Pearlescent Pigment Market Size, Share, Trends, Industry Analysis Report

By Product (Natural Pearl Essence, Titanium Dioxide Mica, Iron/Ferric Oxide Mica), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6036

- Base Year: 2024

- Historical Data: 2020-2023

Overview

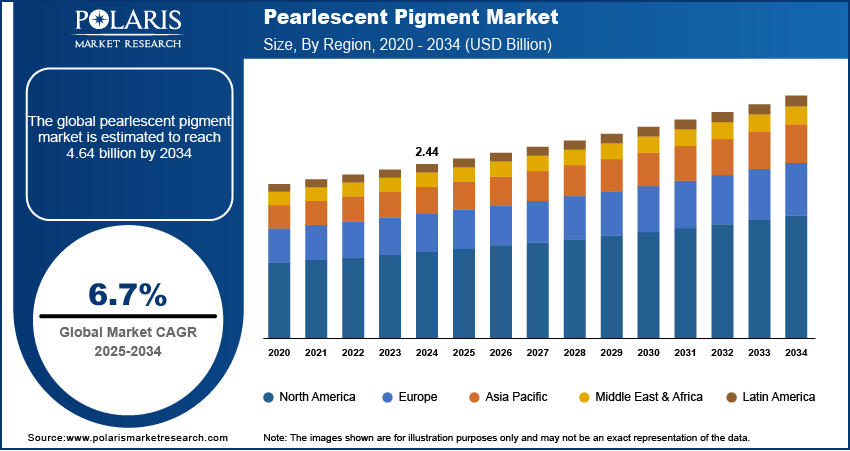

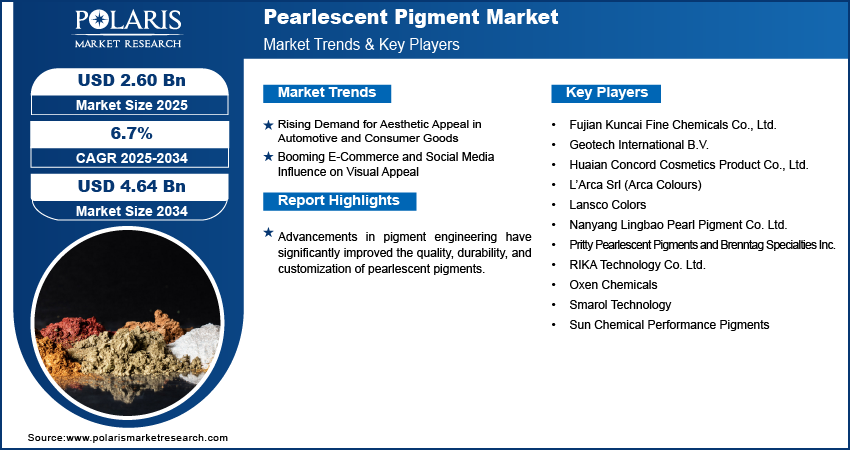

The global pearlescent pigment market size was valued at USD 2.44 billion in 2024, growing at a CAGR of 6.7% from 2025 to 2034. The industry growth is driven by rising demand for aesthetic appeal in automotive and consumer goods, and booming e-commerce and social media influence on visual appeal.

Key Insights

- In 2024, the titanium dioxide mica segment dominated with the largest share due to their strong reflective properties, color brilliance, and wide usage across various industries.

- The natural pearl essence segment is expected to experience significant growth during the forecast period, as natural pearl essence pigments, made from fish scales or other natural sources, are gaining attention as eco-friendly alternatives.

