Luxury Goods Market Size, Share, Trends, Industry Analysis Report

: By Product (Apparels, Watches, Jewelry, Handbags, Perfumes & Cosmetics, Footwear, and Others), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5612

- Base Year: 2024

- Historical Data: 2020-2023

Luxury Goods Market Overview

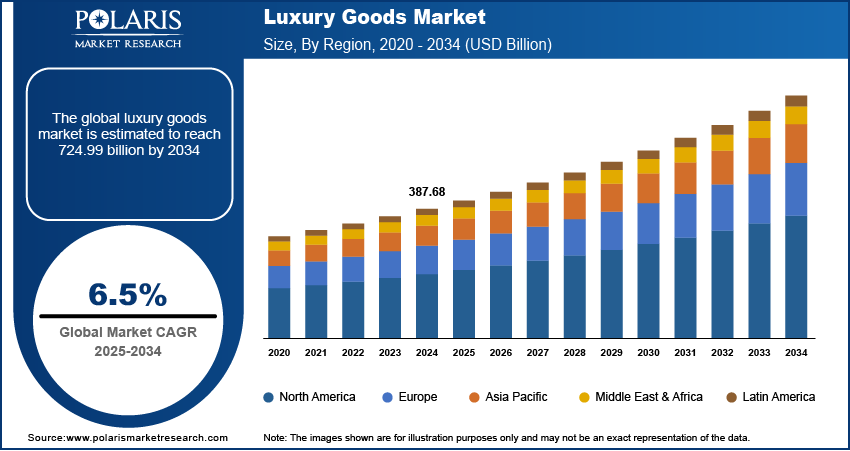

The luxury goods market size was valued at USD 387.68 billion in 2024. The market is projected to grow from USD 412.02 billion in 2025 to USD 724.99 billion by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

Luxury goods are high-quality, expensive products that are not essential for everyday living but are highly sought after for their exclusivity, superior craftsmanship, and ability to signify wealth and social status. These products span a wide range of categories, including designer clothing, high-end watches, and fine jewelry. Consumers often purchase luxury items to express their identity, reward themselves, or elevate their social standing.

The rising disposable income globally is propelling the luxury goods market growth. The Bureau of Economic Analysis published a report stating that the disposable personal income of Americans increased by 0.5% in February 2025 compared to January 2025. Increased disposable income drives people to show greater interest in premium brands that offer quality, exclusivity, and social prestige. People also tend to associate luxury goods with success and personal achievement, so they view such purchases as a reflection of their improved financial status. High disposable income levels further reduce the price sensitivity of consumers, causing them to invest in durable and fashionable luxury goods. Therefore, rising disposable income globally is fueling the market expansion.

To Understand More About this Research: Request a Free Sample Report

The luxury goods market demand is driven by the rising urbanization worldwide. The World Economic Forum in its report quoted that 55% of the world's population lives in urban areas, and is expected to rise to 80% by 2050. Urban centers create environments where people encounter luxury branding more frequently through high-end retail stores, advertisements, and social media, leading to high adoption of luxury goods such as apparel and footwear, watches, and others. Urban people also have better access to shopping malls, flagship boutiques, and online delivery networks, making it easier to discover and purchase luxury goods. Additionally, urban professionals seek to express their identity and success through fashion, accessories, and technology, driving consistent demand for luxury goods.

Luxury Goods Market Dynamics

Rising Demand for Luxury Goods Among Millennials and Gen Z Populations

Millennials and Gen Z invest heavily in luxury products that reflect their identity and aspirations. The World Economic Forum published data stating that millennials are 1.8 billion around the world, while Gen Z accounts for 2.47 billion of the world population. These generations are highly influenced by social media and digital platforms, where luxury brands often have a strong presence, leading to high demand. The increasing purchasing power of millennials and Gen Z is further fueling them to invest in luxury goods such as watches, footwear, apparel, and others. Moreover, millennials and Gen Z are more conscious consumers compared to previous generations. They prioritize sustainability, ethical practices, and social responsibility when making purchasing decisions. Luxury brands are emphasizing these values to attract these consumers. All these factors propel the demand for luxury goods among Gen Z and millennial populations.

Rising Penetration of Smartphones Worldwide

5G Smartphones allow consumers to easily browse luxury brand websites, explore new collections, and shop online with just a few taps. Social media platforms or user generated content platforms, optimized for smartphone use, amplify exposure to luxury lifestyles and luxury goods through influencer endorsements, celebrity posts, and targeted ads, creating aspirational desires among users. Additionally, smartphones enhance the shopping experience through seamless mobile payment options, personalized recommendations, and exclusive app-based perks from luxury brands. Therefore, as the adoption of smartphones worldwide increases, the demand for luxury goods also surges.

