Natural Disaster Management Market Size, Share, Trends, Industry Analysis Report

By Component (Solution, Services), By Application, By End User, By Communication System, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5584

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

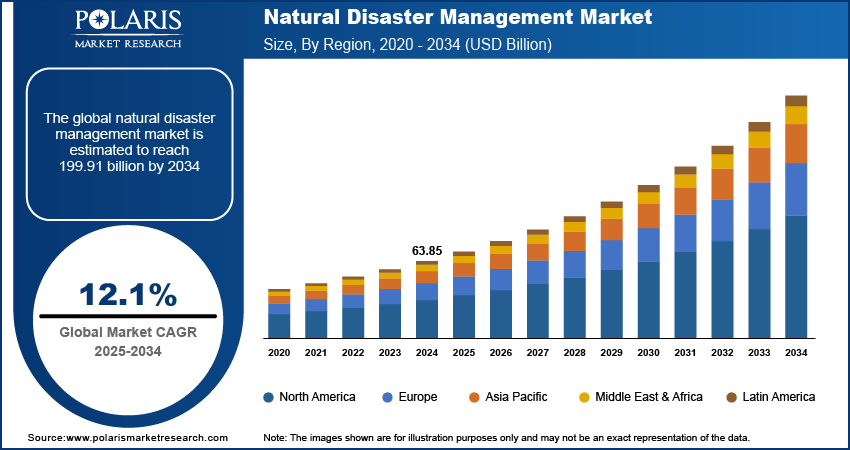

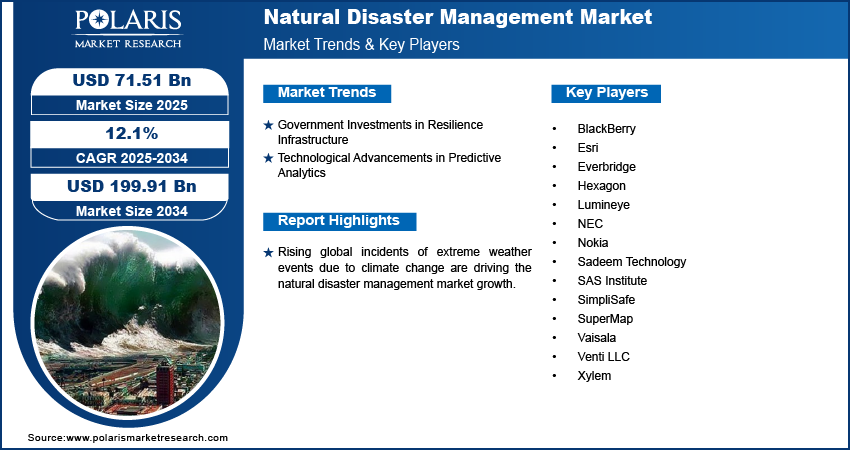

The global natural disaster management market size was valued at USD 63.85 billion in 2024 and is expected to register a CAGR of 12.1% from 2025 to 2034. Rapid urbanization in disaster-prone areas is escalating the need for robust disaster management frameworks, driving demand for scalable solutions. Additionally, heightened awareness of climate-related risks is prompting industries, governments, and communities to adopt proactive disaster management strategies. It is expected to offer lucrative opportunities during the forecast period.

Key Insights

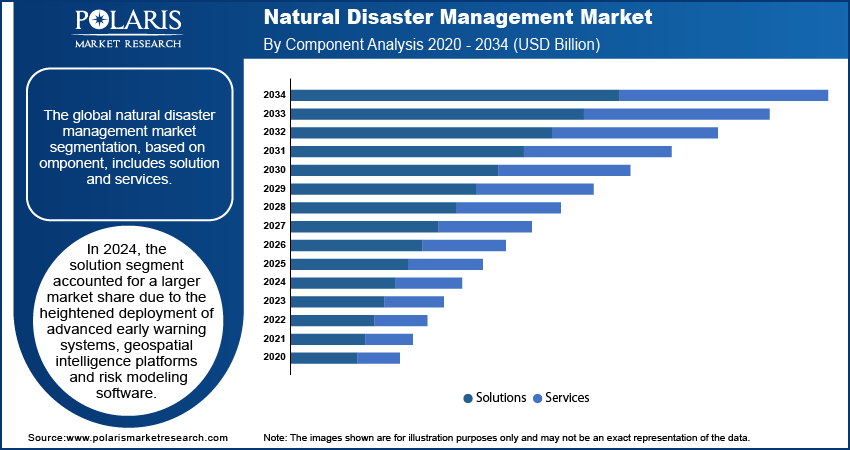

- In 2024, the solution segment accounted for the largest share. It is due to the heightened deployment of advanced early warning systems, geospatial intelligence platforms, and risk modeling software.

