Kombucha Market Share, Size, & Industry Analysis Report

By Product (Hard, Conventional); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 151

- Format: PDF

- Report ID: PM1277

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

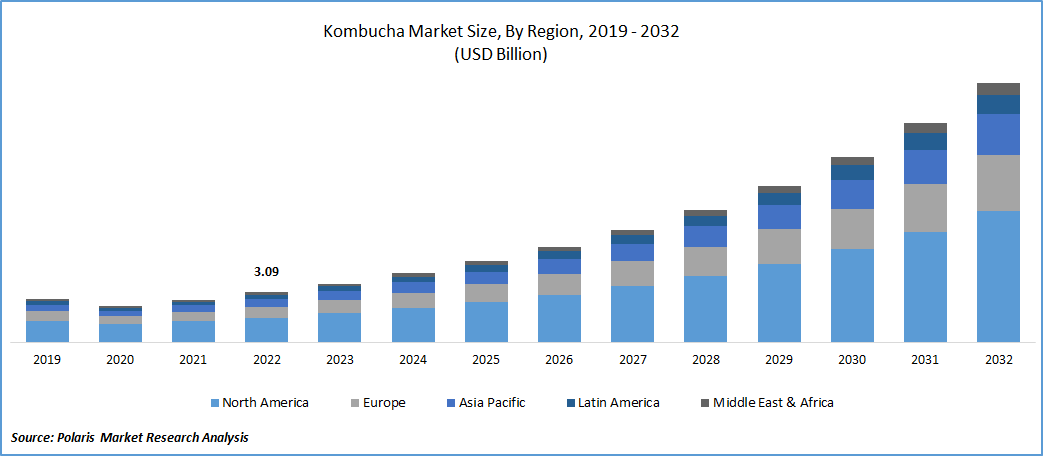

The global kombucha market was valued at USD 4.87 billion in 2024 and is expected to grow at a CAGR of 7.50% from 2025 to 2034. This growth is driven by increasing consumer interest in gut health and natural fermented beverages.

Key Insights

- The hard kombucha segment is expected to expand at a higher CAGR over the forecast period, driven by a sustained consumer shift toward it as a strong alternative to traditional adult beverages.

- The on-trade segment is expected to maintain its revenue leadership in the international kombucha market, driven by the growing consumer appeal for specialty-flavored kombucha cocktails in food service establishments.

- North America was the leading market in 2024, due to increasing demand for healthier, low-sugar, and sustainable drink options.

- Asia Pacific is expected to witness the greatest growth, driven by increasing awareness and demand for personalized, health-focused drinks such as kombucha, which will propel the market.

Industry Dynamics

- Kombucha is gaining popularity as consumers seek healthier alternatives, and companies are responding by gaining a better understanding of its health benefits and engaging customers in the development of new products.

- The increasing popularity of flavored and ready-to-drink kombucha products presents a compelling growth opportunity in the market.

- Selling kombucha both in cans and bottles satisfies the increasing demand for easy-to-carry, on-the-go beverages, prompting more people to purchase it.

- One of the restraints in the market is the high cost of production, which contributes to increased prices and restricts extensive consumer adoption.

Market Statistics

2024 Market Size: USD 4.87 billion

2034 Projected Market Size: USD 16.77 billion

CAGR (2025-2034): 7.50%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Consumers are increasingly taking a proactive approach to address their health and well-being, committing to enhancing their overall longevity. This shift has resulted in greater acceptance of products aimed at promoting wellness. Kombucha, marketed as a detoxifying beverage that enhances energy, strengthens the immune system, and aids in weight loss, is experiencing a rise in global consumption due to these perceived health benefits.

