Froth Flotation Chemicals Market Size, Share, Trends, Industry Analysis Report

By Product (Collectors, Frothers, Modifiers, Other Product), By End-Use Type, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5917

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

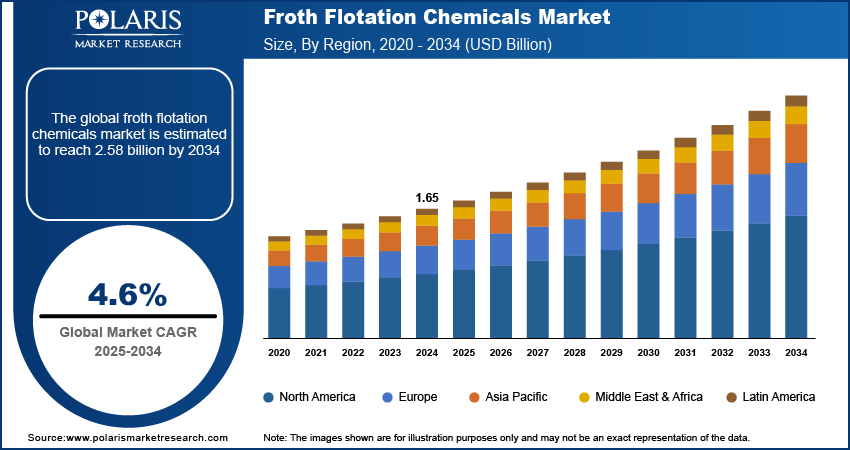

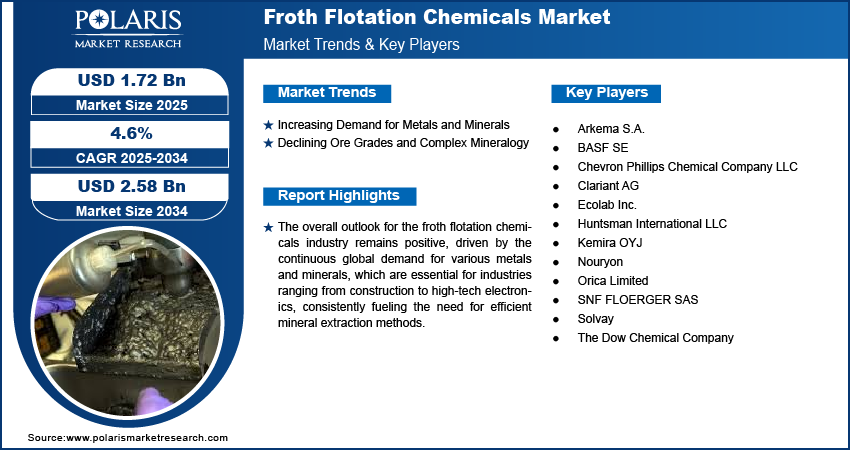

The global froth flotation chemicals market size was valued at USD 1.65 billion in 2024 and is anticipated to register a CAGR of 4.6% from 2025 to 2034. The froth flotation chemicals industry trends are largely influenced by the growing demand for minerals and metals across various sectors, including construction, automotive, and electronics.

The froth flotation chemicals involve specialized reagents crucial for separating valuable minerals from their ores. This process relies on chemicals that alter the surface properties of minerals, allowing them to attach to air bubbles and float as a froth, which is then collected.

To Understand More About this Research: Request a Free Sample Report

Growing global awareness of environmental protection and the increasing implementation of stringent environmental regulations are significant drivers of the froth flotation chemicals market growth. These regulations aim to minimize the environmental footprint of mining and industrial waste treatment by limiting the use of hazardous chemicals and promoting the adoption of more eco-friendly alternatives. This push encourages chemical manufacturers to invest in research and development to create sustainable, biodegradable, and less toxic flotation reagents.

Continuous technological advancements in froth flotation processes propel the demand for specialized chemicals. These innovations include the development of new flotation cell designs, automation in control systems, and improved understanding of mineral-reagent interactions at a microscopic level. As mining operations seek to maximize recovery rates and reduce operational costs, there is a growing need for chemicals that can perform optimally with these advanced technologies.

Industry Dynamics

Increasing Demand for Metals and Minerals

The global demand for metals and minerals is a primary driver for the market growth. Many industries such as construction, automotive, electronics, and renewable energy technologies, require metals and minerals. Moreover, the expanding global population, coupled with urbanization and industrial advancements, is consistently driving up the demand for various metals and minerals such as gold, silver, copper, lead, zinc, and iron.

According to the U.S. Geological Survey’s (USGS) Mineral Commodity Summaries, global demand for various minerals remains strong. The demand for critical minerals, such as those used in clean energy technologies, is also rising significantly. The International Energy Agency (IEA) projects that global demand for critical minerals could increase by 500% by 2050 due to clean energy transition. This includes minerals such as lithium, cobalt, nickel, graphite, copper, and rare earth elements, which are vital for electric vehicles, electricity networks, and renewable energy technologies, including solar PV and wind. This persistent and rising demand for various metals and minerals drives the sustained need for froth flotation chemicals that make their extraction feasible and economical.

