Aortic Aneurysm Devices Market Size, Share, Trend, Industry Analysis Report

: By Type (Thoracic Aortic Aneurysm, Abdominal Aortic Aneurysm), By Treatment, By Product, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5897

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

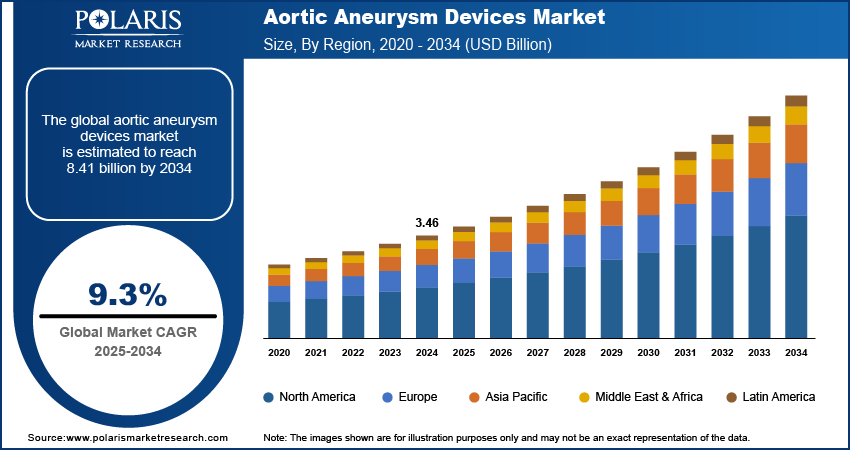

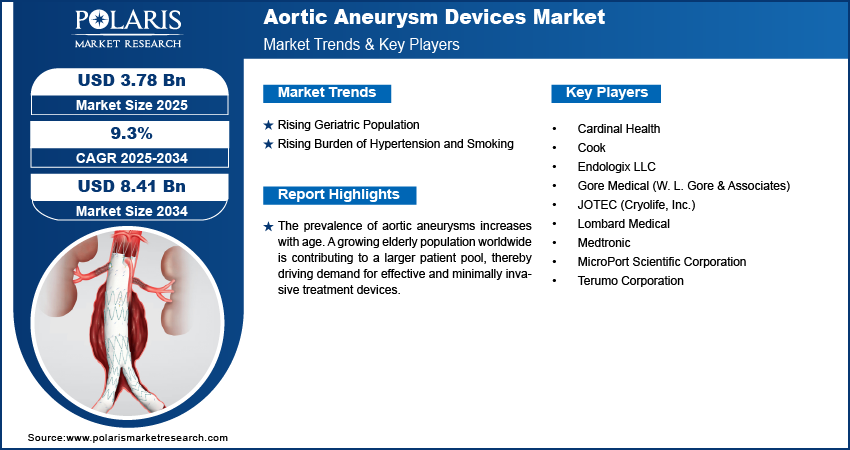

The global aortic aneurysm devices market size was valued at USD 3.46 billion in 2024 and is projected to register a CAGR of 9.3% from 2025 to 2034. The prevalence of aortic aneurysms increases with age. A growing elderly population worldwide is contributing to a larger patient pool, thereby driving demand for effective and minimally invasive treatment devices such as aortic aneurysm devices. The market is also driven by technological advancements and rising adoption of minimally invasive endovascular procedures.

The aortic aneurysm devices market encompasses medical devices used in the diagnosis, management, and treatment of aneurysms occurring in the aorta. These devices include endovascular stent grafts, catheters, and surgical grafts used to prevent aneurysm rupture, support vascular wall integrity, and restore normal blood flow. The market primarily serves patients suffering from abdominal aortic aneurysms (AAA) and thoracic aortic aneurysms (TAA). Healthcare systems are expanding screening programs for high-risk populations. Improved access to imaging technologies such as CT scanner and ultrasound devices are enabling earlier detection of aneurysms, accelerating the need for timely device-based interventions.

