Smart Health Devices Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Diagnostic & Monitoring Devices, Therapeutic Devices, and Others), Sales Channel, End-User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM5656

- Base Year: 2024

- Historical Data: 2020-2023

Smart Health Devices Market Overview:

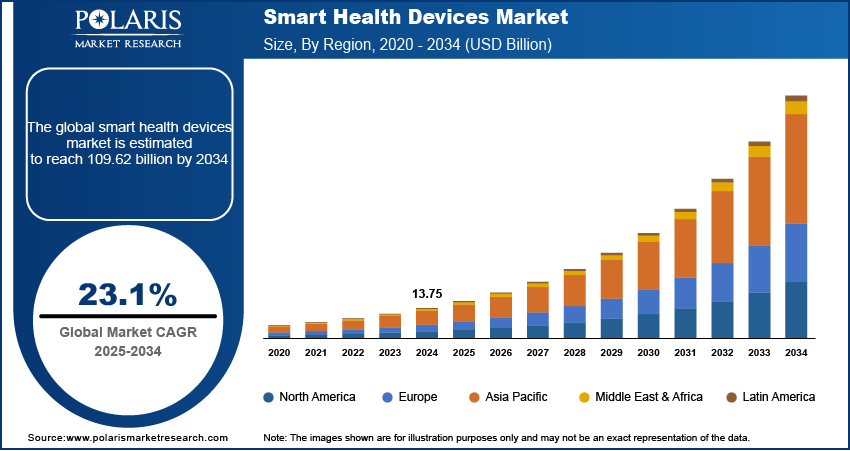

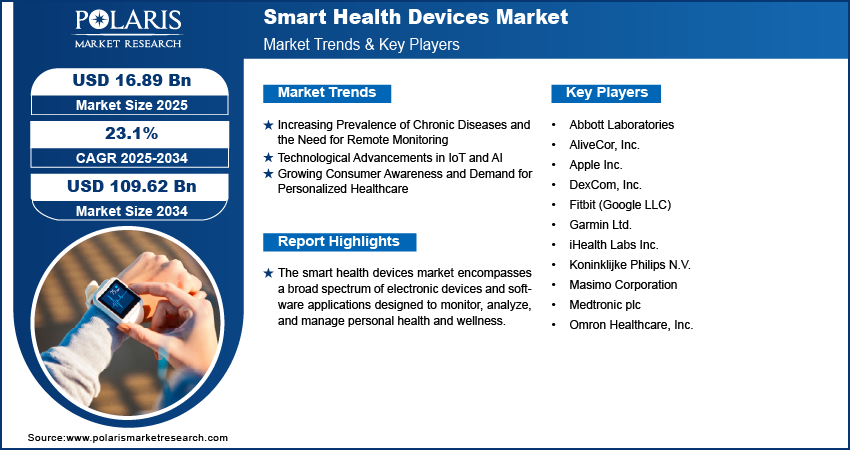

The smart health devices market size was valued at USD 13.75 billion in 2024. The market is projected to grow from USD 16.89 billion in 2025 to USD 109.62 billion by 2034, exhibiting a CAGR of 23.1% during 2025–2034.

The smart health devices market encompasses a diverse range of electronic tools and platforms designed to monitor, analyze, and improve individual health and wellness. These devices, including wearables sensors, remote monitoring systems, and diagnostic tools, leverage advanced technologies such as IoT, AI, and data analytics to provide users with real-time health data. The market's expansion is significantly propelled by an escalating emphasis on proactive healthcare management, coupled with a growing prevalence of chronic diseases necessitating continuous monitoring. Furthermore, the rising consumer awareness regarding personal health and fitness, alongside the increasing adoption of telehealth services, contributes substantially to the market's positive trajectory. These factors collectively shape the market dynamics, influencing both market size and market demand trends.

