Security Automation Market Size, Share, Trends, Industry Analysis Report

: By Offerings, Deployment Mode (Cloud and On-Premises), Application, Technology, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5583

- Base Year: 2024

- Historical Data: 2020-2023

Security Automation Market Overview

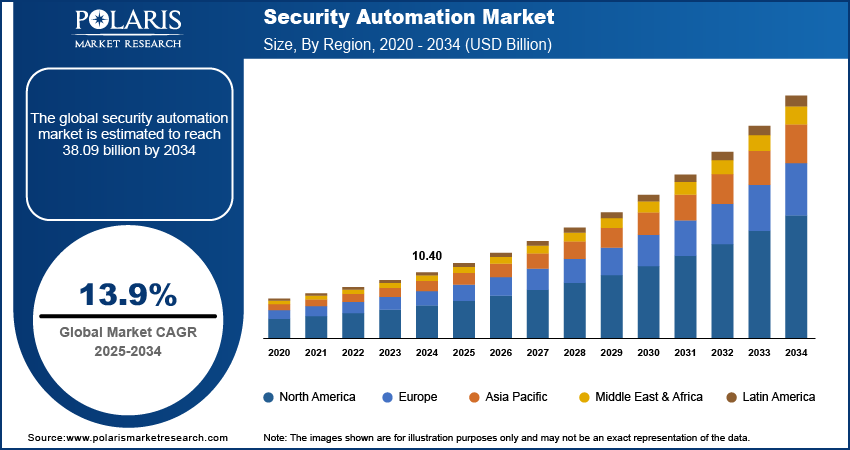

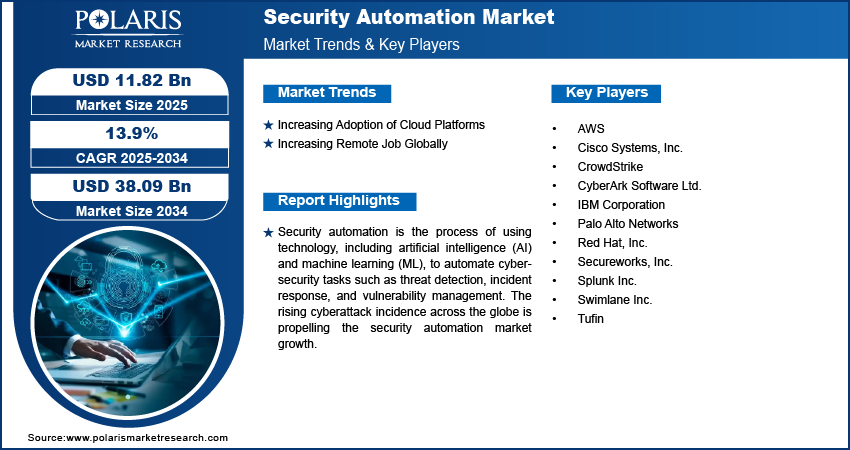

The global security automation market size was valued at USD 10.40 billion in 2024. The market is projected to grow from USD 11.82 billion in 2025 to USD 38.09 billion by 2034, exhibiting a CAGR of 13.9% during 2025–2034.

Security automation is the process of using technology, including artificial intelligence (AI) and machine learning (ML), to automate cybersecurity tasks such as threat detection, incident response, and vulnerability management. It eliminates the need for manual intervention in repetitive processes, enabling security teams to focus on strategic priorities. Security automation enhances efficiency, reduces human error, and accelerates responses to cyber threats by integrating tools and workflows. Security automation also scales effectively with organizational growth, allowing teams to manage expanding attack surfaces without proportional increases in resources. It further supports hybrid cloud computing and thousands of endpoints seamlessly.

The rising cyberattack incidence across the globe is propelling the security automation market growth. According to data published by the INTERNATIONAL MONETARY FUND in April 2024, cyberattacks have more than doubled since the COVID-19 pandemic. Increased cyberattacks drive organizations to adopt security automation tools. as these tools allow organizations to streamline and accelerate their response to cyber threats. The surge in the number of cyberattacks also increases the cost of inaction. Data breaches, ransomware, and system downtime cause massive financial and reputational damage. Organizations are recognizing this risk and turning to automation as a proactive defense strategy. They are investing heavily in automated security platforms to improve resilience, enhance visibility across systems, and maintain compliance with industry regulations. Thus, the demand for security automation solutions is increasing with the rising cyberattack incidence globally.

