Collaborative Robot Market Share, Size, Trends, Industry Analysis Report

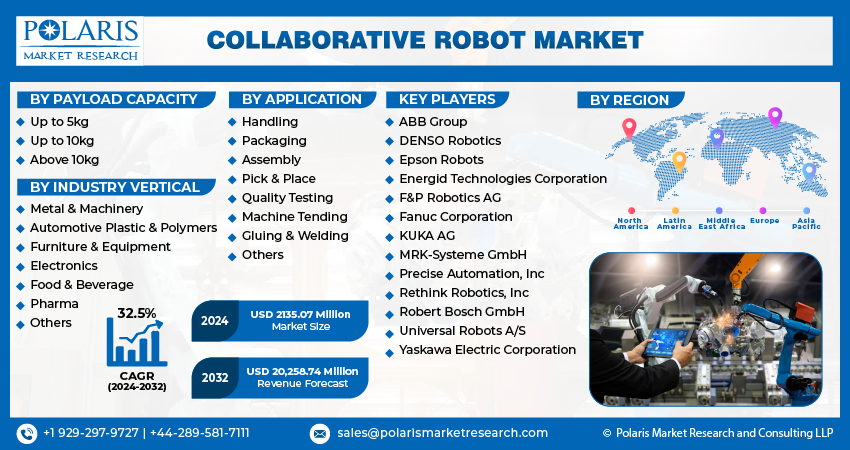

By Payload Capacity (Up to 5kg, Up to 10kg, Above 10kg); By Industry Vertical; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4028

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

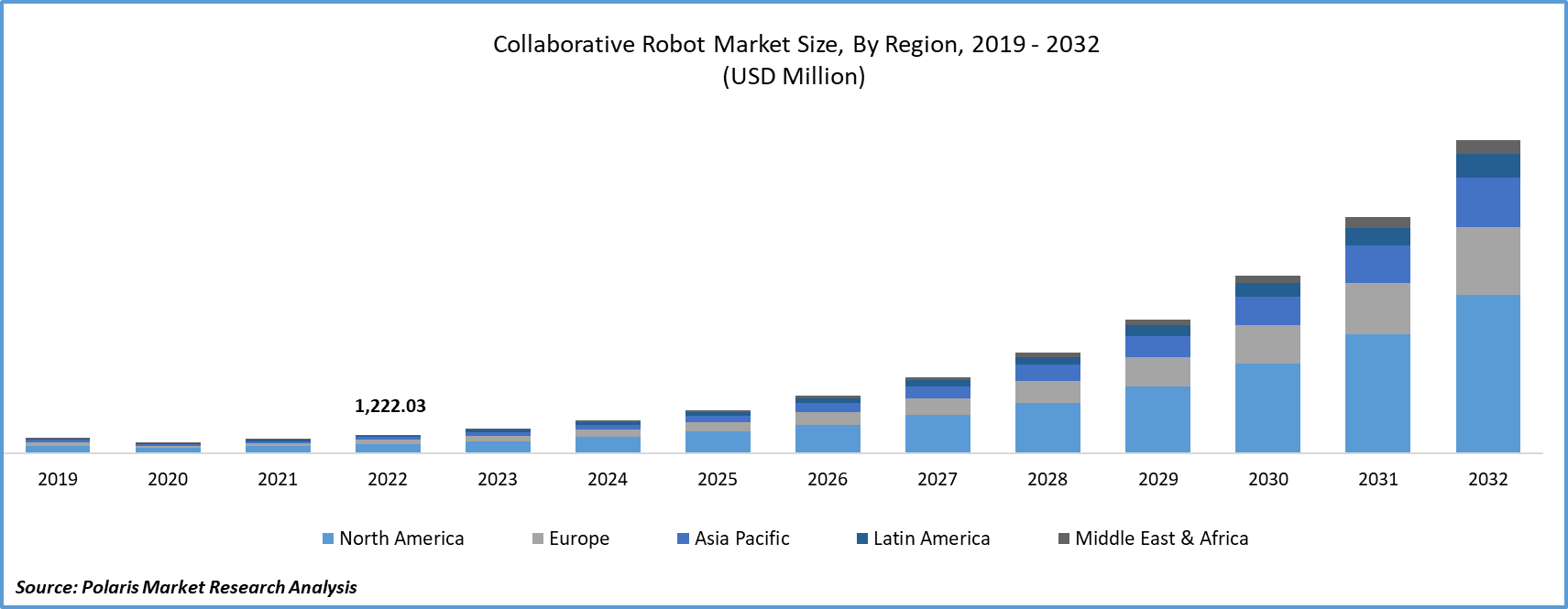

The global collaborative robot market size and share was valued at USD 1614.91 million in 2023 and is expected to grow at a CAGR of 32.5% during the forecast period.