Ongoing innovations in stent graft design, delivery systems, and imaging guidance have significantly improved procedural outcomes. These advancements are increasing the adoption of endovascular aneurysm repair (EVAR and TEVAR) over open surgery. Moreover, patients and physicians are increasingly favoring minimally invasive approaches due to reduced recovery times, lower complication rates, and shorter hospital stays, thereby driving the use of aortic aneurysm devices.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rising Geriatric Population

Aortic aneurysms are more common among individuals over the age of 65, primarily due to age-related vascular degeneration and the cumulative effects of risk factors such as hypertension and atherosclerosis. The global demographic shift toward an aging population is resulting in a growing pool of patients susceptible to aneurysm formation. According to the Population Reference Bureau, in the U.S., the population of individuals aged 65 and above is anticipated to grow significantly from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. This demographic trend is increasing the demand for timely diagnosis and advanced treatment solutions, especially minimally invasive options that carry lower procedural risks for older adults. Healthcare systems are responding by investing in targeted screening programs and expanding access to endovascular repair technologies. Device manufacturers are also prioritizing innovations designed specifically to accommodate the anatomical and clinical challenges seen in elderly patients.

Rising Burden of Hypertension and Smoking

Hypertension and tobacco consumption are two of the most prominent modifiable risk factors for aortic aneurysm development. Chronic high blood pressure puts continuous stress on arterial walls, weakening them over time, while smoking accelerates vascular damage and impairs the body’s ability to repair arterial tissue. According to the American Heart Association, 200 million individuals are affected by peripheral arterial disease worldwide. These factors increase the likelihood of aneurysm formation and also heighten the risk of rupture, prompting early medical intervention. The increasing global prevalence of these conditions is directly influencing the rise in aneurysm cases. This trend is driving consistent demand for reliable therapeutic devices that are deployed quickly and safely, particularly in high-risk and symptomatic patient populations.

Segment Insights

Type Analysis

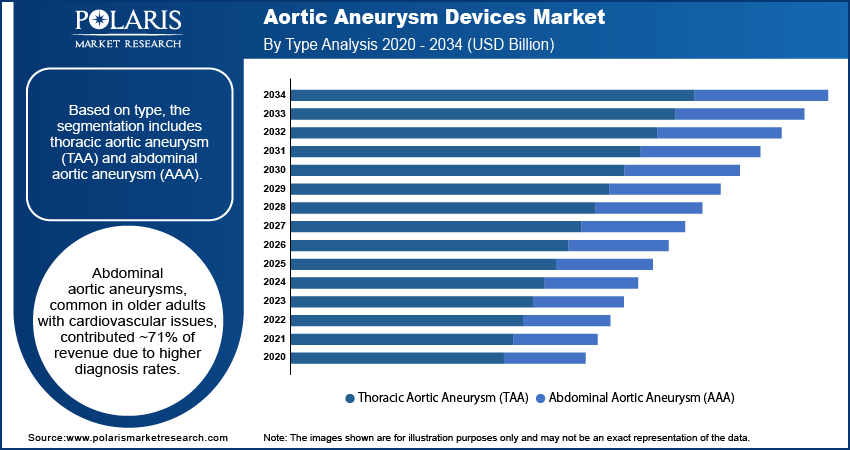

Based on type, the segmentation includes thoracic aortic aneurysm (TAA) and abdominal aortic aneurysm (AAA). The abdominal aortic aneurysm segment accounted for ~71% of the revenue share in 2024. Abdominal aortic aneurysms are more frequently diagnosed compared to thoracic types, particularly in older adults and individuals affected by chronic cardiovascular conditions. These aneurysms are often detected through routine imaging or screenings, especially in high-risk populations. The growing adoption of minimally invasive interventions such as EVAR, which are particularly suited for treating abdominal aneurysms, is also driving segment growth. Increasing awareness and clinical guidelines supporting early detection have resulted in a higher volume of elective procedures, leading to strong market demand for both devices and services. The high prevalence and consistent diagnostic visibility boost this segment growth.