To Understand More About this Research: Request a Free Sample Report

The security automation market demand is driven by increasing digitalization. Digitalization led organizations to shift their operations to cloud environments, adopt remote work models, and integrate Internet of Things (IoT) devices, exposing more endpoints and data streams to potential threats. Cybercriminals target these digital ecosystems with greater precision. Organizations, in turn, are adopting automated security systems to monitor vast digital infrastructures in real-time, identify anomalies, and respond to cyber incidents faster than manual teams can manage. Hence, the demand for security automation solutions is increasing with the growing digitalization worldwide.

Security Automation Market Dynamics

Increasing Adoption of Cloud Platforms

Cloud infrastructures require continuous monitoring, rapid threat detection, and policy enforcement across decentralized systems. Security automation tools provide the visibility and responsiveness needed to manage these environments without compromising performance or agility. Cloud environments also operate on a shared responsibility model, where cloud service providers secure the infrastructure, but customers remain accountable for data protection, identity access management, and application-level security. This division of responsibility increases the need for robust internal controls, thereby fueling organizations to turn to security automation tools to handle identity verification, enforce access policies, and detect configuration errors that may expose sensitive information. Hence, the increasing adoption of cloud platforms propels the security automation market development.

Increasing Remote and Digital Jobs Globally

Increased remote and digital jobs create vulnerabilities that traditional security measures struggle to address effectively. To counter this, companies are deploying automated security solutions that continuously monitor user activity, detect threats, and enforce policies across remote endpoints without relying on manual oversight. Furthermore, remote and digital job setups often lead to collaboration across cloud applications and file-sharing platforms, increasing the likelihood of accidental data leaks and unethical IT practices. Security automation solutions address these challenges by scanning for policy violations, monitoring data transfers, and alerting security teams to anomalies. According to data published by the World Economic Forum, global digital jobs are estimated to grow by around 25% to over 90 million roles by 2030. Thus, the increasing number of remote and digital jobs globally is expected to boost the security automation market opportunities.

Security Automation Market Assessment by Segment

Security Automation Market Evaluation by Technology

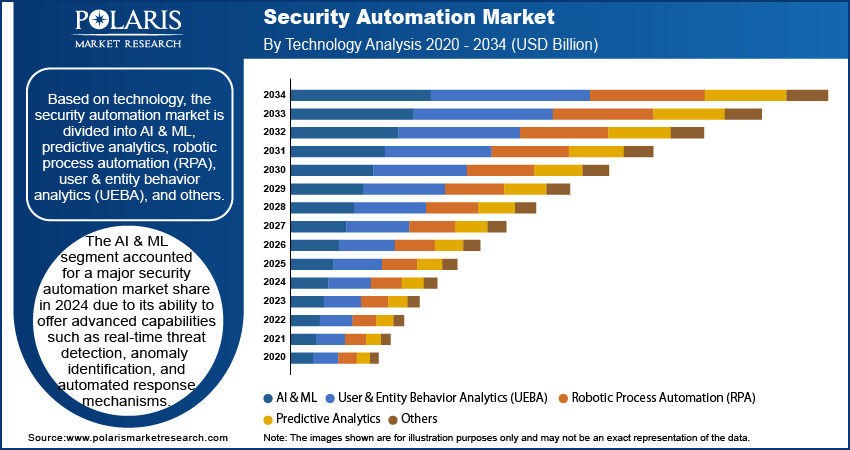

Based on technology, the security automation market is divided into AI & ML, predictive analytics, robotic process automation (RPA), user & entity behavior analytics (UEBA), and others. The AI & ML segment accounted for a major security automation market share in 2024 due to its ability to offer advanced capabilities such as real-time threat detection, anomaly identification, and automated response mechanisms. Organizations prioritized AI and ML as they enable faster decision-making and reduce reliance on manual intervention. The growing sophistication of cyberattacks further pushed companies to adopt AI and ML, which can continuously learn from evolving threats and adapt to new attack vectors.

The user & entity behavior analytics (UEBA) segment is expected to grow at a robust pace in the coming years. UEBA analyzes patterns of behavior from users, applications, and devices to detect insider threats, account takeovers, and other subtle anomalies that traditional tools often miss. The rise in hybrid work models, cloud adoption, and identity-based attacks has fueled demand for behavior-based security approaches. Organizations now prioritize context-aware security measures that go beyond rule-based systems. UEBA addresses this need by providing high-fidelity alerts that reduce false positives and support proactive threat hunting. The growing emphasis on zero-trust architecture and identity-centric security strategies also strengthens UEBA as companies seek greater visibility and control over user activities in complex IT environments.

