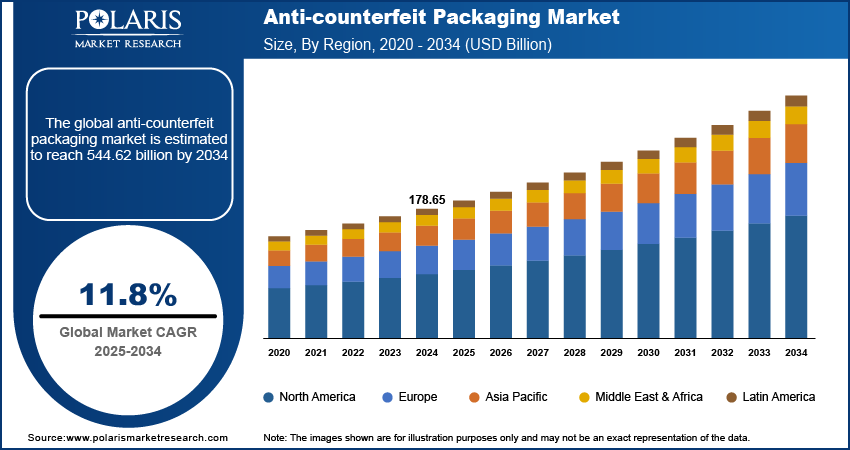

The global anti-counterfeit packaging market was valued at USD 178.65 billion in 2024 and is expected to grow at a CAGR of 11.8% during the forecast period. The emergence of fake products in the market, raising brand awareness, buyer consciousness of product information, the rising e-commerce industry, advances in printing technologies, and issues about the impact of fraudulent packaging on the marketing strategy of products and consumer health are driving the anti-counterfeit packaging market.

Key Insights

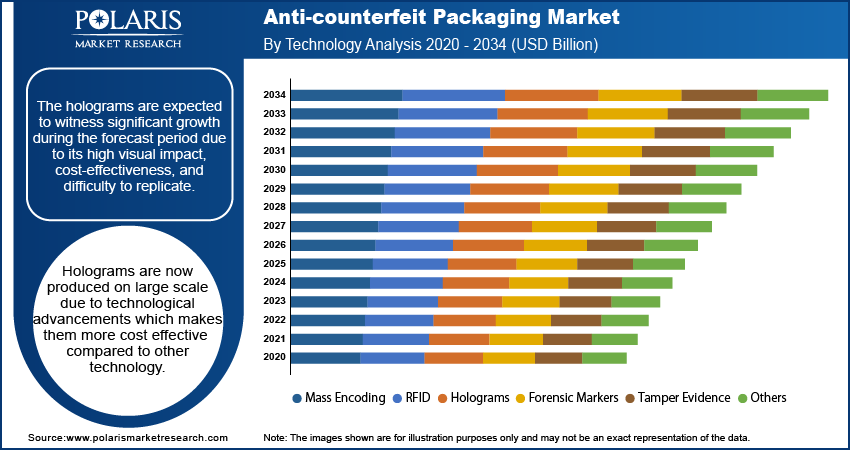

- The holograms are expected to witness significant growth during the forecast period due to its high visual impact, cost-effectiveness, and difficulty to replicate.

- The pharmaceutical segment accounted for the largest share in 2024 driven by the rising demand for genuine pharma products.

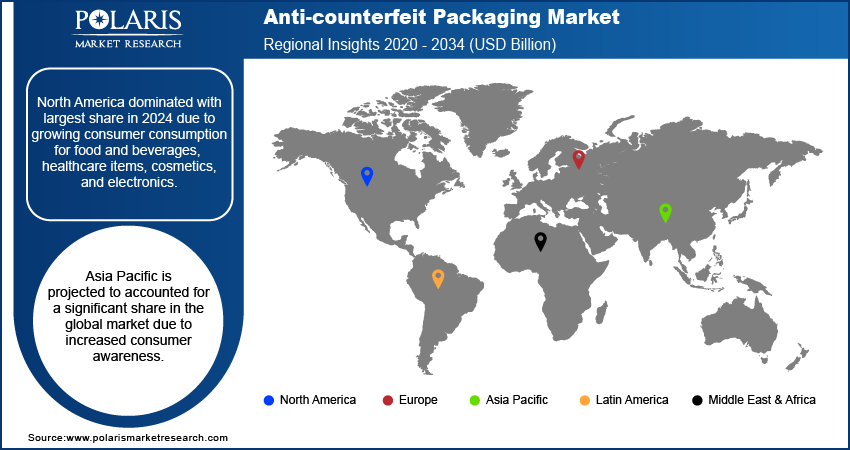

- North America dominated with largest share in 2024 due to growing consumer consumption for food and beverages, healthcare items, cosmetics, and electronics.

- Asia Pacific is projected to accounted for a significant share in the global market due to increased consumer awareness.

Industry Dynamics

- The rising digitalization anti-counterfeiting solutions is fueling the industry growth.

- The growing number of fake products is boosting the industry growth.