The thoracic aortic aneurysm segment is expected to grow steadily in the coming years, as advances in imaging techniques and greater clinical vigilance are improving early detection rates. Patients suffering from connective tissue disorders or traumatic injuries are contributing to this steady caseload. Endovascular thoracic aneurysm repair (TEVAR) technologies have improved clinical outcomes, especially in older or high-risk patients who cannot undergo open surgery. A gradual shift from conservative management to proactive treatment is expanding the demand for thoracic-specific grafts and related devices. The clinical complexity of thoracic cases is also driving interest in device innovation and specialized care models.

Treatment Analysis

Based on treatment, the segmentation includes open surgical repair (OSR) and endovascular aneurysm repair (EVAR). In 2024, the endovascular aneurysm repair segment accounted for ~75% of the revenue share due to its preferred approach for treating aortic aneurysms because of its minimally invasive nature, lower surgical risk, and shorter recovery time. EVAR procedures are especially effective in older adults and patients with comorbidities who may not tolerate open surgery. Continued advancements in stent graft materials, flexible delivery systems, and real-time imaging have further improved procedural safety and success rates. Hospitals and specialists are increasingly favoring this technique, which requires less intensive hospital resources and enables faster discharge. Insurance providers also support EVAR due to its favorable cost-to-outcome ratio, contributing to widespread procedural adoption and revenue generation.

The open surgical repair segment is projected to register significant growth over the forecast period, due to certain complex aneurysms, especially those with irregular anatomy or involving branch vessels, still require open surgical repair. Patients who are younger or have failed previous endovascular interventions often undergo this traditional method. Growing surgical capabilities and improvements in intraoperative imaging and vascular graft technology are enhancing success rates. While the number of open repairs is relatively lower than EVAR, procedure complexity and extended post-op care contribute to higher per-case revenues. The rise of hybrid operating rooms and specialized cardiovascular surgery centers is also improving outcomes, encouraging healthcare providers to maintain and expand surgical repair capabilities alongside endovascular options.

Product Analysis

Based on product, the segmentation includes stent grafts and catheters. In 2024, the stent grafts segment accounted for the largest revenue share of 90%. Stent grafts form the backbone of endovascular repair procedures, which dominate aneurysm treatment globally. These devices are designed to exclude the aneurysm sac from blood flow, effectively preventing rupture. Technological innovations have enabled more precise sizing, better radial force, and enhanced compatibility with varied anatomical structures, improving both procedural success and patient outcomes. High procedural volumes for EVAR and TEVAR directly correlate with demand for stent grafts, resulting in robust and consistent revenue. Manufacturers are also investing in device customization and next-generation grafts, further solidifying this segment's leading position in the market.

The catheters segment is projected to register significant growth over the forecast period. Catheters are essential in delivering stent grafts and contrast agents during EVAR and TEVAR procedures. Increased focus on developing flexible, torque-stable, and hydrophilic-coated catheters has enhanced their utility and safety profile. As interventional radiology and image-guided vascular procedures gain traction, the demand for advanced catheter solutions continues to grow. Catheters are also critical in pre-operative mapping and post-procedure surveillance, expanding their role beyond intervention. Product development aimed at reducing procedural time and improving navigation in tortuous vessels is attracting strong interest from hospitals and device integrators, indicating sustained growth potential in this category.

End Use Analysis

Based on end use, the segmentation includes hospitals, ambulatory surgery centers, and clinics. In 2024, the hospitals segment accounted for ~70% of the revenue share. Hospitals remain the primary centers for both elective and emergency aortic aneurysm interventions. These institutions offer comprehensive diagnostic and surgical capabilities, including hybrid operating rooms, intensive care units, and specialist vascular teams. High patient footfall and access to skilled surgeons ensure a steady flow of procedures. Hospitals also lead in adopting advanced devices and treatment protocols, especially in tertiary care settings. Their ability to handle complex cases, manage complications, and offer multidisciplinary care makes them the dominant channel for device utilization, contributing significantly to market revenues.

