Fruit Beer Market Share, Size, Trends, Industry Analysis Report

By Flavor (Cherries, Blueberries, Peaches, Raspberries, Plums, Apples, Strawberries, Apricots, Others); By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3510

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

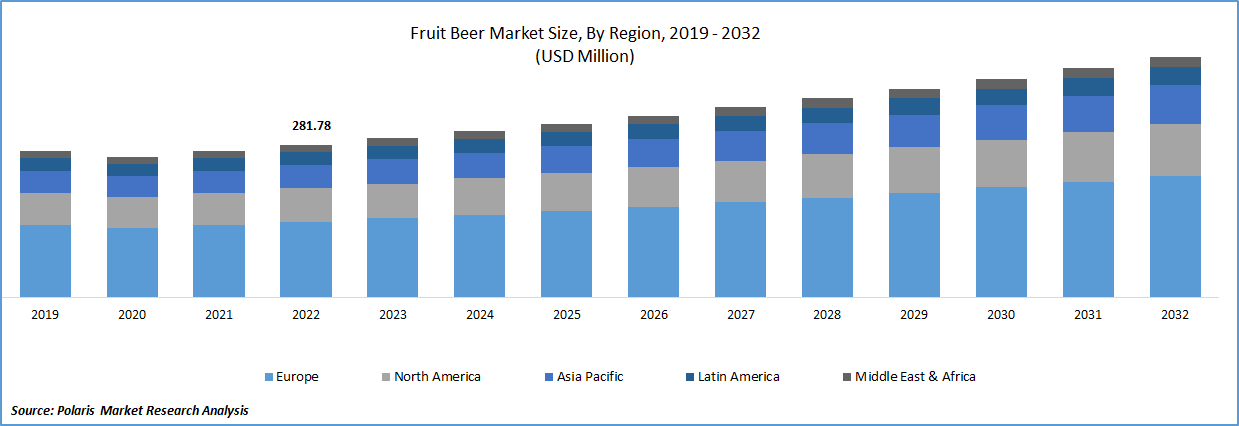

The global fruit beer market was valued at USD 294.06 million in 2023 and is expected to grow at a CAGR of 4.70 % during the forecast period. Various companies are innovating products in the fruit beer market in order to stand out from competitors and meet consumer demands for unique and interesting flavor experiences. Companies are experimenting with new fruit combinations to create unique flavor profiles. For example, in December 2021, a low-calorie, vegan, and gluten-free hard seltzer infused with fruit flavours are now available from the Indian company Wild Drum.

To Understand More About this Research: Request a Free Sample Report

Three flavours of the cool drink were available from the firm: Pure, Mango, and Lemon-Mint. The beer market is highly competitive, and launching fruit beers with different flavors can help companies differentiate themselves from their competitors and attract new customers. As a result, this factor is significantly fuelling the market’s growth globally.

Fruit beer offers a lot of potential for creativity and innovation in terms of flavor combinations, branding, and marketing. This has led to a growing number of craft breweries and larger companies exploring the fruit beer market. Fruit beer often combines the sweetness and tartness of natural fruit flavors with the bitterness of beer, creating a unique taste experience. This can be appealing to consumers looking for a change from traditional beer flavors. It can pair well with a variety of foods, particularly those that have a sweet or fruity flavor profile. This makes it a versatile option for food and drink pairings.

Fruit beer provides a diverse range of flavors and tastes that can appeal to a wide range of consumers. The addition of fruits to beer can create a refreshing, sweet, and fruity taste that may not be found in traditional beer styles. It can provide some health benefits due to the presence of antioxidants, vitamins, and minerals found in the fruit used. This can make it a healthier alternative to traditional beer for consumers looking for a healthier beverage option.

The COVID-19 pandemic has mixed impact on the global market. Disruptions in global supply chains led to shortages in some ingredients used in fruit beer production. This has resulted in higher prices for some fruit beers. Whereas the closure of bars and restaurants during the pandemic resulted in a decrease in sales of draft fruit beer and on-premise sales of bottled and canned fruit beer. However, with more consumers shopping online due to social distancing measures, e-commerce platforms have seen an increase in sales of fruit beer and other alcoholic beverages.

Industry Dynamics

Growth Drivers

Consumer preference towards alcohol-free fruit beer is certainly driving the growth of the fruit beer market. Many consumers are looking for non-alcoholic beverage options due to health concerns, designated driving, or personal preference, and the availability of alcohol-free fruit beer provides a solution for those who still want to enjoy the flavor experience of beer. For example, as per the World Health Organization, alcohol abuse accounts for 7.1% and 2.2%, respectively, of the global burden of illness in men and women. 10% of all deaths in this age range are related to alcohol use, making it the largest risk factor for early mortality and disability. To avoid issues regarding health, consumers are shifting towards alcohol free or low-alcohol beverages. As a result, this factor is boosting the sales of fruit beer among population of various countries worldwide.