Additionally, as reported by Equinox Kombucha, the company faced various challenges in adjusting to the dynamic government guidelines and workplace safety measures during the lockdown. Despite these challenges, the company markedly increased its direct-to-home orders and witnessed considerable growth in its e-commerce sector throughout 2020. For instance, in July 2021, Remedy Drinks has unveiled the introduction of a sugar-free, shelf-stable product in the US. This product, available in cans, will feature four distinct flavors: peach, mixed berry, ginger lemon, and raspberry lemonade. Additionally, the United States Food and Drug Administration (FDA) has affirmed that the product is deemed safe for human consumption when appropriately prepared and has been successfully marketed in numerous countries.

Many consumers remain uninformed about the potential positive impacts of consuming authentic kombucha on their overall well-being and immune system health. However, there exists a substantial opportunity for brands to enlighten consumers about the benefits of gut health and fermented foods and beverages in the years to come.

Products like kombucha are becoming increasingly vital for customers seeking food and beverage options that contribute to their well-being. Market participants are enhancing their comprehension of the specific health benefits associated with regular consumption and actively involving customers in the development and design of new products.

Industry Dynamics

Growth Drivers

The Market is Expected to Be Propelled by the Abundance of Diverse and Appealing Flavor Choices

Modern consumers are increasingly adventurous and unafraid to explore innovative flavors. This trend has prompted manufacturers to introduce new and diverse flavors and ingredients to capture consumer attention. Some enticing new flavors include lavender, blueberry, hibiscus lime, and guava, among others. A variety of herbs, spices, fruits, and juices are employed to enhance the flavor profile of kombucha. For instance, in July 2020, Kombrewcha introduced two new flavors, blood orange, and mango pineapple, in the US. Additionally, the availability of kombucha in both cans and bottles, aligning with the growing mainstream preference for on-the-go convenience, entices consumers to make purchases.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Conventional Segment Held the Largest Revenue Share in 2024

The surge in demand for traditional kombucha aligns with the increasing interest in health-conscious hydration and the widespread adoption of functional beverages by consumers. While benefiting from these escalating trends, it is also undergoing evolution and innovation to drive growth within the segment.

Key players such as BREW DR. KOMBUCHA, Health-Ade LLC, and GT’s Living Foods are notable contributors to the traditional market. They present the product in a diverse array of exotic flavors, including turmeric, ginger, apple, lemon, pineapple, pomegranate, watermelon, strawberry, grape, and cherry, among others. The expanding availability of these products with a variety of options and flavors has significantly boosted growth in this segment.

The hard kombucha segment is expected to exhibit a higher CAGR during the forecast period. There is a gradual trend among consumers shifting towards hard kombucha, viewing it as a sturdy alternative to other adult beverages. A diverse array of participants is entering this market, introducing crafted cocktails with flavors like lemongrass, elderflower, grapefruit & hibiscus, blueberry, coffee, and jalapeno. This influx is fostering increased consumption among those in search of innovative and gut-friendly beverages. Consumers inclined towards these products in lighter flavors are exploring imaginative choices, including green tea-based kombucha sweetened with mint, mango, honey, and various fruit flavors, all featuring relatively lower alcohol content. These innovative offerings are steering the growth of this segment.

By Distribution Channel Analysis

The Off-Trade Segment Accounted for the Highest Market Share During the Forecast Period

These beverages are increasingly accessible through diverse distribution channels, including supermarkets, convenience stores, health stores, and online retailers. The introduction of innovative flavors is capturing a growing consumer base, as companies present unique options like lavender, watermelon, peach, and passionfruit in addition to their original beverages, promoting them through off-trade platforms. Prominent sellers of these beverages include InstaCart, Drizly, Minibar Delivery (ReserveBar Express Corp.), Total Wine, and more.

The on-trade segment has asserted its dominance in the global kombucha market in terms of revenue share, and this pattern is anticipated to persist throughout the forecast period. The growing preference for premium ready-to-drink cocktails featuring flavored kombuchas has led to a notable increase in their consumption through on-trade channels, encompassing cafés, premium bars, pubs, restaurants, and various other food service outlets.

