U.S. Macarons Market Size, Share, Trends, Industry Analysis Report

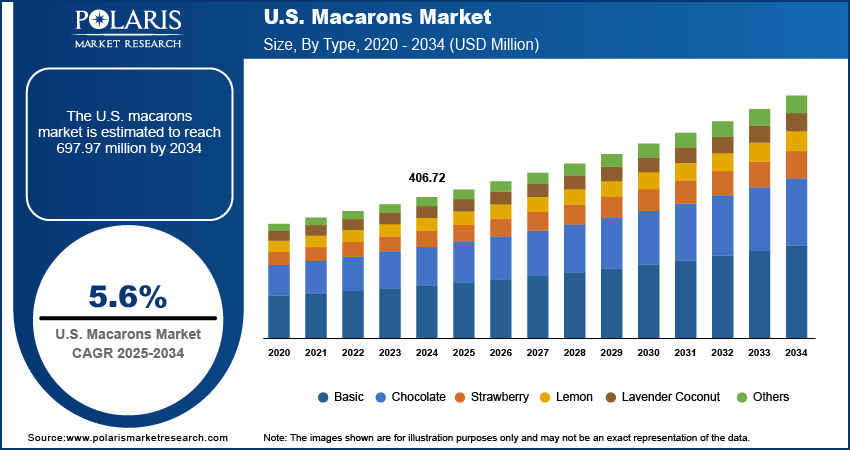

By Type (Basic, Chocolate, Strawberry, Lemon, Lavender Coconut, Others), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5920

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

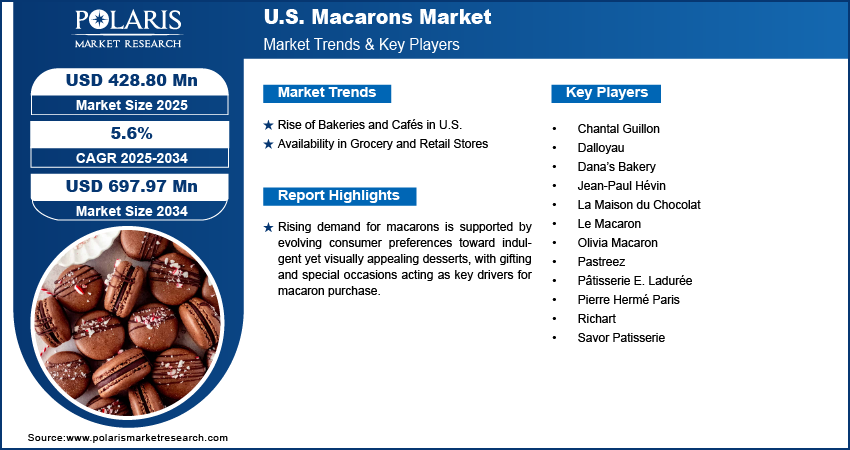

The U.S. macarons market was valued at USD 406.72 million in 2024 and is expected to register a CAGR of 5.6% from 2025 to 2034. The growth is driven by the rise of bakeries and cafés in country and the availability in grocery and retail stores.

Macarons are delicate French confections made with almond flour, egg whites, and sugar, featuring a smooth, crisp shell and a soft, chewy interior. They are filled with ganache, buttercream, or jam in a variety of flavors.

Consumer exposure to international cuisines in the U.S. has increased due to factors such as globalization, social media influence, and diverse urban populations. French desserts, including macarons, have become more familiar as part of this broader interest. Cooking shows, food blogs, and international travel have helped normalize items that were once seen as niche or foreign. Consequently, macarons are being incorporated into more menus and retail offerings. This interest reflects a shift in consumer preferences toward trying new food experiences and exploring culinary traditions from different cultures, including those with European origins, thereby driving the U.S. macarons market growth.

Online food delivery and online retail platforms have expanded rapidly in the U.S., allowing consumers to access a wider range of specialty food items. As macarons are lightweight and packaged for individual or gift-sized portions, they are well-suited for delivery logistics. Many small and mid-sized producers use online platforms to reach customers beyond their local markets. This expansion supports accessibility for non-local or less common desserts such as macarons. Additionally, the rise of gifting culture through online channels has created more opportunities for packaged desserts to be purchased for personal or special occasion, contributing to overall U.S. macarons market demand.

Industry Dynamics

Rise of Bakeries and Cafés in U.S.

The U.S. has seen continued growth in small, independently operated bakeries and cafés, especially in urban and suburban areas. According to the United States Census Bureau, the country consists of 311,811 retail bakeries as of 2021. These establishments offer a broader range of baked goods, including items influenced by international baking traditions. Macarons have become part of this mix, appearing as one of many desserts alongside beverages or other pastries. The increasing number of such outlets provides more points of access for consumers to encounter and try new products. The café setting, in particular, supports demand for individual or small-portion desserts, which aligns with the format in which macarons are typically sold, thereby driving the growth.

Availability in Grocery and Retail Stores

Macarons are increasingly available in major U.S. grocery chains and retail stores such as Whole Foods, Trader Joe’s, Costco, and Target in frozen or bakery sections. This expanded access allows consumers to purchase them without visiting a specialty bakery. Retailers typically carry macarons in pre-packaged formats, making them a convenient option for home consumption. Their presence in mainstream stores suggests growing demand and familiarity with the product. Items such as macarons benefit from being part of this shift toward greater product diversity in the dessert category as grocery stores continue to broaden their offerings to include a wider variety of global or specialty desserts, thereby driving the U.S. macarons market growth.

