Edge AI Market Size, Share, Trends, & Industry Analysis By Component (Hardware, Network, Edge Cloud Infrastructure, Software, and Support Services), By Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5936

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

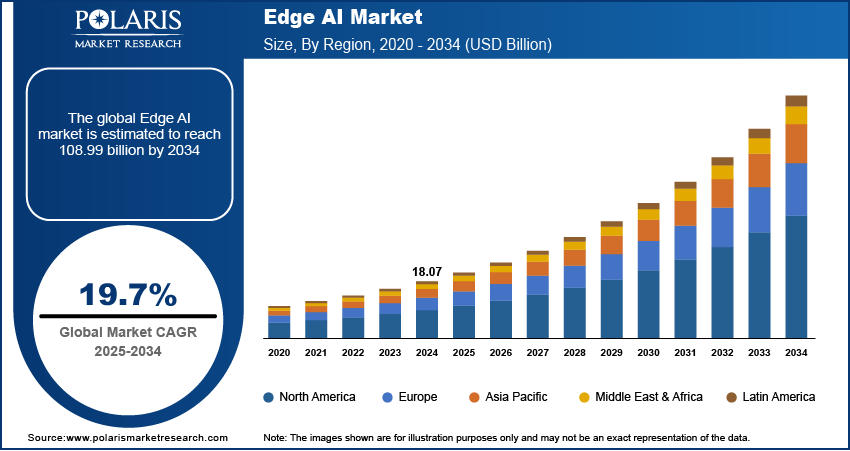

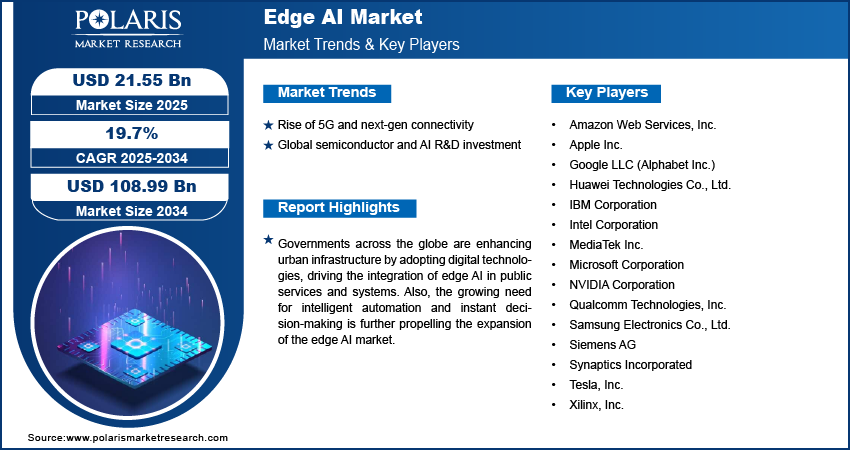

The edge AI market size was valued at USD 18.07 billion in 2024, growing at a CAGR of 19.7% during 2025–2034. Rise of 5G and next-gen connectivity coupled with global semiconductor and AI R&D investment is driving the market growth.

Edge AI refers to the deployment of artificial intelligence algorithms locally on hardware devices, allowing real-time data processing without relying on cloud infrastructure. It enables devices such as smartphones, sensors, surveillance cameras, drones, and industrial robotics to execute AI models directly on the device itself. This reduces latency, lowers bandwidth costs, and enhances data privacy. These capabilities make edge AI suitable for critical applications where immediate decision-making is essential, including autonomous vehicles, predictive maintenance, and remote healthcare diagnostics.

The growing reliance on intelligent systems in sectors such as manufacturing, automotive, and healthcare is fueling the need for distributed AI architecture. Edge AI offers decentralized intelligence, which ensures real-time responsiveness and uninterrupted operation even during network failures. In healthcare, wearable and diagnostic devices edge AI track vitals and deliver alerts without cloud dependence. Also, in manufacturing environments, edge AI enables predictive analytics and process automation that significantly reduces downtime and increases operational efficiency.

