Corrugated Plastic Sheets Market Size, Share, Trends, & Industry Analysis By Material Type (Polyethylene (PE), Polypropylene (PP), and Other Material Types), By Thickness, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5938

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

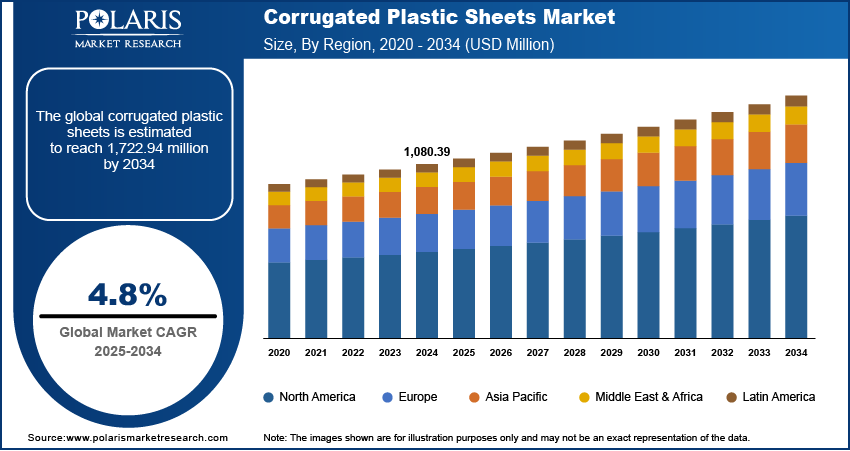

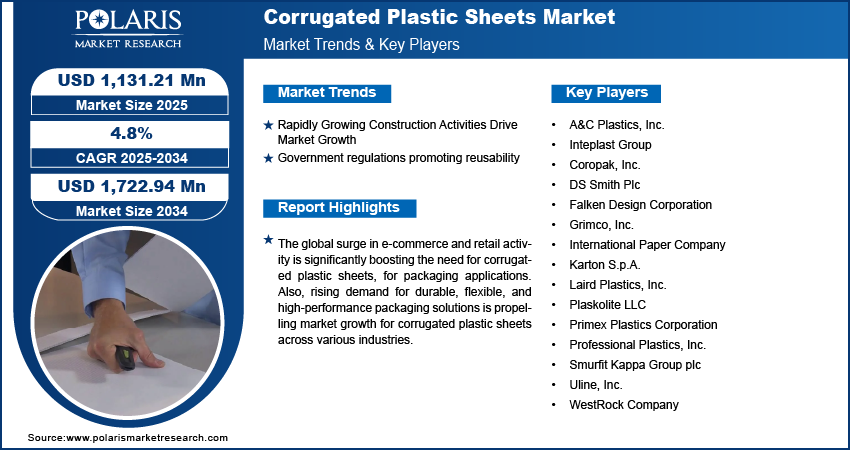

The corrugated plastic sheets market size was valued at USD 1,080.39 million in 2024, growing at a CAGR of 4.8% during 2025–2034. This is primarily driven by the expanding construction industry coupled with favorable government regulations that boost material reusability and sustainability.

Corrugated plastic sheets are lightweight, durable, and moisture-resistant polymer-based materials used in a wide range of industrial and commercial applications. These sheets are primarily manufactured using polypropylene (PP) and polyethylene (PE) and are designed with a fluted or ribbed inner structure that provides a balanced combination of strength, flexibility and cost efficiency. Corrugated plastic sheets are suitable for packaging, signage, construction protection, and agricultural containers as these sheets are recyclable, resistant to chemicals, and easy to fabricate. These sheets are available in different thicknesses and custom sizes for industries with specific functional and environmental needs.

The sheets are extensively used across sectors including logistics, transportation, agriculture, automotive, and building & construction. Corrugated plastic sheets withstand moisture, UV radiation, and impact, increasing the adoption in indoor and outdoor signage. These sheets offer versatility in design, printability and structural configuration across diverse applications, thereby driving the use of corrugated plastic in cost-sensitive and performance-oriented environments.

