eFuse Market Size, Share, & Industry Analysis Report

: By Type (Auto Retry and Latched), By Packaging Type, By Application, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5725

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

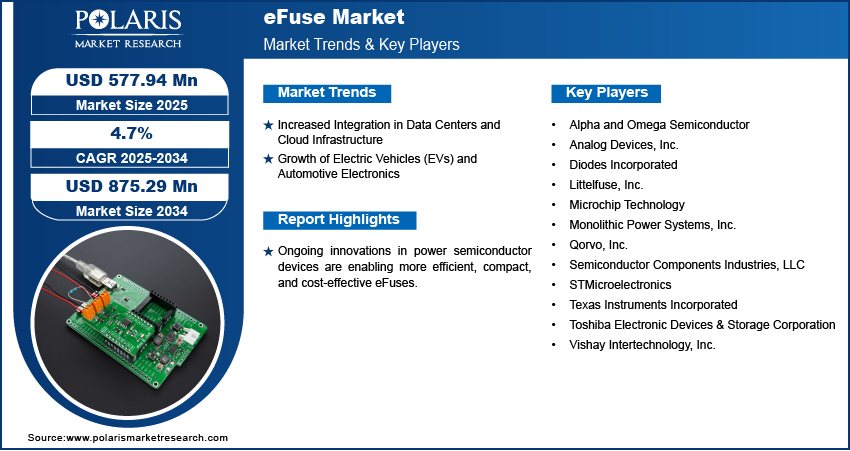

The global eFuse market size was valued at USD 552.42 million in 2024 and is projected to register a CAGR of 4.7% during 2025–2034. The market is witnessing a gradual replacement of traditional mechanical fuses with solid-state eFuses for improved reliability and performance, which is driving overall growth.

The eFuse market refers to the industry centered around electronic fuses—semiconductor-based circuit protection devices designed to replace traditional mechanical fuses. eFuses provide precise overcurrent, overvoltage, short-circuit, and inrush current protection in electronic systems. Unlike conventional fuses, eFuses are resettable, offer faster response times, and can be integrated into compact electronic designs with programmable functionality. These characteristics make them critical components in a wide range of applications, including data centers, consumer electronics, industrial automation, and automotive electronics. Ongoing innovations in power semiconductor devices are enabling more efficient, compact, and cost-effective eFuses.

To Understand More About this Research: Request a Free Sample Report

Increasing emphasis on system safety and regulatory compliance is encouraging OEMs to integrate intelligent protection components such as eFuses in their designs. Additionally, with growing automation and IoT deployment, there is a heightened need for reliable and intelligent protection in distributed and connected systems.

Market Dynamics

Increased Integration in Data Centers and Cloud Infrastructure

The exponential growth in data traffic and the widespread adoption of cloud-based services are driving the construction and expansion of high-density data centers. For instance, in January 2025, AWS announced a strategic investment of about USD 11 billion to expand its infrastructure in Georgia, aimed at enhancing cloud computing and AI capabilities, further establishing the state as a key technology hub. These facilities demand highly reliable, efficient, and precise power management systems to maintain uptime and protect sensitive equipment. eFuses, with their ability to deliver programmable overcurrent, overvoltage, and short-circuit protection, are increasingly being integrated into server boards, power distribution units, and network hardware. Their fast response time, resettable functionality, and diagnostic capabilities support continuous operation and minimize downtime. Moreover, the ability of eFuses to provide digital telemetry and remote monitoring aligns with the growing emphasis on real-time power analytics, operational resilience, and intelligent infrastructure management in next-generation data centers.

Growth of Electric Vehicles (EVs) and Automotive Electronics

The rapid evolution of electric vehicles (EVs) and the growing complexity of automotive electronic systems are significantly contributing to the demand for advanced circuit protection solutions. For instance, according to the International Energy Agency, in 2024, global electric vehicle sales surpassed 17 million units, achieving a share exceeding 20%. This represents an increase of 3.5 million electric vehicles sold compared to the previous year, highlighting significant growth in the sector. eFuses offer advantages over traditional fuses in terms of precision, reset capability, and integration into control systems, making them well-suited for battery management systems, onboard chargers, infotainment units, and electronic control units (ECUs). Their programmable thresholds and fault diagnostics enhance safety, which is critical in high-voltage EV architectures. Additionally, the shift toward autonomous and connected vehicles increases the number of electronic subsystems, amplifying the need for reliable, compact, and intelligent protection components. eFuses contribute to improved energy efficiency, system reliability, and safety compliance across modern electric mobility platforms.