Declining Ore Grades and Complex Mineralogy

The increasing processing of lower-grade and more complex mineral ores propels the demand for froth flotation chemicals. As higher-grade ore deposits become less common, the mining industry is increasingly turning to lower-grade and more complex mineral ores. These ores have a smaller percentage of the desired metal and often possess a more intricate mineral makeup, making extraction more difficult.

Research published in Minerals Engineering in 2023, in the article "Investigating the impact of varying ore feed grade on entrainment, froth stability and flotation performance under varying water," highlights how varying ore feed grades significantly impact flotation performance, necessitating specialized chemical adjustments for optimal recovery. Extracting valuable minerals from these complex ores requires more sophisticated and effective separation techniques, where froth flotation plays a vital role. This process uses specialized chemicals to selectively separate target minerals from waste materials. The increasing reliance on these chemicals helps maintain economically viable extraction from challenging deposits, as mining companies need to use more flotation chemicals per ton of ore processed to achieve acceptable recovery rates from these lower-grade resources.

Segmental Insights

Product Analysis

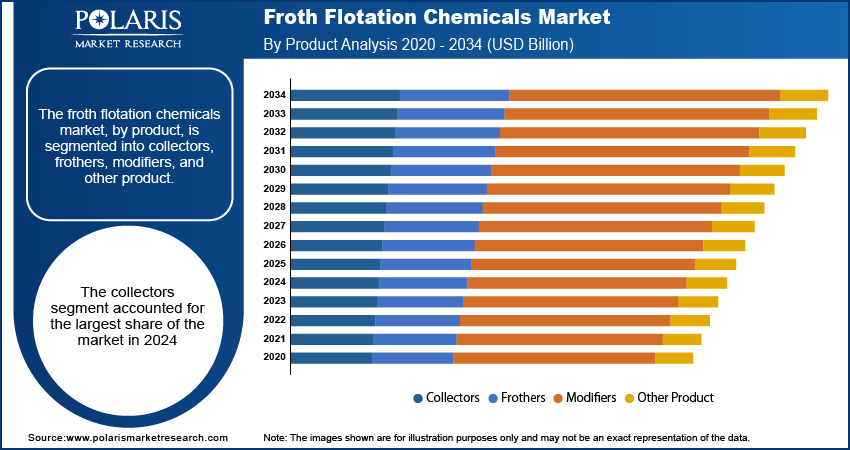

The collectors segment held the largest share of the froth flotation chemicals market in 2024. These chemicals are essential for making target mineral particles water-repellent, a crucial step that allows them to attach to air bubbles and rise to the surface. Collectors are used to separate valuable minerals from waste material more efficiently.

The frothers segment is anticipated to register the highest growth rate during the forecast period. Frothers are responsible for creating a stable foam layer on the surface of the flotation cell, which is necessary to capture and transport the mineral-laden bubbles. Advancements in frother technology, aimed at improving froth stability, bubble size control, and overall process efficiency, are driving this rapid expansion.

End-Use Type Analysis

The mining segment held the largest share in 2024, fueled by the critical role of froth flotation chemicals in extracting valuable minerals such as copper, gold, zinc, and other metals from raw ores. As global demand for these essential resources remains high, mining operations heavily rely on froth flotation to efficiently process increasingly complex and lower-grade ore bodies.

The industrial waste and sewage treatment segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by increasing environmental concerns, stricter regulations on wastewater discharge, and a growing emphasis on water reuse and recycling. Froth flotation effectively removes suspended solids, oils, greases, and other contaminants from industrial effluents and municipal sewage, making it a valuable method for pollution control and resource recovery.

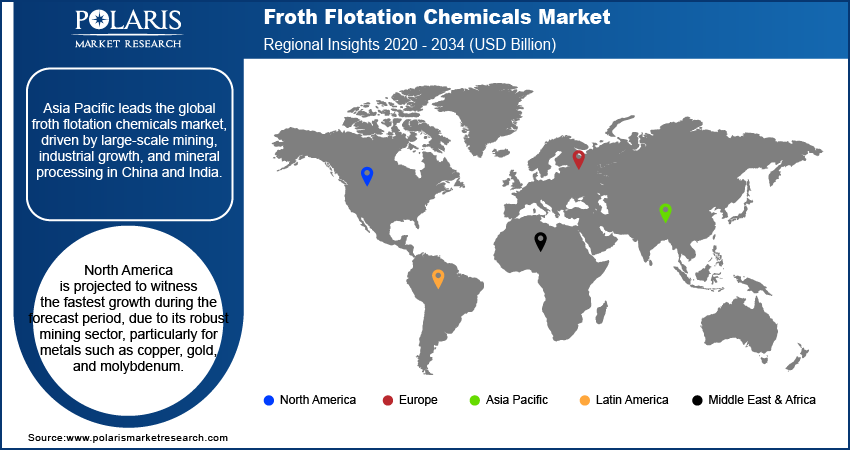

Regional Analysis

The Asia Pacific froth flotation chemicals market dominated across the world in 2024, primarily due to widespread and intensive mining activities across its numerous countries. Rapid industrialization and urbanization in the region have led to a substantial demand for various metals and minerals, directly boosting the consumption of froth flotation chemicals. The presence of significant mineral reserves and ongoing infrastructure development projects further contribute to the high demand for these chemicals in mineral processing applications.