Luxury Goods Market Assessment by Segment

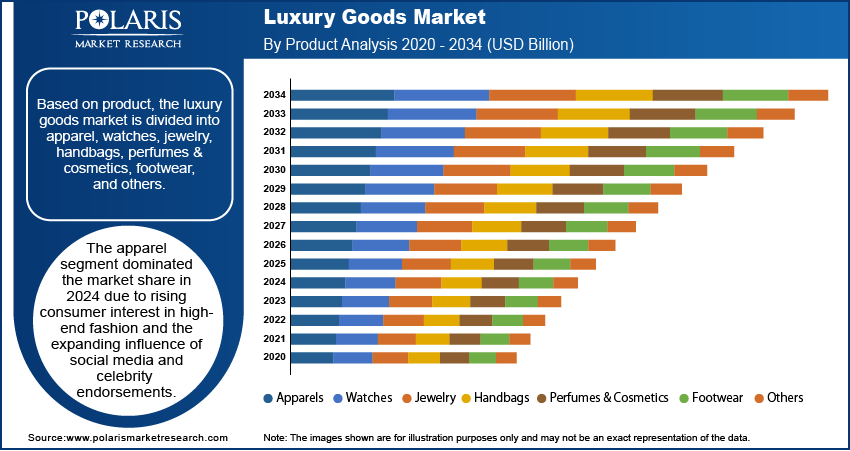

Market Evaluation by Product

Based on product, the luxury goods market is divided into apparel, watches, jewelry, handbags, perfumes & cosmetics, footwear, and others. The apparel segment dominated the market share in 2024 due to rising consumer interest in high-end fashion and the expanding influence of social media and celebrity endorsements. Major fashion houses such as Louis Vuitton, Gucci, and Chanel hold strong brand equity that their seasonal collections and limited-edition apparel sell out instantly. The surge in online retail also contributed to the rising purchase of branded apparel, as digital platforms allowed brands to reach affluent millennials and Gen Z consumers globally. Additionally, the rise of “quiet luxury” and a growing preference for elegance led many consumers to invest in premium wardrobe staples, further propelling apparel sales.

The jewelry segment is expected to grow at a robust pace in the coming years, owing to the increasing demand for personalized jewelry. Consumers are viewing luxury jewelry as a fashion statement but also as a long-term asset, especially amid economic uncertainty. Furthermore, the growing number of high-net-worth individuals in emerging markets such as China and India has expanded the consumer base for luxury jewelry. Technological innovations, including blockchain security and virtual try-ons, have also enhanced transparency and accessibility, making the segment well-positioned for sustained growth.

Market Insight by End User

In terms of end user, the market is segregated into men and women. The women segment dominated the luxury goods market share and is expected to continue its dominance throughout the projection period, owing to the strong demand for high-end fashion, beauty products, and accessories. Women continued to lead spending across categories such as apparel, handbags, jewelry, and cosmetics, where brands heavily focused their marketing efforts. Brands such as Dior, Chanel, and Hermès introduced exclusive collections and personalized shopping experiences that resonated with female consumers. The rise of social media influencers and fashion-forward content on social media platforms such as Instagram and TikTok boosted visibility for women-centric luxury offerings. Additionally, increasing financial independence among women, especially in developing economies, led to greater spending on luxury goods.

Luxury Goods Market Regional Analysis

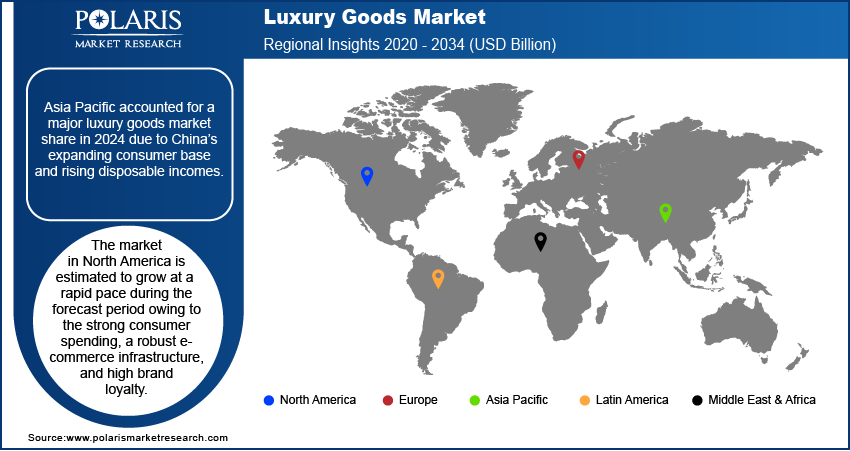

By region, the luxury goods market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to China’s expanding consumer base and rising disposable incomes. China dominated the regional market owing to a strong demand for high-end fashion, jewelry, and cosmetics, fueled by a growing middle class and an increasingly affluent younger generation. The Chinese government’s support for domestic consumption, coupled with a robust digital infrastructure that enabled seamless e-commerce and social media marketing, played a key role in accelerating demand for luxury goods. Additionally, the revival of domestic travel and the preference for local luxury shopping experiences after COVID-19 restrictions further boosted sales of luxury goods in major urban centers of the region, such as Shanghai, Tokyo, Beijing, Mumbai, Bengaluru, Bangkok, and Singapore.

