U.S. Industrial Cleaning Chemicals Market Size, Share, Trends, Industry Analysis Report

By Application (Healthcare, Retail & Food Service, Automotive & Aerospace, Hospitality, Others), By Ingredient Type, By Product Type – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6127

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

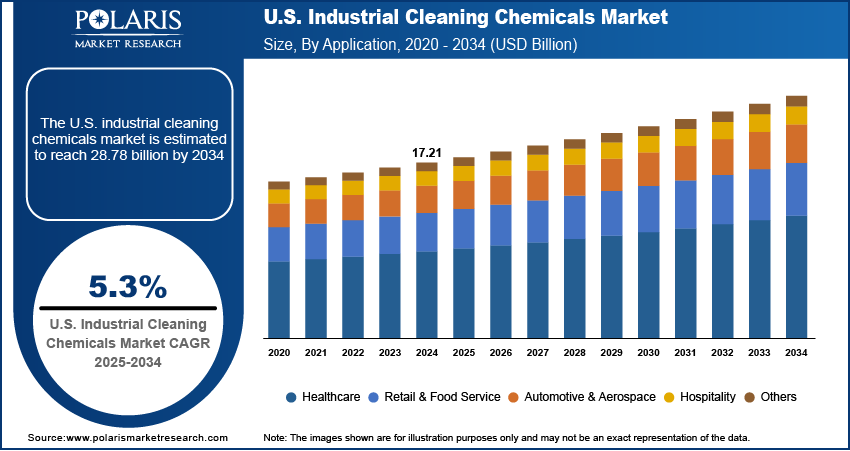

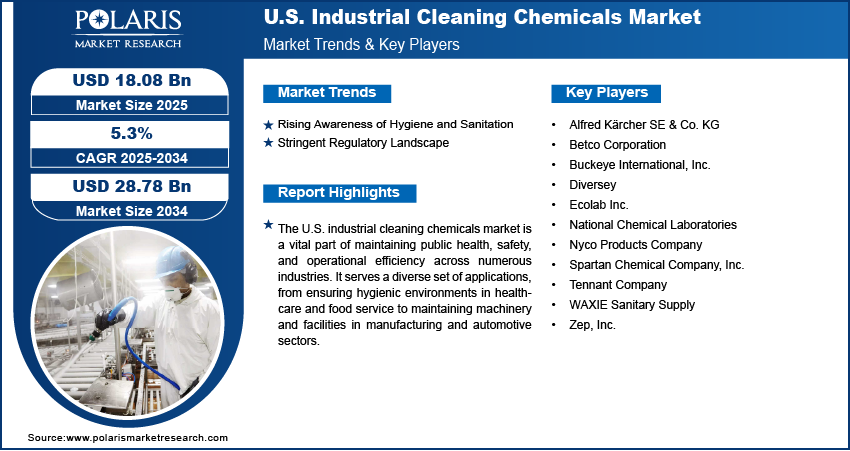

The U.S. industrial cleaning chemicals market size was valued at USD 17.21 billion in 2024 and is anticipated to register a CAGR of 5.3% from 2025 to 2034. The market is primarily driven by rising hygiene standards and stringent health and safety regulations across various industries. Increased demand from sectors such as healthcare and food processing also plays a key role in its expansion. Additionally, a growing focus on sustainable and eco-friendly cleaning solutions continues to influence product development and adoption.

Key Insights

- By application, the healthcare segment held the largest share in 2024, primarily driven by the critical need to maintain sterile and hygienic environments in hospitals and clinics. Strict infection control regulations and the persistent challenge of healthcare-associated infections necessitate continuous use of specialized cleaning and disinfecting agents in the U.S.