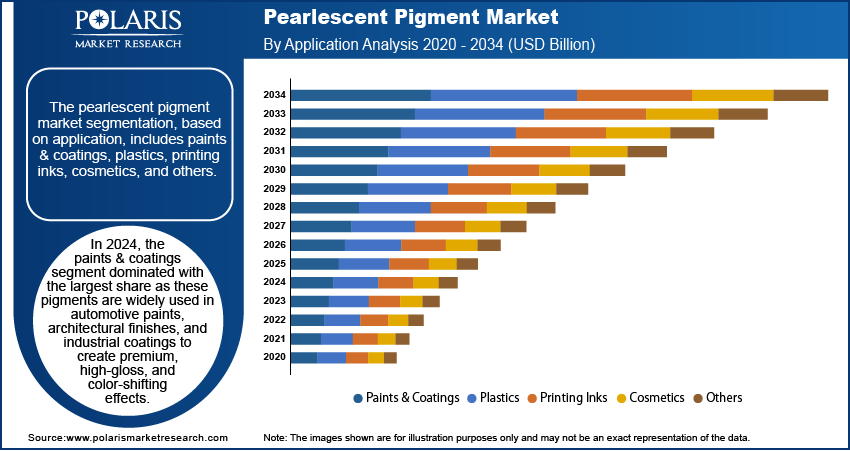

- In 2024, the paints & coatings segment dominated with the largest share as these pigments are widely used in automotive paints, architectural finishes, and industrial coatings to create premium, high-gloss, and color-shifting effects.

- The printing inks segment is expected to experience significant growth during the forecast period due to increasing use in packaging, labels, and decorative prints.

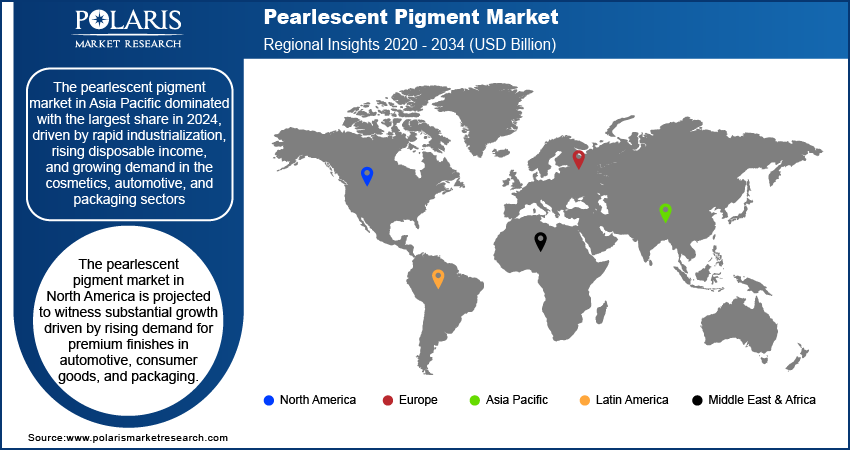

- Asia Pacific dominated the global pearlescent pigment market with the largest share in 2024, driven by rapid industrialization, rising disposable income, and growing demand in the cosmetics, automotive, and packaging sectors.

- The market in North America is projected witness substantial growth during the forecast period, driven by rising demand for premium finishes in automotive, consumer goods, and packaging.

- The U.S. is expected to experience significant growth during 2025–2034, due to the well-established automotive and personal care industry, both of which heavily use pearlescent pigments for their aesthetic value.

To Understand More About this Research: Request a Free Sample Report

Pearlescent pigments are special-effect pigments that create a shimmering, iridescent appearance similar to natural pearls. They are typically made by coating mica flakes with metal oxides such as titanium dioxide. These pigments reflect and refract light, making them popular in coatings, plastics, cosmetics, and inks for decorative and aesthetic enhancement.

The pearlescent pigment applications are expanding in printing inks, textile printing, and industrial coatings. In textiles, they enable fashion brands to create reflective and stylish fabric designs. In industrial coatings, pearlescent pigments are applied to furniture, appliances, and machinery to improve durability and aesthetics. These pigments are in high demand due to the growth of digital printing and the shift toward high-quality surface treatments in manufacturing. Their ability to combine decorative effects with functional benefits, such as UV and chemical resistance, makes them attractive across multiple emerging sectors, thereby driving the growth.

