Lubricant Additives Market Size, Share, Trends, Industry Analysis Report

: By Application (Automotive and Industrial), Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM3276

- Base Year: 2024

- Historical Data: 2020-2023

Lubricant Additives Market Overview

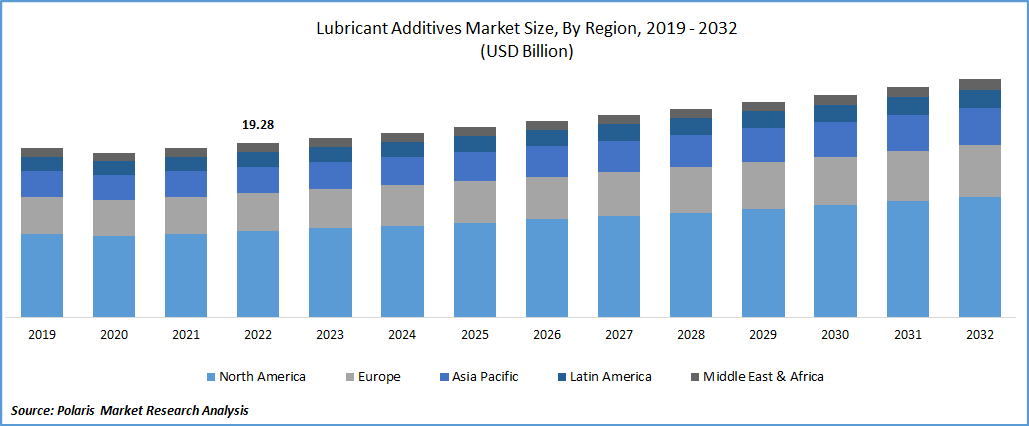

The lubricant additives market size was valued at USD 18.48 billion in 2024. The market is projected to grow from USD 19.21 billion in 2025 to USD 27.81 billion by 2034, exhibiting a CAGR of 4.2% during 2025–2034.

The market encompasses chemical compounds that are incorporated into base oils to enhance their properties and performance in various applications. These additives, typically ranging from 0.1% to 30% of the oil volume, are crucial for improving the longevity and efficiency of lubricants by providing essential functions such as reducing friction, preventing wear, inhibiting corrosion, and maintaining viscosity across different temperatures. The market dynamics are significantly influenced by the increasing demand for high-performance lubricants in the automotive and industrial sectors. A key market driver is the rising global industrialization and manufacturing activities, which necessitate advanced lubricants to ensure the smooth operation and extended lifespan of increasingly sophisticated machinery. Furthermore, the growing sales of passenger and commercial vehicles worldwide contribute significantly to the demand for lubricant additives used in engine oils, transmission fluids, hydraulic fluids, and gear oils.

To Understand More About this Research: Request a Free Sample Report

The imposition of stringent environmental regulations and a growing emphasis on sustainability contribute to the lubricant additives market opportunities during the forecast period. Governments and environmental agencies globally are implementing stricter standards on emissions and promoting the use of eco-friendly products. This has led to a rising demand for lubricant additives that enable the formulation of lubricants meeting these regulations by improving fuel efficiency and reducing wear and tear on machinery, consequently minimizing emissions. The market outlook also indicates a strong trend toward bio lubricant additives derived from renewable resources, aligning with the increasing environmental consciousness and the push for greener alternatives across various industries. This shift in market trends toward sustainable and high-performance lubricants is expected to fuel market development and create new market potential for innovative additive technologies.

Lubricant Additives Market Dynamics

Rising Industrialization and Manufacturing Growth

The rapid expansion of industrial activities and manufacturing sectors globally serves as a significant driver for the market growth. As industries grow and adopt more sophisticated machinery, the demand for high-performance lubricants to ensure operational efficiency and prolong equipment lifespan increases substantially. According to World Bank, in 2023, global manufacturing value added was estimated to be over $16 trillion.