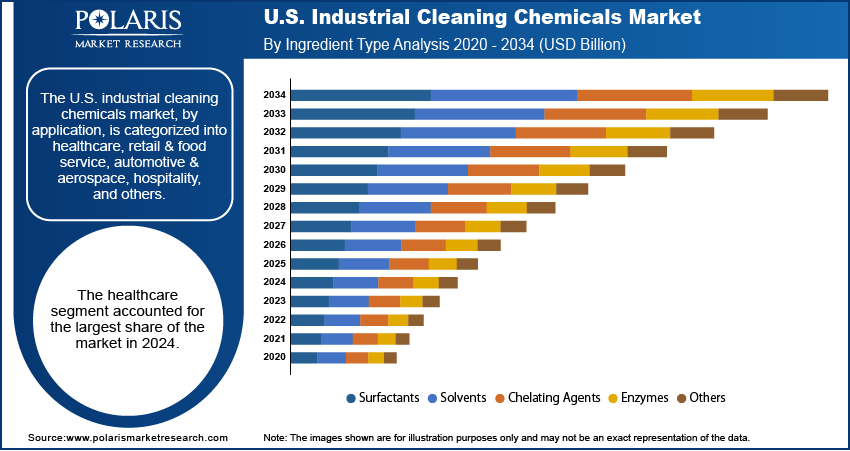

- By ingredient type, the surfactants segment held the largest share in 2024 due to their fundamental role in nearly all cleaning formulations. Their ability to reduce surface tension and effectively lift and suspend dirt makes them indispensable in a wide array of products, ensuring their leading position across various industrial and institutional cleaning applications in the U.S.

- By product type, the general and medical device cleaning products segment held the largest share in 2024, reflecting the widespread and constant need for cleanliness in diverse facilities such as commercial buildings, schools, and healthcare institutions across the U.S.

Industry Dynamics

- Industries worldwide are placing a rising emphasis on maintaining extremely clean and safe environments. This trend is especially strong in sensitive areas such as healthcare facilities, food processing plants, and public spaces, where preventing infections and ensuring product integrity are critical.

- Governments and regulatory bodies globally are implementing more rigorous rules concerning workplace cleanliness and environmental protection. Businesses must adhere to these evolving standards to avoid penalties and ensure the well-being of their employees and customers.

- Rapid expansion of industrial sectors, including manufacturing, automotive, and commercial offices, directly translates to a greater need for specialized cleaning agents. As new facilities are built and existing ones grow, the demand for products to maintain machinery, floors, and general premises rises significantly, fueling the U.S. industrial cleaning chemicals market growth.

Market Statistics

- 2024 Market Size: USD 17.21 billion

- 2034 Projected Market Size: USD 28.78 billion

- CAGR (2025–2034): 5.3%

To Understand More About this Research: Request a Free Sample Report

The industrial cleaning chemicals industry involves the creation and use of specialized products for cleaning, sanitizing, and maintaining various industrial environments. These chemicals are designed to handle demanding tasks in settings such as manufacturing, healthcare, and food processing, surpassing the capabilities of typical household cleaners.

A focused driver for the market is the increasing adoption of automation and robotics in cleaning operations. As industries seek ways to boost efficiency and address labor shortages, automated cleaning systems are becoming more common. These systems often require specific cleaning chemical formulations that are compatible with their dispensing mechanisms and optimized for automated application, leading to new product development and demand.

Another important driver is the continuous advancements in material science, leading to the development of new surfaces and equipment that require specialized cleaning care. As manufacturing processes evolve and new materials are used in industrial settings, cleaning chemical manufacturers must innovate to create products that are both effective and safe for these surfaces. This pushes the boundaries of chemical formulation, fostering innovation in the industry.

Drivers and Trends

Rising Awareness of Hygiene and Sanitation: The increased focus on health and hygiene standards, significantly amplified by recent public health events, is a primary growth factor for the U.S. industrial cleaning chemicals market. Businesses across all sectors are now more aware of the critical need for comprehensive cleaning and disinfection protocols to protect employees, customers, and the general public. This heightened awareness translates directly into a higher demand for effective and reliable cleaning solutions and contract cleaning services that can tackle a wide range of contaminants and pathogens.

This drive for improved cleanliness is particularly evident in healthcare and food industries. For instance, data from the Centers for Disease Control and Prevention (CDC) in their "Healthcare-Associated Infections Progress Report" for 2022 indicated that while some progress has been made, healthcare-associated infections (HAIs) remain a significant concern, with 1 in 31 hospitalized patients having at least one HAI at any given time. This persistent challenge compels healthcare facilities to invest heavily in advanced cleaning and disinfection chemicals to mitigate infection risks. Similarly, the continuous need to prevent foodborne illnesses, as documented by reports from the CDC on outbreaks related to contaminated food, underscores the importance of stringent cleaning and sanitization in food processing environments. The ongoing efforts to minimize such health risks directly drive the demand for a broad spectrum of industrial cleaning chemicals.

