U.S. Central Nervous System Therapeutics Market Size, Share, Trends, & Industry Analysis Report

By Disease (Neurovascular Disease, CNS Trauma, Mental Health), By Drug Class, and By Distribution Channel– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5857

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

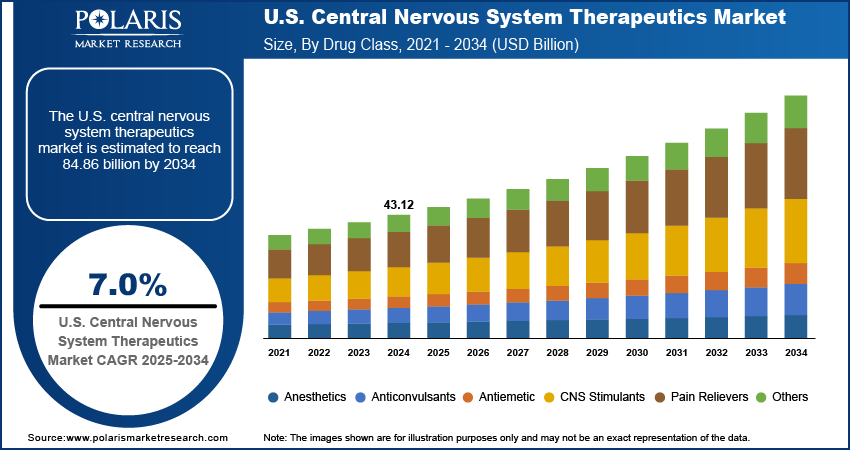

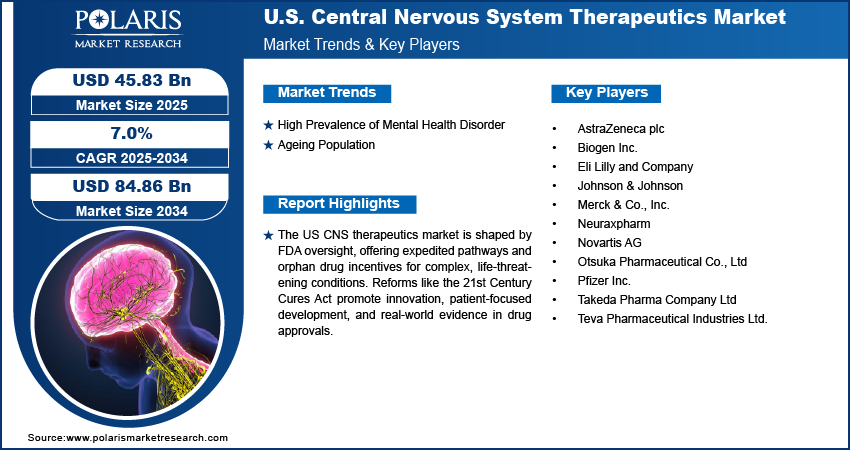

The U.S. central nervous system therapeutics market was valued at USD 43.12 billion in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2034. The growth is driven by rising prevalence of neurological disorder, rising focus by pharmaceutical and biotechnology companies.

The central nervous system (CNS) therapeutics market plays a critical role in addressing one of the most complex and impactful areas of human health. It encompasses a wide range of medications and therapies designed to treat disorders affecting the brain, spinal cord, and peripheral nerves. These disorders include neurodegenerative diseases such as Alzheimer's and Parkinson’s, psychiatric conditions like depression and schizophrenia, and chronic pain, epilepsy, and multiple sclerosis. The demand for effective CNS therapeutics continues to rise significantly as the US population ages and the burden of neurological diseases increases.

The United States represents one of the most mature and dynamic country for CNS therapeutics, regulated primarily by the Food and Drug Administration (FDA). The FDA plays a pivotal role in ensuring that CNS drugs meet rigorous safety, efficacy, and quality standards before they are approved for public use. Given the complexity of CNS disorders and the need for innovation, the FDA has established several expedited pathways such as Fast Track, Breakthrough Therapy, Accelerated Approval, and Priority Review. These mechanisms are especially beneficial for treatments targeting rare, life-threatening, or severely debilitating CNS conditions such as ALS, Huntington’s disease, and treatment-resistant depression. Additionally, the FDA encourages the development of orphan drugs by providing incentives like Market exclusivity, tax credits, and fee waivers. Recent reforms and initiatives under the 21st Century Cures Act have further facilitated the regulatory process by promoting patient-centered drug development and the use of real-world evidence in CNS drug approvals.

