PFAS-free Food Packaging Market Size, Share, Trends, Industry Analysis Report

: By Material, (Paper & Paperboard, Plastics, Glass, and Other Materials), Application, and Region– Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5631

- Base Year: 2024

- Historical Data: 2020-2023

PFAS-free Food Packaging Market Overview

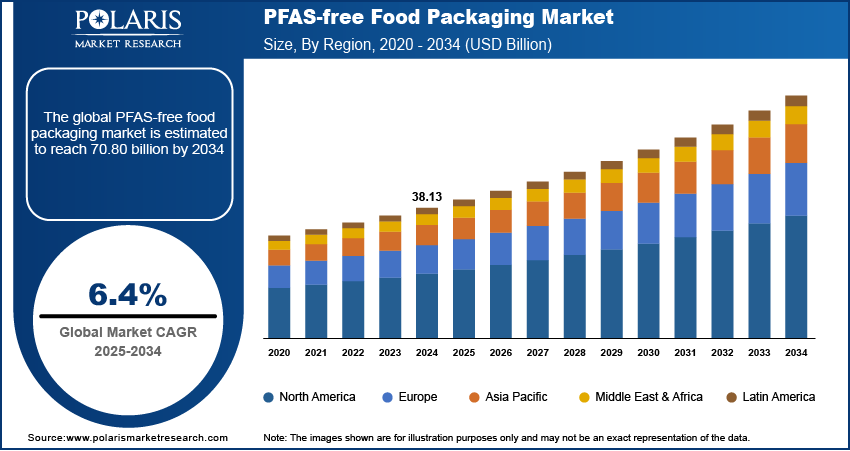

PFAS-free food packaging market size was valued at USD 38.13 billion in 2024, exhibiting a CAGR of 6.4% during the forecast period. Rising regulatory bans on PFAS, consumer demand for safer packaging, and innovations in bio-based materials are driving growth.

Key Insights

- Plastics led the market in 2024 due to strong barrier properties, thermal resistance, and growing demand in frozen and ready meals.

- Restaurants and fast-food outlets will grow fastest, driven by bans, ESG goals, and demand for compostable, grease-resistant, heat-safe packaging.

- Urbanization and takeout growth are increasing the use of PFAS-free single-use formats in quick-service and fast-casual restaurant settings.

- North America led the market due to early regulation, strong ESG focus, and fast adoption of safe, sustainable food packaging solutions.

- Asia Pacific will grow fastest as regulations tighten and urban consumers demand safer packaging across growing food delivery ecosystems.

Industry Dynamics

- Rising global bans on PFAS in food packaging are pushing manufacturers to adopt safer and compliant alternatives across all sectors.

- Increasing consumer awareness about PFAS toxicity is encouraging demand for non-toxic, sustainable packaging in the food and beverage industries.

- Expanding adoption of compostable, fiber-based, and plant-derived coatings creates new scope for innovation in high-performance sustainable packaging.

- Limited availability and high cost of advanced PFAS-free materials can hinder widespread adoption, especially for small-scale manufacturers.

Market Statistics

2024 Market Size: USD 38.13 billion

2034 Projected Market Size: USD 70.80 billion

CAGR (2025–2034): 6.4%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The PFAS-free food packaging market comprises packaging solutions that do not contain per- and polyfluoroalkyl substances (PFAS), which are synthetic chemicals commonly used for their grease- and water-resistant properties. Due to rising health and environmental concerns, the market is witnessing a shift toward sustainable, non-toxic alternative for food contact materials across industries such as foodservice, retail, and ready meal packaging. Increasing global bans and restrictions on PFAS usage in food packaging films are significantly contributing to the market growth.

Heightened public concern over PFAS toxicity and its links to health risks is driving market demand. Additionally, the need for non-toxic, safe packaging in direct food contact is reshaping market dynamics.