Examining the market drive, it is evident that technological advancements are pivotal. The continuous innovation in sensor technology, data processing, and wireless communication enables the development of more sophisticated and user-friendly devices. The increasing accessibility of high-speed internet and the proliferation of smartphones further facilitate the integration of smart health devices into daily life. Additionally, the increasing focus on preventive healthcare and the desire for personalized health solutions are key market growth factors. The need to reduce healthcare costs and improve patient outcomes is also a significant driver, leading to increased investment in remote patient monitoring and digital health solutions. Analyzing these market insights is crucial for market entry assessments and understanding the market potential.

To Understand More About this Research:Request a Free Sample Report

Smart Health Devices Market Dynamics:

Increasing Prevalence of Chronic Diseases and the Need for Remote Monitoring

The escalating global burden of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory illnesses, is a significant catalyst for the smart health devices market. The imperative to manage these conditions effectively, coupled with the need for continuous monitoring outside traditional clinical settings, has fueled the demand for remote patient monitoring (RPM) solutions. Advanced smart health devices enable real-time data collection and transmission, facilitating timely interventions and reducing hospitalization rates. The World Health Organization (WHO) estimates that chronic diseases, such as cardiovascular diseases, cancer, respiratory diseases, and diabetes, account for approximately 74% of all deaths globally. Moreover, in the United States, about 6 in 10 adults have one chronic disease, and 4 in 10 adults have two or more. This growing prevalence places a significant strain on healthcare systems.

For instance, a study published in the National Center for Biotechnology Information (NCBI) in 2023, titled "Remote Patient Monitoring for Chronic Disease Management: A Systematic Review," highlighted the efficacy of RPM in improving patient outcomes and reducing healthcare costs. This research indicates that the integration of smart devices for continuous monitoring of vital signs and medication adherence significantly enhances disease management and reduces the strain on healthcare systems. The need for efficient chronic disease management, supported by evidence-based research, is substantially driving the smart health devices market growth.

Technological Advancements in IoT and AI

The rapid evolution of the Internet of Things (IoT) and Artificial Intelligence (AI) technologies is transforming the smart health devices market. These advancements enable the development of more sophisticated and user-friendly devices capable of collecting, analyzing, and transmitting vast amounts of health data. AI-powered algorithms can detect patterns, predict health risks, and provide personalized insights, enhancing the effectiveness of these devices. A research article on PubMed published in 2022, "Artificial Intelligence in Wearable Health Devices for Personalized Healthcare," explained how AI-driven wearables can analyze physiological data to provide personalized health recommendations and early detection of anomalies. The integration of advanced sensors, cloud computing, and machine learning into smart health devices is enabling the creation of more accurate and reliable solutions, thus creating a significant market drive for the smart health devices market.

Growing Consumer Awareness and Demand for Personalized Healthcare

There is a noticeable shift in consumer behavior towards proactive health management and personalized healthcare solutions. Individuals are increasingly seeking tools that empower them to monitor their health, track fitness goals, and make informed lifestyle choices. Smart health devices, such as fitness equipment, smartwatches, and home diagnostic tools, cater to this growing demand. A study published in the NCBI in 2021, “Consumer Acceptance of Wearable Health Technologies: A Systematic Review,” showed that the increased consumer awareness of personal health and the availability of user-friendly wearable technologies have significantly contributed to the adoption of these devices. The desire for personalized health insights and the convenience offered by these devices are key drivers of the smart health devices market.