Security Automation Market Outlook by Industry Vertical

In terms of industry vertical, the security automation market is segregated into BFSI, manufacturing, media & entertainment, healthcare & life sciences, energy & utilities, government & defense, retail & e-commerce, IT & ITES, and others. According to the security automation market statistics, the BFSI segment dominated the market share in 2024, owing to its critical need for real-time threat detection, stringent regulatory compliance mandates, and increasing volumes of sensitive customer data. Financial institutions prioritized robust cybersecurity frameworks to combat a rising tide of advanced persistent threats, phishing schemes, and insider fraud. They invested heavily in AI and ML-driven solutions to automate threat detection, accelerate incident response, and reduce false positives. These technologies enabled faster decision-making and proactive mitigation of cyber risks, aligning with the sector's emphasis on operational continuity and data integrity. The BFSI industry's aggressive adoption of digital banking and cloud services also pushed organizations to integrate automated scalable and adaptive security architectures, further contributing to their market dominance.

Security Automation Market Regional Analysis

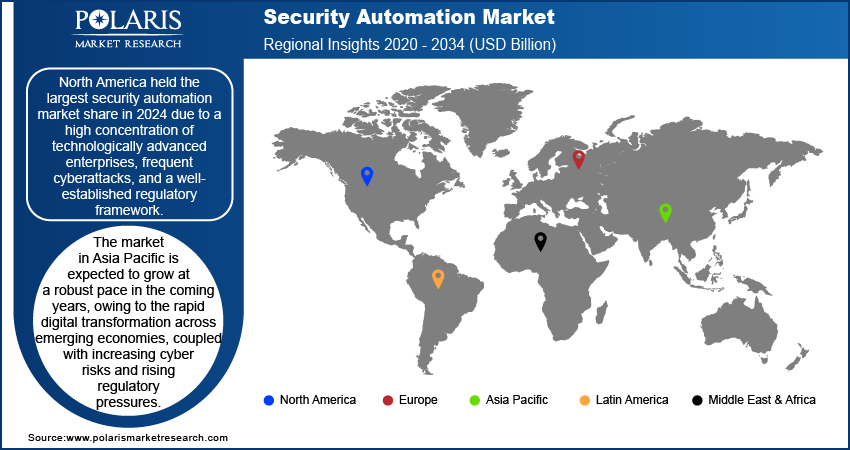

By region, the report provides security automation market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest security automation market share in 2024 due to a high concentration of technologically advanced enterprises, frequent cyberattacks, and a well-established regulatory framework. The US led the regional market, with organizations across industries investing heavily in AI and ML-powered solutions to detect, analyze, and respond to evolving threats with greater speed and precision. Government initiatives such as the Cybersecurity Maturity Model Certification (CMMC) and frameworks issued by the National Institute of Standards and Technology (NIST) pushed both public and private entities to adopt more proactive security postures, contributing to the security automation market expansion in the region. The region also benefited from a mature IT infrastructure and widespread cloud adoption, further fueling the demand for automated threat detection and response solutions. The presence of major cybersecurity vendors and the early adoption of advanced technologies propelled North America's leadership in the market.

The Asia Pacific security automation market is expected to grow at a robust pace in the coming years, owing to the rapid digital transformation across emerging economies, coupled with increasing cyber risks and rising regulatory pressures. Countries such as India, China, and Japan are witnessing high investment in advanced security automation technologies, including behavioral analytics, AI-driven incident response, and endpoint protection systems. India is emerging as a key country within the region due to its growing tech ecosystem, government-backed cybersecurity initiatives such as the National Cyber Security Strategy, and a surge in cyberattacks targeting financial and healthcare institutions. The increasing reliance on marketing cloud platforms, mobile applications, and remote work models in the region has highlighted the need for scalable, intelligent security automation solutions, positioning Asia Pacific as a strategic hub for market expansion.

Security Automation Market – Key Players & Competitive Analysis Report

The security automation market is highly competitive, driven by rapid technological advancements and increasing cyber threats. Key players are leveraging strategic mergers, acquisitions, partnerships, and collaborations to strengthen their market positions and expand their product portfolios. Mergers and acquisitions allow companies to integrate innovative technologies, enhance capabilities, and achieve economies of scale. Market leaders are focusing on delivering comprehensive platforms that combine Security Orchestration, Automation, and Response (SOAR), Endpoint Detection and Response (EDR), and Identity Access Management (IAM). This multi-faceted approach ensures adaptability across industries and organizational sizes while addressing evolving compliance requirements. Smaller niche players are differentiating themselves through specialized offerings, such as automated incident response tools tailored for specific sectors such as finance or healthcare.

The security automation market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are AWS; Cisco Systems, Inc.; CrowdStrike; CyberArk Software Ltd.; IBM Corporation; Palo Alto Networks; Red Hat, Inc.; Secureworks, Inc.; Splunk Inc.; Swimlane Inc.; and Tufin.

