Food Inclusions Market Size, Share, Trends, Industry Analysis Report

: By Product, Form (Solid & Semi Solid and Liquid), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 172

- Format: PDF

- Report ID: PM2633

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global food inclusions market size was valued at USD 15.60 billion in 2024, growing at a CAGR of 5.8% during 2025–2034. Changing consumer preferences, evolving eating habits, and growing demand for premium food products are a few of the key factors driving market growth.

Key Insights

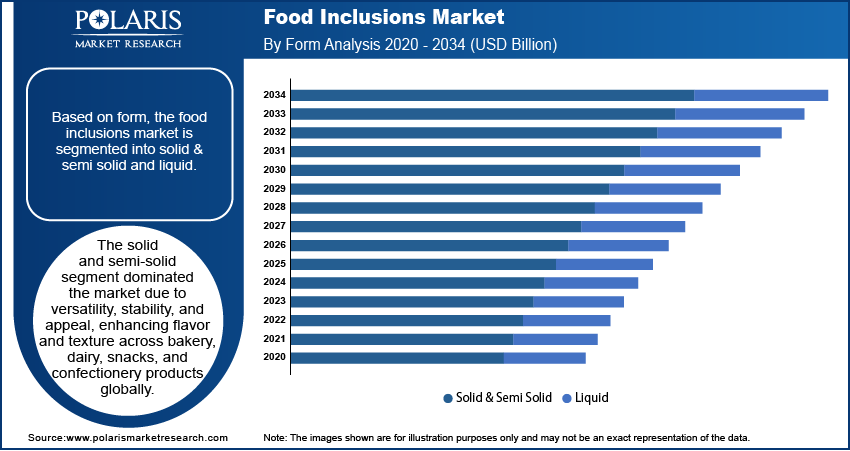

- The solid & semi solid segment accounted for the largest market share, owing to the segment’s versatility and strong consumer appeal.

- The bakery products segment is anticipated to register the highest CAGR during the projection period, primarily due to growing consumer demand for innovative and textured baked goods.

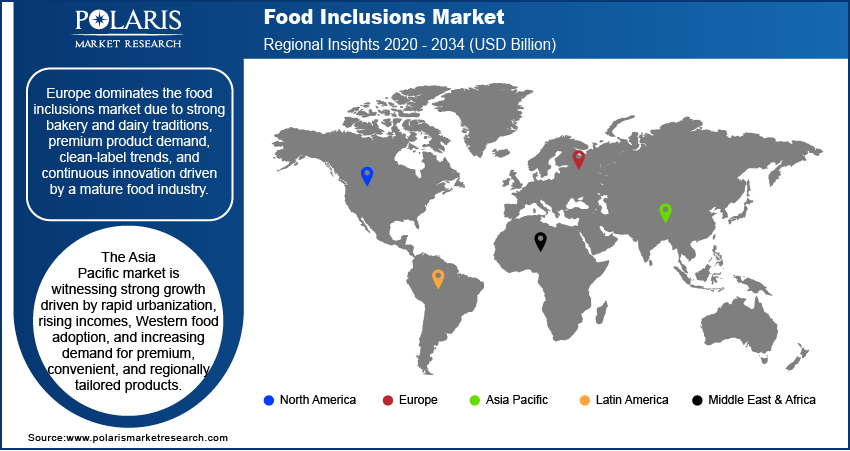

- Europe led the global market. The region’s strong bakery tradition and high dairy consumption consistently fuel innovation in food textures and flavors.

- Asia Pacific is witnessing robust growth, driven by rising disposable incomes, rapid urbanization, and shifting dietary habits in the region.

Industry Dynamics

- Rising consumer preference for value-added food products is fueling demand for food inclusions. Food inclusions help brands meet evolving consumer expectations by adding texture, variety, and premium appeal.

- The expansion of the plant-based food sector is fueling the need for food inclusions that help improve the appeal and functionality of plant-based food products.

- The exploration of novel flavors, textures, and formats by manufacturers to cater to a more discerning customer base presents a major market opportunity.

- Fluctuating raw material costs may present market challenges.

Market Statistics

2024 Market Size: USD 15.60 Billion

2034 Projected Market Size: USD 27.65 Billion

CAGR (2025-2034): 5.8%

Europe: Largest Market in 2024

To Understand More About this Research:Request a Free Sample Report

Food inclusions refer to edible components added to food products to enhance their flavor, texture, appearance, and nutritional value. These can include fruits, nuts, chocolates, candies, cereals, herbs, and more. They are commonly used in bakery, dairy, confectionery, snacks, and frozen foods. The purpose of food inclusions is to elevate the sensory appeal and consumer experience of everyday food items. As brands seek differentiation in a crowded marketplace, food inclusions have become a strategic tool for innovation and value addition.

The global food inclusions market growth is attributed to changing consumer preferences and evolving eating habits. The shifting trends toward personalized and indulgent eating experiences have created strong momentum for the adoption of innovative inclusions. Manufacturers are exploring novel textures, flavors, and formats to cater to a more discerning customer base. This shift represents a significant market growth opportunity, encouraging investments in research and development to create standout products.