Stringent Regulatory Landscape: Another major driver for the U.S. industrial cleaning chemicals market is the increasingly stringent regulatory framework governing workplace safety, public health, and environmental protection. Various federal agencies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) enforce strict guidelines regarding the composition, use, and disposal of cleaning chemicals in industrial and commercial settings. These regulations mandate certain levels of cleanliness and safety, compelling businesses to use compliant and often more advanced chemical products.

The regulatory requirements often necessitate the use of specific types of chemicals and proper handling procedures. For example, OSHA's Hazard Communication Standard (29 CFR 1910.1200) requires employers to ensure that information about chemical hazards is available and understood by workers, including details on safe handling and protective measures, as outlined in their document "Protecting Workers Who Use Cleaning Chemicals." This standard directly influences the formulations of industrial cleaning chemicals, pushing manufacturers to develop safer yet effective products and to provide comprehensive safety data sheets. Furthermore, the EPA's "Safer Choice" program, which helps identify cleaning products meeting stringent human health and environmental standards, influences product development towards more sustainable and less hazardous options, impacting purchasing decisions across industries.

Segmental Insights

Application Analysis

Based on application, the U.S. industrial cleaning chemicals market segmentation includes healthcare, retail & food service, automotive & aerospace, hospitality, and others. The healthcare segment held the largest share in 2024. This dominance is primarily due to the critical need for maintaining sterile and hygienic environments within hospitals, clinics, and other medical facilities. The pervasive threat of healthcare-associated infections (HAIs) and the stringent regulatory mandates for infection control necessitate continuous and intensive use of specialized cleaning and disinfecting agents. These products are vital for sanitizing patient rooms, operating theaters, medical equipment, and communal areas to prevent the spread of pathogens and ensure patient and staff safety. The ongoing expansion of healthcare infrastructure, coupled with an aging population and increasing demand for medical services, further solidifies this segment's leading position. This continuous and indispensable requirement for high-level cleanliness ensures that the healthcare application remains a cornerstone of demand within the industry.

The retail and food service segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is driven by evolving consumer expectations for cleanliness and safety in public spaces, particularly in establishments where food is prepared and served. Post-pandemic shifts in consumer behavior have increased awareness regarding hygiene, pushing restaurants, cafes, supermarkets, and other retail outlets to adopt more rigorous cleaning schedules and utilize advanced cleaning solutions. Furthermore, strict food safety regulations imposed by government bodies compel food service businesses to maintain impeccable sanitation standards, from kitchen surfaces to dining areas. The expansion of quick-service restaurants (QSRs) and online food delivery services also contributes to this trend, as these operations require efficient and effective cleaning protocols to handle high volumes and diverse environments.

Ingredient Type Analysis

Based on ingredient type, the U.S. industrial cleaning chemicals market segmentation includes surfactants, solvents, chelating agents, pH regulators, solubilizers/hydrotropes, enzymes, and others. The surfactants segment held the largest share in 2024. These compounds are fundamental to nearly all cleaning formulations due to their unique ability to reduce surface tension between liquids and solids, allowing water to mix with oils and dirt. This property makes them highly effective in lifting and suspending various contaminants, which can then be easily rinsed away. Surfactants and natural surfactants are indispensable in a broad array of products, from general-purpose cleaners and degreasers to specialized disinfectants and laundry care solutions used across diverse industrial and institutional settings. Their versatility, combined with the ongoing demand for efficient and thorough cleaning in industries such as manufacturing, hospitality, and food service, ensures their continued dominance in the chemical ingredient landscape.

The enzymes subsegment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is largely driven by a rising preference for sustainable and eco-friendly cleaning solutions. Enzymes act as biological catalysts, capable of breaking down specific organic matter such as fats, proteins, and starches more effectively and at lower temperatures than traditional harsh chemicals. This leads to reduced energy consumption, less water usage, and fewer harmful chemical residues, aligning with increasing environmental regulations and corporate sustainability goals. The ability of enzymes to deliver superior cleaning performance in specialized applications, such as medical device cleaning and wastewater treatment, without compromising safety or environmental integrity, further fuels their adoption.