Government-backed healthcare programs such as Medicare and Medicaid, along with private insurers, play a vital role in supporting access to CNS therapeutics in the US. Many CNS disorders, such as Alzheimer’s and Parkinson’s, require long-term treatment and follow-up care, which are costly without proper insurance. Most CNS medications, including branded and generic options, are widely covered under US health plans. The government further provides funding and grants for mental health services through agencies like the National Institutes of Health (NIH) and the Substance Abuse and Mental Health Services Administration (SAMHSA). These efforts promote early diagnosis, reduce treatment gaps, and help develop new therapies. Additionally, the FDA’s fast-track approval process supports quicker access to innovative CNS drugs. This ecosystem of regulatory support and coverage creates a favorable environment for pharmaceutical companies and ensures patients are able to afford and access necessary treatments, thereby driving the growth.

Industry Dynamics

High Prevalence of Mental Health Disorder

The US has one of the highest rates of mental health disorders globally, with millions affected by depression, anxiety, bipolar disorder, PTSD, and schizophrenia. According to the Mental Health America, 60 million people representing 23.08% of total US population are suffering from mental illness. The growing awareness and decreasing stigma around mental health have led to more people seeking treatment, fueling demand for CNS therapeutics. The COVID-19 pandemic further highlighted the mental health crisis, prompting a surge in both public and private mental health initiatives. The US healthcare system actively supports mental health through insurance coverage, telemedicine options, and national awareness campaigns. Organizations like NAMI (National Alliance on Mental Illness) further play a major role in advocacy and education. The need for effective, accessible, and diverse treatment options is growing rapidly with mental health increasingly viewed as a priority in public health policy, thereby driving the growth.

Ageing Population

The country is experiencing a rapid increase in its aging population, with millions entering their senior years. According to the United States Census Bureau, in 2020, 1 in 6 people in country were 65 years and more. Older adults are more vulnerable to CNS-related conditions such as Alzheimer’s disease, Parkinson’s disease, and dementia. The number of elderly individuals needing long-term CNS care rise as life expectancy rises. This demographic shift is placing greater demand on the healthcare system and driving investment in geriatric-focused therapies and services. Families, caregivers, and health institutions are looking for better treatments to manage symptoms and improve quality of life. In response, pharmaceutical companies are focusing more on neurodegenerative research and developing medications that target age-related cognitive decline. Furthermore, country’s policymakers are increasing funding for elderly mental health care and brain health programs, thereby driving the growth.

Segmental Insights

Disease Insight

The mental health segment accounted for 29.26% regional share during the forecast period driven by a surge in diagnosed cases of depression, anxiety, bipolar disorder, and PTSD. Growing public awareness, reduced stigma, and nationwide campaigns promoting mental wellness contributed to higher treatment-seeking behavior. The widespread availability of psychiatrists, therapists, and mental health services through both in-person and telehealth platforms further boosted treatment rates. Federal and state-level funding for mental health programs have strengthened infrastructure and access to medications. The mental health therapeutics demand is rising with high-profile drug launches, increasing use of digital therapeutics, and rising insurance coverage, thereby driving the segment growth.

The neurovascular disease segment recorded USD 9.38 billion in 2024. Aging demographics, high rates of obesity, hypertension, and diabetes are major contributing factors. Advanced emergency care systems, along with greater public awareness about stroke symptoms and the importance of early intervention, have increased diagnosis and treatment rates. US hospitals are further rapidly adopting novel clot-dissolving agents, neuroprotective drugs, and minimally invasive surgical options. Government-backed stroke prevention programs and investments in neurovascular research are accelerating therapy development, thereby driving the growth.

By Drug Class Insight

The pain reliever segment accounted for 28.42% regional share in 2024 as pain relievers remain a major drug class in the US, particularly for managing chronic neurological pain, migraines, and post-surgical nerve discomfort. While opioids have historically dominated, their use is now more controlled due to the opioid crisis. As a result, demand for non-opioid alternatives, including anticonvulsants, antidepressants, and topical agents, has surged. The US FDA continues to prioritize the approval of safer, non-addictive pain treatments. Patients and physicians alike are seeking personalized pain management strategies, combining medication with physical therapy or digital monitoring tools, thereby driving the segment growth.

