Liquid Waste Management Market Size, Share, Trends, Industry Analysis Report

By Source (Residential, Commercial, Industrial), By Industry, By Service, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM3705

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The liquid waste management market was valued at USD 97.03 billion in 2024 and is expected to register a CAGR of 3.0% from 2025 to 2034. The liquid waste management market is driven by rising industrialization, strict environmental regulations, and increasing urban wastewater generation. Growing awareness about sustainable waste disposal and government initiatives for water conservation are also propelling market growth across residential, commercial, and industrial sectors.

Liquid waste management is the process of collecting, treating, and disposing of wastewater and other liquid by-products from households, industries, and commercial activities. It aims to prevent environmental pollution and protect public health by ensuring safe handling and disposal or reuse of liquid waste.

One of the primary benefits of an efficient liquid waste management system is the protection of water resources. Contaminated water sources can lead to serious public health crises and ecological damage. Countries ensure that their lakes, rivers, and groundwater remain safe for consumption and recreational use by implementing effective treatment and disposal methods. Furthermore, proper waste management reduces the risk of soil contamination, preserving agricultural productivity and biodiversity, which fuels the industry growth.

To Understand More About this Research: Request a Free Sample Report

The increasing focus on circular economy principles is driving investments in resource recovery technologies that extract valuable materials from liquid waste streams. Industries are exploring methods to recover nutrients, metals, and clean water from wastewater, turning waste into economic opportunities. The potential for revenue generation from recovered resources is attracting both corporate and institutional investors, leading to increased funding for research and commercialization of advanced treatment methods. Governments are also providing incentives for businesses that adopt resource recovery practices, further encouraging investments in sustainable waste management solutions, thereby driving the industry growth.

Industry Dynamics

Growing Awareness of Water Conservation

Businesses and municipalities are focusing on sustainable water management practices as climate change and water scarcity concerns rise. The push for wastewater recycling, greywater reuse, and zero-liquid discharge (ZLD) systems is gaining momentum, reducing reliance on freshwater resources. Companies are investing in water-saving technologies and closed-loop treatment systems to minimize their environmental footprint. Government initiatives and corporate sustainability goals are accelerating the shift toward more responsible liquid waste management practices, ensuring long-term water security, thereby driving the industry growth.

Rising Urbanization

Cities are expanding rapidly, and more people are moving into urban areas, leading to a sharp increase in liquid waste from households, businesses, and industries. According to the World Bank Group, 57% of world’s population lives in urban settings as of 2023. Limited space and resources in urban settings make it necessary to have efficient systems for collecting and treating liquid waste. This waste includes sewage, wastewater, and industrial discharge. Governments and municipalities are therefore investing heavily in improved waste management infrastructure to meet rising demands. The growing need for safe and effective disposal solutions is fueling the demand for liquid waste management services, particularly in developing countries undergoing fast-paced urban development.

Segmental Insights

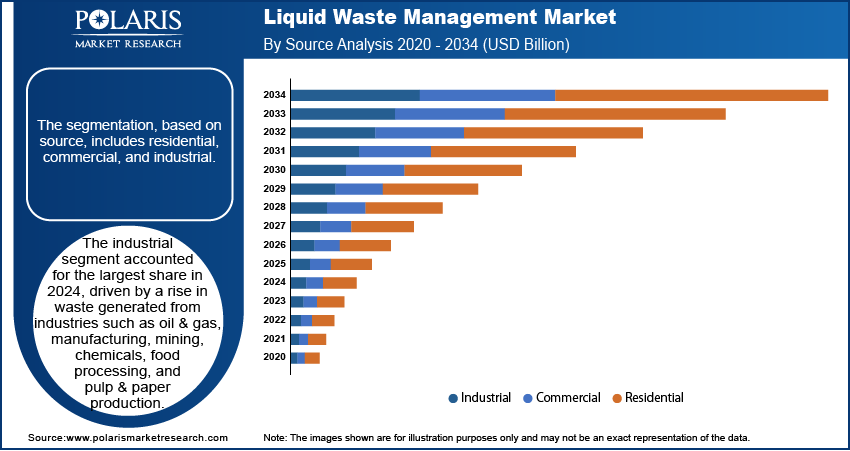

Source Analysis

The segmentation, based on source, includes residential, commercial, and industrial. The residential segment is expected to record significant growth during the forecast period. Residential liquid waste is a significant part of the overall waste management system, comprising wastewater, sewage, greywater, and household hazardous liquids. The demand for efficient residential waste management solutions has intensified with a growing population and increasing urbanization. Municipalities are primarily responsible for handling residential liquid waste through sewage treatment plants, stormwater management systems, and household hazardous waste collection programs. Wastewater from homes, which includes toilet sewage, kitchen waste, and laundry effluents, undergoes extensive treatment before being discharged into the environment. Apart from general wastewater, household hazardous liquid waste such as used motor oil, paints, cleaning solvents, and expired pharmaceuticals poses environmental risks if improperly disposed of down drains or into landfills, thereby driving the demand in residential settings.