The increasing e-commerce industry is playing a vital role in thriving the global market. As e-commerce platforms provide an opportunity for breweries to expand their reach and sell their products to consumers who may not have access to their products through traditional retail channels. This allows breweries to reach a wider customer base and potentially increase their sales. For example, over 2.3 billion people are anticipated to make online purchases in 2022. In 2022, the US, one of the largest e-commerce markets, had about 268 million online consumers. The increasing e-commerce industry provides an opportunity for breweries to expand their reach, increase sales, and offer customized product options. This can lead to the boom of the global market as breweries can reach a wider customer base and potentially increase their profits.

Report Segmentation

The market is primarily segmented based flavor, distribution channel, and region.

|

By Flavor |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Raspberries Segment Held Largest Share in the Global Market in 2022

In fiscal year 2022, the raspberries segment dominates the market share as these are widely available and can be sourced from various regions around the world. This makes them a convenient and reliable fruit for breweries to use in their fruit beer production. Raspberries can appeal to a wide range of beer drinkers, making them a popular choice for breweries.

Additionally, the natural sweetness of raspberries also means that less artificial sweeteners or flavors are needed, making it a healthier and more natural option for consumers. Further, the use of raspberries in fruit beer can provide some of these health benefits, making it a more appealing option for those looking for a healthier alternative to traditional beer.

On-Trade Segment is Emerged as Largest Distribution Channel in the Global Market

On-trade is a major contributor of the global market. These venues provide a convenient option for consumers who want to enjoy fruit beer without having to purchase a full pack or bottle from a retail store. This can encourage consumers to try new flavors and can lead to increased sales for breweries. Bars and restaurants often have a wide variety of fruit beer flavors on tap or in bottles, allowing consumers to choose from different options and try new flavors. This segment often has marketing and promotion activities, such as beer festivals and tastings, which can increase the exposure of fruit beer brands and flavors to a wider audience.

Europe is Accounting the Largest Share in the Global Market

Increasing product launches by market vendors in the region, presence of numerous microbreweries is propelling the market's expansion, and many other factors are attributed to the growth of market. For example, in August 2022, over the past year, nearly 200 new breweries were opened in the U.K. Increasing microbreweries in the region helps to distribute their products locally or regionally, which can improve the availability of fruit beer in specific areas and drive demand. This has fundamentally bolstering the expansion of the market across the European countries and is anticipated to maintain their supremacy during the forecast period.

Asia Pacific is one of the fastest growing regions in the global market expected to expand with high CAGR during the forecast period. Investments by players in the region have led to improve the revenue of the market. Consumers are increasingly looking for unique and interesting flavor experiences, and fruit beer is one way to deliver on that demand. To tap the huge consumer base, many companies are investing in the market. For example, in March 2022, more than USD 1.5 million was spent on the creation of this probiotic beer, with Brewerkz serving as the first brewing partner. Such investments are leading to improve the revenue of the market and hence poised to expand with rapid pace during the assessment years.

Competitive Insight

The global market involves Carlsberg Group, Coolberg Beverages Private Limited, Abita Brewing Company, Founders Brewing Company., St Peter's Brewery Co Ltd., Allagash Brewing Company, Sapporo Breweries Ltd., New Glarus Brewing Company, New Belgium Brewing Company, and Magic Hat Brewing Company

Recent Developments

- In June 2022, a limited-edition fruit beer made with Blackberry and Raspberry, grain, and Ontario fruit was released by Sonnen Hill Brewing. For more than a year and a half, this product was predominantly fermented in stainless steel, preserving the appropriate ratio of fruit, funk, and acidity.

Fruit Beer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD307.09 million |

|

Revenue forecast in 2032 |

USD 444.97 million |

|

CAGR |

4.70 % from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Flavor, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Carlsberg Group, Coolberg Beverages Private Limited, Abita Brewing Company, Founders Brewing Company., St Peter's Brewery Co Ltd., Allagash Brewing Company, Sapporo Breweries Ltd., New Glarus Brewing Company, New Belgium Brewing Company, and Magic Hat Brewing Company. |

FAQ's

The global fruit beer market size is expected to reach USD 444.97 million by 2032.

Key players in the fruit beer market are Carlsberg Group, Coolberg Beverages Private Limited, Abita Brewing Company, Founders Brewing Company.

Europe contribute notably towards the global fruit beer market.

The global fruit beer market is expected to grow at a CAGR of 4.7% during the forecast period.

The fruit beer market report covering key segments are flavor, distribution channel, and region.