To Understand More About this Research: Request a Free Sample Report

Governments worldwide are focusing on strengthening urban infrastructure through digitalization initiatives, which in turn is increasing the demand for edge AI technologies in public systems. For instance, Indonesia launched the “100 Smart Cities Movement” as part of its comprehensive urban digitalization strategy. This program is designed to improve quality of life in cities through data-centric approaches, while addressing the country's projected urbanization challenge by 2045, nearly 83% of Indonesia’s population is expected to reside in urban areas. Also, in August 2024, the Government of India approved 12 new industrial smart city projects with a combined infrastructure development cost of USD 3.43 billion. These projects are aimed at building advanced trunk infrastructure to support technology-led urban growth. The integration of edge AI into such initiatives allows public service systems to function more autonomously, securely, and efficiently, further propelling its adoption in national smart city programs.

In addition, the rising demand for intelligent automation and real-time decision-making is further accelerating the edge AI market growth. Organizations are investing in edge AI platforms to modernize legacy infrastructure, reduce operational risks, and support predictive and autonomous operations. This shift is improving overall process control and data visibility across decentralized networks.

Industry Dynamics

Rise of 5G and Next-Gen Connectivity

The global rollout of 5G infrastructure is laying a transformative foundation for the deployment of edge AI across numerous time-sensitive applications. According to 5G Americas, global 5G connections rose sharply to 1.76 billion in 2023, with a net increase of 700 million connections in that year alone. This number is forecast to grow to 7.9 billion by 2028, reflecting a substantial acceleration in infrastructure expansion and network accessibility. These connectivity advancements are strengthening the viability of deploying AI algorithms directly on devices, reducing the need for cloud round-trips. Thus, edge AI is becoming integral to enabling more intelligent, localized, and autonomous system behaviors across critical environments that requires high performance, strong security, and continuous uptime.

The increased bandwidth and reduced latency offered by 5G services are allowing edge devices to collect, process, and act on information with minimal delay. This capability is helping industries to optimize operations through predictive maintenance, real-time quality control, and dynamic system adjustments. Additionally, the growing shift toward Industry 4.0, combined with rising adoption of smart infrastructure and remote monitoring, is further propelling the growth of the market. Enterprises prioritizing faster insights and lower data transfer costs are driving the demand for 5G and edge AI, providing high responsiveness, improved efficiency, and scalable solutions across real-time applications.

Global Semiconductor and AI R&D Investment

The surge in investments in semiconductor technologies and artificial intelligence research and development is accelerating the market growth. According to the United Nations Conference on Trade and Development (UNCTAD), the global AI market is projected to reach approximately USD 4.8 trillion by 2033, a twenty-five-fold expansion in a decade. This growth reflects the increasing importance of AI in transforming operational models across industries and reinforces the need for robust edge AI infrastructure. Legislative frameworks such as the US CHIPS and Science Act and the EU’s Digital Europe Programme are contributing to the development of advanced fabrication capabilities, AI accelerators, and application-specific integrated circuits (ASICs) designed for edge environments. Therefore, the rising funding, policy support, and technological advancement is boosting the edge AI market growth.

The convergence of AI and semiconductor advancements is unlocking new possibilities for real-time analytics, smart sensing, and autonomous system control outside traditional data centers. Edge AI, supported by cutting-edge semiconductors, allows data to be processed closer to the source, reducing latency and increasing operational security. The expanding innovation through R&D, venture funding, and public programs is enabling AI-ready edge devices to perform complex machine learning tasks independently. Thus, edge AI is becoming a practical and scalable solution for industries looking to improve efficiency, responsiveness, and data privacy in real-world applications.