To Understand More About this Research: Request a Free Sample Report

The rapid expansion of the e-commerce and retail sectors globally is fueling the demand for corrugated plastic sheets in packaging applications. According to the International Trade Administration, global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, growing at a steady compound annual growth rate of 14.4%. This growth is increasing demand for strong, lightweight and cost-effective packaging solutions to ensure product protection during shipping and handling in online retail operations. Moreover, corrugated plastic sheets offer several advantages over traditional materials such as cardboard or paper-based alternatives, including better impact resistance, waterproofing and durability compared to its counterparts. Thus, the growing e-commerce industry is pushing companies to use corrugated plastic sheets for packaging electronics, cosmetics, pharmaceuticals, and delicate consumer goods ensuring safer deliveries and minimizing product returns caused by damage.

In addition, the growing demand for versatile and high-performance packaging solutions is driving the corrugated plastic sheets market. These sheets offer a lightweight and durable alternative to traditional materials that makes it suitable for a broad range of applications such as industrial containers, produce bins, layer pads and bulk packaging. The adaptability of these sheets allows for easy fabrication into boxes, partitions and sleeves to enable customized packaging for reducing material waste and enhances efficiency.

Industry Dynamics

Rapidly Growing Construction Activities Drive Market Growth

The growing volume of global construction activities is significantly increasing the demand for corrugated plastic sheets. These sheets are increasingly used in temporary surface protection, concrete formwork and partitioning solutions on building sites. Corrugated plastics sheets offer moisture resistance and reusability making it a preferred alternative to traditional materials such as plywood or cardboard. According to Oxford Economics, the global construction industry is expected to reach USD 13.9 trillion by 2037. This is due to the rapid urbanization and green infrastructure investments in key economies such as China, the US, and India. This growth in construction activity is influencing the need for flexible, durable materials that improve site efficiency and reduce waste.

The adoption of corrugated plastic sheets is increasing among builders and contractors to protect flooring, walls and fixtures without breaking or warping under tough conditions. The lightweight design supports faster installation and removal, reducing labor time on construction sites. In renovation projects, these sheets offer an added advantage by preventing damage to existing surfaces. Rising demand for sustainable and reusable building materials is driving the adoption of corrugated plastic sheets as a cost-effective solution that supports environmentally conscious construction practices.

Government Regulations Promoting Reusability

Rising regulatory pressure to reduce single-use plastic waste is pushing industries to adopt reusable packaging materials, including corrugated plastic sheets, thereby driving growth of the industry. Several governments are introducing mandates to cut down on single-use plastics and promote reuse. For instance, France, introduced a wide-ranging anti-waste law, aimed at eliminating single-use plastic packaging by 2040, with a 20% reduction target by the end of 2025. Also, Australia’s 2025 National Packaging Targets aim to eliminate single-use plastic packaging and make all packaging reusable, recyclable, or compostable by the end of 2025. These initiatives are pushing businesses to shift toward sustainable packaging solutions, making materials such as corrugated plastic sheets more essential in meeting long-term environmental and regulatory goals.

Corrugated plastic sheets are widely used for transporting agricultural goods, automotive components and industrial supplies due to structural strength and weather resistance. These materials are designed to withstand repeated use, minimizing the need for frequent replacements and offering a more durable solution compared to disposable options. This shift toward green packaging solutions is driving the widespread adoption of corrugated plastic sheets in industries prioritizing operational efficiency and environmental compliance.

Segmental Insights

Material Type Analysis

The segmentation, based on material type includes, polyethylene (PE), polypropylene (PP), and other material types. The polypropylene (PP) segment is projected to grow at a significant pace by 2034. This dominance is driven by superior performance characteristics, including high chemical resistance, rigidity and durability. Polypropylene corrugated sheets are widely used in returnable transit packaging (RTP) and point-of-sale displays due to high strength-to-weight ratio and weather resistance. These attributes help industries lower transportation costs while maintaining structural stability, leading to broad usage across multiple industrial supply chains.

The polyethylene (PE) segment is anticipated to register the fastest growth during the forecast period. PE corrugated sheets are known for flexibility, impact resistance and cost-effectiveness, making it ideal for lightweight packaging, protective surface covers and signage in indoor and outdoor environments. The softer texture of PE corrugated sheets are well suited for delicate handling in agricultural use and temporary construction setups. The recyclable nature of PE-based materials and the need to meet sustainability goals are driving a shift away from single-use options toward reusable solutions. Rising demand for eco-friendly, lightweight and multipurpose plastic sheets is further accelerating PE adoption across developed and emerging markets.