Smart Health Devices Market Segment Insights:

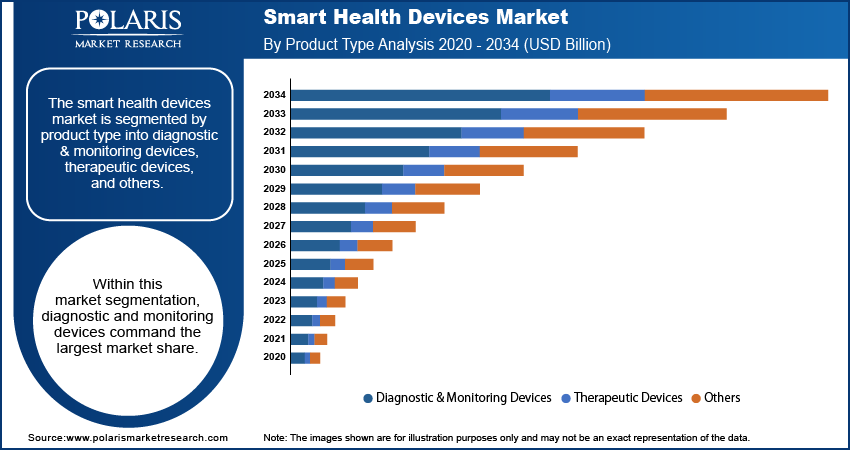

Smart Health Devices Market Assessment – By Product Type

The smart health devices market is segmented by product type into diagnostic & monitoring devices, therapeutic devices, and others. Within this market segmentation, diagnostic and monitoring devices command the largest market share. This dominance is attributed to the widespread adoption of devices such as blood glucose monitors, cardiac monitors, and wearable health trackers. These devices play a crucial role in the early detection and ongoing management of chronic conditions, aligning with the increasing focus on preventive healthcare and remote patient monitoring. The ability to provide real-time health data and facilitate timely interventions has solidified the position of this segment within the smart health devices market.

The therapeutic devices segment exhibits the highest growth rate. This surge is driven by advancements in technologies like insulin pumps, respiratory therapy devices, and pain management solutions. The increasing demand for personalized and non-invasive therapeutic options, coupled with the integration of AI and IoT, is propelling the expansion of this segment. The continuous innovation in therapeutic devices, aiming to improve patient outcomes and enhance quality of life, contributes significantly to the accelerated growth observed within the smart health devices market.

Smart Health Devices Market Evaluation– By Sales Channel

The smart health devices market is segmented by sales channel into pharmacies, online channels, and others. Among these channels, pharmacies currently hold the largest market share. This dominance stems from the established trust and accessibility that traditional pharmacies offer to consumers. Patients often prefer purchasing health-related devices from pharmacies due to the availability of professional advice and the perceived reliability of these establishments. The established infrastructure and consumer familiarity with pharmacies contribute to their significant role in the distribution of smart health devices, thereby influencing the market dynamics.

The online channels segment is experiencing the highest growth rate. This surge is primarily driven by the increasing adoption of e-commerce and the convenience it provides to consumers. The availability of a wide range of products, competitive pricing, and doorstep delivery has significantly boosted online sales. Furthermore, the rising penetration of smartphones and internet access has facilitated the growth of online platforms as a preferred channel for purchasing smart health devices. The ease of access and the growing preference for digital purchasing are key market growth factors for online sales.

Smart Health Devices Market Evaluation– By End-User

The smart health devices market is segmented by end-user into hospitals, clinics, homecare, and others. Among these segments, hospitals currently hold the largest market share. The substantial infrastructure and patient volume within hospital settings create a significant demand for advanced smart health devices. These devices are crucial for patient monitoring, diagnostics, and therapeutic interventions, contributing to improved patient outcomes and operational efficiency within hospital environments. The established use of sophisticated medical technology in hospitals reinforces their dominant position in this market segment.

The homecare segment is experiencing the highest growth rate. This surge is driven by the increasing preference for remote patient monitoring and personalized healthcare solutions. The rising prevalence of chronic diseases and the aging population necessitate continuous monitoring and care outside traditional clinical settings. Smart health devices facilitate this transition, enabling patients to manage their health from the comfort of their homes. This shift towards home-based healthcare is a significant market drive, fostering substantial growth within the homecare end-user segment of the smart health devices market.