Segmental Insights

Type Analysis

The chocolate segment dominated with the largest share in 2024 due to their familiarity and broad appeal. American consumers often choose chocolate as a safe, classic option when trying new desserts. Chocolate macarons are commonly found in both independent bakeries and major retail stores, including frozen and pre-packaged formats. Variants such as dark chocolate, chocolate mint, or chocolate with sea salt are also gaining popularity. The strong consumer preference for chocolate-flavored desserts in general supports continued demand for this flavor in macaron offerings. It remains a staple in seasonal selections, gifting packs, and café menus across the country, thereby driving the segment growth.

The strawberry segment is expected to experience significant growth as strawberry macarons are widely appreciated in the U.S. for their fruity taste and bright color, making them a popular choice for spring and summer seasons. They often appear in themed assortments, gift boxes, and seasonal displays. The flavor appeals to both children and adults and is commonly included in variety packs sold in grocery stores and bakeries. Some U.S. producers use natural fruit flavoring or real fruit purées to meet demand for more authentic ingredients. Strawberry macarons align well with visual trends on social media, contributing to their appeal in a market where appearance plays a major role in dessert selection, thereby driving the segment growth.

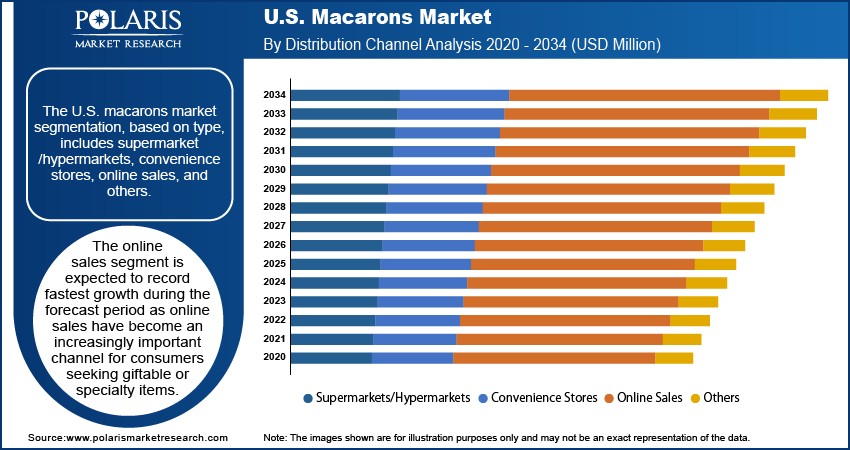

Distribution Channel Analysis

The supermarket/hypermarket segment dominated with the largest share in 2024, as supermarkets and hypermarkets in the U.S. play a major role in expanding access to macarons. Large retail chains such as Costco, Whole Foods, and Walmart offer packaged macarons in bakery product or frozen product sections. These products are usually mass-produced and sold in multi-flavor assortments, catering to shoppers seeking convenient, ready-to-eat desserts. Their presence in mainstream grocery stores is further driving the growth. Bulk retailers provide macarons at competitive prices, making them more affordable for casual consumption. Macarons maintain a stable position in this channel as supermarkets continue to diversify their premium and international dessert options, thereby driving the growth.

The online sales segment is expected to record the fastest growth during the forecast period as online sales have become an increasingly important channel for consumers seeking giftable or specialty items. Many bakeries and dessert brands offer nationwide shipping through their websites or platforms such as Goldbelly and Amazon. Online availability allows for greater customization, including flavor selection and packaging, which appeals to gift buyers and special event planners. The convenience of ordering macarons for delivery supports their use in celebrations, corporate gifting, and holiday occasions. Online platforms provide opportunities for both large and small producers to reach a national audience as e-commerce continues to grow in the U.S. food sector, thereby driving the segment growth.

Key Players and Competitive Analysis

The U.S. macarons market features a mix of domestic producers and internationally recognized French brands, creating a competitive and diverse landscape. Pâtisserie E. Ladurée, Pierre Hermé Paris, and Dalloyau bring established French heritage and global recognition to the market, often operating in major cities through boutiques or luxury retail partnerships. On the domestic front, brands such as Dana’s Bakery, Olivia Macaron, Pastreez, and Savor Patisserie cater to local tastes with innovative flavors, nationwide shipping, and a strong online presence. Le Macaron French Pastries operates a growing franchise model across several states, increasing access to macarons in suburban and urban areas. Companies such as Chantal Guillon and Richart target premium segments through visually distinctive, artisanal offerings. While traditional French styles remain popular, U.S. brands often incorporate local ingredients and modern twists to attract younger and more diverse consumers. The market is shaped by convenience, flavor variety, gifting demand, and strong e-commerce growth.

Key Players

- Chantal Guillon

- Dalloyau

- Dana’s Bakery

- Jean-Paul Hévin

- La Maison du Chocolat

- Le Macaron

- Olivia Macaron

- Pastreez

- Pâtisserie E. Ladurée

- Pierre Hermé Paris

- Richart

- Savor Patisserie

Industry Developments

September 2023: Franck Deville launched macaroons made with 100% French ingredients, showcasing artisanal expertise and reinforcing the brand’s dedication to quality and France’s culinary heritage.

U.S. Macarons Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Basic

- Chocolate

- Strawberry

- Lemon

- Lavender Coconut

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Sales

- Others

U.S. Macarons Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 406.72 Million |

|

Market Size in 2025 |

USD 428.80 Million |

|

Revenue Forecast by 2034 |

USD 697.97 Million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 406.72 million in 2024 and is projected to grow to USD 697.97 million by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period.

A few of the key players in the market are Pâtisserie E. Ladurée, Pierre Hermé Paris, Dalloyau, Jean-Paul Hévin, La Maison du Chocolat, Le Macaron, Dana’s Bakery, Olivia Macaron, Richart, Pastreez, Chantal Guillon, and Savor Patisserie.

The chocolate segment dominated the market share in 2024.

The online sales segment is expected to witness the fastest growth during the forecast period.