Property Management Software Market Share, Size, Trends, Industry Analysis Report

By Deployment Type (On-Premises, Cloud); By Solution; By Application; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3879

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

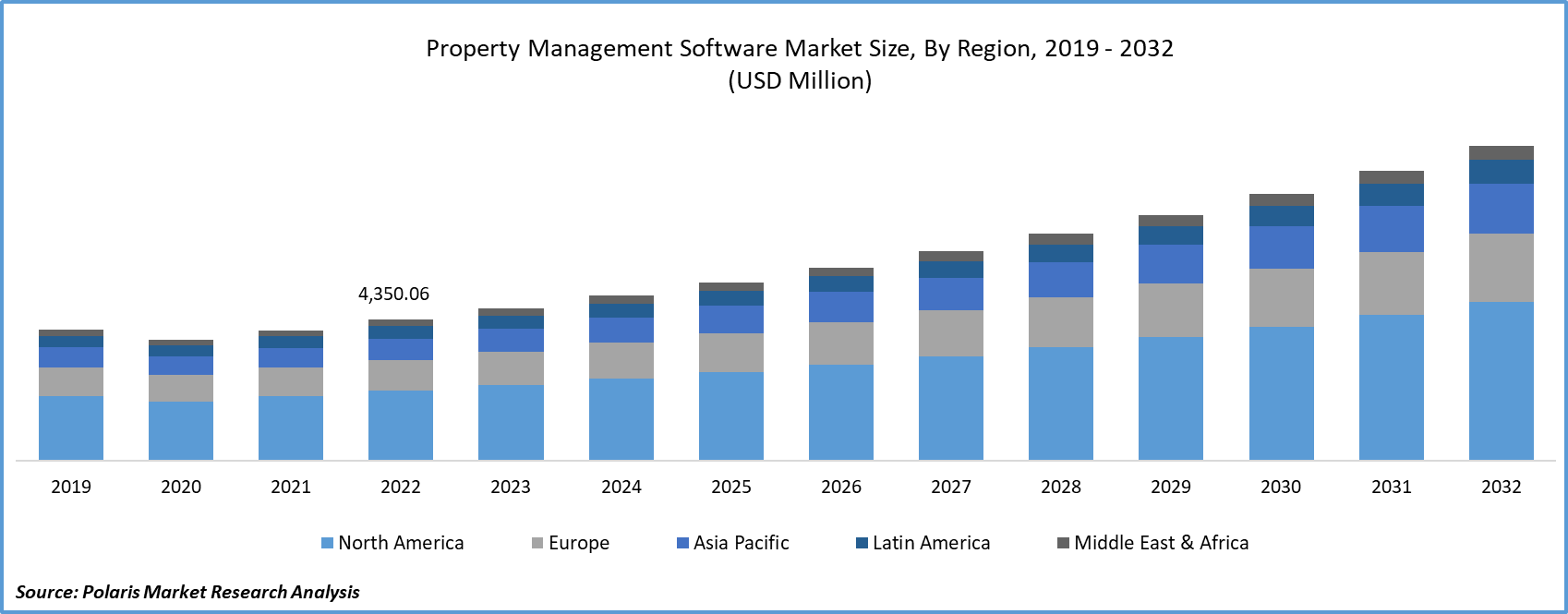

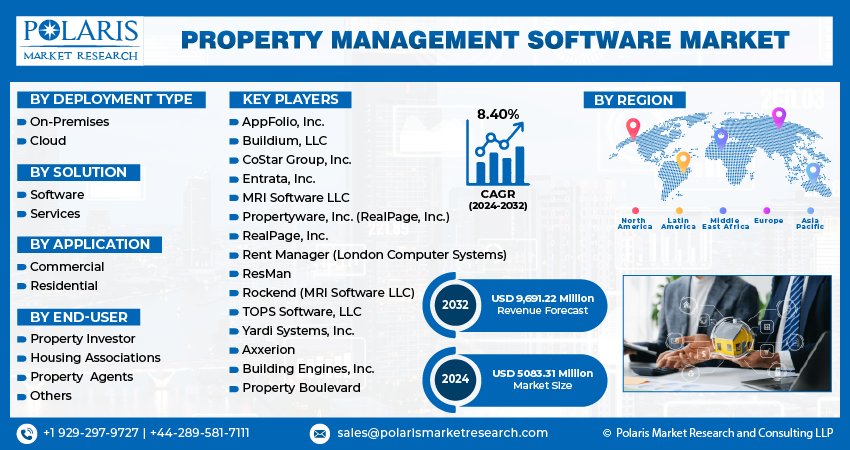

The global property management software market was valued at USD 4701.11 million in 2023 and is expected to grow at a CAGR of 8.40% during the forecast period.