Segment Insights

Market Assessment by Type

Based on type, the segmentation includes auto retry and latched. In 2024, the latched segment captured a larger share due to its strong adoption in high-reliability systems where permanent shutdown upon fault detection is critical. Latched eFuses are particularly favored in applications where fault events must be manually diagnosed and reset, such as in industrial automation, telecom power systems, and mission-critical server infrastructure. Their ability to isolate faults and prevent repetitive fault cycling enhances system stability and safeguards sensitive components. The non-volatile nature of latched protection aligns with stringent compliance in sectors requiring defined fault responses and traceability. These attributes make latched eFuses the default in regulated environments demanding persistent fault isolation and hardware-level protection without auto-restart risks.

The auto retry segment is projected to register a higher CAGR during the forecast period, due to its growing deployment in compact consumer electronics and battery-operated devices that benefit from fault self-recovery. Auto retry eFuses automatically resume normal operation after fault clearance, minimizing system downtime and reducing the need for manual intervention. This functionality is particularly suited to wearables, mobile devices, and low-power IoT systems where uninterrupted operation and user transparency are essential. Advancements in microcontroller integration and intelligent power management are further enabling adaptive retry logic, allowing these fuses to balance safety and availability. The increasing demand for intelligent fault tolerance in miniaturized electronics is expected to continue driving the expansion of this segment.

Market Assessment by Package Type

Based on package type, the segmentation includes small outline no lead, dual flats no leads, and quad flat no leads. In 2024, the small outline no lead (SON) segment captured the largest share due to its compact footprint and excellent thermal performance, making it ideal for high-density PCBs used in portable and embedded systems. SON-packaged eFuses are extensively used in applications such as smartphones, laptops, and networking modules, where board space is at a premium and thermal efficiency is crucial. Their lower parasitic inductance and better electrical performance enable faster response times and more stable circuit behavior under high-speed switching conditions. Furthermore, the SON format supports automated assembly and reflow soldering, reducing production costs and ensuring consistency in large-scale manufacturing environments, thus cementing its dominance in space-constrained electronic designs.

The quad flat no-leads (QFN) segment is projected to register the highest CAGR during the forecast period, due to its superior input/output (I/O) density and enhanced electrical and thermal characteristics, supporting more complex integration within high-power and high-speed electronic assemblies. QFN packaging enables multilayer PCB stacking and efficient heat dissipation, making it suitable for advanced automotive control units, high-performance computing modules, and telecom infrastructure. The package’s low profile also supports vertical system integration, critical in devices where form factor optimization and thermal reliability are top priorities. Increased demand for multifunctional and high-wattage components in evolving EV platforms and edge AI devices is expected to fuel the rapid adoption of QFN-packaged eFuses.

Market Evaluation by Application

Based on application, the segmentation includes solid state drives, hard disk drives, servers and data center equipment, automobile electronics, and other applications. In 2024, the servers and data center equipment segment captured the largest share due to the critical need for resilient power management solutions in hyperscale computing environments. Data centers rely on highly efficient, fault-tolerant power architectures, and eFuses provide granular protection, thermal shutdown, and remote diagnostics essential for maintaining uptime and equipment safety. These features are integral in reducing mean time to repair (MTTR) and enhancing energy efficiency. The integration of eFuses in server motherboards, storage systems, and redundant power supply units contributes to seamless fault isolation and recovery, enabling service providers to meet aggressive service-level agreements (SLAs) and reduce operational risk.

The solid-state drives (SSD) segment is projected to register the highest CAGR during the forecast period, due to the escalating adoption of NVMe and PCIe-based SSDs in enterprise computing and consumer devices. SSDs require precise, low-latency power protection to prevent data corruption and ensure long-term reliability. eFuses deliver fast-acting overcurrent and short-circuit protection that aligns with the stringent power integrity requirements of flash memory and controllers. As SSDs increasingly replace traditional HDDs in laptops, servers, and data-intensive edge devices, the demand for ultra-compact, high-efficiency eFuse solutions embedded in storage modules is rising rapidly. Moreover, the trend toward ruggedized and industrial-grade SSDs amplifies the need for programmable, robust circuit protection.

