Industrial and Commercial LED Lighting Market Size, Share, Trends, Industry Analysis Report

: By Product (Lamps and Luminaires), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 114

- Format: PDF

- Report ID: PM1419

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

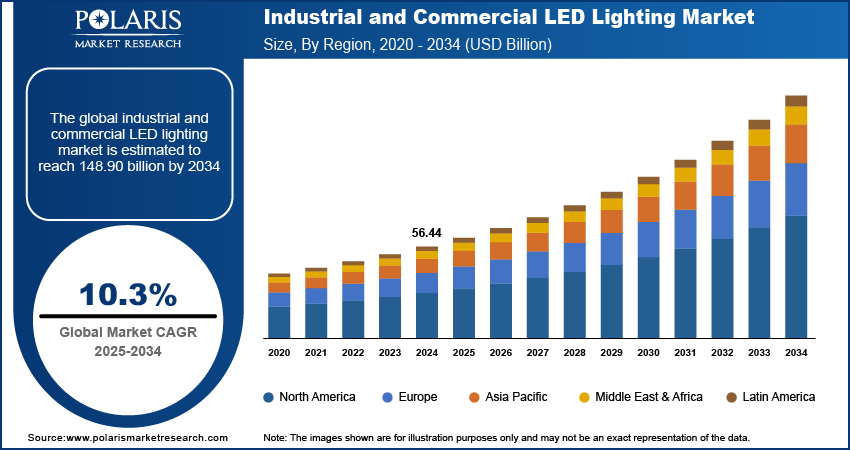

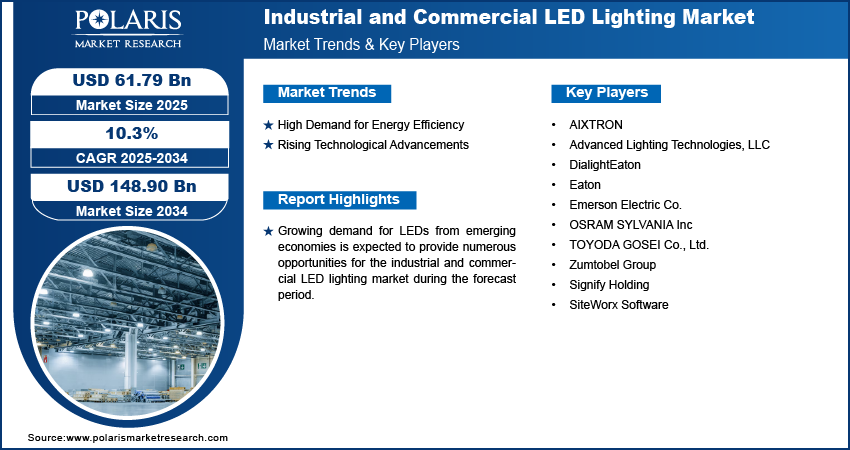

The global industrial and commercial LED lighting market size was valued at USD 56.44 billion in 2024, exhibiting a CAGR of 10.3% from 2025 to 2034. The rising construction of new structures and increased consumer awareness about the use of energy-efficient light systems are the primary factors driving market development.

Key Insights

- The luminaires segment led the market in 2024. This is primarily attributed to the ability of luminaires to distribute light evenly or spread in specific directions.

- The indoor segment accounted for a larger market share in 2024. The segment encompasses a wide range of indoor lighting components, which are a key component in workplaces, schools, and businesses.

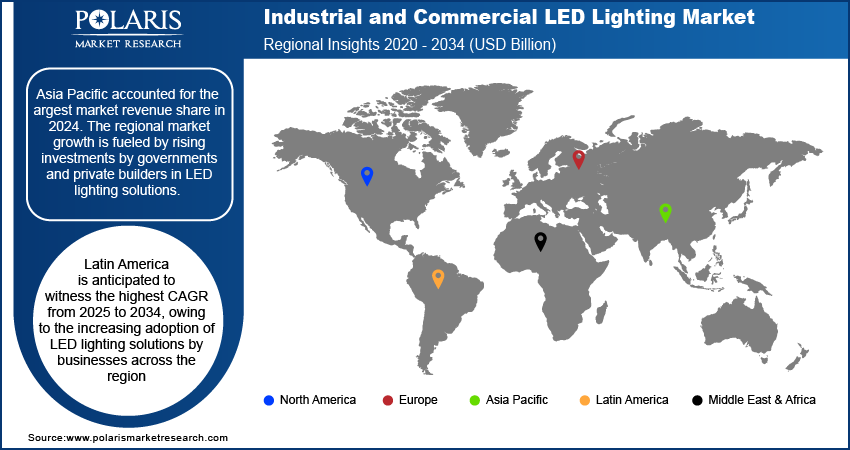

- Asia Pacific led the market with the largest revenue share in 2024. The regional market dominance is attributed to significant growth in urban areas and growing investments by developers in LED lighting solutions.