Advancements in pigment engineering have significantly improved the quality, durability, and customization of pearlescent pigments. Manufacturers now offer pigments with more precise particle sizes, improved weather and chemical resistance, and a broader range of color effects. These advances enable the pigments to perform more effectively in complex applications, such as 3D printing, automotive topcoats, and UV-curable inks. Moreover, customers are increasingly seeking tailored solutions, prompting suppliers to develop custom pigments for specific visual effects or brand colors. This technological progress makes pearlescent pigments more versatile and attractive across a growing number of industries, thereby driving the growth.

Industry Dynamics

- Rising demand for aesthetic appeal in automotive and consumer goods is driving the demand for pearlescent pigment.

- Booming e-commerce and social media influence on visual appeal fuel the industry growth.

- Advancements in formulation drive the reliability and appeal of products.

- High production costs and limited availability of raw materials restrain the market growth.

Rising Demand for Aesthetic Appeal in Automotive and Consumer Goods: Consumers increasingly value appearance and personalization, leading industries such as automotive and consumer electronics to adopt pearlescent pigments. These pigments produce shiny, color-shifting effects that boost the visual appeal of cars, appliances, packaging, and gadgets. Automakers use pearlescent coatings to distinguish models and elevate their luxury image. These industries are growing rapidly, fueling the demand for pigments that deliver rich color effects, long-lasting durability, and compatibility across various surfaces. According to the U.S. Bureau of Labor Statistics, in June 2024, the U.S. alone employed 1.0264 mn people in automotive manufacturing. The strong preference for premium finishes motivates manufacturers to integrate pearlescent pigments as a major element in improving product design, branding, and overall consumer appeal, thereby driving the growth.

Booming E-Commerce and Social Media Influence on Visual Appeal: The rapid rise of e-commerce and visual platforms, such as Instagram and TikTok, has amplified the importance of product appearance. According to Eurostat, in 2023, B2C e-commerce turnover was USD 1,036.65 billion or EUR 887 billion. Brands now need products that photograph well and stand out online from cosmetics to packaging. Pearlescent pigments help achieve eye-catching visuals that drive consumer interest and online engagement. Especially in beauty, fashion, and DIY spaces, shimmering or color-changing effects can go viral, pushing up demand. Pearlescent pigments offer a cost-effective yet impactful solution to improve product perception and boost digital marketing efforts as companies look for ways to improve shelf and screen appeal, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes natural pearl essence, titanium dioxide mica, iron/ferric oxide mica, combination mica, and others. In 2024, the titanium dioxide mica segment dominated with the largest share due to their strong reflective properties, color brilliance, and wide usage across various industries. These pigments are made by coating natural or synthetic mica flakes with titanium dioxide, creating vibrant, shimmering effects. Their excellent weather resistance, nontoxic nature, and stability under UV light make them highly preferred in automotive coatings, cosmetics, and plastic packaging. Their ability to deliver consistent color performance across different applications further boosts their popularity. Manufacturers favor this segment for its proven reliability, visual appeal, and broad compatibility with water- and solvent-based systems, thereby driving the segment growth.

The natural pearl essence segment is expected to experience significant growth during the forecast period as natural pearl essence pigments, made from fish scales or other natural sources, are gaining attention as eco-friendly alternatives. Although traditionally used in high-end cosmetics and luxury items, rising demand for sustainable and biodegradable ingredients is pushing their adoption across newer sectors. These pigments offer a soft, translucent glow that appeals to beauty and fashion brands seeking natural-based shimmer effects. Growing environmental awareness and clean-label trends in the cosmetics and personal care industry are expected to drive strong growth in this segment.

