U.S. High-Torque Synchronous Motor Market Size, Share, & Industry Analysis Report

: By Application (Propulsion, Auxiliary Systems, Deck Machinery), By Mounting Type, By Technology, By Industry – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5853

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

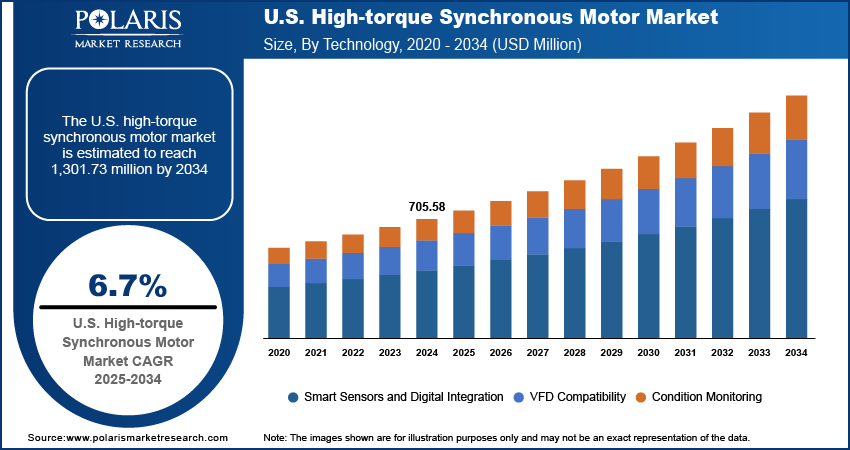

The U.S. high-torque synchronous motor market size was valued at USD 705.58 million in 2024, growing at a CAGR of 6.7% from 2025–2034. The growth is driven by the advancements in motor design, focus on energy efficiency, and expansion of electric vehicle.

A high-torque synchronous motor is a type of electric motor designed to deliver consistent and precise torque at constant speeds, even under varying load conditions. In the U.S., the market for high-torque synchronous motors is witnessing growth driven by advancements in motor design, digital integration, and smart diagnostics. These innovations have greatly improved performance, reliability, and operational visibility. Integrating smart sensors and condition monitoring capabilities allows predictive maintenance and seamless integration with industrial automation systems. Additionally, the evolution of motor control algorithms and compact, energy-dense configurations is also supporting diverse industrial applications, particularly in heavy-duty sectors such as mining, manufacturing, and oil & gas.

The growing focus on energy efficiency and sustainability across US industries further boosts the expansion opportunity. According to a February 2025 BCSE report, US corporate clean power reached 28 GW in 2024, noting 26% growth, with 183 deals signed reflecting growing renewable energy adoption. These motors have emerged as a preferred solution due to their high operational efficiency, reduced power losses, and compatibility with renewable energy systems as organizations transition towards greener practices and aim to meet regulatory and environmental goals. Their ability to maintain efficiency over a wide range of loads contributes to lower lifecycle costs and carbon footprint management. Additionally, this makes them increasingly feasible for long-term deployment in sectors prioritizing clean energy usage and sustainable production methods.