- Latin America is anticipated to register the highest CAGR during the projection period. Businesses across Latin America are increasingly shifting to LED lighting solutions that support corporate sustainability goals and help meet the environmental regulations.

Industry Dynamics

- The increased emphasis on energy efficiency is driving market expansion. The electricity consumption of LED lighting systems is lower as compared to conventional fluorescent and incandescent lights.

- Rising technological advancements, which have improved the color rendering and energy efficiency of LED systems, is fueling market development.

- Growing demand for LEDs from emerging economies is anticipated to provide various opportunities in the coming years.

- High initial costs and complex retrofitting processes may present market challenges.

Market Statistics

2024 Market Size: USD 56.44 billion

2034 Projected Market Size: USD 148.90 billion

CAGR (2025-2034): 10.3%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Industrial and commercial LED lighting systems are designed for large spaces such as factories, warehouses, retail stores, offices, malls, and buildings. These systems focus on providing durable, energy-efficient lighting suitable for harsh environments.

The rising construction of new structures and remodeling of existing buildings are among the primary factors driving the industrial and commercial LED lighting market growth. Increased consumer awareness about the use of energy-efficient lighting systems and the high efficiency offered by LEDs further support the market growth.

Increasing investments in infrastructure modernization, the development of smart cities, and the implementation of favorable government regulations and restrictions regarding minimum efficiency standards are among the key market trends anticipated to drive market expansion in the coming years. Growing demand for LEDs from emerging economies is expected to provide numerous industrial and commercial LED market opportunities during the forecast period.

Market Dynamics

High Demand for Energy Efficiency

LED lighting systems consume less electricity than conventional fluorescent and incandescent lights. This reduced electricity consumption results in substantial cost savings on energy bills for commercial and industrial facilities. Further, it helps organizations lower their carbon footprint and meet sustainability goals. The high energy efficiency of LEDs drives their increased adoption in sectors such as manufacturing and retail, where lighting plays a crucial role in ensuring the optimal functioning of daily operations. Thus, the increased emphasis on energy efficiency is a major contributor to the industrial and commercial LED lighting market revenue.

Rising Technological Advancements

LED technology innovations have improved the brightness, color rendering, and energy efficiency of LED systems. Smart lighting systems, which use sensors to detect ambient light and motion to automatically dim or turn off lights when the space is unoccupied, have enhanced the functionality and convenience of LED systems. In addition, advancements in production techniques and materials have led to the creation of more reliable and durable LED products with longer lifespans. These technological advancements continually expand the use cases of LED systems, impacting the industrial and commercial LED lighting market expansion favorably.