The property management software market is on a trajectory of sustained growth, fueled by the imperative for efficiency, compliance, and elevated tenant experiences. However, overcoming challenges such as integration complexities and ensuring data security will be critical for the sustained success of these software solutions. Property managers must carefully evaluate their requirements and choose software that aligns with their specific needs and long-term objectives.

The research report offers a quantitative and qualitative analysis of the Property Management Software Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Property management software is an app-dependent software instrument that assists property managers in computerizing back office, administrative, and financial procedures. These solutions usually offer attributes such as maintenance tracing, electronic leases, online resident portals, document repositories, and online payment refining. It offers utility for a broad gamut of user types, from unconstrained landlords to property holders handling countless units.

One of the benefits of property management software is streamlining accounting, which assists the person in keeping contemporary with accounts so that when it comes to filing taxes, one has everything already organized. Another benefit associated with it is it automates communication. The property management software market demand is on the rise as it does this by maintaining record tariffs, logging remittances, digitizing receipts, and creating financial reports.

To Understand More About this Research: Request a Free Sample Report

The rise in global urbanization has resulted in an increased appetite for rental properties. Property managers are finding software solutions indispensable in efficiently managing a growing number of units and in delivering enhanced services to tenants.

Simultaneously, the real estate sector is experiencing a substantial digital shift. Technology-driven solutions are at the forefront of this transformation, and property management software is pivotal in providing streamlined, automated, and data-informed tools for effective property management.

- For instance, In July 2023, Entrata, Inc. announced its acquisition of Rent Dynamics, a prominent provider specializing in resident rent reporting and financial resources. This strategic move bolstered Entrata, Inc.'s portfolio and solidified its standing in the property management sector, affording them the ability to furnish residents with enhanced services pertaining to rent reporting and financial oversight.

However, high initial costs, data security, and privacy concerns hamper the market growth. Implementing property management software can involve significant upfront costs, including licensing fees, setup, and training. This can be a barrier for smaller property management firms or individual landlords.

Moreover, given the sensitive nature of property-related data, security and privacy concerns are paramount. Property managers need to ensure that the software they choose adheres to stringent data protection standards.

However, overcoming challenges such as integration complexities and ensuring data security will be critical for the sustained success of these software solutions. Property managers must carefully evaluate their requirements and choose software that aligns with their specific needs and long-term objectives.

Growth Drivers

- Integration with IoT and smart technologies is projected to spur the product demand.

The integration of the Internet of Things (IoT) and smart technologies in properties is becoming more prevalent. Property management software that can effectively manage these interconnected systems is in high demand. These technologies offer benefits like remote monitoring, predictive maintenance, and enhanced security.

Also, real estate investments are becoming increasingly globalized, with investors and property managers overseeing properties in multiple countries or regions. Property management software that can handle the complexities of managing properties across different jurisdictions, currencies, and legal frameworks is essential for global real estate portfolios.

Report Segmentation

The market is primarily segmented based on deployment type, solution, application end-user, and region.

|

By Deployment Type |

By Solution |

By Application |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Type Analysis

- Cloud segment accounted for the largest market share in 2022

In 2022, the cloud segment held the largest share, and this dominance is anticipated to persist throughout the forecast period. This can be attributed to the increasing adoption of cloud deployment across diverse end-users, including property managers, housing associations, and corporate occupiers, among others. The factors driving this shift towards cloud-based property management solutions encompass scalability, cost-effectiveness, user-friendliness, and a reduction in tenant disputes.

Additionally, cloud-based Property Management Software (PMS) provides a secure backup facility and seamless data integration, thus mitigating the risk of data loss. Moreover, it also spares property managers both indirect expenses related to monetary recovery and direct costs associated with automating labor-intensive processes.