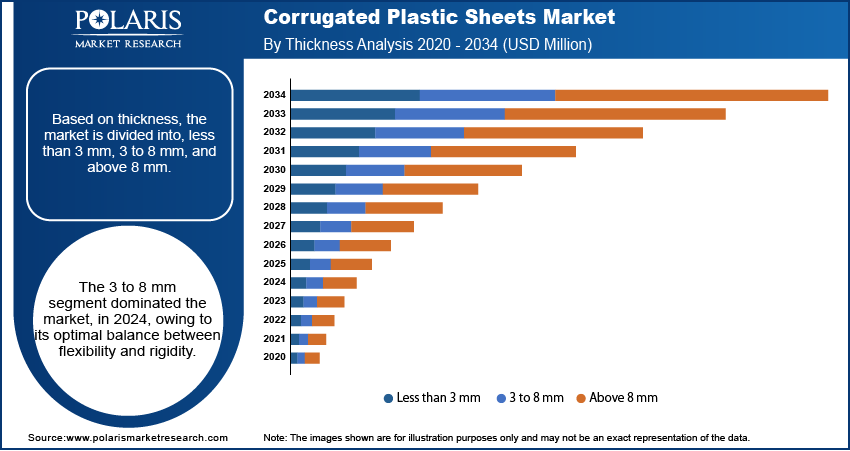

Thickness Analysis

The segmentation, based on thickness includes, less than 3 mm, 3 to 8 mm, and above 8 mm. The 3 to 8 mm segment dominated the market, in 2024, owing to its optimal balance between flexibility and rigidity. Corrugated plastic sheets in this thickness range are extensively used for returnable packaging boxes, warehouse partitions, layer pads and floor protection in construction. These sheets offer a suitable combination of strength and manageability, making them cost-effective and easy to transport. Industries such as food and beverage, electronics and logistics prefer this thickness as it provides sufficient durability to protect products during handling and transit without adding unnecessary weight.

The above 8 mm segment is projected to grow at the fastest pace during the forecast period. Sheets in this category are used in various applications such as heavy-duty protective barriers, structural panels in construction and reusable bins for high-load materials. The added thickness enhances impact strength, rigidity and weather resistance, making it suitable for outdoor and industrial environments where durability is essential. Construction and industrial users are turning to these thicker sheets as alternatives to plywood or metal panels in temporary structures, concrete formwork, and safety partitions. Their reusability along with low maintenance needs and long lifespan is driving the market grow rapidly.

End Use Analysis

The segmentation, based on end use includes, packaging, logistics & transportation, building & construction, agriculture & allied products, and other end uses. The packaging segment accounted for substantial share in 2024. This dominance is due to the rising need for moisture-resistant, impact-tolerant and reusable packaging materials across industries such as pharmaceuticals, electronics, food and beverage and industrial manufacturing. Corrugated plastic sheets are used to create custom-fit packaging solutions such as boxes, trays, sleeves and dividers, offering enhanced protection and efficiency during product transport and storage. In addition, the growing demand for sustainable packaging alternatives is pushing manufacturers to adopt corrugated plastic solutions that reduce waste and operating costs. For instance, Nestlé announced to design over 95% of its plastic packaging for recycling by the end of 2025, with the goal of reaching 100% recyclable or reusable packaging. The company also plans to cut its use of virgin plastic by one-third within the same timeframe.

The building & construction segment is forecasted to grow at the fastest rate over the coming years. Corrugated plastic sheets are used for several applications such as temporary floor protection, formwork liners, insulation backing and wall partitions on construction sites. The sheets’ lightweight nature and resistance to moisture and chemicals coupled with the ease of installation makes it a preferred choice among contractors and site managers looking for reliable and cost-efficient materials. Increasing investments in infrastructure, urban development and renovation projects are driving demand for building materials that offer reusability and safety. According to the Harvard University Joint Center for Housing Studies, home renovation spending in the US is expected to reach to USD 509 billion in 2025, surpassing the record of USD 487 billion set in 2023.