Application Analysis

The segmentation, based on application, includes paints & coatings, plastics, printing inks, cosmetics, and others. In 2024, the paints & coatings segment dominated with the largest share as these pigments are widely used in automotive paints, architectural finishes, and industrial coatings to create premium, high-gloss, and color-shifting effects. Their ability to improve both aesthetic and protective properties makes them highly valuable. In the automotive industry, pearlescent finishes are associated with luxury and uniqueness, while in decorative coatings, they improve surface appeal and perceived value. The versatility of these pigments in various paint formulations, including powder, solvent-based, and water-based systems, drives the growth of the segment.

The printing inks segment is expected to experience significant growth during the forecast period, due to increasing use in packaging, labels, and decorative prints. Pearlescent pigments add shine, depth, and special effects to printed materials, making them ideal for branding and premium product packaging. Demand for high-impact visual effects is rising as companies aim to differentiate their packaging and capture consumer attention on retail shelves. Additionally, the growth of digital and textile printing is expanding the use of pearlescent pigments in inks. Their compatibility with flexographic, gravure, and screen-printing methods supports versatile applications, thereby driving the segment growth.

Regional Analysis

Asia Pacific Pearlescent Pigment Market Trends

The pearlescent pigment market in Asia Pacific dominated with the largest share in 2024, driven by rapid industrialization, rising disposable income, and growing demand in cosmetics, automotive, and packaging sectors. Countries such as India, Japan, and South Korea are experiencing increasing use of decorative and functional coatings where pearlescent pigments are highly valued. The region benefits from low manufacturing costs, strong export capabilities, and high domestic consumption. Expanding beauty and personal care markets, along with a booming automotive sector, further fuel demand. Local manufacturers are innovating eco-friendly pigment solutions to meet global quality standards and sustainability expectations, thereby driving the growth.

China Pearlescent Pigment Market Insights

The pearlescent pigment market in China is expected to witness significant growth in the coming years, as the country’s strong manufacturing base, particularly in plastics, paints, and cosmetics, drives consistent demand. Domestic pigment companies are expanding their capacity and investing in R&D to offer a wider range of color effects and cleaner production processes. Additionally, China’s growing middle class is fueling the cosmetics and personal care segment, where pearlescent pigments are widely used. Government support for clean technologies and sustainable manufacturing is encouraging the shift toward eco-friendly pigments, thereby driving the industry growth in the country.

North America Pearlescent Pigment Market Analysis

The pearlescent pigment market in North America is projected to witness substantial growth driven by demand for premium finishes in automotive, consumer goods, and packaging. Technological advancements, high regulatory standards, and a strong focus on sustainability encourage the use of nontoxic and high-performance pigment formulations. The presence of major players, advanced production facilities, and widespread adoption of high-end coatings fuels growth. The increased use of pearlescent pigments in digital printing and 3D applications contributes to expansion. North American industries are exploring new uses for these specialty pigments as consumer preference shifts toward customized and visually appealing products, thereby driving the growth.

U.S. Pearlescent Pigment Market Overview

The market in the U.S. is expected to experience significant growth due to the well-established automotive and personal care industry, both of which heavily use pearlescent pigments for their aesthetic value. The country's strong innovation ecosystem supports the development of advanced pigment technologies, such as ultra-fine particle pigments for high-resolution printing and durable coatings. Sustainability is a key focus, with increased interest in bio-based and nontoxic alternatives. The rise of e-commerce and visually-driven consumer marketing is boosting demand for eye-catching packaging and decorative finishes, thereby driving the growth.

Europe Pearlescent Pigment Market Insights

The pearlescent pigment market in Europe is expected to experience significant growth during the forecast period, driven by its advanced manufacturing base, strict environmental regulations, and strong demand for sustainable, high-quality finishes. Industries such as automotive, cosmetics, and packaging widely adopt these pigments to meet consumer expectations for visual appeal and eco-consciousness. European consumers favor products with clean-label ingredients, pushing demand for nontoxic, natural-based pigments. The region’s focus on green innovation has further encouraged the use of bio-based and recyclable pigments. Countries such as France, Italy, and the Netherlands contribute through the luxury goods and fashion sectors, where pearlescent pigments add value through shine, texture, and premium branding, thereby driving the growth.