Market Dynamics

Growing Sustainability Initiatives

Growing environmental concerns and increased regulatory scrutiny surrounding single-use plastics and toxic substances are contributing to market growth. For instance, in September 2023, the Department of the Interior has officially confirmed that all bureaus and offices have completed their sustainable procurement strategies aimed at phasing out the use of single-use plastics on public lands over the next ten years. This initiative is part of a broader effort to enhance environmental stewardship and sustainability practices across federal operations. Companies across the food and beverage value chain are prioritizing sustainable alternatives that align with global climate and waste reduction goals. PFAS-free packaging, often made from renewable or recyclable resources, meets these expectations while offering a safer option for consumers.

Technological Advancements in Bio-Based Packaging Materials

Technological advancements in bio-based packaging materials and green packaging are significantly enhancing market growth. Next-generation solutions, including compostable films, molded fiber trays, and plant-based coatings, are increasingly replacing PFAS-treated options without compromising barrier performance. Material scientists and packaging innovators are developing alternatives that meet both functionality and sustainability criteria, supporting long-term market growth. For instance, in February 2025, American Packaging Corporation enhances sustainable packaging solutions with renewable and bio-based materials. The integration of nanotechnology and bio-based polymers is also enabling higher durability and moisture resistance, which are critical in food contact applications.

Segment Insights

By Material Outlook

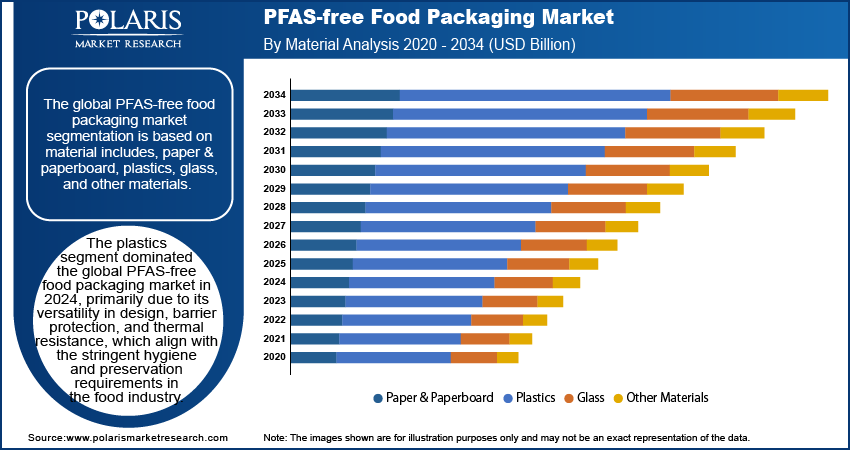

The global market segmentation is based on material includes, paper & paperboard, plastics, glass, and other materials. The plastics segment dominated the market in 2024, primarily due to its versatility in design, barrier protection, and thermal resistance, which align with the stringent hygiene and preservation requirements in the food industry. Manufacturers are investing in the development of PFAS-free plastic formulations that maintain performance while addressing environmental and health concerns, contributing to the growth. Demand from frozen foods, ready-to-eat meals, and high-moisture products has reinforced the segment’s prominence, as these applications require robust sealing and containment properties. Innovations in bio-based and recyclable plastics further support the segment’s continued market expansion.

The paper & paperboard segment is projected to record the fastest CAGR during the forecast period due to rising consumer preference for sustainable, compostable alternatives to fluorinated packaging. Government bans on PFAS and growing retail commitments to plastic reduction are accelerating the adoption of PFAS-free coatings in paper-based formats. Enhanced performance attributes such as grease resistance and durability without compromising biodegradability are attracting foodservice operators and CPG brands seeking regulatory compliance and improved brand perception. Strategic R&D initiatives and investments in aqueous coating technologies are strengthening the segment’s rapid advancement in the market.

By Application Outlook

The global PFAS-free food packaging market segmentation is based on application includes, packaged food & beverages, retail & convenience stores, and restaurants & fast food outlets. The packaged food & beverages segment accounted for the largest share in 2024, driven by increasing regulatory scrutiny and growing consumer awareness of toxic chemical exposure from traditional food contact materials. Major food manufacturers are transitioning to PFAS-free solutions to meet labeling transparency standards, retailer requirements, and eco-conscious buyer expectations. The surge in demand for on-the-go meals, convenience snacks, and frozen products necessitates scalable, safe, and compliant packaging options. PFAS-free solutions also enable brand differentiation in a competitive retail environment, contributing to widespread industry adoption and sustained segment leadership.

