Vibration Damping Material Market Size, Share, Trends, Industry Analysis Report

: By Type (Polymers, Metals, Composites), Form, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034.

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5668

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

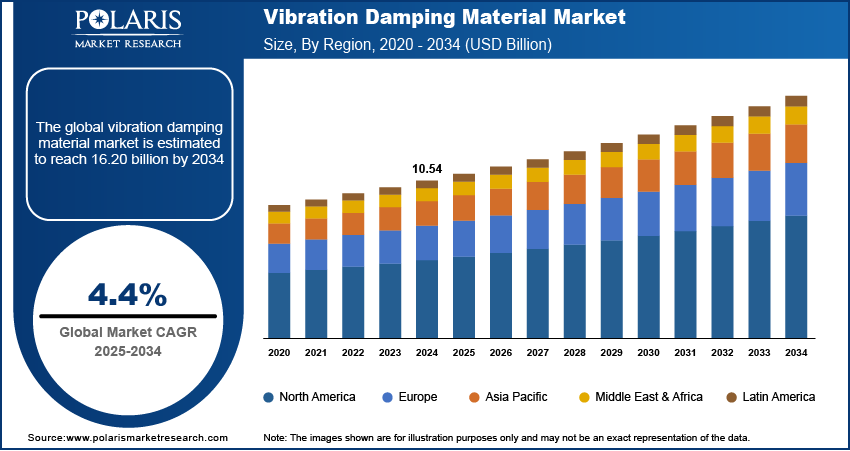

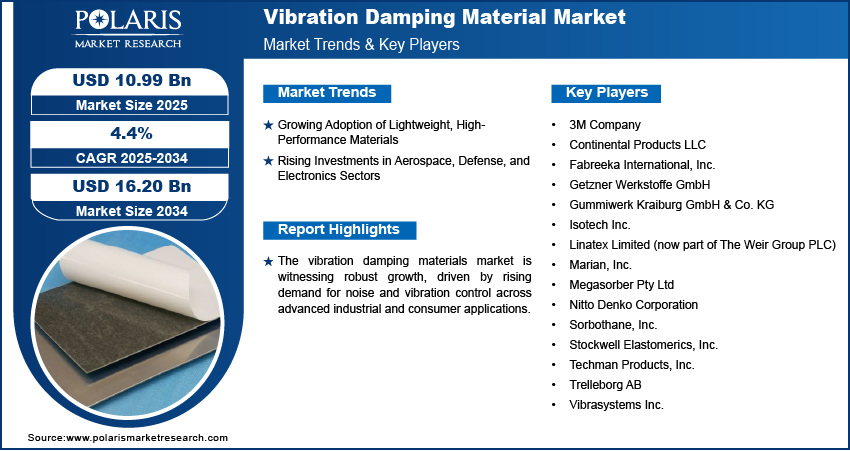

The global vibration damping material market size was valued at USD 10.54 billion in 2024, at a CAGR of 4.4% during 2025–2034. The market is driven by rising automotive demand for noise control, expanding use in construction for durability, growing adoption of lightweight composites, and increased aerospace, defense, and electronics investments requiring advanced damping solutions.

Key Insights

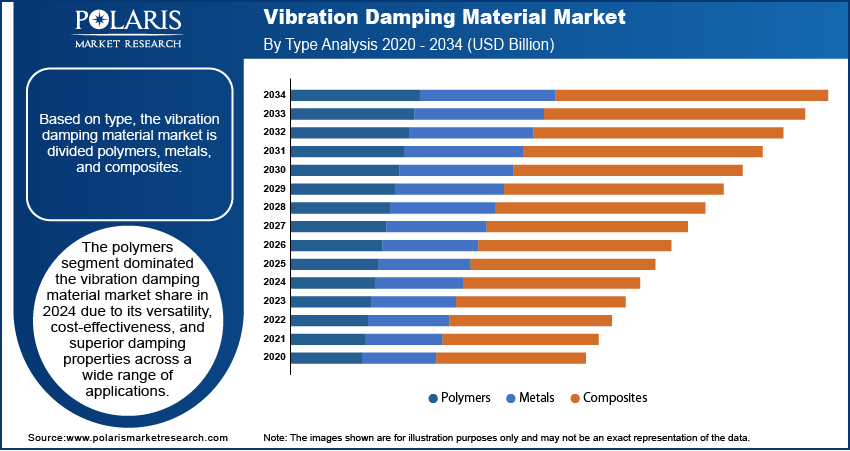

- Polymers dominate the market due to versatility, cost-effectiveness, and superior damping properties across automotive and electronics applications.

- The pads & tapes segment shows the fastest growth, driven by ease of application, adaptability, and rising demand in compact designs.