Segmental Insights

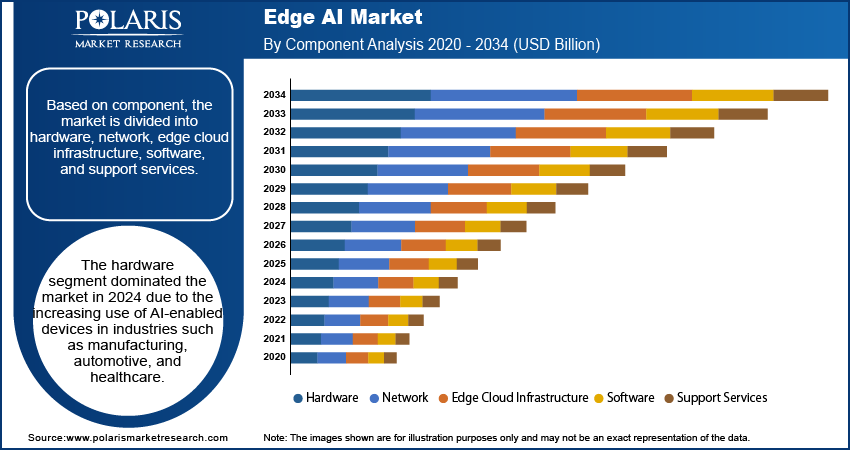

Component Analysis

The segmentation, based on component includes, hardware, network, edge cloud infrastructure, software, and support services. The hardware segment dominated the market in 2024 due to the increasing use of AI-enabled devices in industries such as manufacturing, automotive, and healthcare. Companies are adopting edge AI chips, sensors, and processing units that allow machines and equipment to analyze data locally without relying on the cloud. These components are essential in running real-time operations, requiring quick decision-making is needed. The growing number of smart cameras, drones, and robots is contributing to the strong demand for edge AI hardware.

The edge cloud infrastructure segment is expected to grow at the fastest rate during the forecast period. Businesses are increasingly combining on-site data processing with cloud-based tools to improve flexibility and data control. This shift is driving the need for edge cloud platforms that support faster decision-making, better data security, and seamless connectivity. Companies in sectors such as logistics and energy are investing in such hybrid infrastructure to support smart operations, optimize workflows, and reduce downtime.

Industry Analysis

The segmentation, based on industry includes, automotive, manufacturing, healthcare, energy & utility, retail & consumer goods, it & telecom, and others. The automotive segment dominated the market in 2024. This dominance is attributed to the increasing adoption of edge AI into vehicles to support features such as driver assistance, navigation, and in-car personalization. These systems help vehicles process information instantly from sensors and cameras, improving safety and responsiveness. The push toward autonomous driving and connected mobility is pushing manufacturers to invest in edge AI for faster and more secure data processing inside the vehicle. For instance, in October 2024, Infineon introduced the DEEPCRAFT brand for Edge AI software solutions, launching new Ready Models including "directional sound arrival detection" that can trigger various safety enhancements or enable autonomous driving.

The healthcare segment is projected to grow at the fastest pace in the coming years. This growth is attributed to the rising adoption of edge AI in patient monitoring, diagnostics, and portable medical devices. Hospitals and healthcare providers are adopting AI-enabled tools that deliver real-time insights at the point of care. For instance, in June 2024, Anumana collaborated with InfoBionic.Ai integrated Anumana's ECG-AI algorithms validated with Mayo Clinic into InfoBionic’s MoMe ARC platform for remote cardiac telemetry. This integration empowered edge AI in patient monitoring by enabling real-time detection of cardiac conditions such as low ejection fraction directly from wearable ECG devices. These tools help doctors make faster decisions, reduce delays in treatment, and enhance patient outcomes. The growing demand for home-based and remote healthcare services is fueling the need for edge AI solutions that operate independently without constant internet access.