Industry Dynamics

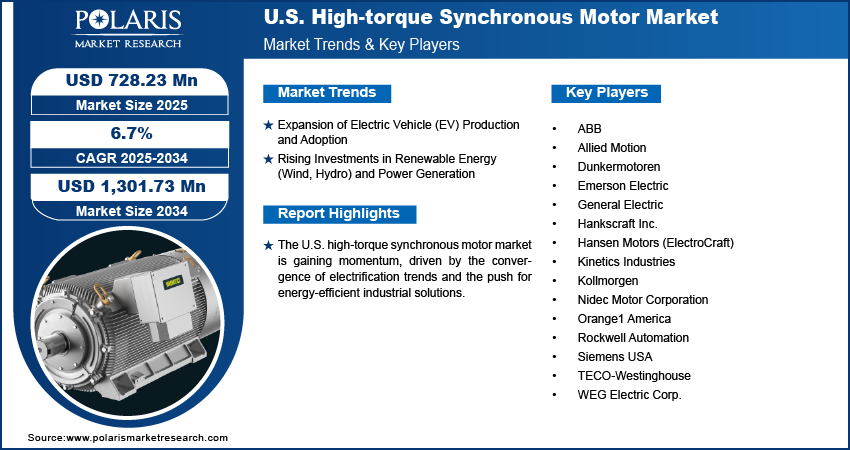

Expansion of Electric Vehicle (EV) Production and Adoption

The expansion of electric vehicle (EV) production and adoption is driving growth opportunities, as these motors play a critical role in electric drivetrains and component manufacturing processes. According to an April 2025 ICCT report, electric vehicles accounted for 1.56 million sales in 2024, representing 10% of total light-duty vehicle sales. Their high efficiency, precision torque control, and compact design make them ideal for EV propulsion systems and assembly line automation. Demand for high-performance motors that can meet stringent operational and energy standards continues to grow as automotive manufacturers scale up production and introduce next-generation EV platforms. Moreover, the integration of high-torque synchronous motors into EV infrastructure, such as testing equipment and battery manufacturing units, further broadens their application scope in the growing e-mobility ecosystem.

Rising Investments in Renewable Energy (Wind, Hydro) and Power Generation

Rising investments in renewable energy, particularly in wind and hydroelectric power, are boosting demand for high-torque synchronous motors in the US. According to a 2024 IEA report, U.S. clean energy investment reached USD 280 billion in 2023. These motors are widely used in power generation systems where high reliability, energy efficiency, and precision are essential. In hydroelectric plants and wind turbines, they provide the stable and controllable torque needed for optimal energy conversion and grid integration. The deployment of such motors in green energy installations becomes critical as the country pushes towards de-carbonization and strengthens its clean energy targets. Their role in improving operational efficiency and reducing maintenance downtime further supports the reliability and sustainability of renewable power infrastructure.

Segmental Insights

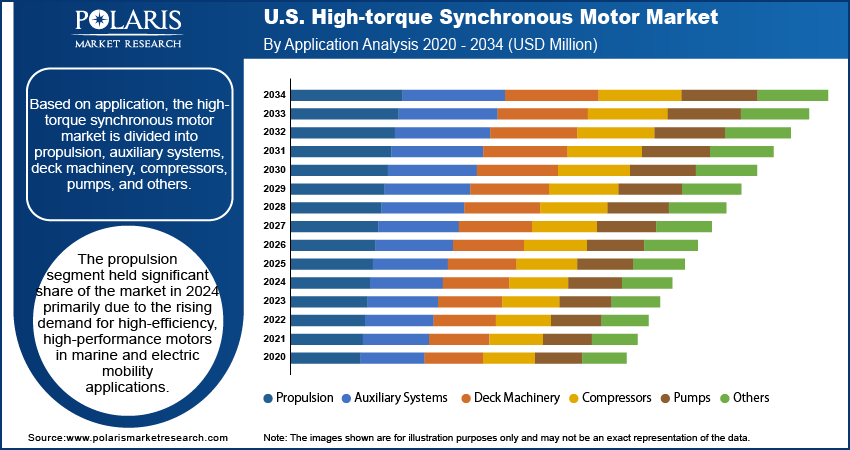

Application Analysis

The segmentation, based on application, includes propulsion, auxiliary systems, deck machinery, compressors, pumps, and others. The propulsion segment held significant share of the market in 2024 primarily due to the rising demand for high-efficiency, high-performance motors in marine and electric mobility applications. These motors are well-suited for propulsion systems as they provide consistent torque, precise speed control, and improved energy efficiency under changing load conditions. The growing focus on reducing fuel consumption and emissions in transportation and marine operations has accelerated the shift toward electric propulsion, where these synchronous motors are increasingly integrated. Their superior torque density and ability to operate effectively in dynamic environments make them ideal for propulsion-driven systems in both commercial and industrial use.

Mounting Type Analysis

The segmentation, based on mounting type, includes horizontal and vertical. The horizontal segment growth is driven its widespread use in industrial applications that require stable and compact motor alignment. Horizontal motors are generally easier to install and maintain, and they allow for efficient transmission of torque in conveyor systems, compressors, and pumps. Their design facilitates better heat excess and integration with existing mechanical layouts, making them particularly attractive for large-scale manufacturing and processing plants. Horizontal synchronous motors offer a reliable and space-efficient solution as industries continue to modernize and automate, further supporting their increased adoption across various sectors.

Technology Analysis

The segmentation, based on technology, includes smart sensors and digital integration, VFD compatibility, and condition monitoring. The smart sensors and digital integration segment is expected to grow at a significant CAGR during the forecast period supported by the shift toward Industry 4.0 and intelligent automation. These motors, integrated with smart sensor technology, enable real-time performance monitoring, predictive maintenance, and seamless system diagnostics. These features help reduce unplanned downtime and improve operational efficiency. The growing focus on digital transformation in industries is accelerating the need for motors equipped with advanced connectivity and analytics capabilities, making smart-integrated solutions increasingly indispensable for next-generation motor systems.

