Potassium Sorbate Market Size, Share, Trends, Industry Analysis Report

By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial, Others), By Form, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5912

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

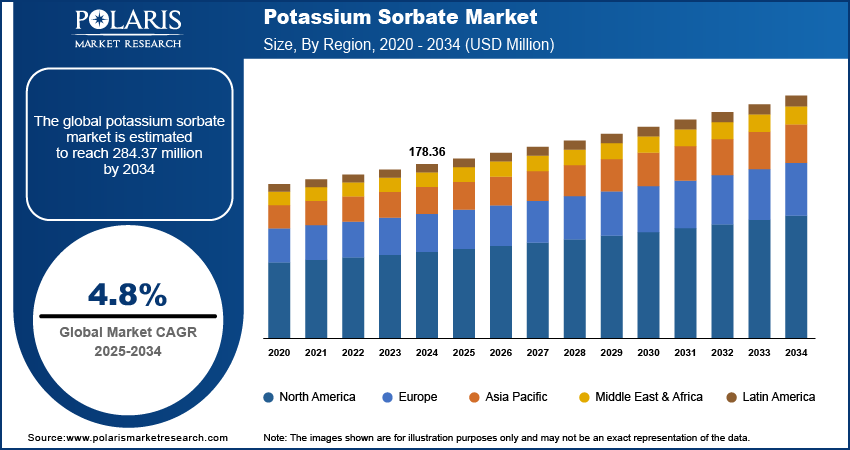

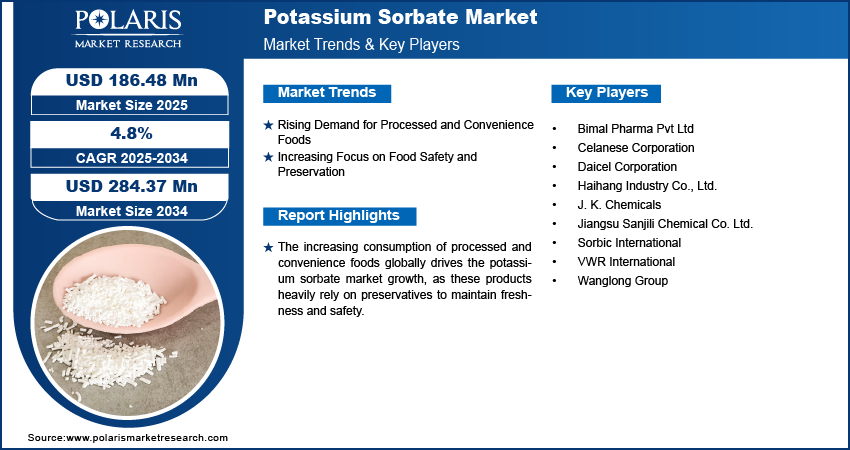

The global potassium sorbate market size was valued at USD 178.36 million in 2024 and is anticipated to register a CAGR of 4.8% from 2025 to 2034. The increasing demand for processed and convenience foods drives the market growth, as potassium sorbate helps extend their shelf life. Another key factor is the growing awareness of food safety and preservation among consumers and food manufacturers.

The potassium sorbate market involves the production and sale of potassium sorbate, a chemical additive primarily used as a food preservative. This white, odorless, and water-soluble salt works by stopping the growth of mold, yeast, and certain bacteria, thereby extending the shelf life of various products.

The rapid growth of e-commerce and online grocery shopping is significantly driving the demand for potassium sorbate. As more consumers prefer to purchase food and beverages online, there is an increased need for products with extended shelf lives to withstand longer supply chains and varied storage conditions. Potassium sorbate ensures that products remain fresh and safe during transit and until they reach the consumer's pantry.

A growing consumer preference for “clean label” products, which contain fewer artificial ingredients and a focus on natural or naturally derived components, is driving the requirement for potassium sorbate. While synthetically produced, potassium sorbate is derived from sorbic acid, which is naturally found in some fruits. This allows it to be perceived more favorably by consumers seeking ingredients they understand or consider less artificial compared to some other synthetic preservatives.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Rising Demand for Processed and Convenience Foods

Modern lifestyles, characterized by busy schedules and a desire for easy meal solutions, have led to a greater reliance on packaged and ready-to-eat food items. Potassium sorbate plays a crucial role in these products by preventing spoilage from mold, yeast, and bacteria, thereby extending their shelf life. The United Nations projects that 68% of the world's population will live in urban areas by 2050, up from 55% today. This increasing urbanization is a key factor driving demand for convenient, ready-to-eat foods that often contain preservatives. The inherent need to preserve these products for longer periods, from manufacturing to consumption, directly drives the demand for effective preservatives such as potassium sorbate. This growing preference for convenience and processed foods, which require longer shelf lives, greatly drives the demand for potassium sorbate.

Increasing Focus on Food Safety and Preservation

A heightened global awareness of food safety and the critical need for effective preservation solutions are strongly contributing to the growth of the potassium sorbate market. Consumers and regulatory bodies alike are placing a greater emphasis on ensuring that food products are safe for consumption and maintain their quality throughout their shelf life. Potassium sorbate is widely recognized and approved by various health organizations as a safe and efficient preservative.