Lubricant additives play a crucial role in enhancing the properties of these lubricants, offering benefits such as reduced friction, improved wear protection, and extended oil drain intervals, which are vital for the smooth functioning of industrial operations. The Indian industrial lubricants market is projected to grow significantly, supported by favorable government initiatives aimed at boosting manufacturing capabilities and promoting local production through schemes such as "Make in India”. These initiatives are expected to create additional opportunities for lubricant manufacturers as they adapt to evolving market needs driven by industrial expansion. Consequently, the increasing pace of industrialization and manufacturing growth worldwide is a key factor driving the lubricant additives market demand by necessitating advanced lubrication solutions.

Growing Automotive Sector and Demand for High-Performance Lubricants

The expanding automotive sector worldwide, encompassing both passenger and commercial vehicles, is a major driver for the lubricant additives market expansion. Modern vehicles, with their increasingly complex engine designs and stringent performance requirements, necessitate high-performance lubricants formulated with advanced additives. These additives are essential for enhancing engine performance, improving fuel efficiency, reducing emissions, and extending the lifespan of critical engine components. According to Mordor Intelligence, global automotive vehicle production reached 85 million units in 2022, representing a 6% increase from the previous year, highlighting the robust recovery and growth of the automotive industry. Furthermore, the increasing emphasis on fuel efficiency and emission control is compelling automotive manufacturers and lubricant formulators to develop engine oils with advanced specifications, thereby driving the demand for innovative lubricant additives. Therefore, the continuous growth of the automotive sector and the escalating need for high-performance lubricants are significant factors propelling the demand for lubricant additives.

Stringent Environmental Regulations and Sustainability Initiatives

Increasingly stringent environmental regulations and a growing global emphasis on sustainability are significantly driving the market. Governments and environmental agencies worldwide are implementing stricter standards on emissions and promoting the use of eco-friendly products. This regulatory landscape necessitates the development and adoption of lubricant additives that enable the formulation of lubricants meeting these environmental requirements. This emphasis on improving vehicular fuel economy and emission controls creates a growing demand for low-viscosity oils and advanced lubricant additives. Moreover, there is a rising demand for bio-based lubricant additives derived from renewable resources, aligning with the increasing environmental consciousness and the push for greener alternatives across industries. Thus, stringent environmental regulations and the focus on sustainability are crucial drivers fostering the lubricant additives market development.

Lubricant Additives Market Segment Insights

Market Assessment – By Application

The market, by application, is segmented into automotive and industrial. The automotive segment represents a larger market share. This dominance is primarily driven by the sheer volume of lubricant consumption in the automotive sector, encompassing engine oils, transmission fluids, gear oils, and hydraulic fluids used in a vast array of passenger and commercial vehicles globally. The continuous advancements in automotive technology, coupled with the increasing vehicle parc worldwide, necessitate a substantial demand for high-performance lubricants formulated with various additives to ensure optimal engine performance, fuel efficiency, and component durability. This large-scale consumption across diverse vehicle types solidifies the automotive sector's leading position in terms of market share within the lubricant additives landscape.

The industrial segment is anticipated to exhibit the highest growth rate over the forecast period. This accelerated growth is fueled by the rapid industrialization and expansion of manufacturing activities across emerging economies, alongside the increasing adoption of sophisticated machinery in various industrial sectors. The demand for specialized industrial lubricants, enhanced with performance-boosting additives to withstand extreme operating conditions, reduce wear and tear, and extend equipment lifespan, is on the rise. Furthermore, the growing emphasis on predictive maintenance and the need for lubricants that contribute to energy efficiency and reduced downtime are expected to further propel the demand for advanced lubricant additives within the industrial application segment, making it the fastest-growing segment in the market.

Market Evaluation – By Type

The market, by type, is segmented into dispersants, viscosity index improvers, detergents, anti-wear agents, antioxidants, corrosion inhibitors, friction modifiers, emulsifiers, and others. The anti-wear agents segment accounts for the largest share of the lubricant additives market revenue. This significant market dominance is primarily attributed to the critical role these additives play in minimizing friction and wear between moving parts in engines and industrial machinery. The increasing demand for enhanced durability and extended lifespan of automotive engines and industrial equipment necessitates the extensive use of anti-wear agents in lubricant formulations. Their ability to protect critical components from damage under high-stress conditions makes them an indispensable part of lubricant technology, thus securing their leading position in the overall market share.

