Medical Spa Market Share, Size, Trends, Industry Analysis Report

By Service (Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal); By Age Group; By Service Provider; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM2955

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

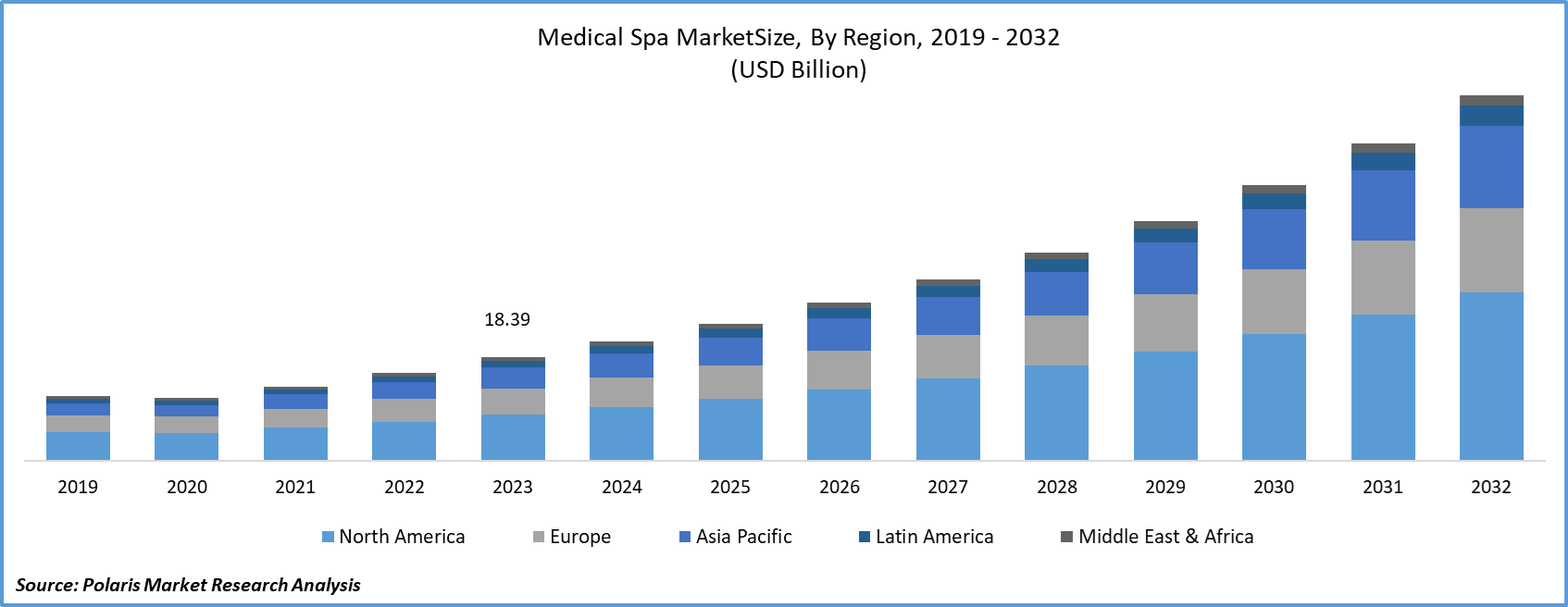

The global medical spa market size was valued at USD 18.39 billion in 2023. The market is anticipated to grow from USD 21.13 billion in 2024 to USD 64.69 billion by 2032, exhibiting the CAGR of 15.0% during the forecast period.

The increased use of cosmetic treatments and pharmaceuticals for aesthetic enhancement in developed nations is the primary driver of the business. The development of skincare technology, the rise in skin-related illnesses, and the need for better medical spa treatments are some of the causes contributing to this market.

Know more about this report: Request for sample pages

Many people associate medical aesthetics with treatments like injectable and laser skin rejuvenation, but medical spas are increasingly using complete wellness to assist enhance their patients' entire health. This fusion of conventional aesthetic medical procedures and lifestyle medicine gives patients not only remedies for the glaring concerns they encounter every day but also for the underlying disorders that make them feel unwell and complicate their daily lives.

Furthermore, the continually shifting needs of the customers have shaped the medical spa. Awareness of anti-aging products is growing as consumers become more adept at using social media. For instance, according to the 2021 Aesthetic Plastic Surgery report, surgical procedures increased by 54%, non-surgical procedures by 44%, and body procedures by 63%, all of which were boosted by rises in liposuction procedures by 66% and abdominoplasties by 49%.

According to the Alexander Valiga et al. research paper published in June 2022, medical spas have increased in quantity to the point where they now outweigh physician-based cosmetic operations in 73% of major U.S. cities.

The COVID-19 epidemic has raised public awareness of the value of health and well-being, but it has also led to the closure of spas and wellness facilities. As a result, recent years have seen changes in both supply and demand. Many of the nation's medical spas, also known as med spas, are attempting to capitalize on a trend toward aesthetic operations after lockdowns were lifted.

Industry Dynamics

Growth Drivers

Aesthetic medications and cosmetic treatments are in high demand. In addition, the global market for medical spas is expanding quickly due to raising consumer awareness of self-care services. The need for these services is increasing due to the expansion of the tourism industry, particularly in developing nations. To support their high prices and capitalize on their position, many firms provide customized beauty treatments. A new development in the industry is the integration of wellness architecture and biophilic design across the entire structural design of the building.