The industrial segment accounted for the largest share in 2024, driven by a rise in waste generated from industries such as oil & gas, manufacturing, mining, chemicals, food processing, and pulp & paper production. The volume of industrial liquid waste is rising as the world continues to expand its industrial output and infrastructure projects, necessitating advanced treatment, hazardous waste disposal, and regulatory compliance measures. The growing adoption of circular economy and digital circular economy practices, water reuse technologies, and zero-liquid discharge (ZLD) systems is further driving demand for specialized liquid waste management services, thereby driving the segment growth.

Industry Analysis

The segmentation, based on industry, includes textile, paper, iron & steel, automotive, pharmaceutical, oil & gas, and others. The automotive segment is expected to record significant growth as the automotive industry generates a range of liquid waste, including oils, lubricants, and solvents, as well as wastewater from car wash operations, paint shops, and manufacturing processes. Automotive plants produce wastewater that often contains heavy metals, volatile organic compounds, and paint residues, requiring specialized treatment to ensure that the waste does not harm the environment or violate regulatory standards. Treatment methods in this industry often involve oil-water separation, chemical coagulation, and activated carbon filtration to remove hazardous components before safe disposal or recycling. Due to increasing consumer demand for eco-friendly products and sustainability, the automotive industry is under growing pressure to minimize the adverse environmental impact of its operations, thereby driving the segment growth.

Service Analysis

The segmentation, based on service, includes transportation, collection, and retreading. The collection segment accounted for the largest share in 2024 as the collection of liquid waste is the first step in the waste management process and involves the gathering of liquid waste from residential, commercial, or industrial sites. The increasing focus on sustainability and eco-friendly solutions is pushing for improvements in collection services. For example, many municipalities and industries are adopting separate collection systems for non-hazardous and hazardous liquid waste to streamline treatment processes and improve safety. Collection methods are evolving as well, with the implementation of smart waste bins and automated collection systems that enhance operational efficiency. This trend toward smart waste management will continue to grow, driven by advancements in technology and increasing awareness of environmental responsibility, thereby driving the segment growth.

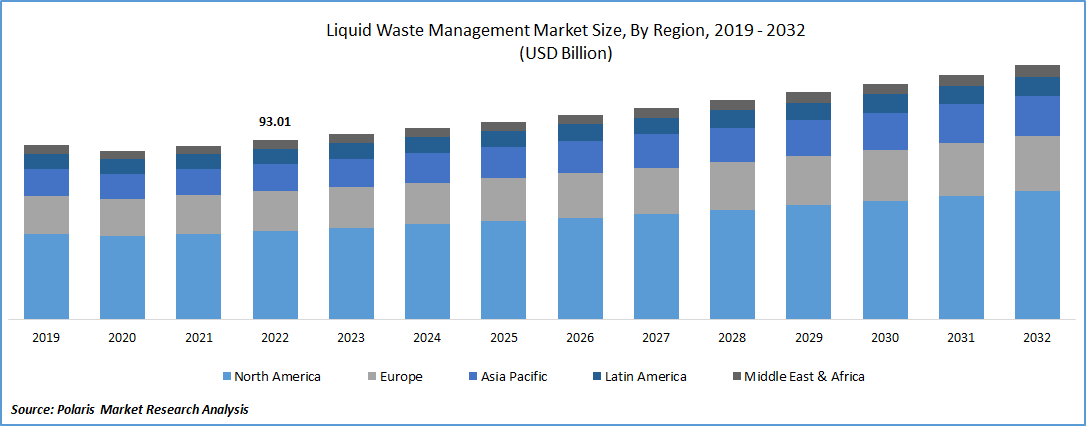

Regional Analysis

North America Liquid Waste Management Market Trends

The market in North America accounted for a 39.37% share in 2024, due to strict environmental regulations and well-established infrastructure. Government enforcement of wastewater treatment standards ensures that industries and municipalities comply with proper waste disposal practices. The region also benefits from high awareness of environmental issues and strong investments in waste management technologies. Industrial growth and urban development further contribute to increased waste generation, driving demand for advanced treatment solutions. Ongoing innovation and public-private partnerships continue to strengthen the industry. The presence of key players in the region further drives the growth in the region.

US Liquid Waste Management Market Assessment

The market in the US accounted for 78.55% of regional share, driven by increased industrial activities and tighter environmental policies. The Environmental Protection Agency (EPA) has enforced strict guidelines for liquid waste disposal and treatment, prompting industries to adopt compliant systems. Population growth and urban expansion are contributing to greater wastewater volumes, requiring enhanced municipal management services. Rising public awareness about water pollution and government support for sustainable practices are fueling expansion. Additionally, investments in infrastructure modernization and smart waste technologies are encouraging innovation in waste treatment, thereby driving the industry growth.