The research study provides a comprehensive analysis of the industry, assessing the market based on various segments and sub-segments. It sheds light on the competitive landscape and introduces collaborative robot market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Collaborative robots, commonly known as Cobots, are robotic systems specifically designed for working alongside humans or engaging in cooperative tasks with them. Unlike traditional industrial robots, which are typically isolated within safety enclosures and must maintain strict separation from human workers, collaborative robots are engineered to operate safely in close proximity to humans. The defining characteristic of these robots is their capacity to interact and collaborate with people without causing harm or posing risks. They are equipped with sophisticated sensors, safety mechanisms, and intelligent programming to ensure secure and efficient collaboration. These robots are often engineered to be lightweight, compact, and mobile, making them easily reconfigurable and adaptable to various existing work environments.

A collaborative robot is an industrial robot that can securely function beside humans in a collective workspace. Progressions in mobile technology, artificial intelligence, machine vision, and connect technology are rendering it feasible for compact, lesser potential robots to be apprised of their environment and execute countless kinds of chores securely in immediacy to human workers. Further being arranged to safeguard the security of their human colleagues, cobots can swiftly assimilate chores through verification and supplementing learning.

Cobots are armed with software-regulated sensors that sanction them to discern items, people, and probable strikes. The collaborative robot market size is expanding as the software observes each gesture of a cobot and instantly clamps it down if it discloses something unanticipated. Predominantly industrial robots are power and force limitation cobots which indicate that in the event of an unanticipated clash, their integral sensors can recognize when unusual force is registered, creating the cobot to either retard or halt functioning to prohibit mischance and injuries.

To Understand More About this Research: Request a Free Sample Report

Collaborative robots are used in various industries to perform monotonous or physically demanding tasks with human workers. They are particularly useful in pick-and-place operations, assembly, quality assurance, packaging, and machine maintenance. Cobots also play a critical role in healthcare, research and development, logistics, and other sectors where human-robot collaboration can boost productivity and safety. The collaborative robot market is growing due to demand for automation, technological advancements, labor shortages, and emphasis on safety in high-risk work environments.

Technological advancements have brought about significant progress in the field of robotics. Initially expensive with limited functionality, such as fixed spindles or restricted rotation angles, modern robots can now efficiently undertake complex tasks at a reduced cost, thanks to technological breakthroughs. This results in a swift Return on Investment (ROI) due to lowered overall expenses and increased production rates. Moreover, the integration of robots in industrial processes has contributed to a decline in workplace injuries and accidents. Additionally, it has enhanced product quality, leading to increased profits for various businesses.

The collaborative robot market report is a comprehensive assessment of all the opportunities and challenges in the industry. It covers all the recent innovations and major events in the industry while shedding lights on the key market features such as CAGR, supply/demand, cost, production rate and consumption. Along with that, the study offers a thorough analysis of the key market dynamics and latest trends to help businesses develop strategies that will drive collaborative robot industry growth.

The COVID-19 pandemic has had a significant impact on the collaborative robot (cobot) market. While the robotics industry had been experiencing steady growth before the pandemic, the need for social distancing and reduced physical interaction in workplaces accelerated the adoption of cobots. These robots, designed to work alongside humans, became crucial in industries like manufacturing, logistics, and healthcare, where maintaining operations with minimal human contact was necessary. As a result, the demand for cobots increased during the pandemic, as they could perform tasks like material handling, quality control, and disinfection without risking worker health. Additionally, the pandemic highlighted the flexibility and adaptability of cobots in rapidly changing environments. It's expected that the cobot market will continue to expand post-pandemic as businesses recognize the benefits of automation and collaboration in their operations.

Industry Dynamics

Growth Drivers

Increasing Betterment in the Human-Machine Interface Boosts the Growth of the Collaborative Robot Market

Automation has emerged as a pivotal strategy adopted by numerous large-scale industries to enhance production efficiency while reducing operational costs. With a growing number of companies embracing automation, the utilization of collaborative robots has witnessed a surge in the field of manufacturing technology. Diverse sectors, including automotive, electronics, semiconductor, metalworking, and machinery, have increasingly incorporated collaborative robots into their operations for tasks such as assembly line processes, pick-and-place operations, injection molding, and quality control applications.

The human-machine interface is evolving with advancements such as touchscreen technology, larger screens with higher resolutions, advanced processors, and the integration of Industrial Internet of Things (IIoT) capabilities. These improvements empower operators to remotely monitor robots from any location through the Human-Machine Interface (HMI). This seamless integration of technology is driving the widespread adoption of collaborative robots, paving the way for greater efficiency and cost savings across various industries.

Report Segmentation

The market is primarily segmented based on payload capacity, industry vertical, application, and region.

|

By Payload Capacity |

By Industry Vertical |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Payload Capacity Analysis

The 5kg Segment Accounted for the Largest Revenue Share in the Forecast Period

The 5kg segment accounted for the largest revenue share in the forecast period. Collaborative robots with a 5kg payload capacity are highly versatile, and used in factory automation tasks and the automotive industry. They operate at 1.2 m/s, boast 1000mm reach, and feature position and torque sensors. These robots are compatible with third-party peripherals and offer adaptability, safety, and repeatability. They are poised for rapid growth in the market.