China Froth Flotation Chemicals Market Trends

China plays a key role in the Asia Pacific market. Its vast mineral resources and large-scale mining operations, particularly for coal, iron ore, and other industrial minerals, drive substantial demand for froth flotation chemicals. The country's continuous industrial growth and focus on resource extraction efficiency propel constant need for effective chemicals to support its diverse mineral processing requirements.

North America Froth Flotation Chemicals Market Overview

The North America market is significantly driven by its robust mining sector, particularly for metals such as copper, gold, and molybdenum. The region's rising focus on extracting valuable resources from various ore types, including increasingly lower-grade deposits, drives the demand for a diverse range of froth flotation chemicals. Environmental regulations also play a role, propelling the use of more sustainable and eco-friendly reagents, which influences product development and adoption across the region.

U.S. Froth Flotation Chemicals Market Insight

In North America, the US is a major contributor, due to its extensive mining operations and ongoing efforts in mineral processing. The country's demand is also propelled by the need for specific minerals crucial for its industrial and technological sectors, including those used in electric vehicles and renewable energy. Furthermore, the U.S. emphasizes advancements in chemical formulations to improve efficiency and reduce the adverse environmental impact of mining, fostering innovation in the types of flotation chemicals used.

Europe Froth Flotation Chemicals Market Analysis

The market in Europe is characterized by a blend of established mining activities and a strong emphasis on environmental sustainability. While mineral extraction, especially for industrial minerals and certain metals, remains a key application, stringent environmental regulations in the region are influencing the types of chemicals developed and used. There is a notable trend toward biodegradable and less toxic reagents to minimize ecological footprints from mining and industrial waste management processes.

Germany Froth Flotation Chemicals Market

Germany significantly contributes to the regional demand for froth flotation chemicals. Its strong industrial base, coupled with a focus on advanced manufacturing and resource efficiency, drives the need for sophisticated mineral processing solutions. The country's commitment to environmental protection and technological innovation also encourages the adoption of high-performance and environmentally compliant froth flotation chemicals, particularly in areas such as industrial wastewater treatment and specialized mineral recovery.

Key Players and Competitive Insights

The froth flotation chemicals industry features a competitive landscape with a mix of global players and specialized regional manufacturers. Companies are continuously innovating to offer more efficient and environmentally friendly solutions, focusing on tailored reagents that can address the complexities of varying ore types and processing conditions.

A few prominent companies in the industry include BASF SE, Clariant AG, The Dow Chemical Company, Kemira OYJ, Solvay, SNF FLOERGER SAS, Huntsman International LLC, Nouryon, Arkema S.A., Chevron Phillips Chemical Company LLC, Orica Limited, and Ecolab Inc.

Key Players

- Arkema S.A.

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Ecolab Inc.

- Huntsman International LLC

- Kemira OYJ

- Nouryon

- Orica Limited

- SNF FLOERGER SAS

- Solvay

- The Dow Chemical Company

Industry Developments

April 2025: Quadra announced its acquisition of Florida-based Bell Chem, a supplier serving a wide range of industries, including water treatment. This strategic acquisition strengthens Quadra’s presence and capabilities in the water treatment and froth flotation chemicals sectors—critical components of environmental management and mineral processing.

October 2023: BASF introduced two new flotation reagent brands—Luprofroth, focused on frothers, and Luproset, tailored for modifiers. These additions complement the existing Lupromin collector range, further solidifying BASF’s role as a full-spectrum provider for the mining sector.

Froth Flotation Chemicals Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Collectors

- Frothers

- Modifiers

- Other Product

By End-Use Type Outlook (Revenue – USD Billion, 2020–2034)

- Mining

- Pulp & Paper

- Industrial Waste & Sewage Treatment

- Other End Uses

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Froth Flotation Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.65 billion |

|

Market Size in 2025 |

USD 1.72 billion |

|

Revenue Forecast by 2034 |

USD 2.58 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.65 billion in 2024 and is projected to grow to USD 2.58 billion by 2034.

The global market is projected to register a CAGR of 4.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include BASF SE, Clariant AG, The Dow Chemical Company, Kemira OYJ, Solvay, SNF FLOERGER SAS, Huntsman International LLC, Nouryon, Arkema S.A., Chevron Phillips Chemical Company LLC, Orica Limited, and Ecolab Inc.

The collectors segment accounted for the largest share of the market in 2024.

The industrial waste and sewage treatment segment is expected to witness the fastest growth during the forecast period.