- The rescue personnel segment accounted for the largest market share in 2024. The dominance is attributed to their frontline operational role, requiring high-performance disaster response tools.

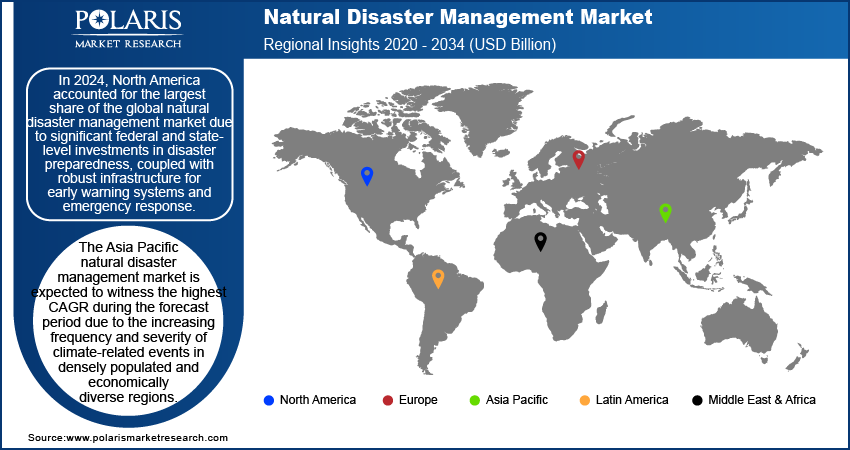

- In 2024, North America dominated the natural disaster management industry share. This is fueled by significant federal and state-level investments in disaster preparedness system, coupled with robust infrastructure for early warning systems and emergency response.

- The Asia Pacific industry is expected to register the highest CAGR during the forecast period. The increasing frequency and severity of climate-related events in densely populated and economically diverse regions boost the growth.

Industry Dynamics

- Increasing global incidents of extreme weather events, due to climate change, propel the demand for advanced natural disaster management solutions .

- Government investments in resilience infrastructure boost the industry expansion.

- The integration of technologies such as artificial intelligence, machine learning, and big data analytics into disaster management systems is reshaping industry trends.

- Financial and infrastructure challenges hinder the industry expansion.

Market Statistics

2024 Market Size: USD 63.85 billion

2034 Projected Market Size: USD 199.91 billion

CAGR (2025–2034): 12.1%

North America: Largest market in 2024

AI Impact on Natural Disaster Management Market

- Governments and organizations across the world invest a high amount in AI solutions to improve real-time insights, resource allocation, and predictive analytics.

- AI systems analyze weather, sensor, and seismic data to detect anomalies and issue timely alerts.

- The technology helps determine where to deploy medical supplies, rescue teams, and shelters based on real-time impact assessments.

- Natural language processing (NLP) is used to analyze emergency communications and social media for situational awareness.

To Understand More About this Research: Request a Free Sample Report

The natural disaster management market refers to the ecosystem of technologies, services, and solutions designed to predict, mitigate, respond to and recover from natural disasters such as earthquakes, floods, hurricanes, wildfires, and droughts. This includes various tools such as early warning systems, satellite imaging, drones, IoT sensors, AI-based analytics, and emergency response planning platforms. Rising global incidents of extreme weather events due to climate change are driving demand for advanced disaster management solutions, which is significantly contributing to the natural disaster management market growth.

Market Dynamics

Government Investments in Resilience Infrastructure

Governments are prioritizing the development of robust systems such as flood barriers, earthquake-resistant buildings, and advanced early warning mechanisms to mitigate the impact of natural disasters. Thus, they are allocating substantial budgets to disaster-resilient infrastructure. For instance, in 2023, the Federal Emergency Management Agency (FEMA) allocated USD 3 billion in grants specifically aimed at enhancing the resilience of communities against climate threats. This funding included USD 350 million designated for the Nonprofit Security Grant Program, which witnessed a significant uptick in applications, increasing by 50%. Additionally, FEMA introduced a USD 18 million allocation via the newly established Tribal Cybersecurity Grant Program, aimed at supporting cybersecurity measures among tribal entities. These investments are enhancing public safety and also driving innovation in the creation of scalable and sustainable solutions. The emphasis on resilience infrastructure is boosting collaboration between public and private sectors, leading to the development of advanced technologies tailored for disaster management. This focus on long-term preparedness, through government investments in resilience infrastructure, is significantly accelerating the natural disaster management market demand.

Technological Advancements in Predictive Analytics

The integration of artificial intelligence, machine learning, and big data analytics into disaster management systems is reshaping the natural disaster management market trends by improving the precision and speed of predictions. For instance, the Probability of Fire (PoF) model from the European Centre for Medium-Range Weather Forecasts enhances wildfire prediction by utilizing machine learning to analyze extensive datasets, including meteorological factors, fuel load characteristics, and human activities. This approach significantly improves the accuracy of identifying potential ignition hotspots compared to traditional methods. These advancements enable real-time analysis of vast datasets, allowing stakeholders to anticipate disasters with greater accuracy and implement timely response strategies. Enhanced predictive capabilities are increasing the adoption rates of sophisticated tools across industries and governments, further fueling natural disaster management market development.