The World Health Organization (WHO) reports that unsafe food causes more than 200 diseases, ranging from diarrhea to cancer. In 2015, the WHO estimated over 600 million cases of foodborne illnesses annually. This highlights the critical need for effective food preservation to prevent such illnesses. Manufacturers, aiming to meet stringent food safety standards and consumer expectations for fresh and safe products, increasingly incorporate potassium sorbate into their formulations. This strong emphasis on food safety and the approved status of potassium sorbate actively drives its adoption across the food & beverage industry.

Segmental Insights

Application Analysis

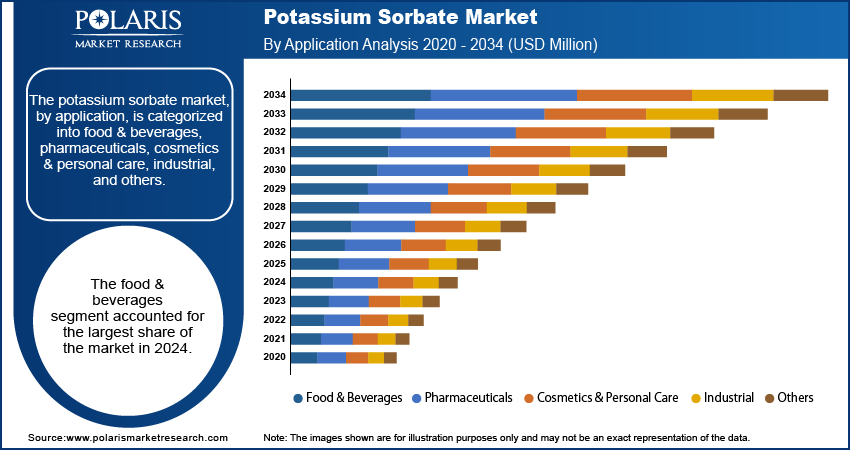

The food and beverages segment held the largest share in 2024. This dominance is attributed to the widespread use of potassium sorbate as a preservative across a broad range of food products, including baked goods, dairy products, processed fruits and vegetables, and various beverages. Its ability to effectively inhibit mold, yeast, and bacterial growth makes it an essential ingredient for extending shelf life and ensuring product safety in the ever-growing processed food industry. The high global consumption of packaged foods continues to drive its strong presence in this application area.

The cosmetics and personal care segment is anticipated to register the highest growth rate during the forecast period. As consumers increasingly seek personal care products with longer shelf lives and improved safety, manufacturers are turning to effective preservatives such as potassium sorbate. It is used in various cosmetic formulations, such as creams, lotions, shampoos, and makeup, to prevent microbial contamination and maintain product integrity over time. The rising demand for safe and stable personal care items, coupled with the innovation in new product development, is fueling significant expansion in this segment.

Form Analysis

The powder segment held the largest share in 2024 due to its widespread applicability and ease of handling. Powdered potassium sorbate offers advantages such as longer shelf life, cost-effectiveness for bulk applications, and high solubility in water, making it ideal for integration into various food and beverage products. In baking, powdered potassium sorbate can be easily incorporated into dough and batter to prevent mold growth, a common issue for baked goods that require a stable preservative. This versatility and convenience contribute significantly to its dominance across industries, particularly in the vast food preservation sector.

The granular segment is anticipated to register the highest growth rate during the forecast period, primarily driven by its advantages in specific industrial applications where uniform particle distribution and reduced dust formation are crucial. Granular potassium sorbate offers benefits such as faster dissolution and better flow properties, making it well-suited for automated dosing systems in large-scale production. In the beverage industry, granular forms can be precisely measured and quickly dissolved in large tanks, ensuring consistent preservation across batches of juices or soft drinks. This increasing adoption in specialized industrial processes is driving its accelerated growth.

Regional Analysis

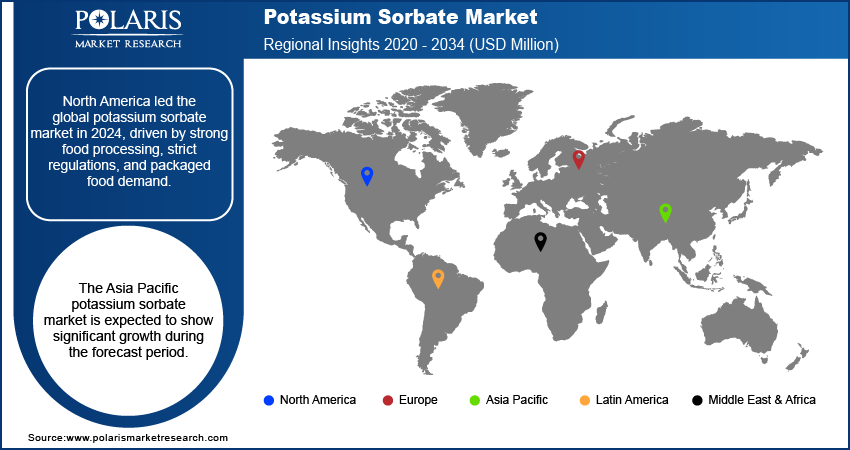

The North America potassium sorbate market accounted for the largest share in 2024. The growth is mainly attributed to the region's well-developed food processing industry and the high demand for packaged and convenience foods among consumers. The imposition of strict food safety regulations also plays a key role, encouraging manufacturers to use effective and approved preservatives such as potassium sorbate to ensure product quality and shelf stability. The emphasis on advanced manufacturing and innovation in food preservation further supports the market share.