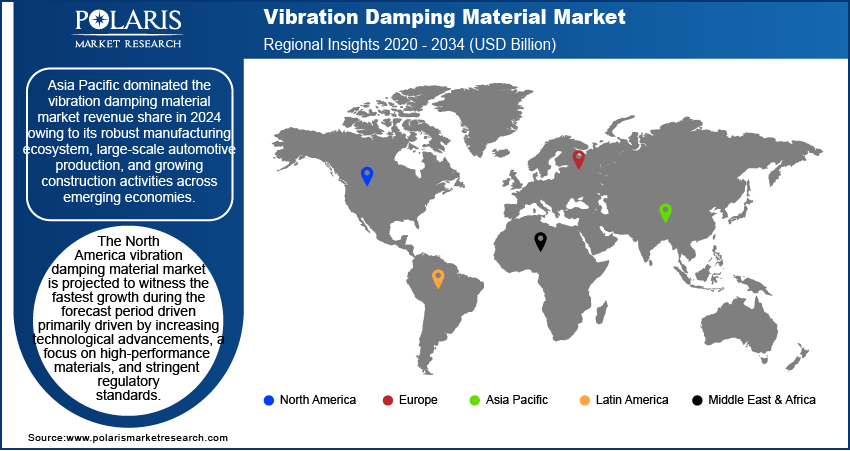

- Asia Pacific leads revenue share due to strong manufacturing, automotive production, and infrastructure growth in China, India, Japan, and South Korea.

- North America is forecasted for the fastest growth with advancements in the aerospace, defense, and automotive sectors, and rising EV adoption, boosting demand.

Industry Dynamics

- Rising demand in the automotive sector for noise and vibration control is driving the market growth globally.

- Increasing construction and infrastructure projects require vibration damping materials to ensure structural integrity and occupant comfort.

- Adoption of lightweight, high-performance composites enhances product efficiency and fuels demand for advanced vibration damping materials.

- Growing investments in aerospace, defense, and electronics sectors increase demand for durable vibration control materials with strict safety standards.

- High production and raw material costs limit widespread adoption and reduce cost competitiveness in emerging markets.

Market Statistics

2024 Market Size: USD 10.54 billion

2034 Projected Market Size: USD 16.20 billion

CAGR (2025–2034): 4.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Vibration damping materials are specialized substances used to reduce or eliminate unwanted vibrations and noise in various mechanical systems. The increasing demand for noise and vibration monitoring in the automotive industry is propelling the vibration damping materials market growth. The need for advanced materials that minimize vibration and acoustic disturbances has grown considerably as vehicle manufacturers prioritize improved comfort, safety, and performance. For instance, in November 2021, Getzner Werkstoffe launched Sylocraft, a new vibration-damping material for cost-effective small-component production. The injection-molded plastic material offers customizable shapes, noise reduction, durability surpassing rubber, and aesthetic appeal. These materials are now integrated into various vehicle components such as chassis, engine mounts, and interior panels to enhance the overall driving experience and reduce wear and tear. Additionally, the shift towards electric vehicles, which are inherently quieter, has further emphasized the need for effective vibration damping to eliminate even minimal noise and maintain a premium cabin environment.

The adoption of vibration damping materials is expanding the construction and infrastructure development. For instance, a 2023 AGC report highlighted construction as a major US economic driver, with over 919,000 establishments and annual structure production valued at nearly USD 2.1 trillion, highlighting the sector's economic impact and vibration damping materials market expansion. Modern buildings, bridges, and industrial structures require effective vibration control systems to monitor vibrations caused by machinery, environmental forces, or human activity. Vibration damping materials are increasingly utilized in construction elements to enhance structural integrity, occupant comfort, and equipment longevity. The integration of these materials into architectural and civil engineering designs is becoming a standard practice as urbanization accelerates and smart infrastructure becomes a focus area globally. Highlighting the essential role of vibration damping materials in ensuring the long-term performance and sustainability of advanced infrastructure systems.

Vibration Damping Material Market Dynamics

Growing Adoption of Lightweight, High-Performance Materials

The growing adoption of lightweight, high-performance composites is boosting the vibration damping materials market size as industries increasingly seek to enhance product efficiency without compromising structural integrity. In sectors such as automotive, aerospace, and consumer electronics, the push for weight reduction to improve fuel efficiency, device portability, and performance has led to the integration of advanced damping solutions that are both lightweight and effective. For instance, in March 2021, Rocket Lab launched its Neutron rocket, an 8-ton payload launch vehicle designed for mega-constellations, interplanetary missions, and crewed flights of up to 300 kg (660 lb). Building on Electron's reliability, Neutron aims to serve larger commercial and government payloads with high launch frequency. These materials help manage noise and vibration, and they also contribute to the durability and longevity of components by minimizing mechanical stress. Their compatibility with high-performance composites and metals makes them ideal for use in cutting-edge applications where both performance and comfort are critical, reinforcing their growing demand.