Segment Insights

Market Assessment by Component Outlook

The global natural disaster management market segmentation, based on component, includes solution and services. In 2024, the solution segment accounted for a larger share of the natural disaster management market revenue due to the heightened deployment of advanced early warning systems, geospatial intelligence platforms, and risk modeling software. Demand has upsurged among agencies and enterprises for modular, interoperable technologies capable of delivering precise real-time data and predictive insights. These platforms facilitate integrated response frameworks and enhance situational awareness, making them indispensable in both pre-disaster planning and post-disaster coordination. The growing availability of AI-driven simulation tools and real-time alerting systems continues to strengthen this segment's value proposition, reflecting a strategic shift toward automation and data-driven decision-making in disaster risk reduction.

The services segment is expected to register a higher CAGR over the forecast period due to the rising emphasis on continuity planning, consulting, and training services tailored to region-specific threats. Governments and private organizations are increasingly outsourcing expertise to manage evolving risks and complex operational environments. Managed services, including 24/7 monitoring, cyber-disaster recovery, and incident response support, are gaining traction across critical infrastructure and utility sectors. Additionally, the expanding use of professional services for regulatory compliance, emergency drills, and public-private collaboration models is reinforcing sustained growth, reflecting a broader institutional focus on resilience enhancement and adaptive capacity building.

Market Evaluation by End User Outlook

The global natural disaster management market segmentation, based on end user, includes government organization, private companies, rescue personnel, and others. According to the natural disaster management market statistics, the rescue personnel segment accounted for the largest market share in 2024 due to their frontline operational role requiring high-performance disaster response tools. The segment benefits from specialized demand for ruggedized communication devices, real-time tracking systems, and unmanned aerial vehicles that support search and rescue missions. Increasing investments in equipment interoperability and situational intelligence platforms tailored for rapid deployment have amplified procurement volumes. Furthermore, the integration of wearable biosensors and geolocation-enabled systems into standard operating procedures has elevated operational efficiency and safety standards, making this segment a consistent revenue generator in both natural and human-induced disaster scenarios.

The private companies segment is expected to register the highest CAGR over the forecast period due to the growing need for enterprise-level disaster resilience and continuity solutions. Corporate stakeholders, particularly in manufacturing, energy, and data infrastructure sectors, are investing in predictive analytics, automated alerts, and cyber-physical risk mitigation systems. The increasing financial and reputational risks posed by climate events and regulatory scrutiny are accelerating the adoption of advanced disaster preparedness frameworks within private enterprises. Customized solutions that align with ESG mandates and business continuity certifications reinforce the strategic importance of disaster management as a core component of risk governance in the private sector.

Regional Analysis

By region, the study provides natural disaster management market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the natural disaster management market share due to significant federal and state-level investments in disaster preparedness system, coupled with robust infrastructure for early warning systems and emergency response. Government agencies, such as FEMA and NOAA, have heavily adopted AI-powered analytics, satellite-based geospatial systems, and resilient communication frameworks to manage climate-induced disasters. The region’s high incidence of wildfires, hurricanes, and floods has prompted continuous upgrades in predictive modeling and public safety platforms. Moreover, public–private partnerships and a strong focus on cybersecurity in disaster response have driven sustained demand for integrated and scalable solutions.

The Asia Pacific natural disaster management market is expected to register the highest CAGR during the forecast period due to the increasing frequency and severity of climate-related events in densely populated and economically diverse regions. Governments across emerging economies are expanding investments in smart disaster risk reduction technologies, real-time surveillance systems, and cloud-based emergency command centers. For instance, Heightened interest in bosai, a Japanese approach focused on disaster prevention and mitigation. This framework aims to create robust disaster-resilient systems by leveraging innovative technologies and data-driven strategies for improved preparedness and response. Rapid urbanization in disaster-prone zones has created an urgent need for resilient infrastructure and predictive response frameworks. Additionally, international aid and cross-border collaborations have accelerated the deployment of AI-enabled monitoring tools and mobile-based alert platforms, particularly in Southeast Asia and the Indian subcontinent, fueling accelerated market expansion.