These collaborative robots in this payload capacity, are versatile and well-suited for a diverse array of tasks. They excel in applications like assembly, pick-and-place tasks, packaging, and handling small parts. Their widespread utilization spans various industries, including electronics, automotive, consumer goods, and pharmaceuticals, where the need for precision and skill is paramount.

By Industry Vertical Analysis

The Automotive Segment is Anticipated to Dominate the Market During the Forecast Period

The automotive segment is expected to dominate the market during the forecast period, in the automotive sector, these collaborative robots, find extensive use in a wide range of applications. This encompasses activities like assembly line tasks, material handling, logistics, quality assurance and inspection, painting, and finishing, as well as testing and validation.

Specifically, within the automotive assembly lines, cobots are engineered for diverse functions, including the insertion of components, fastening screws, welding operations, and quality control assessments. They collaborate closely with human operators, providing valuable support for repetitive and precise assembly tasks. Consequently, they contribute to increased efficiency, reduced errors, and an overall enhancement in worker safety. Cobots also play essential roles in activities like engine assembly, assembly of interior and exterior components, and the installation of electrical systems. Consequently, the burgeoning demand for cobots in various automotive industry applications is anticipated to drive substantial growth in this segment's revenue.

Regional Insights

Europe is Anticipated to Dominate the Market in the Forecast Period

Europe is expected to dominate the market in the forecast period. The region has seen a notable surge in the integration of collaborative robots (cobots) in various industries, including automotive, electronics, manufacturing, healthcare, and logistics. This has led to the expansion of the market in Europe. Additionally, Europe boasts a robust industrial foundation, making it a conducive environment for the deployment of cobots. Key nations like France, Italy, Germany, and the United Kingdom have thriving manufacturing sectors, with a particular focus on the early adoption of cobots in the automotive industry.

The presence of a well-established manufacturing infrastructure and a commitment to innovation has significantly fostered the adoption and expansion of cobots in the region. Furthermore, Europe places great importance on safety standards and regulations. Cobots are specifically designed to work safely alongside human employees, and European countries have implemented stringent regulations to ensure the safety of cobots within industrial settings.

Asia-Pacific is anticipated to grow fastest over the forecast period. Due to the efforts of regional governments, collaborative robots have gained significant recognition for their role in driving industrial growth and enhancing competitiveness. Various initiatives, policies, and financial support mechanisms have been put in place to encourage the widespread adoption and development of collaborative robots. These government-led actions are primarily aimed at stimulating innovation, strengthening manufacturing capabilities, and creating conducive conditions for businesses to embrace automation technologies.

Additionally, factors such as escalating labor costs, aging populations, and shifting demographics in countries like China and Japan have spurred the demand for automation solutions, with a specific emphasis on collaborative robots. Collaborative robots, or cobots, present a cost-effective alternative to manual labor, allowing businesses to enhance operational efficiency, reduce dependence on labor-intensive tasks, and effectively address workforce-related challenges.

Competitive Analysis

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ABB Group

- DENSO Robotics

- Energid Technologies Corporation

- Epson Robots

- F&P Robotics AG

- Fanuc Corporation

- KUKA AG

- MRK-Systeme GmbH

- Precise Automation, Inc

- Rethink Robotics, Inc

- Robert Bosch GmbH

- Universal Robots A/S

- Yaskawa Electric Corporation

Recent Developments

- In July 2023, Collaborative Robotics secured $30 million in funding during their Series A round, aiming to advance the development and deployment of innovative cobots.

- In May 2023, Universal Robots and Denali Advanced Integration, a well-established technology integration provider, unveiled their strategic collaboration. This partnership brings together cutting-edge technology and top-tier services, forming a powerful alliance. By joining forces with Universal Robots, the foremost player in collaborative robotics, and Denali, a seasoned IT/OT partner, they are uniquely positioned to offer customers the most innovative automation solutions, ensuring substantial returns on their technology investments.

- In September 2022, Graham Partners Growth invested in Novarc Technologies through a Series A funding round. Novarc Technologies is a leading robotics company focused on the development and promotion of collaborative robots (cobots) and artificial intelligence-driven machine vision systems tailored for robotic welding applications. This injection of capital will empower Novarc to broaden its range of products and fuel its worldwide expansion efforts.

Collaborative Robot Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2135.07 million |

|

Revenue Forecast in 2032 |

USD 20,258.74 million |

|

CAGR |

32.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Payload Capacity, By Industry Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the collaborative robot market report with a phone call or email, as and when needed.

Delve into the intricacies of collaborative robots in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Educational Robot Market Size, Share 2024 Research Report

Milking Robots Market Size, Share 2024 Research Report

Delivery Robots Market Size, Share 2024 Research Report

Data Center Robotics Market Size, Share 2024 Research Report

Warehouse Robotics Market Size, Share 2024 Research Report