The ambulatory surgery centers segment is projected to register a CAGR of 12.5% during the forecast period. Ambulatory surgery centers are emerging as viable alternatives for selected EVAR procedures, particularly in patients with straightforward anatomies and low surgical risk. Advancements in device miniaturization and streamlined procedural protocols are enabling safer outpatient treatments. Lower overhead costs and quicker turnover times make these centers attractive to both patients and insurers. Regulatory support for cost-effective healthcare delivery is encouraging more referrals to ambulatory settings. As these centers expand capabilities and partner with vascular specialists, their role in the aortic aneurysm treatment ecosystem is expected to grow rapidly in the coming years, contributing to higher procedural volumes and device demand.

Regional Analysis

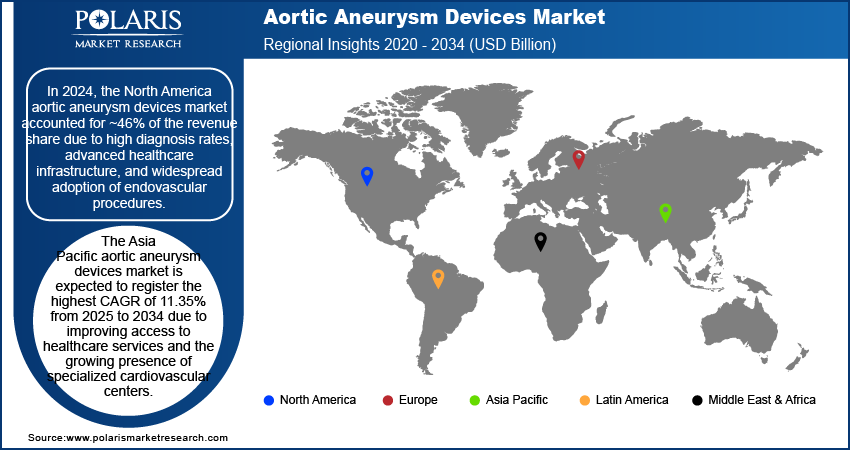

In 2024, the North America aortic aneurysm devices market accounted for ~46% of the revenue share due to high diagnosis rates, advanced healthcare infrastructure, and widespread adoption of endovascular procedures. Hospitals and surgical centers across the region are equipped with state-of-the-art hybrid operating rooms that facilitate complex EVAR and TEVAR interventions. Strong clinical guidelines, regular screening programs, and active reimbursement policies support early treatment and procedure volume. The presence of established device manufacturers also contributes to continuous innovation and rapid integration of next-generation stent grafts. These factors support a mature regional market environment with high procedural throughput and consistent revenue generation.

U.S. Aortic Aneurysm Devices Market Outlook

The aortic aneurysm devices market in the U.S. accounted for the largest revenue share in 2024, supported by large-scale investments in vascular care, combined with the growing aging population susceptible to aneurysms. A well-established ecosystem of vascular surgeons, interventional radiologists, and cardiovascular specialists ensures a high standard of care and device utilization. Government-backed awareness initiatives and insurance coverage for diagnostic imaging and EVAR procedures encourage early identification and timely treatment. The strong presence of domestic device manufacturers accelerates clinical adoption of new graft technologies and catheter systems. Continuous improvements in outpatient vascular care settings further enhance market performance by enabling more efficient and less invasive procedures across the U.S.

Asia Pacific Aortic Aneurysm Devices Market Trends

The aortic aneurysm devices market in Asia Pacific is expected to register the highest CAGR of 11.35% from 2025 to 2034, due to the growing aging population, improving access to healthcare services, and the growing presence of specialized cardiovascular centers. According to the World Health Organization, China is experiencing one of the most rapid increases in its aging population. Projections indicate that by 2040, individuals aged 60 and above are expected to constitute ~28% of the total population. Rising awareness about vascular diseases and increasing investments in hospital infrastructure are creating favorable conditions for aneurysm diagnosis and intervention. Medical tourism and public-private partnerships are expanding the reach of advanced surgical procedures in countries such as India, China, and Thailand. Local production of stent grafts and cost-effective treatment models support affordability and regional market penetration. The expanding middle class and aging population further contribute to a consistent rise in demand for aneurysm repair solutions.