These on-trade channels are expanding their offerings by introducing non-alcoholic and gut-supporting kombucha cocktails with diverse ingredients and novel flavors, resulting in a rise in consumption through these channels. With a minimal alcohol content ranging from 0.5% to 2%, kombucha emerges as a viable option for cocktails, prompting numerous bars and pubs to introduce more budget-friendly alternatives in response to this ongoing trend.

Regional Insights

North America Dominated the Largest Market in 2024

The local market has witnessed swift expansion as consumers increasingly gravitate towards a superior and healthier substitute for traditional soft drinks. In the US and Canada, there is a rising demand for a lifestyle that is ethical, sustainable, and low in sugar, propelling the heightened popularity of this beverage.

In this region, the product has become a favored distinctive beverage, valued for its potential health benefits associated with fermented foods and probiotics. The demand has undergone a resurgence, positioning the beverage as a health-conscious product now readily available in various stores. Moreover, the USDA's approval of certain ingredients used in organic kombuchas as safe for consumption has further bolstered the demand for organic kombuchas among American consumers.

The Asia Pacific region is positioned to witness the most rapid growth throughout the forecast period. The sustained demand for the product in the Asia Pacific region can be attributed to increasing awareness and visibility in countries such as China, Australia, Japan, Malaysia, and Vietnam. Consumers in the region are actively seeking personalized beverage options that align with their lifestyle choices, placing greater emphasis on the quality of what they consume. This has propelled the demand for mindful mixers such as kombucha.

Numerous brands are emphasizing the probiotic properties of their products, along with wellness-friendly ingredients like vitamins, enzymes, organic acids, and minerals. These beverages are typically low in calories, sugar, and carbohydrates, often meeting criteria such as being non-GMO, organic, and gluten-free.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- BB Kombucha

- Brothers and Sisters

- Equinox Kombucha

- GO Kombucha

- GT’s Living Food

- København Kombucha

- Læsk

- Lo Bros.

- MOMO KOMBUCHA

- Real Kombucha

- Remedy Drinks

- VIGO KOMBUCHA

Recent Developments

- In March 2025, Lipton launched its first kombucha range in the UK, introducing bold flavours such as Strawberry Mint, Raspberry, and Mango Passionfruit to attract new consumers and expand the brand’s presence in the rapidly growing kombucha market.

- In July 2022, Nova Easy Kombucha, recognized for its intricate and alcohol-free selections, has unveiled a novel product range of high-performance non-alcoholic beverages. The lineup includes a pre-workout ‘POWER’ Kombucha blend enriched with naturally-derived caffeine for enhanced performance and a ‘RECOVERY’ blend formulated with probiotics to support a healthy gut. Tailored for health-conscious consumers in search of an all-natural and low-sugar alternative, these products cater to a wellness-focused audience.

- In February 2022, Superfoods Company has introduced a "rapid Kombucha" recipe available in a range of flavors. This Kombucha variant is enriched with carefully selected black tea, providing enough recipes to produce 30 drinks. The company asserts that this product is designed with a beneficial concentration of polyphenols, flavonoids, and prebiotics to enhance digestive and metabolic health.

- In February 2022, Brew Dr. recently introduced its inaugural peach-flavored Kombucha, aptly named Just Peachy. Crafted by blending five varieties of organically grown peaches with premium organic loose green tea, it brings forth a splendid fusion of subtle, savory, and sweet flavors, complemented by hints of honey and spring flowers.

Kombucha Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.51 billion |

|

Revenue forecast in 2034 |

USD 16.77 billion |

|

CAGR |

7.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Kombucha Market report covering key segments are product, distribution channel, and region.

Kombucha Market Size Worth USD 16.77 Billion By 2034

The global Kombucha market is expected to grow at a CAGR of 7.50% during the forecast period.

North America is leading the global market.

The key driving factors in Kombucha Market increasing preference for inventive non-alcoholic beverages is expected to drive market growth.