Industry Analysis

The segmentation, based on industry, includes marine, oil & gas, metal & mining, paper & pulp, chemicals & petrochemicals, automotive, and others. The marine segment is expected to witness highest share of the market driven by the increasing adoption of electric and hybrid propulsion systems in maritime vessels. These synchronous motors offer a viable alternative with lower emissions and greater fuel efficiency as environmental regulations get strict, and the sector shifts toward sustainable solutions. Their ability to handle heavy-duty propulsion tasks with high reliability under marine operating conditions supports their integration into ships, ferries, and offshore platforms. Additionally, the demand for precise motor control and improved energy efficiency at sea is driving consistent growth in the marine sector's reliance on these motors.

Key Players & Competitive Analysis

The U.S. high-torque synchronous motor landscape is driven by technological advancements in energy-efficient designs and smart manufacturing, with leaders such as Siemens, ABB, and TMEIC driving strategic investments in IoT-enabled solutions. Industry trends highlight rising demand from renewable energy and electric mobility sectors, where precise torque control and reliability are critical. Competitive intelligence reveals a focus on sustainable value chains, with manufacturers adopting rare-earth-free magnets to mitigate supply chain risks. Disruptions and trends include the integration of AI-driven predictive maintenance and modular motor architectures, addressing latent demand from oil & gas and marine industries. Regional footprints show concentrated R&D in the Midwest and Northeast, supported by government incentives for clean energy infrastructure. Future development strategies emphasize partnerships with EV and wind turbine OEMs, while economic and geopolitical shifts in raw material sourcing pose challenges.

A few key players are ABB, Allied Motion, Dunkermotoren, Emerson Electric, General Electric, Hankscraft Inc., Hansen Motors (ElectroCraft), Kinetics Industries, Kollmorgen, Nidec Motor Corporation, Orange1 America, Rockwell Automation, Siemens USA, TECO-Westinghouse, WEG Electric Corp.

Key Players

- ABB

- Allied Motion

- Dunkermotoren

- Emerson Electric

- General Electric

- Hankscraft Inc.

- Hansen Motors (ElectroCraft)

- Kinetics Industries

- Kollmorgen

- Nidec Motor Corporation

- Orange1 America

- Rockwell Automation

- Siemens USA

- TECO-Westinghouse

- WEG Electric Corp.

Industry Developments

February 2023: NORD launched IE5+ synchronous motors, DuoDrive, and NORDAC ON/ON+ VFDs for conveyor systems. The VFDs include Ethernet, PLC functions, Plug-&-Play, and compact mounting. Combined with NORD’s modular system, they support IIoT-ready, energy-efficient drive solutions.

November 2021: NORD launched IE5+ synchronous motors (0.5–3HP, 0–2100 rpm) and NORDAC ON/ON+ VFDs for airport applications. The motors feature low-noise operation, flexible mounting (direct/adapters), integrated encoders, and reduced variants to cut costs.

U.S. High-torque Synchronous Motor Market Segmentation

By Application Outlook (Revenue, USD Million, 2020–2034)

- Propulsion

- Auxiliary Systems

- Deck Machinery

- Compressors

- Pumps

- Others

By Mounting Type Outlook (Revenue, USD Million, 2020–2034)

- Horizontal

- Vertical

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Smart Sensors and Digital Integration

- VFD Compatibility

- Condition Monitoring

By Industry Outlook (Revenue, USD Million, 2020–2034)

- Marine

- Oil & Gas

- Metal & Mining

- Paper & Pulp

- Chemicals & Petrochemicals

- Automotive

- Others

U.S. High-torque Synchronous Motor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 705.58 million |

|

Market Size in 2025 |

USD 728.23 million |

|

Revenue Forecast by 2034 |

USD 1,301.73 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 705.58 million in 2024 and is projected to grow to USD 1,301.73 million by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few of the key players in the market are ABB, Allied Motion, Dunkermotoren, Emerson Electric, General Electric, Hankscraft Inc., Hansen Motors (ElectroCraft), Kinetics Industries, Kollmorgen, Nidec Motor Corporation, Orange1 America, Rockwell Automation, Siemens USA, TECO-Westinghouse, WEG Electric Corp.

The propulsion segment held significant share of the market in 2024.

The smart sensors and digital integration segment is expected to grow at a significant CAGR during the forecast period.