Key Players & Competitive Analysis Report

The competitive landscape of the natural disaster management market is defined by aggressive market expansion strategies, continuous technology advancements, and a growing focus on integrated solution development. Industry analysis reveals a strong emphasis on innovation, where key players are investing heavily in AI-driven early warning systems, geospatial intelligence, and web real-time communication networks to enhance disaster preparedness and response. Strategic alliances are increasingly common, particularly among technology providers and government agencies, to co-develop scalable platforms that address region-specific threats. Joint ventures and collaborative frameworks are facilitating the localization of disaster management capabilities and accelerating deployment in high-risk zones. Mergers and acquisitions are reshaping the market by consolidating complementary capabilities, expanding geographic reach, and enabling end-to-end service offerings. Post-merger integration strategies are focused on aligning product portfolios, streamlining operational frameworks, and enhancing interoperability across platforms. Companies are leveraging cross-sector expertise to differentiate through bespoke solutions tailored for urban resilience, infrastructure protection, and business continuity. Additionally, private equity involvement and venture funding continue to catalyze growth, particularly in emerging markets where the modernization of disaster management infrastructure is a strategic priority. The evolving landscape underscores a shift from reactive response models to predictive, data-driven ecosystems, driving sustained competition and accelerating technological maturity in the sector.

NEC, founded in 1899 and headquartered in Tokyo, Japan, is engaged in providing IT and network solutions to various sectors, including government agencies and business enterprises. The company specializes in integrating technologies such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) to enhance disaster management capabilities. NEC's product portfolio includes a range of disaster prevention solutions, such as the Regional Disaster Prevention Information Platform, River Inundation Simulation, and Real-Time Tsunami Inundation and Damage Estimation System. These solutions utilize advanced technologies such as AI and image analysis to assess disaster damage and enhance information sharing during emergencies. NEC provides services that support disaster resilience through early warning systems, infrastructure monitoring, and damage assessment tools. The company operates globally, serving markets in Japan, the US, Singapore, and other regions, and has expanded its presence through strategic partnerships to enhance climate change resilience.

Esri, founded in 1969 and headquartered in Redlands, California, is engaged in developing geographic information system (GIS) software and services. The company specializes in providing spatial analysis and mapping solutions that are crucial for natural disaster management. Esri's product portfolio includes ArcGIS, a comprehensive platform for mapping, spatial analysis, and data visualization. This platform is used to create detailed maps and models that help predict and respond to natural disasters such as floods and earthquakes. Services provided by Esri include data analytics, spatial modeling, and emergency response planning tools. These tools enable governments and organizations to better prepare for disasters by identifying high-risk areas and optimizing resource allocation. Esri has a global presence, serving clients across various industries and regions, including government agencies, environmental organizations, and emergency response teams. The company's solutions are widely used in disaster management to enhance situational awareness and improve response times.

List of Key Companies

- BlackBerry

- Esri

- Everbridge

- Hexagon

- Lumineye

- NEC

- Nokia

- Sadeem Technology

- SAS Institute

- SimpliSafe

- SuperMap

- Vaisala

- Venti LLC

- Xylem

Natural Disaster Management Industry Developments

In April 2025, Vaisala awarded a contract to modernize Greece's weather monitoring system for the Hellenic National Meteorological Service through two contracts: one for seven dual-polarization C-band weather radars and another for a lightning detection network with 12 advanced sensors. This initiative aims to enhance data accuracy and severe weather monitoring.

In October 2024, SuperMap and Soluciones SIG collaborated to develop an advanced urban emergency management platform tailored for Querétaro, Mexico. This initiative leverages sophisticated geospatial technology and data analytics to enhance situational awareness and optimize resource allocation during urban emergency scenarios.

Natural Disaster Management Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solutions

- Services

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Flood Detection

- Volcano Detection

- Forest Fire Detection

- Landslide Detection

- Earthquake Detection

- Weather Monitoring

- Others

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Government Organization

- Private Companies

- Rescue Personnel

- Others

By Communication System Outlook (Revenue – USD Billion, 2020–2034)

- Satellite Assisted Equipment

- Vehicle Ready Gateways

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Natural Disaster Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 63.85 billion |

|

Market Size Value in 2025 |

USD 71.51 billion |

|

Revenue Forecast in 2034 |

USD 199.91 billion |

|

CAGR |

12.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global natural disaster management market size was valued at USD 63.85 billion in 2024 and is projected to grow to USD 199.91 billion by 2034.

The global market is projected to register a CAGR of 12.1% during the forecast period.

In 2024, North America accounted for the largest market share due to significant federal and state-level investments in disaster preparedness, coupled with robust infrastructure for early warning systems and emergency response.

• A few of the key players in the market are BlackBerry, Esri, Everbridge, Hexagon, Lumineye, NEC, Nokia, Sadeem Technology, SAS Institute, SimpliSafe, SuperMap, Vaisala, Venti LLC, and Xylem.

In 2024, the solution segment accounted for a larger market share due to the heightened deployment of advanced early warning systems, geospatial intelligence platforms, and risk modeling software.

In 2024, the rescue personnel segment accounted for the largest market share due to their frontline operational role requiring high-performance disaster response tools.