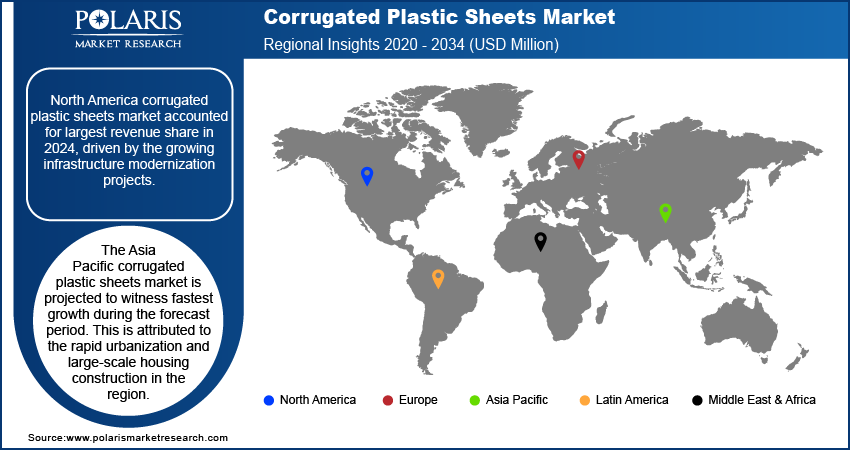

Regional Analysis

North America corrugated plastic sheets market accounted for largest revenue share in 2024, driven by the growing infrastructure modernization projects. Governments in the region are prioritizing investments in roads, bridges, public buildings and urban redevelopment projects. These initiatives fuel the adoption of protective materials that combine reusability, durability, and resistance to water and chemicals. Also, the rising implementation of automation technologies in manufacturing, warehousing and logistics facilities across the region is propelling the demand for lightweight, durable and stackable packaging materials. Corrugated plastic sheets offer an ideal solution for returnable containers, dividers and bins used in automated conveyor and storage systems. Growing adoption of automated material handling and lean logistics practices is driving demand for resilient and reusable packaging systems, thus accelerating the regional market expansion.

The US Corrugated Plastic Sheets Market Insight

The US dominated the regional share in 2024 due to the growing e-commerce sector in the country in the packaging and logistics segments. According to the US Census Bureau, retail e-commerce sales in the US reached USD 288.8 billion in Q3 2024, a 2.2% rise over the previous quarter. E-commerce accounted for 15.6% of total retail sales during this period, highlighting the growing logistics volumes and packaging needs in the country. Retailers shifting toward omnichannel distribution and investing in streamlined warehousing are increasing the preference for durable, reusable materials that safeguard products during storage and transit. Corrugated plastic sheets are used to create custom-fit packaging, containers and inserts that are lightweight and weather-resistant.

Asia Pacific Corrugated Plastic Sheets Market

The Asia Pacific corrugated plastic sheets market is projected to witness fastest growth during the forecast period. This is attributed to the rapid urbanization and large-scale housing construction in the region. Countries such as China, India, Indonesia, and Vietnam are investing heavily in urban development such as residential, commercial and infrastructural projects. For instance, in May 2025, the Asian Development Bank (ADB) announced a five-year investment plan committing up to USD 10 billion investment to enhance India’s urban infrastructure. The initiative prioritizes metro rail expansion, regional rapid transit systems (RRTS), and improvements in essential city services including water supply, sanitation and housing. These developments require cost-effective, moisture-resistant, and reusable construction materials. Corrugated plastic sheets are adopted for temporary floor protection, wall barriers, and covering surfaces during ongoing construction activities.

In addition, surge in agricultural exports across the region are accelerating the growing use of corrugated plastic sheets in packaging and transportation. Countries such as China and India are using plastic trays, crates and containers made from corrugated plastic to safely transport fresh produce, seafood and horticultural items to domestic and international markets. India Brand Equity Foundation reported that the country’s agricultural exports reached USD 26.41 billion in the fiscal year 2024–25. The growth in cold-chain logistics and rising demand for food quality and safety are pushing exporters to transition toward more durable and hygienic packaging solutions, strengthening regional demand.

Europe In Corrugated Plastic Sheets Market Overview

Europe corrugated plastic sheets market growth is driven by strict regulations on single-use plastics. The European Union imposed multiple bans and reduction targets that is pushing manufacturers, retailers, and logistics operators to shift to reusable packaging materials. Corrugated plastic sheets are recyclable, offer long service life and provide versatility, making it a sustainable alternative for various end-use industries. Businesses aiming to meet regional sustainability goals and circular economy directives are rapidly using corrugated plastic sheets for packaging, material handling and product protection.

