On-Device AI Market Size, Share, & Industry Analysis Report

: By Component (Hardware and Software), By Deployment, By Technology, By Device Type, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5741

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

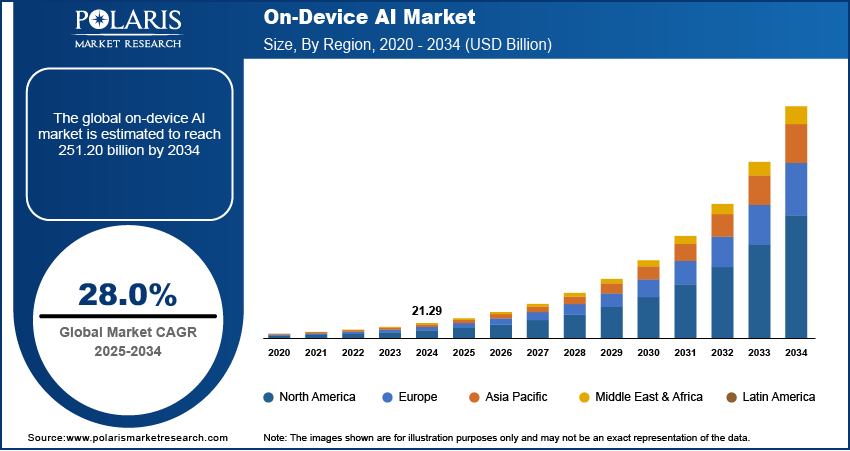

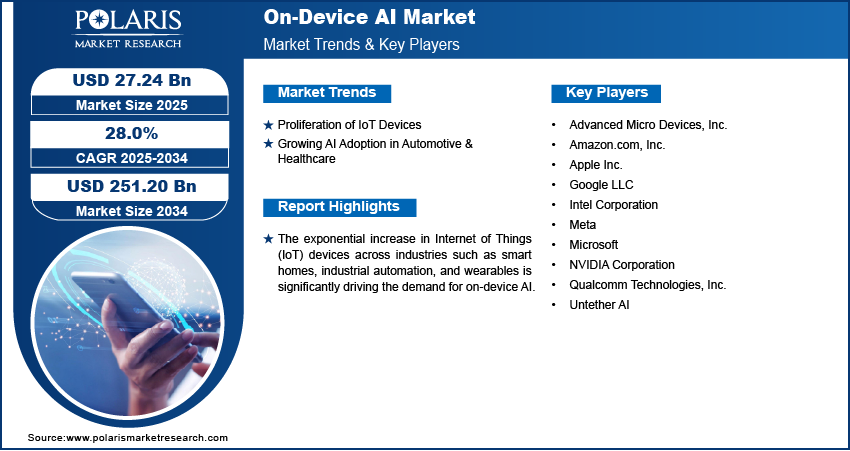

The global on-device artificial intelligence (AI) market size was valued at USD 21.29 billion in 2024 and is projected to register a CAGR of 28.0% during 2025–2034. On-device AI supports immediate data interpretation and action, essential for time-sensitive applications such as autonomous driving and voice assistants. This capability enhances user experience and system reliability in real-world environments, thereby fueling market growth.

The on-device AI market refers to the deployment of artificial intelligence algorithms directly on local devices such as 5G smartphones, IoT gadgets, and edge hardware, enabling data processing without cloud reliance. Processing data locally minimizes the need to transmit sensitive information to the cloud, reducing exposure to breaches. This aligns with stricter data protection laws and consumer expectations for greater privacy control.

To Understand More About this Research: Request a Free Sample Report

Industries such as healthcare and manufacturing require split-second decisions where delays are unacceptable. On-device AI eliminates reliance on network connectivity, ensuring rapid response times for critical operations and real-time monitoring. Additionally, modern chips such as NPUs and TPUs are optimized for AI tasks, enabling powerful local computation. These innovations allow complex models to run efficiently on compact devices, boosting performance without high energy consumption.

Market Dynamics

Proliferation of IoT Devices

The exponential increase in adoption of Internet of Things (IoT) devices across industries such as smart homes, industrial automation, and wearables is significantly driving the demand for on-device AI. According to projections from the National Institute of Standards and Technology, the number of IoT devices in operation will exceed 75 billion by 2025. These connected devices generate massive volumes of real-time data that require immediate processing to enable timely responses. On-device AI enables localized computation, reducing latency and reliance on cloud infrastructure. This decentralized architecture enhances responsiveness, energy efficiency, and data privacy, which are critical in applications such as remote monitoring, predictive maintenance, and intelligent sensors. Manufacturers are embedding AI accelerators directly into chips and microcontrollers to support real-time inferencing, further reinforcing the synergy between edge computing and AI-enabled IoT ecosystems.