U.S. Potassium Sorbate Market Insight

The U.S. is a major contributor to the potassium sorbate market in North America. The country's strong regulatory framework, including the FDA's GRAS status for potassium sorbate, instills confidence in its use. The rising consumer demand for processed and convenience food items, coupled with the trend toward "clean label" products that still require effective preservation, continues to drive the adoption of potassium sorbate. The extensive use in dairy products, baked goods, and beverages contributes significantly to its demand.

Europe Potassium Sorbate Market Trends

Europe is another key region in the market, driven by its robust food & beverage industry and increasing consumer awareness regarding food safety. The region's diverse culinary landscape, with a strong tradition of cured meats, cheeses, and baked goods, leads to a consistent demand for effective preservatives. Additionally, the growing popularity of convenience foods and the focus on reducing food waste across European nations contribute to the sustained use of potassium sorbate in this region.

Germany Potassium Sorbate Market Assessment

Germany is a significant market in Europe. There is a strong demand for potassium sorbate across the country, influenced by its highly developed food industry and stringent food safety standards. German consumers increasingly prefer food products with extended shelf lives, including a variety of processed meats, dairy items, and bakery products. The country's focus on quality control and adherence to European Union food additive regulations means that potassium sorbate is a favored ingredient for ensuring product integrity and safety in a wide array of consumer goods.

Asia Pacific Potassium Sorbate Market Overview

The Asia Pacific potassium sorbate market is expanding rapidly, fueled by the region's large and growing population, rapid urbanization, and rising disposable incomes, which collectively lead to increased consumption of processed and packaged foods. As modern retail formats expand and lifestyles change, the demand for longer-lasting food products, coupled with an increasing focus on food safety, drives the need for preservatives such as potassium sorbate across various food and beverage applications. The China potassium sorbate market stands out as a major market in Asia Pacific. As a leading producer and consumer of processed foods, China's vast population and evolving dietary habits create substantial demand for preservatives. The country's burgeoning food processing industry, coupled with improving food safety standards and an expanding export market for food products, significantly drives the adoption of potassium sorbate to ensure product stability and compliance with international trade requirements.

Key Players and Competitive Insights

The competitive landscape of the potassium sorbate market is marked by the presence of several key players vying for market share through product innovation, strategic partnerships, and expanding production capabilities. These companies focus on providing high-quality potassium sorbate in various forms to cater to the diverse needs of the food & beverage, pharmaceutical, and cosmetics industries.

A few prominent companies in the industry include Celanese Corporation; Wanglong Group; Daicel Corporation; Sorbic International; Jiangsu Sanjili Chemical Co. Ltd.; J. K. Chemicals; Wego Chemical Group; VWR International; Haihang Industry Co., Ltd.; and Bimal Pharma Pvt Ltd.

Key Players

- Bimal Pharma Pvt Ltd

- Celanese Corporation

- Daicel Corporation

- Haihang Industry Co., Ltd.

- J. K. Chemicals

- Jiangsu Sanjili Chemical Co. Ltd.

- Sorbic International

- VWR International

- Wanglong Group

Industry Developments

March 2024: Ningbo Wanglong Technology Co., Ltd. received kosher certification for its potassium sorbate product. This certification broadens the market reach for Wanglong Group's potassium sorbate, allowing it to be used in kosher-certified food products. It caters to a specific segment of the food industry and consumers.

June 2023: Celanese Corporation and Mitsui & Co. finalized their agreement to form a food ingredients joint venture called Nutrinova. This collaboration brings together Celanese's technology and product portfolio, including sorbic acid and potassium sorbate, with Mitsui's positions across the food value chain, especially in Asia.

Potassium Sorbate Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial

- Others

By Form Outlook (Revenue – USD Million, 2020–2034)

- Powder

- Granular

- Liquid

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Potassium Sorbate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 178.36 million |

|

Market Size in 2025 |

USD 186.48 million |

|

Revenue Forecast by 2034 |

USD 284.37 million |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 178.36 million in 2024 and is projected to grow to USD 284.37 million by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Celanese Corporation; Wanglong Group; Daicel Corporation; Sorbic International; Jiangsu Sanjili Chemical Co. Ltd.; J. K. Chemicals; Wego Chemical Group; VWR International; Haihang Industry Co., Ltd.; and Bimal Pharma Pvt Ltd.

The food & beverages segment accounted for the largest share of the market in 2024.

The granular segment is expected to witness the fastest growth during the forecast period.