Market Evaluation by Vertical

Based on vertical, the segmentation includes automotive & transportation, aerospace & defense, consumer electronics, healthcare, IT & telecommunications, and others. In 2024, the IT & telecommunications segment held the largest share due to the ongoing expansion of global 5G infrastructure and digital connectivity networks that require high-availability power protection systems. Telecom base stations, fiber-optic modules, and network routers integrate eFuses to safeguard against surges, transients, and thermal faults. Their ability to offer telemetry, remote programmability, and reset functionality makes them well-suited to dynamic, high-reliability telecom systems. As service providers prioritize uninterrupted connectivity and power fault resilience, eFuses have become standard in both central office and edge network equipment, providing fine-tuned protection without sacrificing form factor or response time.

The healthcare segment is projected to register the highest CAGR during the forecast period, due to the increasing integration of electronics in life-support systems, portable diagnostics, and wearable medical devices. These devices require ultra-reliable power protection with minimal latency to avoid failure in mission-critical scenarios. eFuses offer precise current regulation and built-in monitoring, supporting compliance with stringent medical safety standards such as IEC 60601. Miniaturization in implantable and point-of-care devices is also pushing demand for compact, intelligent protection components. As remote patient monitoring and connected healthcare infrastructure expand, the need for fault-tolerant, programmable circuit protection solutions such as eFuses is expected to accelerate significantly during the forecast period.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America eFuse market held the largest share due to the widespread adoption of advanced power management technologies across data centers, enterprise IT infrastructure, and next-generation automotive systems. In December 2024, the US Department of Energy (DOE) reported that data center energy loads have tripled over the past decade and are projected to double or triple by 2028. Data center expansion, the rise of AI applications, growth in domestic manufacturing, and the electrification of various industries propel electricity demand. The region’s mature semiconductor ecosystem and early integration of eFuses into power-sensitive applications such as AI servers, cloud storage, and telecommunication equipment drove strong deployment. Key players have also expanded their product lines to meet the region’s demand for smart circuit protection, aligning with trends in system miniaturization and predictive maintenance. High R&D investments, robust regulatory standards, and strong OEM collaboration further accelerated the implementation of programmable eFuses in mission-critical sectors, including aerospace, medical devices, and electric vehicle platforms.

The Asia Pacific eFuse market is projected to register the highest CAGR during the forecast period, due to rapid growth in domestic semiconductor manufacturing, aggressive investments in EV infrastructure, and expanding adoption of smart consumer electronics. According to the Government of China, China is rapidly developing its charging infrastructure for new energy vehicles, supported by government incentives. A recent plan aims to expand road networks to ∼461,000 kilometers by 2035 and promotes the construction of charging piles and hydrogen fueling stations. Countries in the region are increasingly focused on digital transformation and industrial automation, generating substantial demand for reliable and efficient circuit protection solutions. OEMs across automotive, telecom, and healthcare verticals are integrating eFuses to address rising power density and ensure operational safety. Favorable government policies supporting electronics exports and manufacturing innovation are also contributing to the accelerated deployment of high-integration eFuse solutions, particularly in compact and high-reliability system designs.

The China eFuse market is experiencing accelerated growth driven by large-scale 5G deployment, advancements in battery electric vehicle (BEV) platforms, and state-backed support for semiconductor self-sufficiency. Domestic OEMs are increasingly adopting eFuses for critical subsystems such as automotive battery management, power distribution units, and telecom base stations, where programmable protection and thermal stability are crucial. China's aggressive expansion of data centers and cloud infrastructure also reinforces the need for high-reliability, remotely manageable power protection components. Additionally, ongoing R&D initiatives and partnerships between local foundries and electronics manufacturers are enhancing the country’s capability to produce advanced eFuse technologies for both domestic use and export.