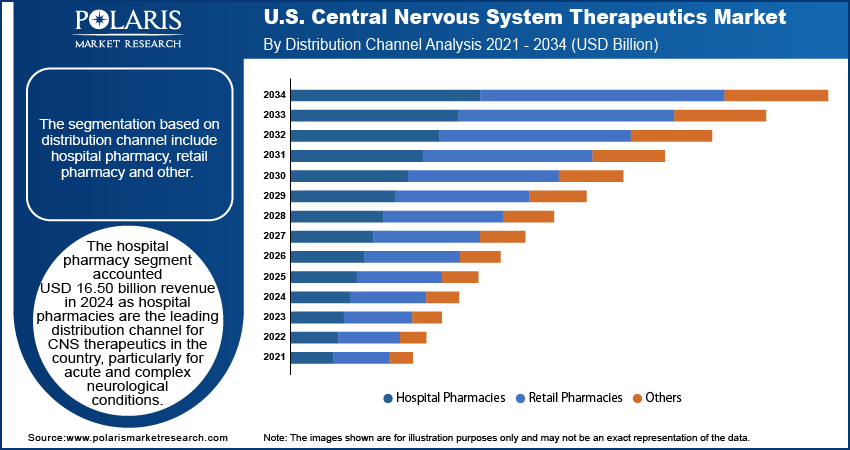

By Distribution Channel Insight

The hospital pharmacy segment accounted USD 16.50 billion revenue in 2024 as hospital pharmacies are the leading distribution channel for CNS therapeutics in the country, particularly for acute and complex neurological conditions. Medications for stroke, seizures, and psychiatric emergencies are typically initiated in hospital settings under professional supervision. US hospitals are well-equipped with neurologists, psychiatrists, and advanced diagnostic services, enabling tailored and timely treatment. Additionally, specialty CNS drugs require controlled environments for storage and administration, which hospital pharmacies are designed to provide, thereby driving the segment growth.

Key Players & Competitive Analysis

The industry experiences a high degree of competitive rivalry due to the presence of numerous established pharmaceutical giants, biotechnology firms, and a growing number of startups focused on neurological and psychiatric diseases. Companies such as Pfizer, Novartis, Johnson & Johnson, Biogen, and Eli Lilly are consistently investing in R&D to gain Market share through novel drug launches and expanded indications. The Market is intensely competitive in high-volume drug categories such as antidepressants, antipsychotics, and pain relievers, where generics and biosimilars have also eroded margins. Additionally, the race to develop effective treatments for complex and poorly understood disorders such as Alzheimer’s and Parkinson’s further fuels competition, with frequent product pipeline updates, clinical trial breakthroughs, and licensing deals. While brand loyalty, regulatory hurdles, and high development costs create some entry barriers, the pace of innovation and patent expirations contribute to an environment of continuous rivalry.

Key Players

- AstraZeneca plc

- Biogen Inc.

- Eli Lilly and Company

- Johnson & Johnson

- Merck & Co., Inc.

- Neuraxpharm

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd

- Pfizer Inc.

- Takeda Pharma Company Ltd

- Teva Pharmaceutical Industries Ltd.

Industry Developments

May 2025: Biogen Inc. and City Therapeutics, Inc., a privately held biopharmaceutical company that is pioneering the future of RNA interference (RNAi)-based medicine, announced a strategic partnership to develop select innovative RNAi therapeutics.

May 2025: Eli Lilly and firm ("Lilly") and SiteOne Therapeutics, Inc. ("SiteOne"), a private biotechnology firm researching small molecule sodium channel inhibitors to treat pain and other neuronal hyperexcitability disorders, announced a definitive agreement for Lilly to acquire SiteOne.

April 2025: Merck, known as MSD outside of the United States and Canada, has announced the start of construction on a USD 1 billion, 470,000-square-foot cutting-edge biologics centre of excellence in Wilmington, Delaware.

US Central Nervous System Therapeutics Market Segmentation

By Disease Outlook (Revenue, USD Billion, 2020–2034)

- Neurovascular Diseases

- CNS Trauma

- Mental Health

- Neurodegenerative Diseases

- Alzheimer’s Disease

- Parkinson's Disease

- Multiple Sclerosis

- Huntington’s Disease

- Amyotrophic Lateral Sclerosis

- Others

- Infectious Diseases

- CNS Cancer

- Others

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- Anesthetics

- Anticonvulsants

- Antiemetic

- CNS Stimulants

- Pain Relievers

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Other

US Central Nervous System Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 43.12 Billion |

|

Market Size in 2025 |

USD 45.83 Billion |

|

Revenue Forecast by 2034 |

USD 84.86 Billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 43.12 billion in 2024 and is projected to grow to USD 84.86 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

A few of the key players in the market are AstraZeneca plc; Biogen Inc.; Eli Lilly and Company; Johnson & Johnson; Merck & Co., Inc.; Neuraxpharm; Novartis AG; Otsuka Pharmaceutical Co., Ltd; Pfizer Inc.; Takeda Pharma Company Ltd; Teva Pharmaceutical Industries Ltd.

The mental health segment dominated the market share in 2024.

The hospital pharmacy segment is expected to witness the fastest growth during the forecast period.