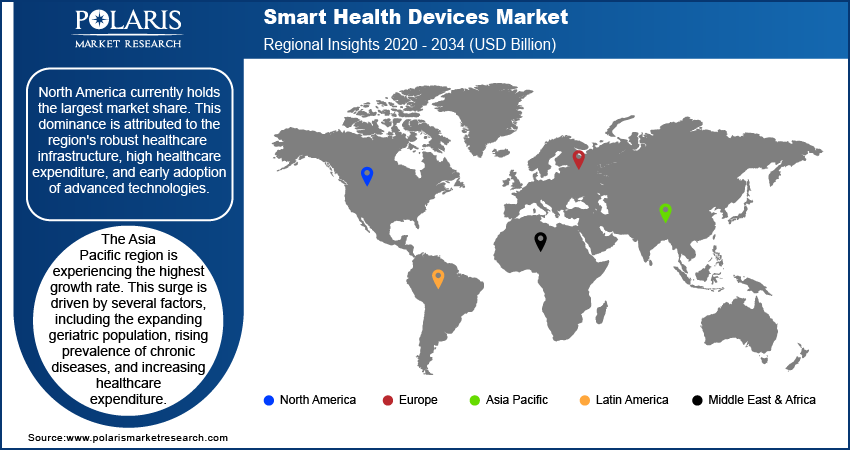

Smart Health Devices Market – Regional Footprint

The smart health devices market exhibits varied regional dynamics, with notable differences in adoption rates, regulatory frameworks, and healthcare infrastructure. North America and Europe have established themselves as significant markets, driven by advanced healthcare systems and high consumer awareness. The Asia Pacific region is rapidly emerging as a key growth area, fueled by increasing healthcare expenditure and a growing geriatric population. Latin America and the Middle East & Africa are also witnessing increased market penetration, albeit at a relatively slower pace, due to improving healthcare infrastructure and rising awareness of digital health solutions. Each region's specific market dynamics are shaped by unique socio-economic factors, influencing the overall market outlook.

North America currently holds the largest market share. This dominance is attributed to the region's robust healthcare infrastructure, high healthcare expenditure, and early adoption of advanced technologies. The presence of leading medical device manufacturers and a favorable regulatory environment further contribute to the region's substantial market share. The strong emphasis on preventive healthcare and the widespread adoption of remote patient monitoring solutions solidify North America's leading position within the smart health devices market.

The Asia Pacific region is experiencing the highest growth rate. This surge is driven by several factors, including the expanding geriatric population, rising prevalence of chronic diseases, and increasing healthcare expenditure. The growing awareness of digital health solutions and the increasing penetration of smartphones and internet access are also contributing to the region's rapid growth. Furthermore, the proactive initiatives by governments to improve healthcare infrastructure and promote digital health adoption are significantly boosting the Asia Pacific region's market potential.

Smart Health Devices Market – Key Players and Competitive Insights

Key players actively contributing to the smart health devices market include Abbott Laboratories, (Johnson & Johnson) DexCom, Inc., Medtronic plc, Omron Healthcare, Inc., Koninklijke Philips N.V., Masimo Corporation, Garmin Ltd., Apple Inc., Fitbit (Google LLC), AliveCor, Inc., and iHealth Labs Inc.

The competitive landscape of the smart health devices market is characterized by intense innovation and strategic partnerships. Companies are focusing on developing advanced technologies, expanding their product portfolios, and enhancing user experience to gain a competitive edge. Market players are also engaging in collaborations with healthcare providers, technology companies, and research institutions to drive product development and market penetration. The emphasis on personalized healthcare and remote patient monitoring is driving companies to integrate AI and IoT into their devices, creating a dynamic and competitive market environment.