Rising Investments in Aerospace, Defense, and Electronics Sectors

Rising investments in the aerospace, defense, and electronics sectors are contributing to the vibration damping materials market expansion. For instance, in March 2025, GE Aerospace announced a USD 1 billion US investment to upgrade factories, innovative new parts and materials, nearly doubling its 2024 commitment. The funding aims to enhance engine safety, quality, and production across facilities in 16 states. These industries operate under strict performance and safety standards, necessitating advanced materials that can withstand high stress, temperature variations, and continuous mechanical loads. Vibration damping solutions are essential in these sectors to enhance operational reliability, reduce noise emissions, and protect sensitive components from fatigue or failure. The demand for specialized damping materials that can meet precise functional requirements is steadily increasing as innovation and technological advancement continue to shape these high-value industries, further solidifying their role in critical applications.

Vibration Damping Material Market Segment Insights

Vibration Damping Material Market Assessment by Type

The global vibration damping material market segmentation, based on type, includes polymers, metals, and composites. The polymers segment dominated the vibration damping material market share in 2024 due to its versatility, cost-effectiveness, and superior damping properties across a wide range of applications. Polymers such as polyurethanes, silicones, and rubber additives offer excellent noise and vibration attenuation while maintaining flexibility and ease of processing. Their lightweight nature, combined with compatibility with diverse substrates, makes them highly suitable for use in industries such as automotive, electronics, and industrial machinery. Additionally, the availability of customized polymer formulations allows manufacturers to tailor damping solutions to specific performance needs, further reinforcing their widespread adoption across end-use sectors.

Vibration Damping Material Market Evaluation by Form

The global vibration damping material market segmentation, based on form, includes films & sheets, pads & tapes, foams & gaskets, and other forms. The pads & tapes segment is expected to witness the fastest growth during the forecast period driven by its ease of application, adaptability, and rising demand in compact and intricate component designs. These forms are preferred for their strong adhesive properties and the ability to conform to various surfaces, enabling quick and efficient installation without additional hardware. Their effectiveness in reducing both structural and airborne noise, especially in consumer electronics and automotive interiors, has contributed to their growing popularity. Moreover, ongoing innovations in adhesive technologies and material compositions are enhancing the performance and durability of pads and tapes, positioning them as a go-to solution in high-growth application areas.

Vibration Damping Material Market Outlook by Region

By region, the report provides the vibration damping material market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the vibration damping material market revenue share in 2024 owing to its robust manufacturing ecosystem, large-scale automotive production, and growing construction activities across emerging economies. Countries such as China, India, Japan, and South Korea have witnessed substantial investments in industrial machinery, transportation, and infrastructure projects, all of which require advanced damping solutions to ensure safety, durability, and user comfort. An April 2025 IBEF report outlined India's target of attracting USD 100 billion in annual FDI, supported by infrastructure development, manufacturing expansion, social initiatives, and streamlined regulations, alongside projected sustained GDP growth of 6-8% over the next ten years. The region's strong presence of OEMs and material suppliers, combined with supportive government policies toward industrial development and urbanization, has fostered high demand for vibration damping materials across multiple sectors.

The North America vibration damping material market is projected to witness the fastest growth during the forecast period driven primarily driven by increasing technological advancements, a focus on high-performance materials, and stringent regulatory standards. The region’s aerospace, defense, and automotive sectors are actively adopting innovative materials to improve product performance and comply with noise and vibration control norms. Additionally, the growing shift toward electric vehicles and smart electronics is spurring the need for efficient damping solutions that align with the evolving product design requirements. An IEA report noted US electric car registrations reached 1.4 million in 2023, marking a 40% increase from 2022 levels, reflecting continued growth in EV adoption. This focus on innovation, along with a mature industrial base and strong R&D infrastructure, positions North America for sustained growth in the vibration damping materials market.

Key Players & Competitive Analysis Report

The vibration damping materials industry is experiencing substantial growth driven by expanding applications across automotive, aerospace, and construction industries. Industry leaders such as 3M, Fabreeka International, Inc., Sorbothane, and others maintain market dominance through extensive product portfolios and technical innovation, particularly in viscoelastic polymers and composite solutions. Emerging players are disrupting traditional market dynamics by focusing on eco-friendly formulations and specialized application-specific materials. Technological advancement in nano-enhanced composites and smart damping materials represents the most important competitive battleground, with substantial R&D investments across the industry. Supply chain disruptions following global logistics challenges have created strategic opportunities for regional manufacturers, particularly in Asia-Pacific, where local production capabilities are expanding rapidly. Future development strategies increasingly focus on sustainable value chains and lightweight solutions for transportation applications. Companies differentiating through customization capabilities and technical support services maintain premium positioning despite increasing price pressures from commodity-grade alternatives. A few key major players are 3M Company; Continental Products LLC; Fabreeka International, Inc.; Getzner Werkstoffe GmbH; Gummiwerk Kraiburg GmbH & Co. KG; Isotech Inc.; Linatex Limited (The Weir Group PLC); Marian, Inc.; Megasorber Pty Ltd; Nitto Denko Corporation; Sorbothane, Inc.; Stockwell Elastomerics, Inc.; Techman Products, Inc.; Trelleborg AB; and Vibrasystems Inc.