However, during the projected period, the on-premises segment is anticipated to witness substantial growth. This can be attributed to its inherent advantages, including the ownership and control of hardware and the elevated level of data security it provides in comparison to cloud-based Property Management Software (PMS). Furthermore, on-premise PMS allows for tailoring to meet specific business or user needs. These advantages of on-premise deployment play a pivotal role in driving the anticipated growth of this segment over the forecast period.

By Solution Analysis

- Services is expected to witness highest growth during forecast period

The services segment is expected to witness the highest growth during the forecast period. This surge can be attributed to the growing demand for specialized expertise in handling intricate property-related responsibilities. Service providers offer customized solutions encompassing legal compliance, tenant relations, marketing, and strategic planning, catering to the diverse facets of property management. This segment not only imparts industry insights and a personalized approach but also elevates software platforms through training, customer support, and customization efforts, making a substantial contribution to its notable growth.

Also, the software segment is sub-categorized into reporting analytics, rental listings management, maintenance activities management, applicant management, and others.

As property management becomes more complex, the demand for robust software platforms is imperative. These platforms offer automation, advanced data analytics, and remote accessibility. The surge in adoption is also propelled by property managers' acknowledgment of the software's competitive edge, leading to increased investments in improving tenant experiences, occupancy rates, and resource allocation.

By Application Analysis

- Commercial segment held the significant market revenue share in 2022

The growing commercial sector stands as a significant catalyst for market demand. Factors such as the increasing focus on cyber risk management, escalating disposable income, and evolving consumption technologies are anticipated to stimulate investments in the commercial sector further, consequently propelling the growth of the Property Management Software (PMS) market. Additionally, within the commercial segment, there are distinct sub-categories, including retail spaces, office spaces, hotels, and others. In the hotel management industry, PMS has evolved into an indispensable tool.

By End-User Analysis

- Housing Associations is expected to witness highest growth during forecast period

In 2022, the housing associations segment is poised for substantial growth in the forecast period. This growth can be attributed to the various challenges faced by apartments and townships, including payment processing, lease management, and tenant tracking, among others. These challenges have prompted market players to offer solutions for inspections, transparent and comprehensive reporting, and efficient maintenance. Utilizing Property Management Software (PMS) for affordable housing ensures precise rent allocations based on the tenant's payment compared to government subsidies.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. North America is driven by a combination of technological advancement, regulatory compliance, market demands, and the need for efficiency and productivity in managing properties. These factors collectively contribute to the sustained growth of the market in the region.

The Asia-Pacific region is expected to be the fastest growing region during the projected period, owing to the rapid evolution of infrastructure, along with enhanced accessibility for gathering and managing property data, which is a key factor driving this trend in the region. Additionally, government regulations, a growing population, the adoption of cloud-based solutions, and the outsourcing of services all contribute significantly to the market's expansion in the area.

Key Market Players & Competitive Insights

The property management software market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AppFolio, Inc.

- Buildium, LLC

- CoStar Group, Inc.

- Entrata, Inc.

- MRI Software LLC

- Propertyware, Inc. (RealPage, Inc.)

- RealPage, Inc.

- Rent Manager (London Computer Systems)

- ResMan

- Rockend (MRI Software LLC)

- TOPS Software, LLC

- Yardi Systems, Inc.

- Axxerion

- Building Engines, Inc.

- Property Boulevard

Recent Developments

- In June 2023, Hostaway secured a substantial $175 million in funding aimed at bolstering its property management software tailored for short-term rentals. The funding will be allocated towards expediting expansion initiatives, refining services, and enhancing the platform's functionality. Hostaway's vacation rental software and management system streamline and automate property management processes, empowering customers to oversee more than 100,000 properties across 100 countries. PSG spearheaded the funding round, commending the Hostaway team for their remarkable vision and execution.

Property Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5083.31 million |

|

Revenue forecast in 2032 |

USD 9,691.22 million |

|

CAGR |

8.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Deployment Type, By Solution, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

Kidney Function Tests Market Size, Share 2024 Research Report

Brachytherapy Market Size, Share 2024 Research Report

Flow Cytometry Market Size, Share 2024 Research Report

Rhinoplasty Market Size, Share 2024 Research Report

Electrosurgical Devices Market Size, Share 2024 Research Report