Germany Pearlescent Pigment Market Analysis

The pearlescent pigment market in Germany is expected to experience significant growth in the future, driven by its large automotive manufacturing, industrial coatings, and precision engineering. German automakers use pearlescent finishes to create high-end, differentiated vehicle designs. The country’s emphasis on research and technology has resulted in advanced pigment formulations with better durability, weather resistance, and color consistency. Additionally, Germany’s strong environmental policies are encouraging the shift toward sustainable pigment solutions. The presence of major pigment producers and chemical companies further strengthens the industry.

Key Players and Competitive Analysis

The industry is moderately fragmented, with a mix of global leaders and regional specialists driving innovation and competition. Sun Chemical Performance Pigments stands out as a key global player, leveraging strong R&D and diverse application coverage. Lansco Colors and Brenntag Specialties Inc., through strategic distribution and partnerships, maintain a strong foothold in North America and Europe. Asian manufacturers such as Fujian Kuncai Fine Chemicals, Nanyang Lingbao, and Pritty Pearlescent Pigments dominate in volume production, benefiting from cost-efficient manufacturing and expanding international reach. Kolortek and RIKA Technology cater to niche cosmetics and automotive segments, emphasizing color variety and custom formulations. Meanwhile, Geotech International and Smarol Technology focus on high-purity and eco-friendly options, aligning with sustainability trends. The market is characterized by product differentiation, technical innovation, and strategic alliances as companies seek to meet evolving demands across the automotive, cosmetics, plastics, and coatings industries.

Key Players

- Fujian Kuncai Fine Chemicals Co., Ltd.

- Geotech International B.V.

- Huaian Concord Cosmetics Product Co., Ltd. (Kolortek)

- L’Arca Srl (Arca Colours)

- Lansco Colors

- Nanyang Lingbao Pearl Pigment Co. Ltd.

- Oxen Chemicals

- Pritty Pearlescent Pigments and Brenntag Specialties Inc.

- RIKA Technology Co. Ltd.

- Smarol Technology

- Sun Chemical Performance Pigments

Pearlescent Pigment Industry Developments

In June 2025, Oxen Chemicals launched “HOT NEW Effect 15-4,” a high-gloss, nontoxic pearlescent pigment with superior weather, heat, and chemical resistance—ideal for water, solvent, and powder-based coatings.

In October 2024, Sun Chemical launched its Xennia Pearl pigment inks during Innovate 2021, targeting sustainable digital textile printing. The inks delivered high fastness, multi-substrate compatibility, and reduced water usage, reinforcing Sun Chemical’s commitment to eco-friendly fashion and home décor solutions.

Pearlescent Pigment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Natural Pearl Essence

- Titanium Dioxide Mica

- Iron/Ferric Oxide Mica

- Combination Mica

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Paints & Coatings

- Plastics

- Printing Inks

- Cosmetics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Pearlescent Pigment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.44 Billion |

|

Market Size in 2025 |

USD 2.60 Billion |

|

Revenue Forecast by 2034 |

USD 4.64 Billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.44 billion in 2024 and is projected to grow to USD 4.64 billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Fujian Kuncai Fine Chemicals Co., Ltd.; Geotech International B.V.; Huaian Concord Cosmetics Product Co., Ltd. (Kolortek); L’Arca Srl (Arca Colours); Lansco Colors; Nanyang Lingbao Pearl Pigment Co. Ltd.; Pritty Pearlescent Pigments and Brenntag Specialties Inc.; RIKA Technology Co. Ltd.; Oxen Chemicals; Smarol Technology; and Sun Chemical Performance Pigments

The titanium dioxide mica segment dominated the market share in 2024.

The printing ink segment is expected to witness the significant growth during the forecast period.