The market in North America is estimated to grow at a rapid pace during the assessment period owing to the strong consumer spending, a robust e-commerce infrastructure, and high brand loyalty. American consumers value on craftsmanship, exclusivity, and sustainability, prompting luxury brands to innovate with eco-conscious materials and limited-edition collections. Influencer-driven marketing and a rise in experiential retail stores, such as flagship stores, are playing a crucial role in attracting younger and affluent buyers in the region to invest in luxury goods.

Luxury Goods Market – Key Players & Competitive Analysis Report

The market is characterized by intense competition and a dynamic landscape shaped by strategic mergers and acquisitions, partnerships, and collaborations. Major players have solidified their positions through aggressive expansion strategies. Mergers and acquisitions are crucial in the market, enabling conglomerates to diversify their product portfolios and enter new markets. Partnerships and collaborations further enhance brand value and innovation. Product portfolio diversification remains central to maintaining competitive advantage, with companies expanding beyond traditional categories such as fashion and accessories into lifestyle, wellness, and experiential luxury. Moreover, sustainability-focused collaborations reflect growing consumer demand for eco-conscious luxury.

The luxury goods market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Burberry Group PLC, Chanel, Coty Inc., Estée Lauder Companies Inc., Golden Goose, Hermès International S.A., Hugo Boss AG, Kering SA, L'Oréal S.A., Omega, Pandora Inc., PATEK PHILIPPE SA, Prada S.p.A., RALPH LAUREN, Richemont S.A., and Rolex SA.

Rolex SA is a Swiss luxury watch manufacturer known for its exceptional craftsmanship, innovation, and enduring status. Founded in 1905 in London by Hans Wilsdorf and Alfred Davis, the company registered the Rolex brand in 1908 and relocated its headquarters to Geneva, Switzerland, in 1919 to benefit from the country’s strong watchmaking tradition and economic stability. Rolex has remained privately owned by the Hans Wilsdorf Foundation since 1960, a unique structure that allows the company to reinvest profits into its operations and charitable initiatives. The brand’s watches are widely regarded as status symbols, coveted by collectors and enthusiasts worldwide for their blend of technical excellence and luxury appeal.

Golden Goose is an Italian luxury fashion brand known for its distinctive approach to footwear and apparel, blending traditional craftsmanship with a philosophy of “perfect imperfection.” Founded in 2000 in Venice by Francesca Rinaldo and Alessandro Gallo, the brand quickly set itself apart by introducing high-end sneakers. Golden Goose has expanded its offerings to include apparel, accessories, and personalized experiences, while maintaining footwear as its core business. Golden Goose stands as a symbol of Italian craftsmanship, creative freedom, and the enduring appeal of luxury goods that embrace imperfection.

List of Key Companies in Luxury Goods Market

- Burberry Group PLC

- Chanel

- Coty Inc.

- Estée Lauder Companies Inc.

- Golden Goose

- Hermès International S.A.

- Hugo Boss AG

- Kering SA

- Omega

- Pandora Inc.

- PATEK PHILIPPE SA

- Prada S.p.A.

- RALPH LAUREN

- Richemont S.A.

- Rolex SA

Luxury Goods Industry Developments

April 2025: Rolex announced the launch of its new models of watches such as The GMT-Master II, The Oyster Perpetual, and others, born from an imagination in perpetual movement that inspires every part of the manufacture.

October 2024: Golden Goose, a Next Gen luxury brand specialized in the sourcing, designing, and distribution of iconic products, entered India with the opening of its first store at New Delhi’s Chanakya Mall.

Luxury Goods Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Apparels

- Watches

- Jewelry

- Handbags

- Perfumes & Cosmetics

- Footwear

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Men

- Women

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Luxury Goods Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 387.68 Billion |

|

Market Forecast in 2025 |

USD 412.02 Billion |

|

Revenue Forecast in 2034 |

USD 724.99 Billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 387.68 billion in 2024 and is projected to grow to USD 724.99 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are Burberry Group PLC, Chanel, Coty Inc., Estée Lauder Companies Inc., Golden Goose, Hermès International S.A., Hugo Boss AG, Kering SA, L'Oréal S.A., Omega, Pandora Inc., PATEK PHILIPPE SA, Prada S.p.A., RALPH LAUREN, Richemont S.A., and Rolex SA.

The women segment dominated the market revenue share in 2024.

The jewelry segment is expected to grow at the fastest pace in the coming years.