The restaurants & fast-food outlets segment is expected to register the fastest CAGR over the forecast period, driven by mounting regulatory pressures to eliminate PFAS-laden food packaging and heightened consumer demand for sustainability in dining experiences. Quick service and fast-casual operators are shifting toward fiber-based and PFAS-free coated alternatives to align with ESG goals and avoid reputational risk. Packaging innovation focused on oil resistance, compostability, and heat insulation is facilitating this transition. Moreover, increasing urbanization and rising takeaway consumption are expanding the volume of single-use packaging, prompting brands to seek compliant, safe, and scalable solutions, thereby accelerating market penetration.

Regional Analysis

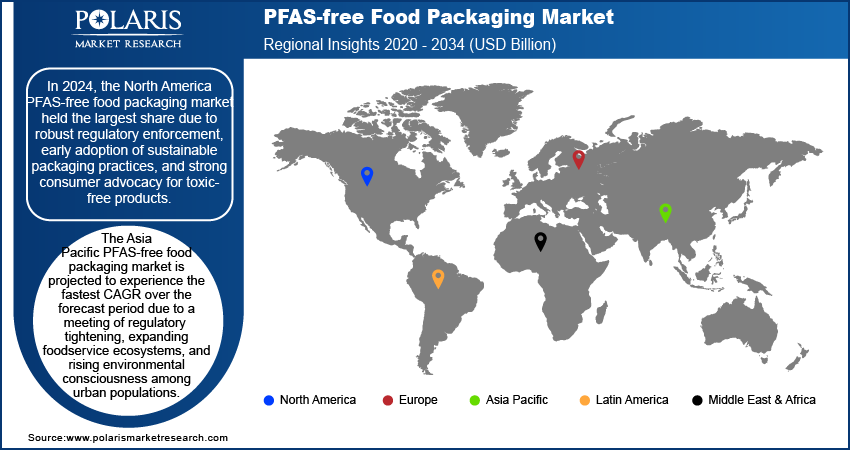

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America held the largest share due to robust regulatory enforcement, early adoption of sustainable packaging practices, and strong consumer advocacy for toxic-free products. For instance, in June 2024, the US Department of Agriculture, the US Food and Drug Administration, the US Environmental Protection Agency, and the White House announced the National Strategy for Reducing Food Loss and Waste and Recycling Organics. This initiative is part of President Biden’s comprehensive approach to address climate change, feed the population, promote environmental justice, and support a circular economy. Moreover, legislative actions, particularly in the US, banning the use of PFAS in food contact materials have compelled major food manufacturers and retailers to shift toward compliant alternatives. The region’s mature packaging infrastructure, combined with a high level of investment in material science, has accelerated the commercialization of advanced PFAS-free coatings and laminates. Consumer demand for clean-label packaging and corporate ESG initiatives further reinforced the dominance of North America.

The Asia Pacific is projected to experience the fastest CAGR over the forecast period due to a meeting of regulatory tightening, expanding foodservice ecosystems, and rising environmental consciousness among urban populations. Emerging economies like India and China are witnessing increased scrutiny around food safety standards, prompting governments and businesses to phase out fluorinated compounds. Growing middle-class consumer bases, coupled with the rapid rise of delivery-based food services, are driving demand for sustainable packaging. Accelerated investment in biodegradable and PFAS-free materials from local and international suppliers is reshaping the competitive landscape, propelling growth at an unprecedented pace in the region.