Growing AI Adoption in Automotive & Healthcare

The automotive and healthcare sectors are rapidly integrating on-device AI to address application-specific requirements such as low latency, real-time decision-making, and offline functionality. According to a report by Hitachi, 44% of automotive companies are currently investigating the integration of AI technologies, which is poised to significantly influence vehicle design, production processes, and operational efficiency. In autonomous and semi-autonomous vehicles, embedded AI supports functions such as object detection, lane tracking, and driver monitoring without depending on constant cloud connectivity. Similarly, in healthcare, wearable devices and remote monitoring systems leverage on-device AI for continuous patient health tracking, early anomaly detection, and personalized feedback. This approach improves response times and also enhances user privacy and reliability in mission-critical environments. Continuous advancements in low-power AI chipsets and domain-specific models accelerate adoption across these highly regulated and performance-sensitive industries.

Segment Insights

Market Assessment by Component

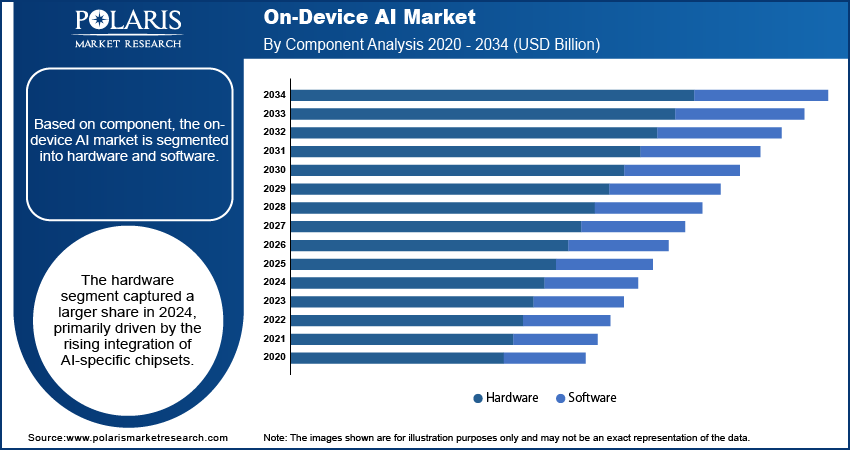

Based on component, the segmentation includes hardware and software. The hardware segment captured a larger share in 2024, primarily driven by the rising integration of AI-specific chipsets such as NPUs (Neural Processing Units), TPUs (Tensor Processing Units), and edge AI accelerators into consumer and industrial devices. Manufacturers are embedding these chips to handle complex inference tasks locally, reducing dependence on cloud infrastructure. Demand for compact, energy-efficient processors capable of real-time data processing has surged across smartphones, smart cameras, and automotive systems. The widespread availability of customized AI chip architectures optimized for on-device processing further reinforced hardware’s dominant position in the industry.

The software segment is projected to grow significantly during the forecast period, supported by advancements in AI model optimization, low-latency inference engines, and federated learning frameworks. Development tools enabling efficient AI deployment on constrained devices and runtime environments for real-time analytics are becoming more sophisticated. Growing demand for scalable AI development platforms tailored for specific use cases, such as vision and speech processing, is also fueling growth across both consumer and enterprise applications.

Market Assessment by Technology

Based on technology, the segmentation includes on-device AI, natural language processing, computer vision, and speech recognition. The on-device AI segment accounted for the largest share in 2024, largely due to increased demand for real-time decision-making, low power consumption, and improved data privacy. The ability to perform AI computations directly on local devices eliminates the need for continuous cloud connectivity, making it ideal for latency-sensitive applications in wearables, automotive systems, and smart home automation.

The natural language processing segment is expected to grow significantly during the forecast period, driven by the increasing integration of voice assistants, chatbots, and language-based user interfaces into mobile and home devices. Real-time, on-device NLP enables faster response times and enhanced privacy, particularly in multilingual and accent-sensitive environments. Advancements in transformer-based architectures and quantized models are enabling powerful NLP capabilities on resource-constrained devices.