Swimlane Inc. is a major provider of security orchestration, automation, and response (SOAR) solutions designed to address the growing challenges in cybersecurity operations. Founded in 2015, Swimlane has established itself as a pioneer in AI-enhanced security automation, offering tools that streamline incident response, reduce false positives, and optimize workflows. The company’s platform integrates with over 300 security systems and supports more than 1,800 endpoints, enabling organizations to centralize their security data and automate threat detection and response processes. Swimlane’s low-code approach allows users with minimal coding expertise to create customized workflows, making automation accessible to a wider audience. Its flagship product, Swimlane Turbine, combines advanced automation capabilities with AI innovations such as Hero AI for enhanced case management and actionable recommendations. The platform executes up to 25 million daily actions per customer, making it one of the fastest and most scalable solutions in the industry. Swimlane’s solutions are trusted by Fortune 500 companies, federal agencies, and managed security service providers (MSSPs) to improve operational efficiency while reducing resource strain.

Cisco Systems, Inc. is a global company in networking and cybersecurity solutions, providing advanced technologies to secure and automate complex infrastructures. Cisco has emphasized the integration of security automation into its portfolio to address evolving cyber threats effectively. Cisco’s security automation solutions leverage advanced programming concepts, RESTful APIs, and data models to streamline operations, enhance scalability, and protect against cyberattacks. Platforms such as Cisco Firepower Management Center, Cisco Stealthwatch Enterprise, Cisco Umbrella, and Cisco Identity Services Engine (ISE) are central to these efforts, enabling organizations to automate threat detection, response, and compliance processes.

List of Key Companies in Security Automation Market

- AWS

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk Software Ltd.

- IBM Corporation

- Palo Alto Networks

- Red Hat, Inc.

- Secureworks, Inc.

- Splunk Inc.

- Swimlane Inc.

- Tufin

Security Automation Industry Developments

December 2024: AWS announced the general availability of AWS Security Incident Response, a new service that helps organizations prepare for, respond to, and recover from security events. This service offers automated monitoring and investigation of security findings.

October 2023: Swimlane, the AI-enabled security automation company, announced the launch of a security automation ecosystem to protect financial institutions.

Security Automation Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- SOAR

- SIEM

- XDR

- Services

- Professional Services

- Managed Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-Premises

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Network Security

- Intrusion Detection and Prevention System

- Firewall Management

- Network Access Control

- Network Traffic Analysis

- Others

- Endpoint Security

- Threat Detection and Prevention

- Malware Detection and Protection

- Configuration Management

- Phishing and Email Protection

- Others

- Incident Response Management

- Incident Triage and Escalation

- Incident Categorization and Prioritization

- Workflow Orchestration

- Evidence Gathering

- Others

- Vulnerability Management

- Vulnerability Scanning and Assessment

- Prioritization

- Vulnerability Remediation and Ticketing

- Patch Management and Remediation

- Others

- Identity and Access Management

- User Provisioning and Deprovisioning

- Single Sign On (SSO)

- Multi-Factor Authentication

- Access Policy Enforcement

- Others

- Compliance and Policy Management

- Automated Compliance Auditing

- Policy Enforcement Automation

- Regulatory Compliance Reporting

- Audit Trail Generation

- Others

- Data Protection and Encryption

- Encryption Key Management

- File and Database Encryption

- Data Loss Prevention

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- AI & ML

- Predictive Analytics

- Robotic Process Automation (RPA)

- User & Entity Behavior Analytics (UEBA)

- Others

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Manufacturing

- Media & Entertainment

- Healthcare & Life Sciences

- Energy & Utilities

- Government & Defense

- Retail & E-commerce

- IT & ITES

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Security Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 10.40 Billion |

|

Market Forecast in 2025 |

USD 11.82 Billion |

|

Revenue Forecast by 2034 |

USD 38.09 Billion |

|

CAGR |

13.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global security automation market size was valued at USD 10.40 billion in 2024 and is projected to grow to USD 38.09 billion by 2034.

The global market is projected to register a CAGR of 13.9% during the forecast period.

North America held the largest share of the global market revenue in 2024.

A few of the key players in the market are AWS; Cisco Systems, Inc.; CrowdStrike; CyberArk Software Ltd.; IBM Corporation; Palo Alto Networks; Red Hat, Inc.; Secureworks, Inc.; Splunk Inc.; Swimlane Inc.; and Tufin.

The AI & ML segment dominated the market revenue share in 2024.

The user & entity behavior analytics (UEBA) segment is expected to grow at the fastest pace in the coming years.