3M Company, originally the Minnesota Mining and Manufacturing Company, is an American multinational company with a strong reputation for innovation across diverse industries, such as industry, worker safety, and consumer goods. Headquartered in Maplewood, Minnesota, 3M operates globally and produces over 60,000 products, ranging from adhesives and abrasives to medical supplies and consumer items such as Scotch Tape and Post-it Notes. The company is structured into four main business segments: Safety & Industrial, Transportation & Electronics, Health Care, and Consumer, serving customers in homes, businesses, hospitals, and various industries worldwide. In 2024, 3M employed around 61,500 people. A substantial area of 3M’s materials expertise is in vibration-damping solutions, which are crucial for reducing noise, fatigue, and wear in mechanical systems. 3M manufactures specialized vibration damping materials, such as the 3M Vibration Damping Tapes 434 and 436, and Damping Aluminum Foam Sheets 4014. These products typically feature a viscoelastic polymer layer combined with a constraining aluminum foil or foam backing, effectively absorbing and dissipating vibrational energy as heat. Applications span aerospace, automotive, construction, appliances, and maintenance, repair, and operations (MRO). Notably, these materials are engineered for durability, chemical resistance, and performance across a wide temperature range, offering efficient noise reduction and protection against structural fatigue with minimal surface coverage.

Isotech Inc., headquartered in Hatfield, Pennsylvania, is a distributor and manufacturer’s representative specializing in proprietary mechanical and electromechanical products since 1982. The company serves a broad range of markets, such as industrial, medical, military, OEM, and in-plant sectors, offering a comprehensive product portfolio that addresses both standard and highly specialized application needs. Isotech’s expertise lies in linear motion systems, motion control, fabrication, and marking processes, supported by a knowledgeable engineering team that assists clients in selecting and integrating the right components for their specific requirements. Among its diverse offerings, Isotech provides vibration-damping materials, such as vibration absorbers and isolators, which are critical for minimizing unwanted vibrations and noise in sensitive equipment and machinery. These solutions are particularly valued in automation, medical equipment, and military hardware, where performance and reliability are paramount. Isotech’s commitment to customer satisfaction is reflected in its tailored approach, ensuring that even unique or challenging applications receive optimal solutions.

List of Key Companies

- 3M Company

- Continental Products LLC

- Fabreeka International, Inc.

- Getzner Werkstoffe GmbH

- Gummiwerk Kraiburg GmbH & Co. KG

- Isotech Inc.

- Linatex Limited (now part of The Weir Group PLC)

- Marian, Inc.

- Megasorber Pty Ltd

- Nitto Denko Corporation

- Sorbothane, Inc.

- Stockwell Elastomerics, Inc.

- Techman Products, Inc.

- Trelleborg AB

- Vibrasystems Inc.

Vibration Damping Material Industry Development

January 2025: Toray Industries developed a damping nylon resin with four times the vibration absorption of conventional materials while maintaining high-temperature rigidity. Targeted for EVs and autonomous vehicles, samples are now available, with commercialization planned by March 2027.

February 2024, Kitagawa Industries America launched a silicone-free, heat-conductive vibration damping sheet designed for applications requiring simultaneous thermal management and vibration/shock absorption.

Vibration Damping Material Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Polymers

- Metals

- Composites

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Films & Sheets

- Pads & Tapes

- Foams & Gaskets

- Other Forms

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial Machinery

- Aerospace & Defense

- Electronics

- Building & Construction

- Sports & Leisure

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vibration damping material Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.54 billion |

|

Market Size Value in 2025 |

USD 10.99 billion |

|

Revenue Forecast in 2034 |

USD 16.20 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global vibration damping material market size was valued at USD 10.54 billion in 2024 and is projected to grow to USD 16.20 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are 3M Company; Continental Products LLC; Fabreeka International, Inc.; Getzner Werkstoffe GmbH; Gummiwerk Kraiburg GmbH & Co. KG; Isotech Inc.; Linatex Limited (The Weir Group PLC); Marian, Inc.; Megasorber Pty Ltd; Nitto Denko Corporation; Sorbothane, Inc.; Stockwell Elastomerics, Inc.; Techman Products, Inc.; Trelleborg AB; and Vibrasystems Inc.

The polymers segment dominated the vibration damping material market share in 2024.

The pads & tapes segment is expected to witness the fastest growth during the forecast period.