The rising demand for premium and artisanal food products is playing a vital role in fueling the food inclusions market expansion. Consumers actively seek authenticity and uniqueness in their food choices, favoring handmade or high-quality offerings that feature distinctive ingredients. Artisanal brands are using inclusions such as gourmet nuts, exotic fruits, or small-batch chocolates to craft exclusive products that resonate with modern expectations.

The increasing consumer preference for texture-rich foods amplifies this trend. Crunchy, chewy, or creamy inclusions add a multisensory dimension, making food more engaging. This growing demand for texture-rich and sensory-enhanced products is pushing brands to innovate continuously, unlocking new avenues for the market growth opportunity.

Market Dynamics

Growing Preference for Value-Added Food Products

Growing consumer preference for value-added food products is significantly driving the demand for food inclusions. Modern consumers are no longer satisfied with basic offerings and actively seek foods that provide enhanced taste, nutrition, and sensory experience. Food inclusions such as fruits, nuts, chocolates, and grains help brands meet these evolving expectations by adding variety, texture, and premium appeal to standard products. Health-conscious buyers also favor inclusions that offer functional benefits, such as protein-rich seeds or antioxidant-packed berries. This shift in consumer behavior encourages manufacturers to innovate, incorporating high-quality inclusions to stay competitive. The rising interest in indulgent yet nutritious foods continues to expand the demand for food inclusions, creating numerous opportunities for product diversification and market growth across multiple food categories.

Expanding Plant-Based Food Sector

The expanding plant-based food sector is significantly driving the market growth. Consumers are increasingly seeking innovative, health-conscious alternatives that also deliver on taste and texture. According to the European Commission, Europe’s plant-based food industry grew by an impressive 49% over two years, reaching USD 3.94 billion in sales. This surge spans categories such as plant-based meat, milk, yogurt, cheese, ice cream, and fish, emphasizing the growing consumer shift. Food inclusions such as fruit pieces, nuts, grains, and flavor clusters play a crucial role in enhancing the appeal and functionality of these products. Manufacturers are nowadays leveraging inclusions to differentiate offerings and meet evolving preferences, further fueling market demand across diverse segments within the plant-based landscape.

Food Inclusions Market Segment Analysis

Market Assessment by Form

The global food inclusions market segmentation, based on form, includes solid & semi solid and liquid. The solid & semi solid segment accounted for ~86% of the food inclusions market share due to their versatility, ease of incorporation, and strong consumer appeal. These formats enhance texture, flavor, and visual appeal in a wide range of products such as bakery, confectionery, dairy, and snacks. Manufacturers prefer solid and semi-solid inclusions for their stability during processing and storage. Growing demand for premium and indulgent food experiences has further driven the adoption of chunks, chips, flakes, and similar formats. Their compatibility with multiple food matrices significantly contributes to the dominance of the solid & semi solid segment in the market.

Market Evaluation by Application

The global food inclusions market segmentation, based on application, includes cereal products, snacks & bars, bakery products, dairy, frozen desserts, chocolate & confectionery products, and others. The bakery products segment is expected to register the highest CAGR during the forecast period due to increasing consumer demand for innovative, flavorful, and textured baked goods. The rising interest in premium bakery items such as filled pastries, flavored breads, muffins, and cookies is driving the use of food inclusions such as fruits, nuts, chocolate chips, and seeds. Changing lifestyles and a growing preference for convenience foods are encouraging manufacturers to enhance product appeal through inclusions. The popularity of artisanal and health-focused bakery products is also contributing to this trend. The expanding product lines and frequent product launches in the bakery sector are significantly supporting the growth of the segment.

Food Inclusions Market Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the global market share due to its strong tradition of bakery, confectionery, and dairy consumption, which consistently drives innovation in food textures and flavors. The high consumer awareness regarding premium and indulgent products has fueled demand for inclusions such as fruits, nuts, chocolates, and cereals. The presence of major food manufacturers and a mature food processing industry further supports the integration of diverse inclusions into everyday products. Stringent quality standards and growing interest in clean-label and natural ingredients have encouraged the use of high-quality inclusions. Constant product innovation, supported by a strong retail infrastructure, continues to meet evolving consumer preferences, reinforcing Europe’s position as a leading region in the global market.

The Asia Pacific food inclusions market is experiencing substantial growth due to rapid urbanization, rising disposable incomes, and changing dietary habits. Consumers in the region are increasingly seeking premium, flavorful, and convenient food products, driving the demand for inclusions in bakery, dairy, and snack items. The expanding middle-class populations and growing interest in Western-style foods are boosting the appeal of products containing chocolate chips, fruit pieces, nuts, and other inclusions. Local manufacturers are also innovating to cater to regional tastes, further fueling food inclusions demand. The combination of economic development and evolving consumer preferences positions Asia Pacific as a key growth region in the global market.