The friction modifiers segment is projected to experience the highest growth rate during the forecast period. This rapid expansion is driven by the increasing focus on fuel efficiency and the reduction of carbon emissions in both the automotive and industrial sectors. Friction modifiers enhance the lubricity of oils, leading to decreased energy loss due to friction and consequently improved fuel economy. With stringent environmental regulations and a growing demand for energy-efficient solutions, the incorporation of advanced friction modifiers in lubricant formulations is gaining significant traction. This trend is expected to continue as industries and consumers alike prioritize sustainability and cost-effectiveness, thereby positioning friction modifiers as the fastest-growing segment within the market.

Lubricant Additives Market Regional Analysis

The lubricant additives market exhibits a global presence, with key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, contributing uniquely to the overall market dynamics. These regions display varying levels of market maturity, industrial activity, and regulatory landscapes, influencing the demand and adoption of different types of lubricant additives. While established regions benefit from well-developed industrial and automotive sectors, emerging economies present significant growth opportunities driven by rapid industrialization and increasing vehicle ownership. The interplay of these regional factors shapes the global market outlook and influences the strategic approaches of lubricant additive manufacturers and suppliers.

Asia Pacific dominates the lubricant additives market revenue share. This dominance can be attributed to the region's burgeoning industrial sector, particularly in countries such as China and India, which serve as major manufacturing hubs globally. Furthermore, the rapidly expanding automotive industry in Asia Pacific, fueled by increasing disposable incomes and urbanization, contributes significantly to the high demand for various lubricant applications and consequently, the additives required to enhance their performance. The sheer volume of industrial and automotive lubricant consumption in this region establishes its leading position in the global lubricant additives market.

The Asia Pacific market is also anticipated to register the highest growth rate in over the forecast period. This rapid growth is propelled by the ongoing industrialization and infrastructure development across several developing economies within the region. Additionally, the increasing adoption of advanced technologies in manufacturing and the rising demand for high-performance vehicles are necessitating the use of sophisticated lubricants with specialized additives. The confluence of robust economic growth, expanding industrial activities, and a burgeoning automotive sector positions Asia Pacific as the region with the most promising growth prospects for the lubricant additives market.

The lubricant additive market in Europe is growing steadily due to increasing demand for high-performance engine oils and industrial lubricants. These additives are mixed with lubricants to improve their performance, reduce wear and tear, and extend the life of machines and engines. Countries like Germany, France, and the UK are leading in this market due to strong automotive and manufacturing industries. Environmental regulations in Europe are also pushing companies to develop cleaner and more efficient additives. Synthetic and bio-based additives are becoming more popular as industries focus on sustainability. Overall, the European lubricant additive market is expected to grow further as technology advances and more industries require high-quality lubrication solutions for smooth and efficient operations.

Lubricant Additives Market – Key Players and Competitive Insights

The Lubrizol Corporation (Berkshire Hathaway Inc.); Evonik Industries AG; BASF SE; Afton Chemical Corporation (NewMarket Corporation); Chevron Oronite Company LLC (Chevron Corporation); Infineum International Limited (Exxon Mobil Corporation and Shell plc); Clariant AG (SABIC); LANXESS AG; Dover Chemical Corporation (ICC Industries Inc.); King Industries, Inc.; and Vanderbilt Chemicals, LLC are among the key participants actively operating in the lubricant additives market. These entities are significant contributors to the market, offering a wide array of additive solutions that cater to diverse application needs across the automotive and industrial sectors.

Competitive analysis of the lubricant additives market reveals a landscape characterized by intense rivalry among a mix of large multinational corporations and specialized smaller players. Competition is primarily based on product innovation, performance, cost-effectiveness, and the ability to meet increasingly stringent environmental regulations and evolving industry specifications. Market insights indicate a continuous focus on developing advanced additive technologies that enhance fuel efficiency, extend equipment life, and reduce environmental impact. Strategic collaborations, research and development investments, and expansions into emerging markets are common strategies employed by these players to maintain and gain market share in this dynamic industry.