- The technological advancement is driving the growth.

- High implementation costs and complexity of integrating advanced anti-counterfeit technologies restrain widespread adoption.

Market Statistics

- 2024 Market Size: USD 178.65 Billion

- 2034 Projected Market Size: USD 544.62 Billion

- CAGR (2025-2034): 11.8%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

The digitization of anti-counterfeiting solutions is boosting growth. One significant benefit of electronic anti-counterfeiting packing is that smartphones are able to be used to enable consumer-usable alternatives. Quick-response (QR) codes, for example, boast of the ease of scanning with no need to install any app. So, because the majority of users use smartphones, individuals are familiar with scanning procedures and effectively authenticate particular products. Additionally, digital technology is making a significant impact in marketing and data collection. NeuroTags safe anti-counterfeit QR Codes include a complete integrated loyalty and data gathering solution, allowing the business marketing department to establish a two-way digital connection with your top customers and instantly engage them for repeat sales.

Industry Dynamics

Growth Drivers

The global trade volume is increasing, due to which the concern regarding fake products is rising. This rise in concern regarding fake products among consumers are prompting manufacturers to adopt anti-counterfeit packaging to identify the genuine products. This rise in concern is also fueled by increase in counterfeit goods, majorly in pharmaceuticals, electronics, cosmetics, and luxury products. Moreover, the e-commerce growth is further fueling the demand for the anti-counterfeit packaging. E-commerce platforms feature wide range of products from different manufacturers. This has further raised concern regarding product originality, which in turn is further fueling the demand for this packaging, thereby driving the industry growth.

Report Segmentation

The market is primarily segmented based on technology, end-use, and region.

|

By Technology |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The holograms are expected to witness significant growth during the forecast period due to its high visual impact, cost-effectiveness, and difficulty to replicate. Holograms are now produced on large scale due to technological advancements which makes them more cost effective compared to other technology. Holograms provide visual verification which enable consumers to identify genuine product more quickly which further fuels the adoption of holograms. Moreover, holograms are difficult to replicate because they required specialized equipment and techniques which further drives the demand. Modern holograms can be combined with QR codes, serial numbers, and blockchain, offering layered security and traceability, thereby diving the segment growth.

Insight by End-Use

The pharmaceuticals segment dominated with largest share in 2024 driven by increased demands for anti-counterfeit packaging and human health and safety, which is increasing recognition of anti-counterfeit packaging and human health and safety. The strict regulations governing counterfeiting operations, the necessity for effective supply chain management, and the availability of cost-effective counterfeiting solutions have prompted packaging firms to invest in anti-counterfeiting technology, which provides cost savings and brand protection, thereby driving the segment growth.

Geographic Overview

North America had the largest revenue share. Growing consumer consumption for food and beverages, healthcare items, cosmetics, and electronics is predicted to contribute significantly to the industry growth. Consumers' demands for transparency are increasing, resulting in a huge increase in the traceability of these products. The presence of sophisticated anti-counterfeit rules has supported the market's growth. As a result, to meet the expanding demand, manufacturers include breakthrough technologies in equipment with particular features for effective production tracking and identification.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. It is developing due to increased consumer knowledge, which has resulted in a greater understanding of the product-related information, raising the demand for counterfeit packaging in the region.

Competitive Insight

Major players operating in the global market include 3D AG, 3M Company, AlpVision SA, Applied DNA Sciences, Authentix, Avery Dennison Corporation, CCL Industries, Dupont, Sato Holdings, Savi Technology, Sicpa, SML Group, Systech International, Tracelink Inc., and Zebra Technologies.

Anti-counterfeit Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 178.65 billion |

| Market size value in 2025 | USD 199.26 billion |

|

Revenue forecast in 2034 |

USD 544.62 billion |

|

CAGR |

11.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3D AG, 3M Company, AlpVision SA, Applied DNA Sciences, Authentix, Avery Dennison Corporation, CCL Industries, Dupont, Sato Holdings, Savi Technology, Sicpa, SML Group, Systech International, Tracelink Inc., and Zebra Technologies. |

Navigate through the intricacies of the 2024 Anti-Counterfeit Packaging Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2030. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Bottled Water Processing Market Size, Share 2024 Research Report

Data Center Solutions Market Size, Share 2024 Research Report

Industrial Networking Solutions Market Size, Share 2024 Research Report

Electric Mid- and Large (9-14m) Bus Market Size, Share 2024 Research Report

FAQ's

• The market size was valued at USD 178.65 Billion in 2024 and is projected to grow to USD 544.62 Billion by 2034

• The market is projected to register a CAGR of 11.8% during the forecast period.

• A few of the key players in the market are 3D AG, 3M Company, AlpVision SA, Applied DNA Sciences, Authentix, Avery Dennison Corporation, CCL Industries, Dupont, Sato Holdings, Savi Technology, Sicpa, SML Group, Systech International, Tracelink Inc., and Zebra Technologies.

• The pharmaceutical accounted for the largest market share in 2024.

• The holograms segment is expected to record significant growth.