Europe Aortic Aneurysm Devices Market Insight

The aortic aneurysm devices market in Europe registers significant growth, as structured screening programs across European countries play a key role in the early detection of aortic aneurysms, especially in high-risk populations. Public health systems provide strong reimbursement support for endovascular interventions, making EVAR a widely accepted standard of care. Academic medical centers and university hospitals lead clinical research and trial participation, accelerating the adoption of innovative devices. There is growing demand for minimally invasive surgery due to the region’s aging demographic, which is more likely to benefit from lower-risk interventions. Increasing collaboration between device manufacturers and healthcare providers is fostering a competitive yet quality-focused treatment environment.

Key Players and Competitive Analysis

The competitive landscape of the aortic aneurysm devices market is shaped by ongoing advancements in stent graft design, endovascular techniques, and vascular imaging technologies. Industry analysis highlights a strong focus on innovation, where market participants are prioritizing low-profile delivery systems, fenestrated and branched stent grafts, and minimally invasive approaches to address complex anatomies. Market expansion strategies include geographic penetration into emerging regions and portfolio diversification targeting both thoracic and abdominal aneurysms. Mergers and acquisitions continue to reshape the competitive dynamics, enabling vertical integration and expansion into adjacent product categories such as catheters and vascular access systems. Joint ventures and strategic alliances between medical device manufacturers and academic institutions support R&D efforts aimed at enhancing long-term outcomes and procedural success rates. Post-merger integration strategies are centered around consolidating manufacturing capabilities and expanding clinical distribution networks. Digital integration, including image-guided navigation and AI-driven procedural planning, is also gaining traction. Companies are actively pursuing regulatory approvals in multiple jurisdictions to accelerate time-to-market. The competitive environment is further intensified by the presence of regional players focusing on cost-effective solutions for emerging markets.

List of Key Companies

- Cardinal Health

- Cook

- Endologix LLC

- Gore Medical (W. L. Gore & Associates)

- JOTEC (Cryolife, Inc.)

- Lombard Medical

- Medtronic

- MicroPort Scientific Corporation

- Terumo Corporation

Aortic Aneurysm Devices Industry Development

In January 2025, W. L. Gore & Associates received FDA approval for the GORE EXCLUDER Thoracoabdominal Branch Endoprosthesis, off-the-shelf endovascular solution specifically designed for managing complex aneurysms affecting the visceral aorta. This device provides a significant advancement in the treatment of thoracoabdominal aortic pathologies by offering a ready-to-use alternative in endovascular repair.

Aortic Aneurysm Devices Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Thoracic Aortic Aneurysm (TAA)

- Abdominal Aortic Aneurysm (AAA)

By Treatment Outlook (Revenue USD Billion, 2020–2034)

- Open Surgical Repair (OSR)

- Endovascular Aneurysm Repair (EVAR)

By Product Outlook (Revenue USD Billion, 2020–2034)

- Stent Grafts

- Catheters

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgery Centers

- Clinics

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aortic Aneurysm Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.46 billion |

|

Market Size in 2025 |

USD 3.78 billion |

|

Revenue Forecast by 2034 |

USD 8.41 billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.46 billion in 2024 and is projected to grow to USD 8.41 billion by 2034.

The global market is projected to register a CAGR of 9.3% during the forecast period.

In 2024, North America accounted for ~46% of the revenue share of the aortic aneurysm devices market due to high diagnosis rates, advanced healthcare infrastructure, and widespread adoption of endovascular procedures.

A few of the key players are Medtronic, Endologix LLC, Gore Medical (W. L. Gore & Associates), MicroPort Scientific Corporation, Cook, JOTEC (Cryolife, Inc.), Cardinal Health, Terumo Corporation, and Lombard Medical.

The abdominal aortic aneurysm segment accounted for ~71% of the revenue share. Abdominal aortic aneurysms are more frequently diagnosed compared to thoracic types, particularly in older adults and individuals suffering from chronic cardiovascular conditions.

In 2024, the endovascular aneurysm repair segment accounted for ~75% of the revenue share due to its preferred approach for treating aortic aneurysms because of its minimally invasive nature, lower surgical risk, and shorter recovery time.