PFAS-free Food Packaging Key Market Players & Competitive Analysis Report

The competitive landscape is defined by an intensified focus on sustainability-driven innovation, strategic diversification, and regulatory compliance. Industry analysis indicates that leading players are adopting aggressive market expansion strategies, leveraging technology advancements in barrier coatings, fiber-based materials, and compostable polymers to address performance challenges previously met by PFAS-containing solutions. Joint ventures and strategic alliances between packaging manufacturers, material science firms, and foodservice chains are accelerating the commercialization of next-generation PFAS-free solutions. Mergers and acquisitions are playing a critical role in enabling companies to access proprietary technologies and broaden geographic reach. Launches of novel fiber-based and water-resistant coatings are increasingly aligned with global ESG commitments, reflecting a shift toward safer consumer touchpoints. Post-merger integration efforts are focused on aligning R&D pipelines and ensuring rapid scalability of PFAS-free innovations. The competitive dynamics are also shaped by evolving regulatory standards that continue to raise the barrier for market entry, rewarding companies with strong compliance frameworks and adaptable manufacturing ecosystems. Strategic investment in recyclable, compostable, and biodegradable formats is transforming the landscape, creating differentiation through both functionality and environmental performance.

Stora Enso is engaged in providing renewable solutions in packaging, biomaterials, wooden constructions, and paper. Specializing in fiber-based materials, the company develops innovative products to replace fossil-based materials. The company was founded in 1998 and is headquartered in Helsinki, Finland. Stora Ensos product portfolio includes paperboard for packaging, pulp for various applications, and wooden construction materials. The company offers services such as customized packaging solutions for industries like food and beverages, pharmaceuticals, and retail. Stora Enso operates globally with a presence in Europe, Asia-Pacific, and North America.

Solenis is engaged in manufacturing specialty chemicals used in water-intensive industries. Specializing in water treatment and process chemicals, the company focuses on improving operational efficiency and sustainability. Solenis was founded in 2014, and is headquartered in Delaware, US. The companys product portfolio includes process aids, functional additives, and water treatment chemicals tailored for industries like pulp and paper, oil and gas, and mining. Solenis provides services such as technical support and chemical management programs to optimize industrial processes. The company has a strong presence across North America, Europe, Asia-Pacific, and Latin America.

Key Companies in the PFAS-free Food Packaging Market

- Ahlstrom

- APP Group

- CARCCU

- CarePac

- delfortgroup AG

- Detpak

- Farnell Packaging

- Fox Packaging

- Genpak

- Guyenne Papier

- Kroonpak

- Solenis

- Stora Enso

- YUTOECO

PFAS-free Food Packaging Market Developments

In March 2025, YUTOECO launched FluoZero, a PFAS-free greaseproof technology for molded fiber food packaging, providing a sustainable alternative to traditional materials.

In March 2025, Ahlstrom released LamiBak Flex, a PFAS-free base paper for flexible food packaging, enhancing barrier properties while meeting compostability standards.

In September 2024, CARCCU introduced PFAS-free greaseproof papers made from renewable materials, offering biodegradable solutions for high-fat food packaging in fast-food and bakery industries.

PFAS-free Food Packaging Market Segmentation

By Material Outlook (Revenue USD Billion 2020 - 2034)

- Paper & Paperboard

- Plastics

- Glass

- Other Materials

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Packaged Food & Beverages

- Retail & Convenience Stores

- Restaurants & Fast Food Outlets

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

PFAS-free Food Packaging Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 38.13 billion |

|

Market Size Value in 2025 |

USD 40.51 billion |

|

Revenue Forecast in 2034 |

USD 70.80 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global PFAS-free food packaging market size was valued at USD 38.13 billion in 2024 and is projected to grow to USD 70.80 billion by 2034.

The global market is projected to grow at a CAGR of 6.4% during the forecast period.

In 2024, the North America held the largest share due to robust regulatory enforcement, early adoption of sustainable packaging practices, and strong consumer advocacy for toxic-free products.

Some of the key players in the market are Ahlstrom, APP Group, CARCCU, CarePac, delfortgroup AG, Detpak, Farnell Packaging, Fox Packaging, Genpak, Guyenne Papier, Kroonpak, Solenis, Stora Enso, YUTOECO.

In 2024, the plastics segment accounted for the largest market share due to its versatility in design, barrier protection, and thermal resistance, which align with the stringent hygiene and preservation requirements in the food industry.

In 2024, the packaged food & beverages segment accounted for the largest share, driven by increasing regulatory scrutiny and growing consumer awareness of toxic chemical exposure from traditional food contact materials