Regional Analysis

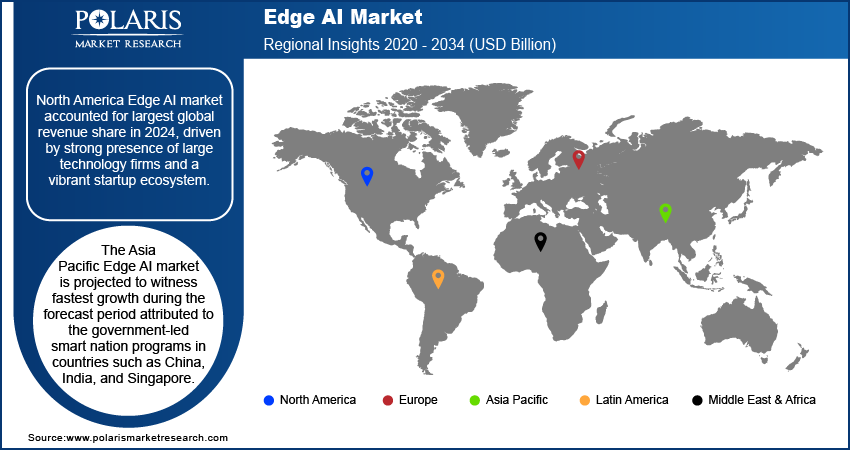

North America Edge AI market accounted for largest global revenue share in 2024, driven by strong presence of large technology firms and a vibrant startup ecosystem. Companies such as Google, Amazon, NVIDIA, and Microsoft are investing heavily in edge-based AI platforms to support real-time computing in sectors including healthcare, retail, automotive, and manufacturing. These organizations are developing AI chips, edge servers, and software frameworks tailored for localized processing, allowing enterprises to deploy intelligent systems with minimal latency. In addition, the rising adoption of edge AI in defense and aerospace is fueling the growth of the market in the region. Defense agencies and military contractors are deploying AI-enabled edge devices for real-time surveillance, secure communication, and autonomous threat detection. This demand is further propelled by national defense modernization programs aimed at integrating AI into tactical and operational platforms.

The US Edge AI Market Insight

The US, in particular, dominated the regional share in 2024 due to strong support from federal and state-level funding initiatives. Public-private partnerships and R&D grants are fueling innovation in AI-enabled infrastructure across healthcare, transportation, and defense sectors. Government programs are supporting startups and research institutions working on edge AI applications for diagnostic tools, smart public services, and autonomous platforms. For instance, in January 2025 the US government partnered with OpenAI, Oracle, SoftBank, and others to launch the “Stargate Project,” committing up to USD 500 billion over four years to build AI infrastructure starting with an initial USD 100 billion investment in data centers and power systems. These fundings are making it easier for companies to scale new technologies and bring advanced AI models closer to end users. Thus, the advanced technology ecosystem coupled with surge in investment in AI is accelerating the edge AI adoption in the country.

Asia Pacific Edge AI Market

The Asia Pacific Edge AI market is projected to witness fastest growth during the forecast period attributed to the government-led smart nation programs in countries such as China, India, and Singapore. These countries are integrating AI at the edge into public systems including transport networks, utility grids, and security infrastructure. For instance, in 2024, Singapore introduced Smart Nation 2.0, building on the foundation of Smart Nation 1.0. The updated vision shifts from broad capability development to a more focused approach, using technology to drive national transformation and collective progress. These programs are focused on improving efficiency, citizen safety, and sustainability, and edge AI enables real-time monitoring, autonomous decision-making, and secure data handling. Urban development projects and national digitalization strategies are further expanding the market growth in the region.

Additionally, surge in adoption of industrial automation is further fueling the market growth in the region. Countries such as Japan, South Korea, and China are home to leading manufacturing hubs where companies are adopting edge AI to improve production efficiency, reduce downtime, and manage energy usage. AI-enabled sensors and controllers deployed at the machine level allow factories to detect failures, monitor workflows, and adjust operations in real time. These applications are helping manufacturers stay competitive while meeting high standards for productivity and quality.