Additionally, the growth in green building initiatives across Europe is accelerating the adoption of corrugated plastic sheets in the construction industry. The European Commission set a target to double renovation rates by 2030, aiming to enhance energy and resource efficiency across the building sector. Under this initiative, approximately 35 million buildings are expected to be renovated, potentially generating up to 160,000 new green jobs in construction by the end of the decade. Builders and contractors are adopting these sheets for protective purposes during renovations and construction of energy-efficient buildings. Moisture resistance, reusability, and thermal insulation capabilities make corrugated plastic sheets well-suited for modern building practices focused on reducing environmental impact. The emphasis on BREEAM and LEED certifications is further fueling the use of materials that are environmentally responsible and functionally effective, boosting market demand across region.

Key Players & Competitive Analysis Report

The corrugated plastic sheets market is highly competitive, with the presence of several established players and regional suppliers striving to expand their market footprint through product innovation, pricing strategies, and customized offerings. Companies operating in this space are actively investing in enhancing production capabilities, improving material performance, and developing environmentally sustainable alternatives to meet evolving industry demands. The competition is primarily driven by the increasing need for durable, reusable, and lightweight solutions across industries such as packaging, logistics, construction, and agriculture. Leading market players are focusing on expanding their distribution networks and strengthening customer relationships through value-added services, including custom fabrication, printing, and design consultation.

Prominent companies in the corrugated plastic sheets market include A&C Plastics, Inc., Inteplast Group, Coropak, Inc., DS Smith Plc, Falken Design Corporation, Grimco, Inc., International Paper Company, Karton S.p.A., Laird Plastics, Inc., Plaskolite LLC, Primex Plastics Corporation, Professional Plastics, Inc., Smurfit Kappa Group plc, Uline, Inc., and WestRock Company.

Key Players

- A&C Plastics, Inc.

- Inteplast Group

- Coropak, Inc.

- DS Smith Plc

- Falken Design Corporation

- Grimco, Inc.

- International Paper Company

- Karton S.p.A.

- Laird Plastics, Inc.

- Plaskolite LLC

- Primex Plastics Corporation

- Professional Plastics, Inc.

- Smurfit Kappa Group plc

- Uline, Inc.

- WestRock Company

Industry Developments

December 2024: Inteplast Group acquired CoolSeal USA, a Perrysburg, Ohio-based manufacturer specializing in polypropylene corrugated sheets and boxes. The acquisition enhances Inteplast’s sustainable packaging offerings and reinforces its focus on eco-conscious manufacturing and circular economy practices.

April 2024: Zeus Group acquired The Weedon Group, one of the largest independent integrated corrugated packaging manufacturers in the UK. The acquisition aligns with Zeus Group’s strategy to expand its capabilities in sustainable and innovative packaging solutions.

Corrugated Plastic Sheets Market Segmentation

By Material Type Outlook (Revenue, USD Million, 2020–2034)

- Polyethylene (PE)

- Polypropylene (PP)

- Other Material Types

By Thickness Outlook (Revenue, USD Million, 2020–2034)

- Less than 3 mm

- 3 to 8 mm

- Above 8 mm

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Packaging

- Logistics & Transportation

- Building & Construction

- Agriculture & Allied Products

- Other End Uses

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Corrugated Plastic Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,080.39 Million |

|

Market Size in 2025 |

USD 1,131.21 Million |

|

Revenue Forecast by 2034 |

USD 1,722.94 Million |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,080.39 million in 2024 and is projected to grow to USD 1,722.94 million by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are A&C Plastics, Inc., Inteplast Group, Coropak, Inc., DS Smith Plc, Falken Design Corporation, Grimco, Inc., International Paper Company, Karton S.p.A., Laird Plastics, Inc., Plaskolite LLC, Primex Plastics Corporation, Professional Plastics, Inc., Smurfit Kappa Group plc.

The polypropylene (PP) segment dominated the market share in 2024.

The polyethylene (PE) segment is anticipated to register the fastest growth during the forecast period.