Asia Pacific Liquid Waste Management Market Overview

The market in Asia Pacific accounted for a 21.82% share in 2024, fueled by rapid urbanization and industrialization across countries such as China and India. Increasing population density and expanding manufacturing sectors have led to higher volumes of liquid waste. Governments are introducing stricter regulations to control pollution and protect water resources, encouraging investments in treatment facilities and technologies. Demand for clean water and proper sanitation is further growing, particularly in rural and semi-urban areas. Public and private sector initiatives focused on environmental protection and infrastructure development are driving the demand for these services across the region, thereby driving the growth.

Japan Liquid Waste Management Market Insights

The market in Japan is expected to experience significant growth due to its advanced industrial base and strong environmental regulations. The government enforces strict waste disposal standards, pushing industries to adopt efficient and eco-friendly treatment methods. Japan’s commitment to sustainability and resource conservation drives continuous investments in waste management technology. Urban population density and limited natural resources make efficient waste handling essential. The country also emphasizes recycling and water reuse, which increases the need for advanced liquid waste treatment solutions, thereby driving the growth.

Europe Liquid Waste Management Market Outlook

The market in Europe accounted for a 29.41% share in 2024, driven by comprehensive environmental regulations and sustainability goals set by the European Union. Strict directives such as the Urban Waste Water Treatment Directive require proper collection, treatment, and discharge of wastewater across member states. Growing industrial activities, increasing urban populations, and the demand for cleaner water resources drive the regional market growth. Governments and private operators are investing in modern infrastructure and advanced treatment technologies. The region's rising focus on circular economy practices, including water reuse and resource recovery, fuels the demand for liquid waste management services in Europe.

Germany Liquid Waste Management Market Insights

The market in Germany is expected to experience significant growth due to its strong industrial sector and stringent environmental policies. National regulations mandate thorough treatment of both municipal and industrial wastewater, encouraging the adoption of advanced treatment systems. The country’s commitment to environmental sustainability and resource efficiency supports investments in innovative technologies. Urban development and high population density increase the demand for effective liquid waste solutions. Additionally, Germany’s leadership in engineering and environmental technology promotes continuous improvement in waste management infrastructure, thereby driving the industry growth in the country.

Key Players and Competitive Analysis

The competitive landscape of the liquid waste management market is characterized by the presence of both global and regional players offering a wide range of services, including collection, transportation, treatment, and disposal of liquid waste. Major companies such as Veolia Environment S.A., Clean Harbors Inc., and GFL Environmental Inc. focus on expanding service capabilities through technology integration and strategic acquisitions. Firms such as Republic Services, Inc. and Stericycle, Inc. emphasize regulatory compliance and environmental sustainability. Specialized providers, including Liquid Environmental Solutions (LES) and Hazardous Waste Experts, cater to industry-specific needs. The market remains highly competitive, driven by innovation, regulations, and growing demand.

Key Players

- Clean Harbors Inc.

- Clean Water Environmental

- Covanta Holding Corp.

- DC Water

- GFL Environmental Inc.

- Hazardous Waste Experts

- Liquid Environmental Solutions (LES)

- Republic Services, Inc.

- Stericycle, Inc.

- U.S. Ecology, Inc.

- VeoliaEnvironment S.A.

- Waste Management Solutions

Industry Developments

January 2024: Clean Earth, a division of Enviri Corporation, has signed a long-term collaboration agreement with Veolia North America for substantial incineration capacity at a new, advanced thermal facility in Southwest Arkansas. The facility is expected to be completed in 2025.

November 2024: WM announced that it has completed the acquisition of Stericycle, Inc. The previously disclosed purchase price of USD 62.00 per share in cash corresponds to a total enterprise value of about USD 7.2 billion.

Liquid Waste Management Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Toxic & Hazardous

- Organic & Non-hazardous

- Industrial

- Toxic & Hazardous

- Organic & Non-hazardous

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Textile

- Paper

- Iron & Steel

- Automotive

- Pharmaceutical

- Oil & Gas

- Others

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Transportation

- Collection

- Retreading

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Liquid Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 97.03 Billion |

|

Market Size in 2025 |

USD 99.59 Billion |

|

Revenue Forecast by 2034 |

USD 130.86 Billion |

|

CAGR |

3.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regions Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 97.03 billion in 2024 and is projected to grow to USD 130.86 billion by 2034.

The market is projected to register a CAGR of 3.0% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Clean Harbors Inc.; Clean Water Environmental; Covanta Holding Corp.; DC Water; GFL Environmental Inc.; Hazardous Waste Experts; Liquid Environmental Solutions (LES); Republic Services, Inc.; Stericycle, Inc.; U.S. Ecology, Inc.; Veolia Environment S.A.; Waste Management Solutions.

The industrial segment dominated the market share in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.