Europe In Edge AI Market Overview

The Europe edge AI market is projected to reach at significant revenue share by 2034. The large-scale funding and digital transformation strategies in the region is propelling the growth of the market. The European Union’s Horizon Europe and Digital Europe Programme are directing capital toward AI research, development, and deployment including edge computing infrastructure. For example, in May 2025, the European Commission committed more than USD 8.25 billion through its Horizon Europe work programme for 2025 to boost the region’s research and innovation landscape. The investment aims to advance scientific breakthroughs, support the EU’s green and digital transitions, and strengthen Europe’s global competitiveness. These initiatives are enabling businesses and research institutions to build specialized edge platforms for use in healthcare, transport, energy, and manufacturing. Investments in edge AI are supporting local innovation ecosystems and helping small to mid-sized enterprises adopt intelligent automation.

Strict data privacy and compliance requirements in Europe are further shaping the adoption of edge AI. Regulations such as the General Data Protection Regulation (GDPR) require that sensitive data be processed and stored locally, which limits reliance on centralized cloud services. Edge AI solutions enable real-time, on-device processing that helps businesses comply with data sovereignty laws while reducing the risk of data breaches. This growing emphasis on regulatory compliance is pushing organizations to implement AI models that operate within controlled, secure environments making edge AI a preferred approach in sectors handling personal or confidential information.

Key Players & Competitive Analysis Report

The edge AI market is highly competitive and evolving rapidly as companies focus on developing faster, smarter, and more energy-efficient solutions that operate close to data sources. Industry leaders are actively investing in the development of edge-native AI hardware and software tools that handle real-time processing with minimal reliance on centralized data centers. Major players are expanding product portfolios, forming technology alliances, and acquiring specialized AI startups that offer complementary capabilities. Companies are also prioritizing industry-specific solutions tailored to applications in automotive, industrial automation, healthcare, and smart devices. In addition, the integration of 5G, IoT, and machine learning platform is pushing organizations to deliver AI solutions that balance speed, security, and performance at the network edge.

Prominent players operating in the edge AI market include Amazon Web Services, Inc., Apple Inc., Google LLC (Alphabet Inc.), Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, MediaTek Inc., Microsoft Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Siemens AG, Synaptics Incorporated, Tesla, Inc., and Xilinx, Inc.

Key Players

- Amazon Web Services, Inc.

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- MediaTek Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Siemens AG

- Synaptics Incorporated

- Tesla, Inc.

- Xilinx, Inc.

Industry Developments

June 2025: Google introduced the Gemma 3n lightweight generative AI model that runs offline on edge devices with 2 GB RAM, supporting multimodal tasks including image, audio, video, and text processing. This enabled secure, privacy-preserving AI use in low-resource environments such as mobile devices and IoT nodes.

May 2025: EDGE Group launched the Group AI Accelerator to scale AI innovation across defense and industrial manufacturing sectors via a centralized Centre of Excellence. The program also aimed to nurture local AI talent and accelerate product readiness in harsh and security-sensitive environments.

December 2024: Synopsys and SiMa.ai announced a strategic partnership to deliver a silicon and software platform for automotive edge AI applications accelerating SoC development for ADAS and infotainment systems. The joint solution targeted low-latency inferencing and energy efficiency, critical for autonomous features in next-gen vehicles.

July 2024: NTT DATA launched its Ultralight Edge AI platform, offering a fully managed service that auto-discovers IT/OT devices and orchestrates lightweight AI agents for real-time insights. It supported real-time anomaly detection, predictive maintenance, and seamless cloud integration with edge scalability.

Edge AI Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Network

- Edge Cloud Infrastructure

- Software

- Support Services

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Manufacturing

- Healthcare

- Energy & Utility

- Retail & Consumer Goods

- IT & Telecom

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Edge AI Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.07 Billion |

|

Market Size in 2025 |

USD 21.55 Billion |

|

Revenue Forecast by 2034 |

USD 108.99 Billion |

|

CAGR |

19.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 18.07 billion in 2024 and is projected to grow to USD 108.99 billion by 2034.

The global market is projected to register a CAGR of 19.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amazon Web Services, Inc., Apple Inc., Google LLC (Alphabet Inc.), Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, MediaTek Inc., Microsoft Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Siemens AG, Synaptics Incorporated, Tesla, Inc., and Xilinx, Inc.

The hardware segment dominated the market share in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.