Food Inclusions Market – Key Players and Competitive Analysis Report

The market is highly dynamic, driven by innovation in taste, texture, and health-conscious formulations. Competitive positioning among key players reflects strategic investments in R&D, flavor diversification, and clean-label offerings. Archer Daniels Midland Co. (ADM); AGRANA Beteiligungs-AG; Balchem Corp.; Cargill Inc.; Chaucer Foods UK; Dawn Foods Products, Inc.; Kerry Group PLC; Tate and Lyle; Nimbus Foods Ltd.; Georgia Nut Company, Inc.; Orchard Valley Foods Limited; and Taura Natural Ingredients Ltd. are among the leading companies shaping the market landscape. Competitive trends indicate a growing emphasis on plant-based, allergen-free, and functional inclusions to meet evolving consumer demands. Companies are leveraging advanced processing technologies and sustainable sourcing to strengthen market share. Partnerships, mergers, and global expansions are further intensifying competition as firms aim to secure broader distribution channels and enhance product portfolios. Innovation-driven differentiation and customer-centric approaches define the current competitive positioning in this fast-evolving industry.

ADM is a global agribusiness company offering food ingredients, biofuels, and logistics services, with operations across six continents and expertise in agricultural commodity processing. In December 2021, ADM announced that it had acquired Flavor Infusion International, S.A. (FISA), a full-range provider of flavor and specialty ingredient solutions for customers across Latin America and the Caribbean.

Cargill is a global provider of food, agriculture, financial, and industrial services, offering branded products, risk management, and technological support across diverse international markets. In May 2021, Cargill acquired Leman Decoration Group to expand its cake decoration offerings, enhancing its cocoa and chocolate business for gourmet customers in Europe and globally.

List of Key Companies

- AGRANA Beteiligungs-AG

- Archer Daniels Midland Co (ADM)

- Balchem Corp.

- Cargill Inc.

- Chaucer Foods UK

- Dawn Foods Products, Inc.

- Georgia Nut Company, Inc.

- Kerry Group PLC

- Nimbus Foods Ltd.

- Orchard Valley Foods Limited

- Tate and Lyle

- Taura Natural Ingredients Ltd.

Food Inclusions Industry Developments

In May 2022, Kerry officially opened the largest and most advanced taste manufacturing facility in KwaZulu-Natal, South Africa. The new R650m (USD41.59m) facility will produce sustainable nutrition solutions that will be consumed across the African continent.

In February 2022, ADM acquired Comhan to develop its nutrition business in the emerging markets. Both of the companies will work on developing a portfolio with fruits and chocolate flavors, which would be applied in bakeries and confectioneries.

Food Inclusions Market Segmentation

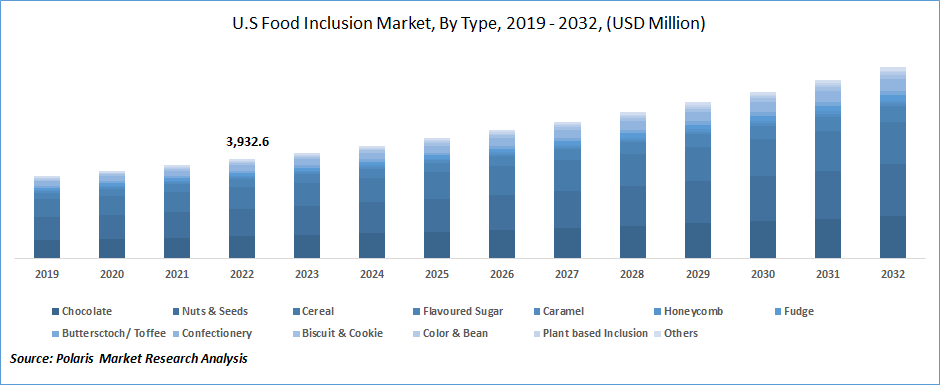

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Chocolate

- Nuts & Seeds

- Cereal

- Flavored Sugar

- Caramel

- Honeycomb

- Fudge

- Butterscotch/Toffee

- Confectionery

- Biscuit & Cookie

- Color & Bean

- Plant-Based Inclusion

- Others

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Solid & Semi Solid

- Pieces

- Nuts

- Flakes & Crunches

- Chips & Nibs

- Powder

- Liquid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cereal Products

- Snacks & Bars

- Bakery Products

- Dairy

- Frozen Desserts

- Ice Cream

- Chocolate & Confectionery Products

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food Inclusions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.60 Billion |

|

Market Size Value in 2025 |

USD 16.71 Billion |

|

Revenue Forecast by 2034 |

USD 27.65 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.60 billion in 2024 and is projected to grow to USD 27.65 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

Europe dominated the market share in 2024.

A few key players in the market are Archer Daniels Midland Co. (ADM); AGRANA Beteiligungs-AG; Balchem Corp.; Cargill Inc.; Chaucer Foods UK; Dawn Foods Products, Inc.; Kerry Group PLC; Tate and Lyle; Nimbus Foods Ltd.; Georgia Nut Company, Inc.; Orchard Valley Foods Limited; and Taura Natural Ingredients Ltd.

The solid & semi solid segment led the market share in 2024.

The bakery aircraft segment is anticipated to register the highest growth rate during the forecast period.