For instance, a report by Annie Jin and Ian Whittall released by Harvard Medical on August 29, 2022, states that one of the main factors driving the expansion of South Korea's medical tourism business is the country's inexpensive cost of high-quality procedures.

Report Segmentation

The market is primarily segmented based on service, age group, service provider and region.

|

By Service |

By Age Group |

By Service Provider |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Facial treatment segment will account for a higher share of the market.

The facial treatment segment dominated the market with a revenue share in 2022. The face and neck are the primary areas of focus for many of today's well-liked medical spa treatments. Furthermore, the popularity of video calling implies that more individuals are paying attention to how their faces and necks seem on camera. As a result, the amount of face and neck treatments purchased at med spas has increased significantly.

For instance, According to the Elite Facial Plastic Surgery study issued in 2021, the number of annual Botox treatments surged by roughly 459% between 2000 and 2020. Results from these quick fixes last for months and only take a few minutes to complete. Botox is most frequently used by people in the 40–54 age range. Botox was administered to 2,503,229 persons aged 40 to 54 in 2020. In 2020, 1,010,138 Botox procedures were performed on people in the 55–69 age group, which is second most.

Adult segment is predicted to dominate the industry's market segment.

Adults lead the market in 2022, due to rising interest in body contouring and anti-aging treatments in adults, the main driver of medical spa market expansion is the fact that the bulk of med spa clients is in their mid-30s and 50s. The new standard for measuring societal value seems to be beauty. The huge social media effect is driving up the adolescent desire for facial treatments. Since people seek permanently scar-free skin, they also choose nonsurgical scar alterations.

Moreover, the need for dermal fillers among adults in the 35 to 50 age range and their high purchasing power are driving the segment's expansion. For instance, according to the “Will Surgical Arts” analysis issued in 2022, around 42.9% of the cosmetic procedures performed each year are performed for people aged 35-50, making them the most likely to seek out aesthetic augmentation. Anti-aging and body reshaping operations are by far the most common for this age range.

The single ownership segment has the highest revenue.

In 2022, the single ownership segment had the largest revenue share. The key drivers of market expansion were single-owned, small-sized, and single-location medical spa facilities outfitted with cutting-edge equipment. More doctors are also choosing to lead medical spas, becoming the facility's sole or joint proprietors, or both due to rising burnout rates and declining reimbursement rates.

According to an EHL Group report, there are over 6,800 medical spas globally. Additionally, the US currently has about 2100 Medi spas. Technology advancements have increased the effectiveness of laser equipment.

The demand in North America is expected to witness significant growth

North America is expected to dominate the market, owing to higher expenses on wellness tourism than other regions. The U.S. and Canada have easy access to a variety of services for different cosmetic procedures and are anticipated to further accelerate market expansion.

The rising demand for minimally invasive procedures like chemical peels and non-invasive skin tightening, body sculpting, and tattoo removal is another factor fueling the market expansion in the US. For instance, according to a 2020 report published by the American Society of Plastic Surgeons, Intense Pulsed Light (IPL) therapy replaces Laser Skin Removal as the top 5 cosmetics minimally invasive technique, with over 827,000 IPL operations performed in 2020.

Competitive Insight

Key players in the global market are Biovital Medspa, Chic La Vie Med Spa, Bijoux Medical, Westchase Medsap, LLC, LISSÈ MEDICAL AESTHETICS, SHA Wellness Clinic, Cocoona.ae, Lily Medical and Spa, Aesthetics Medispa, The Drx Medispa, Allure Medspa, Serenity Medspa, Ideal Image Development Corp., Clinique La Prairie and SkinSpirit.

Recent Developments

- January 2024: Empower Aesthetics announced its partnership with AW Skin Co., a renowned medical spa and wellness center that has locations in Franklin, Cool Springs, and Murfreesboro, Tennessee, and DermaTouch RN.

- November 2023: The SHA Wellness Clinic opened its first overseas location in Mexico. The company's plans to expand globally will begin with the opening, with an Abu Dhabi location to follow in 2025.

- In November 2021, Botox skin rejuvenating procedure was launched by Chic La Vie for men aimed at starting a new revolution.

Medical Spa Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.13 billion |

|

Revenue forecast in 2032 |

USD 64.69 billion |

|

CAGR |

15.0% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Service, By Age Group, By Service Provider, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Biovital Medspa, Chic La Vie Med Spa, Bijoux Medical, Westchase Medsap, LLC, LISSÈ MEDICAL AESTHETICS, SHA Wellness Clinic, Cocoona.ae, Lily Medical and Spa, Aesthetics Medispa, The Drx Medispa, Allure Medspa, Serenity Medspa, Ideal Image Development Corp., Clinique La Prairie and SkinSpirit |

FAQ's

Medical Spa Market Size Worth $63.79 Billion By 2032.

Top market players in the medical spa market are Biovital Medspa, Chic La Vie Med Spa, Bijoux Medical, Westchase Medsap, LLC, LISSÈ MEDICAL AESTHETICS, SHA Wellness Clinic

North America contribute notably towards the global medical spa market.

The global medical spa market expected to grow at a CAGR of 14.6% during the forecast period.

The medical spa market report covering key segments are service, age group, service provider and region.