Abbott Laboratories, headquartered in Abbott Park, Illinois, United States, provides a wide range of diagnostic and monitoring devices, including continuous glucose monitoring systems and cardiac rhythm management devices. Their focus on innovative medical technologies and their established presence in the healthcare sector make them a significant player in the smart health devices market. DexCom, Inc., based in San Diego, California, United States, specializes in continuous glucose monitoring systems for diabetes management. Their advanced sensor technology and data analytics capabilities enable real-time monitoring and personalized insights, contributing significantly to the growing demand for smart health solutions.

List of Key Companies in Smart Health Devices Market:

- Abbott Laboratories

- AliveCor, Inc.

- Apple Inc.

- DexCom, Inc.

- Fitbit (Google LLC)

- Garmin Ltd.

- iHealth Labs Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Omron Healthcare, Inc.

Smart Health Devices Market Industry Developments

- February 2025: MediBuddy, India’s digital healthcare platform, has announced a strategic partnership with ELECOM, a renowned Japanese electronics company, to co-develop and launch cutting-edge smart health IoT devices in the Indian market. This collaboration aligns with MediBuddy’s mission to enhance access to quality healthcare for a billion people, leveraging innovation to advance preventive health management.

- March 2024: Masimo announced that it had received FDA clearance for its expansion into the consumer health sector. This includes their telehealth platforms and professional patient monitoring devices. This also included their high tech baby monitoring system, and their health focused smart watches.

Smart Health Devices Market Segmentation

By Product Type Outlook (Revenue-USD Billion, 2020–2034)

- Diagnostic & Monitoring Devices

- Therapeutic Devices

- Others

By Sales Channel Outlook (Revenue-USD Billion, 2020–2034)

- Pharmacies

- Online Channels

- Others

By End-User Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals

- Clinics

- Homecare

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Health Devices Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.75 billion |

|

Market Size Value in 2025 |

USD 16.89 billion |

|

Revenue Forecast by 2034 |

USD 109.62 billion |

|

CAGR |

23.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The smart health devices market has been segmented into detailed segments of product type, sales channel, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A successful growth and marketing strategy within the smart health devices market necessitates a multi-faceted approach. Emphasizing digital marketing and leveraging social media platforms can enhance consumer engagement and brand visibility. Strategic partnerships with healthcare providers and insurance companies can facilitate market penetration. Focusing on personalized health solutions and highlighting the benefits of remote patient monitoring can drive consumer adoption. Investing in research and development to introduce innovative and user-friendly devices is crucial for maintaining a competitive edge. Ultimately, a strong focus on building consumer trust and demonstrating the clinical efficacy of these devices will be vital for sustained market growth.

FAQ's

The smart health devices market size was valued at USD 13.75 billion in 2024 and is projected to grow to USD 109.62 billion by 2034.

The market is projected to register a CAGR of 23.1% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the smart health devices market include Abbott Laboratories, (Johnson & Johnson) DexCom, Inc., Medtronic plc, Omron Healthcare, Inc., Koninklijke Philips N.V., Masimo Corporation, Garmin Ltd., Apple Inc., Fitbit (Google LLC), AliveCor, Inc., and iHealth Labs Inc.

The pharmacies segment accounted for the larger share of the market in 2024.

Following are some of the smart health devices market trends: ? Remote Patient Monitoring (RPM): ? There is a growing emphasis on RPM solutions, enabling healthcare providers to monitor patients remotely. This trend is driven by the need to manage chronic diseases and reduce healthcare costs. ? Wearable Health Technology: ? The adoption of wearable devices, such as smartwatches and fitness trackers, is increasing. These devices provide real-time health data and personalized insights. ? Integration of AI and Machine Learning: ? AI-powered algorithms are being integrated into smart health devices to analyze data, predict health risks, and provide personalized recommendations.

Smart health devices are electronic tools and platforms that utilize advanced technologies to monitor and manage health. These devices, ranging from wearables to remote monitoring systems, leverage IoT, AI, and data analytics. They provide real-time health data, enabling proactive health management and improved patient outcomes. Their purpose is to empower individuals and healthcare providers with data-driven insights for better health.