Product Type Analysis

Based on product type, the U.S. industrial cleaning chemicals market segmentation includes general & medical device cleaning, metal cleaners, disinfectants, commercial laundry, dish washing, and others. The general & medical device cleaning segment held the largest share in 2024. This segment's dominance is directly linked to the widespread and continuous need for cleanliness across a vast array of facilities, including commercial buildings, schools, offices, and, crucially, and healthcare institutions. These general-purpose and specialized cleaners are essential for daily maintenance, ensuring hygiene on various surfaces such as floors, walls, and equipment. The consistent demand for these versatile products stems from the fundamental requirement to maintain safe, clean, and healthy environments that comply with various public health and safety standards in numerous industries.

The disinfectants segment is anticipated to register the highest growth rate during the forecast period, primarily driven by increasing global awareness of infection prevention and control, especially following recent widespread health concerns. Many industries such as healthcare, food service, and public transportation hubs are maintaining an elevated level of vigilance regarding hygiene, leading to a significant increase in the adoption of powerful disinfection and sanitization solutions, including hand sanitizers. The continuous development of new pathogens and the need to protect public health ensure a sustained and growing demand for effective disinfectants that can neutralize a wide spectrum of microorganisms, thereby pushing this segment forward at a rapid pace.

Key Players and Competitive Insights

The competitive landscape of the U.S. industrial cleaning chemicals market is shaped by factors such as the development of sustainable and high-performance cleaning solutions, the ability to meet evolving regulatory standards, and the strength of distribution networks. Companies often focus on specialized segments, such as healthcare or food processing, to gain a competitive edge, while also offering a broad portfolio of general-purpose cleaners. The drive toward automation in cleaning, including cleaning & hygiene products, also influences competition, with firms developing chemical formulations compatible with robotic systems. Further intensifying competition are market players' investments in research and development to introduce advanced formulations that offer improved efficacy, safety, and environmental benefits.

A few key players in the U.S. industrial cleaning chemicals market include Ecolab Inc.; Diversey; Alfred Kärcher SE & Co. KG; Spartan Chemical Company; Zep, Inc.; Tennant Company; Betco Corporation; Nyco Products Company; WAXIE Sanitary Supply; Buckeye International; and National Chemical Laboratories.

Key Players

- Alfred Kärcher SE & Co. KG

- Betco Corporation

- Buckeye International, Inc.

- Diversey

- Ecolab Inc.

- National Chemical Laboratories

- Nyco Products Company

- Spartan Chemical Company, Inc.

- Tennant Company

- WAXIE Sanitary Supply

- Zep, Inc.

U.S. Industrial Cleaning Chemicals Industry Developments

June 2025: Solenis announced a definitive agreement to acquire NCH Corporation's chemicals business. This acquisition is expected to merge complementary business models, further solidifying Solenis' position as a global leader in water and hygiene solutions by expanding its reach and offerings, particularly in the middle market.

U.S. Industrial Cleaning Chemicals Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Healthcare

- Retail & Food Service

- Automotive & Aerospace

- Hospitality

- Others

By Ingredient Type Outlook (Revenue – USD Billion, 2020–2034)

- Surfactants

- Solvents

- Chelating Agents

- pH Regulators

- Solubilizers/Hydrotropes

- Enzymes

- Others

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- General & Medical Device Cleaning

- Metal Cleaners

- Disinfectants

- Commercial Laundry

- Dish Washing

- Others

U.S. Industrial Cleaning Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.21 billion |

|

Market Size in 2025 |

USD 18.08 billion |

|

Revenue Forecast by 2034 |

USD 28.78 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 17.21 billion in 2024 and is projected to grow to USD 28.78 billion by 2034.

The market is projected to register a CAGR of 5.3% during the forecast period.

A few key players in the market include Ecolab Inc.; Diversey; Alfred Kärcher SE & Co. KG; Spartan Chemical Company; Zep, Inc.; Tennant Company; Betco Corporation; Nyco Products Company; WAXIE Sanitary Supply; Buckeye International; and National Chemical Laboratories.

The healthcare segment accounted for the largest share of the market in 2024.

The enzymes segment is expected to witness the fastest growth during the forecast period.