Market Evaluation by Device Type

Based on device type, the segmentation includes smart home devices, smartphones & tablets, wearables, and others. The smartphones & tablets segment dominated the market in 2024, fueled by the rapid adoption of AI-enhanced features such as face recognition, image optimization, real-time translation, and contextual user behavior analysis. On-device AI capabilities embedded in mobile processors support seamless user experiences without requiring cloud access. Leading mobile OEMs are integrating dedicated AI engines to enable faster inferencing and lower battery consumption, which has solidified the segment’s leadership. The growing need for personalized services and intelligent UI interactions in handheld devices continues to reinforce this trend.

The wearables segment is projected to experience significant growth, driven by the demand for real-time health tracking, gesture recognition, and intelligent notifications without depending on external data centers. Increasing consumer preference for privacy-focused health devices and AI-powered features such as fall detection and irregular heartbeat monitoring is accelerating adoption. Compact AI chips capable of operating under low-power conditions are enabling wearable manufacturers to embed sophisticated intelligence into increasingly smaller form factors.

Market Evaluation by Vertical

Based on vertical, the segmentation includes automotive, consumer electronics, healthcare, manufacturing, retail, security & surveillance, and others. The consumer electronics segment dominated the market in 2024, fueled by the widespread adoption of AI-powered smart TVs, speakers, home automation systems, and entertainment devices. On-device AI enables these systems to provide adaptive user experiences, including dynamic content recommendations, speech-based control, and predictive maintenance. Consumer demand for high responsiveness and offline functionality has led to the integration of AI accelerators across a range of devices. Innovation in low-power AI chipsets and tailored AI models for consumer interactions has further supported leadership in this vertical.

The healthcare segment is projected to experience significant growth, driven by the increasing use of AI-powered wearables, diagnostic devices, and remote monitoring systems. Medical-grade wearables leveraging on-device AI deliver real-time alerts and health insights, reducing hospital visits and supporting chronic disease management. Enhanced data privacy and offline functionality address critical regulatory and patient concerns, making on-device AI a strategic enabler for personalized and responsive healthcare delivery.

Regional Analysis

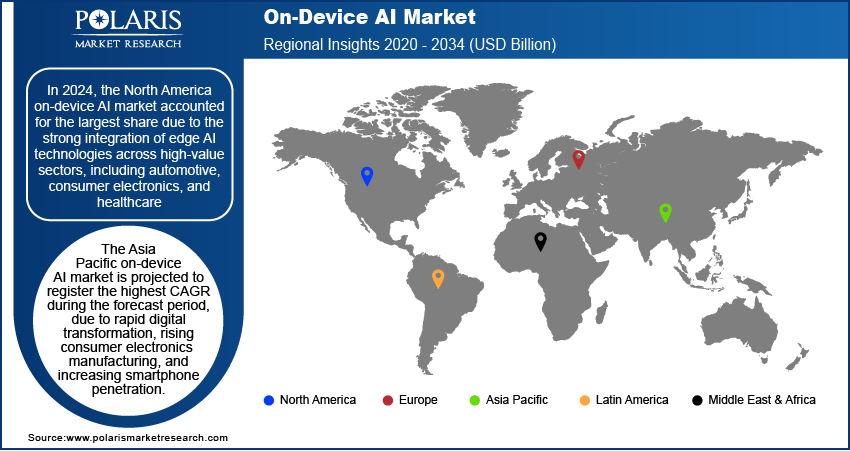

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America on-device AI market accounted for the largest share due to the strong integration of edge AI technologies across high-value sectors, including automotive, consumer electronics, and healthcare. Robust R&D infrastructure, early commercialization of AI chipsets, and strategic collaborations between tech giants and hardware manufacturers have accelerated market maturity. The region’s enterprise landscape favors on-device processing for privacy, real-time analytics, and reduced cloud dependency. High demand for advanced AI features in mobile devices, surveillance systems, and smart home applications has supported large-scale deployments. Government support for AI-driven innovation and established semiconductor supply chains reinforce regional dominance. In April 2025, the Department of Energy announced a progressive initiative aimed at the establishment of AI-optimized data centers and energy systems nationwide. This move is part of the US strategic objective to strengthen its dominance in the field of AI through the enhancement of its foundational AI infrastructure.

The US on-device AI market maintained the largest share in North America in 2024, driven by the rapid adoption of AI-enabled smartphones, wearables, and connected automotive systems. A strong culture of consumer tech innovation has fueled demand for intelligent edge capabilities, particularly in devices requiring ultra-low latency and secure offline functionality. Leading semiconductor companies based in the US continue to pioneer AI accelerators optimized for edge use. The growing footprint of AI in defense, healthcare, and industrial automation has intensified investments in on-device solutions. Widespread 5G coverage and high digital readiness further position the US as a technological front-runner in edge AI deployments.