Segment Insights

Industrial and Commercial LED Lighting Market Outlook by Product Insights

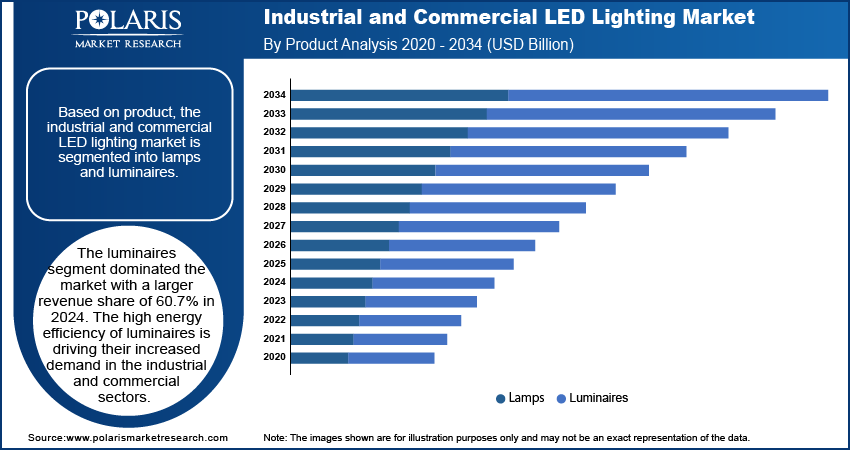

The industrial and commercial LED lighting market, based on product, is bifurcated into lamps and luminaires. The luminaires segment dominated the market with a larger revenue share of 60.7% in 2024. LED luminaires are complete lighting systems designed to distribute light evenly or spread in specific directions. These systems are available in various shapes and sizes, with linear and circular being the most common ones. They are more energy-efficient as compared to incandescent bulbs and compact fluorescent lamps. Advances in thermal management, optics, and LED chip technology have led to enhanced efficiency, performance, and reliability of LED luminaries, thereby driving their increased demand in the industrial and commercial sectors.

Industrial and Commercial LED Lighting Market Outlook by Application Insights

The industrial and commercial LED lighting market, based on application, is bifurcated into indoor and outdoor. The indoor segment held a larger industrial and commercial LED lighting market share in 2024. The segment encompasses a range of indoor lighting applications in various spaces, such as schools, factories, and businesses. Smart indoor lighting solutions are a key component in modern workplaces for cabins, corridors, and meeting rooms. The installation of indoor LED lights consumes less energy and increases electricity savings, making LEDs a viable option for businesses seeking to lower operational expenses.

Regional Analysis

By region, the research report offers industrial and commercial LED lighting market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest market revenue share in 2024. Asia Pacific is witnessing significant growth in urban areas, resulting in increased development of public infrastructure, industrial facilities, and commercial buildings. Governments and private developers are increasingly investing in LED lighting solutions in these new developments owing to their high energy efficiency, reduced maintenance costs, and long lifespan.

Latin America is anticipated to register the highest CAGR from 2025 to 2034. Businesses across the region are increasingly adopting LED lighting solutions that support corporate sustainability goals and help them meet environmental regulations. Also, the growing demand for efficient and reliable lighting systems from emerging economies has a favorable impact on regional market expansion.

Key Players and Competitive Insights

The leading players are introducing innovative LED lighting systems to cater to the growing demand for consumers. Further, they are entering new markets in developing regions to expand their customer base, strengthen their market presence, and increase their industrial and commercial LED lighting market share. To expand and survive in a more competitive environment, the market participants must offer innovative products.

In recent years, the market for industrial and commercial LEDs has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. The industrial and commercial LED lighting market report offers a market assessment of all the key players, including AIXTRON; Advanced Lighting Technologies, LLC; DialightEaton; Eaton; Emerson Electric Co.; OSRAM SYLVANIA Inc; TOYODA GOSEI Co., Ltd.; Zumtobel Group; Signify Holding; and SiteWorx Software.

List of Key Companies in Industrial and commercial LED lighting Market

- AIXTRON

- Advanced Lighting Technologies, LLC

- DialightEaton

- Eaton

- Emerson Electric Co.

- OSRAM SYLVANIA Inc

- TOYODA GOSEI Co., Ltd.

- Zumtobel Group

- Signify Holding

- SiteWorx Software

Industrial and Commercial LED Lighting Industry Developments

July 2023: Dialight announced the launch of the new version of its Area Light product with battery backup. The company stated that the battery backup model ensures enhanced safety in harsh industrial environments, such as mining, pulp and paper, refining, and general manufacturing facilities.

January 2023: RapidGrow LED introduced its latest LED light, SOLITE, for legal cannabis producers and growers. According to RapidGrow, the new product integrates bluelight and UV light for enhancing genetic expression and increasing resin production.

Industrial and Commercial LED Lighting Market Segmentation

By Product Outlook

- Lamps

- Luminaires

By Application Outlook

- Indoor

- Outdoor

By End Use Outlook

- Industrial

- Commercial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial and Commercial LED Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 56.44 billion |

|

Market Size Value in 2025 |

USD 61.79 billion |

|

Revenue Forecast by 2034 |

USD 148.90 billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 56.44 billion in 2024 and is projected to grow to USD 148.90 billion by 2034.

The market is projected to register a CAGR of 10.3% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are AIXTRON; Advanced Lighting Technologies, LLC; DialightEaton; Emerson Electric Co.; Eaton; OSRAM SYLVANIA Inc; TOYODA GOSEI Co., Ltd.; Zumtobel Group; Signify Holding; and SiteWorx Software.

The luminaires segment dominated the market in 2024.

The indoor segment held a larger market share in 2024