The Europe eFuse market is characterized by steady growth supported by increasing demand for intelligent circuit protection in renewable energy systems, automotive electrification, and medical device innovation. The region’s strong emphasis on environmental sustainability and energy efficiency aligns with eFuses’ advantages in thermal management and precise fault control. European automotive OEMs are particularly active in adopting eFuses for EV powertrains, advanced infotainment, and safety-critical electronics. In industrial automation and robotics, eFuses offer protection against overcurrent and enable real-time diagnostics, meeting compliance with stringent CE and IEC standards. Strategic collaboration between technology providers and research institutions continues to foster innovation in compact, high-performance protection devices tailored for European applications.

Key Players & Competitive Analysis Report

The competitive landscape of the eFuse market is shaped by dynamic industry analysis, where key players continually evaluate emerging power management trends to strengthen their positioning. Expansion strategies focus on diversifying product portfolios and entering high-growth sectors such as electric vehicles, industrial automation, and high-density data centers. Joint ventures and strategic alliances are increasingly leveraged to accelerate time-to-market and enhance global supply chain capabilities. Mergers and acquisitions are common as firms aim to consolidate intellectual property and manufacturing competencies. Technology advancements in programmable circuit protection, thermal shutoff, and real-time diagnostics drive differentiation and customer retention.

Frequent product launches address evolving design requirements, particularly in miniaturization and energy-efficient electronics. Post-merger integration efforts emphasize harmonizing innovation roadmaps and optimizing production scalability. Strategic collaborations with OEMs and contract manufacturers also support the development of robust, application-specific eFuse solutions that meet reliability, compliance, and form factor constraints in mission-critical environments.

List of Key Companies

- Alpha and Omega Semiconductor

- Analog Devices, Inc.

- Diodes Incorporated

- Littelfuse, Inc.

- Microchip Technology

- Monolithic Power Systems, Inc.

- Qorvo, Inc.

- Semiconductor Components Industries, LLC

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Vishay Intertechnology, Inc.

eFuse Industry Developments

In July 2024, Toshiba Electronic Devices & Storage Corporation launched the TCKE9 Series, comprising eight high-voltage eFuse ICs designed for power supply line protection. Initial shipments include two models, TCKE905ANA and TCKE903NL.

In July 2024, Nexperia launched new high-current eFuses, the NPS3102A and NPS3102B, to enhance its power device lineup. These low-ohmic (17 mΩ), high current (13.5 A), resettable fuses protect downstream loads from excessive voltages and safeguard power supplies from load faults and inrush currents.

In June 2024, Asahi Kasei Microdevices Corporation (AKM) and Silicon Austria Labs GmbH (SAL) displayed eFuse technology for high-voltage applications using silicon carbide (SiC) power devices. This technology significantly enhances safety and reduces material and maintenance costs in systems such as on-board chargers (OBC) for automobiles.

eFuse Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Auto Retry

- Latched

By Package Type Outlook (Revenue, USD Million, 2020–2034)

- Small Outline No Lead

- Dual Flats No Leads

- Quad Flat No Leads

By Application Outlook (Revenue, USD Million, 2020–2034)

- Solid State Drives

- Hard Disk Drives

- Servers and Data Center Equipment

- Automobile Electronics

- Other Applications

By Vertical Outlook (Revenue, USD Million, 2020–2034)

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics

- Healthcare

- IT & Telecommunications

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

eFuse Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 552.42 million |

|

Market Size Value in 2025 |

USD 577.94 million |

|

Revenue Forecast by 2034 |

USD 875.29 million |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 552.42 million in 2024 and is projected to grow to USD 875.29 million by 2034.

The global market is projected to register a CAGR of 4.7% during the forecast period.

In 2024, the North America eFuse market held the largest share due to widespread adoption of advanced power management technologies across data centers, enterprise IT infrastructure, and next-generation automotive systems.

A few of the key players includes are Alpha and Omega Semiconductor; Analog Devices, Inc.; Diodes Incorporated; Littelfuse, Inc.; Microchip Technology; Monolithic Power Systems, Inc.; Qorvo, Inc.; Semiconductor Components Industries, LLC; STMicroelectronics; Texas Instruments Incorporated; Toshiba Electronic Devices & Storage Corporation; and Vishay Intertechnology, Inc.

In 2024, the latched segment captured a larger share due to its strong adoption in high-reliability systems where permanent shutdown upon fault detection is critical.

The healthcare segment is projected to register the highest CAGR during the forecast period, due to the increasing integration of electronics in life-support systems.