The Asia Pacific on-device AI market is projected to register the highest CAGR during the forecast period due to rapid digital transformation, rising consumer electronics manufacturing, and increasing smartphone penetration. According to the India Brand Equity Foundation, India's smartphone industry became the second largest globally by unit volume and third by value in Q3 2024, with 15.5% of global shipments, with China at 22%. Shipments in India grew 3% year-on-year, while value increased by 12%, reaching a record quarterly high. Regional OEMs are embedding AI capabilities directly into devices to meet growing demand for localized, responsive features across languages, contexts, and applications. The proliferation of AI-powered surveillance systems, especially in urban infrastructure, is accelerating adoption in public safety and smart city initiatives. Investments in AI-focused chip design and edge computing by regional technology firms are reshaping competitive dynamics. Expanding 5G networks and affordable AI chipsets are also enabling faster market scalability.

The Europe on-device AI market is experiencing steady growth, driven by the strong emphasis on data privacy, regulatory compliance, and energy-efficient AI applications. Demand for localized processing aligns with the region’s stringent data protection frameworks, encouraging on-device intelligence over cloud-based alternatives. Deployment in smart home systems, autonomous vehicles, and industrial automation reflects a focus on sustainability and reliability. European tech companies and research institutions are investing in low-power AI chips and interpretable models for real-time decision-making. Increasing interest in AI-driven wearables for health and wellness, along with smart infrastructure investments, continues to support consistent expansion across both consumer and enterprise domains.

Key Players and Competitive Analysis Report

The competitive landscape of the on-device artificial intelligence market is highly dynamic, shaped by rapid technology advancements and aggressive expansion strategies. Industry analysis reveals that key players are focusing on enhancing edge computing capabilities to deliver faster, more secure AI processing directly on devices. Strategic alliances and joint ventures are becoming increasingly common as firms collaborate to integrate advanced AI chips, optimized neural networks, and efficient power management systems. Mergers and acquisitions are also playing a pivotal role in consolidating the industry, with larger entities absorbing innovative startups to strengthen their AI-on-chip portfolios.

Post-merger integration efforts are centered around streamlining R&D pipelines and accelerating product launches. Companies are frequently introducing new edge-AI-enabled hardware and software solutions tailored for the automotive, healthcare, and consumer electronics sectors. Market expansion strategies now emphasize regional growth, especially in Asia Pacific and North America, where demand for smart IoT ecosystems is surging. Competitive differentiation is largely driven by proprietary AI architectures, energy-efficient processors, and scalable deployment models. As part of broader strategic moves, firms are leveraging partnerships and in-house innovations to capture overall share and define future industry standards in embedded AI technologies.

List of Key Companies

- Advanced Micro Devices, Inc.

- Amazon.com, Inc.

- Apple Inc.

- Google LLC

- Intel Corporation

- Meta

- Microsoft

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Untether AI

On-Device AI Industry Developments

In May 2025, NVIDIA launched its AI-First DGX personal computing solutions in collaboration with leading hardware manufacturers.

In May 2025, NVIDIA launched NVLink Fusion, a new silicon architecture designed to enable industries to develop semi-custom AI infrastructures. This innovation leverages the extensive ecosystem of partners utilizing NVIDIA NVLink.

On-Device AI Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-premises

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- On-Device AI

- Natural Language Processing

- Computer Vision

- Speech Recognition

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Smart Home Devices

- Smartphones & Tablets

- Wearables

- Others

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Consumer Electronics

- Healthcare

- Manufacturing

- Retail

- Security & Surveillance

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

On-Device AI Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.29 billion |

|

Market Size Value in 2025 |

USD 27.24 billion |

|

Revenue Forecast by 2034 |

USD 251.20 billion |

|

CAGR |

28.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.29 billion in 2024 and is projected to grow to USD 251.20 billion by 2034.

The global market is projected to register a CAGR of 28.0% during the forecast period.

In 2024, the North America on-device AI market accounted for the largest share due to strong integration of edge AI technologies across high-value sectors, including automotive, consumer electronics, and healthcare.

A few of the key players are Apple Inc.; Amazon.com, Inc.; Google LLC; Meta; Microsoft; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Untether AI; and Advanced Micro Devices, Inc.

The hardware segment captured a larger share in 2024, primarily driven by the rising integration of AI-specific chipsets.

The healthcare segment is projected to experience significant growth, driven by increasing use of AI-powered wearables, diagnostic devices, and remote monitoring systems.