The Lubrizol Corporation is a company located in Wickliffe, Ohio, USA. Their offerings encompass a comprehensive range of lubricant additives, including dispersants, detergents, anti-wear agents, antioxidants, viscosity index improvers, and friction modifiers, serving both the automotive and industrial sectors. These products are essential for formulating high-performance lubricants that meet the demanding requirements of modern engines and industrial machinery.

Evonik Industries AG, headquartered in Essen, Germany, provides a diverse portfolio of lubricant additives, such as viscosity index improvers, pour point depressants, and synthetic lubricant base oils, which are crucial components in enhancing the performance and reliability of lubricants used in various applications, including automotive, marine, and industrial equipment.

List of Key Companies in Lubricant Additives Market

- Afton Chemical Corporation

- BASF SE

- Chevron Oronite Company LLC

- Clariant AG (SABIC)

- Dover Chemical Corporation

- Evonik Industries AG

- Infineum International Limited

- King Industries, Inc.

- LANXESS AG

- The Lubrizol Corporation

- Vanderbilt Chemicals, LLC

Lubricant Additives Industry Developments

- May 2024: Lubrizol introduced Lubrizol CV9660, a next-generation low-SAPS heavy-duty lubricant technology designed to meet elevated performance standards while offering a versatile solution across various viscosity grades.

- March 2024: Evonik entered into a strategic partnership with Tongyi Petrochemical to advance sustainable development within the lubricant sector. The collaboration aims to develop low-carbon lubricant solutions in response to emerging industry trends.

Lubricant Additives Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Automotive

- Industrial

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Dispersants

- Viscosity Index Improvers

- Detergents

- Anti-wear Agents

- Antioxidants

- Corrosion Inhibitors

- Friction Modifiers

- Emulsifiers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Lubricant Additives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.48 billion |

|

Market Size Value in 2025 |

USD 19.21 billion |

|

Revenue Forecast by 2034 |

USD 27.81 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The lubricant additives market has been segmented into detailed segments of application and type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

The lubricant additives market growth strategies are increasingly focused on innovation and sustainability. Companies are investing in research and development to create high-performance additives that meet evolving engine and industrial equipment demands while also adhering to stricter environmental regulations. Market penetration efforts often involve strategic collaborations with lubricant manufacturers and OEMs to ensure seamless integration of new additive technologies. Furthermore, expanding into emerging economies with rapid industrialization and growing automotive sectors presents significant market potential. Tailoring product offerings to specific regional needs and emphasizing the performance and environmental benefits of advanced additives are key marketing strategies for sustained market development and capturing market share.

FAQ's

The market size was valued at USD 18.48 billion in 2024 and is projected to grow to USD 27.81 billion by 2034.

The market is projected to register a CAGR of 4.2% during the forecast period.

Asia Pacific had the largest share of the market in 2024

A few key players in the market include The Lubrizol Corporation (Berkshire Hathaway Inc.); Evonik Industries AG; BASF SE; Afton Chemical Corporation (NewMarket Corporation); Chevron Oronite Company LLC (Chevron Corporation); Infineum International Limited (Exxon Mobil Corporation and Shell plc); Clariant AG (SABIC); LANXESS AG; Dover Chemical Corporation (ICC Industries Inc.); King Industries, Inc.; and Vanderbilt Chemicals, LLC.

The automotive segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Increasing Demand for High-Performance Lubricants: Driven by more sophisticated engines and industrial machinery requiring enhanced durability and efficiency. ? Stringent Environmental Regulations: Pushing for the development of additives that enable lower emissions and improved fuel efficiency. ? Growing Focus on Bio-based lubricant additives: Driven by sustainability concerns and the need for renewable and environmentally friendly alternatives.

Lubricant additives are chemical compounds that are added to base oils to enhance their existing properties, suppress undesirable ones, or impart new beneficial characteristics. These additives typically constitute a small percentage of the total lubricant volume, ranging from 0.1% to 30%, depending on the specific application and desired performance. Their primary functions include reducing friction and wear between moving parts, preventing corrosion and oxidation, maintaining viscosity across a wide temperature range, keeping the system clean by dispersing contaminants, and protecting metal surfaces under extreme pressure conditions. Essentially, lubricant additives are crucial for ensuring the efficient operation, longevity, and reliability of machinery and engines across various industries.