Drone Data Services Market Share, Size, Trends, Industry Analysis Report

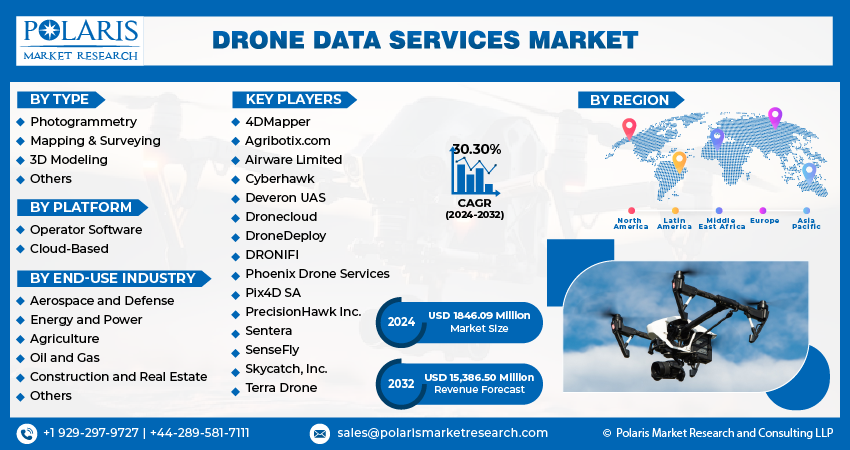

By Type (Photogrammetry, Mapping & Surveying, 3D Modeling, Others); By Platform; By End Use Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4032

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

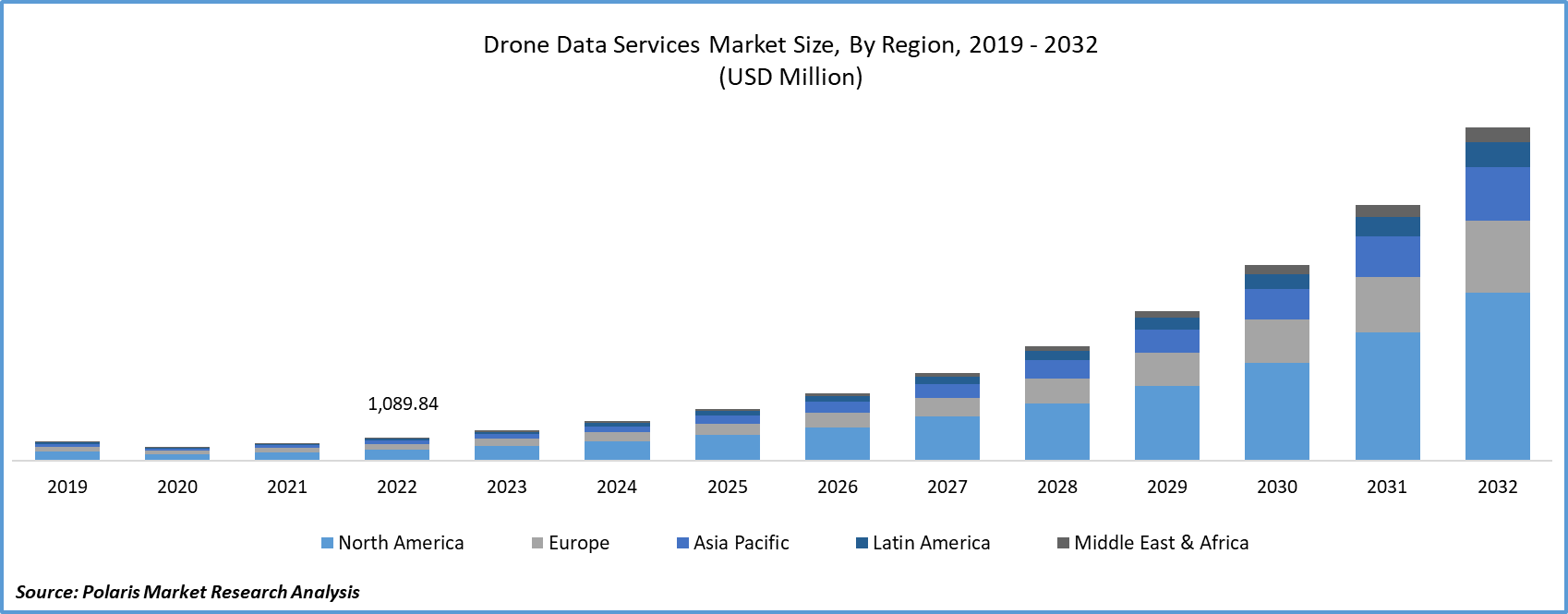

The global drone data services market was valued at USD 1418.21 million in 2023 and is expected to grow at a CAGR of 30.30% during the forecast period.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the drone data services market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Drones enhance safety by reducing the need for human workers to access hazardous or hard-to-reach areas. In sectors like infrastructure inspection and emergency response, drones enhance worker safety while providing valuable data.

To Understand More About this Research: Request a Free Sample Report

The cost-effectiveness of drone data services is a substantial driver. Reduced operational expenses, especially in labor and equipment, make drones an attractive choice for businesses looking to cut costs while improving data quality.

In addition, several companies are expanding their offerings to cater to the growing consumer demand.

- In March 2023, Vodafone and Dimetor introduced DroNet, a digital data service that assesses the safety of commercial drone flights.

The integration of data analytics and artificial intelligence (AI) is transforming data interpretation and insights. Drones collect vast datasets, and the application of AI algorithms enables more sophisticated analysis, predictive capabilities, and automation of routine tasks.

Environmental concerns, including climate change and biodiversity loss, are driving the use of drones for monitoring and protecting ecosystems. Drones provide a non-invasive, cost-effective means of conducting aerial surveys, contributing to conservation and sustainability efforts.

The pandemic accelerated the need for contactless and remote solutions. Drone data services, offering minimal physical interaction, gained prominence in various industries, including healthcare, logistics, and construction. Drones played a crucial role in healthcare, monitoring quarantine areas, and providing aerial surveillance for large gatherings. The pandemic underscored the value of drones in healthcare logistics and emergency response.

Growth Drivers

- Diverse applications, supportive regulatory framework, and technological advancements is projected to spur the drone data services market demand

Ongoing advancements in drone technology, such as the integration of LiDAR, hyperspectral imaging, and multi-sensor systems, enhance the accuracy and capabilities of data collection. These innovations enable drones to capture more comprehensive and detailed data, expanding their utility across various industries.

Supportive regulatory frameworks that provide clear guidelines for drone operations foster market growth. Governments and aviation authorities are actively working to strike a balance between safety and innovation, ensuring that drones can be safely integrated into airspace.

The diversification of industries adopting drone data services presents significant growth opportunities. Beyond traditional sectors like agriculture and construction, drones are increasingly employed in applications such as insurance, real estate, and cultural heritage preservation.

Report Segmentation

The market is primarily segmented based on type, platform, end-use industry, and region.

|

By Type |

By Platform |

By End-Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Mapping & Surveying segment accounted for a significant share in 2022

The mapping and surveying segment accounted for a significant share in 2022. The employment of drone data services in mapping and surveying accelerates data acquisition while elevating precision, providing invaluable information for an array of industries, including urban planning, agriculture, natural resource management, and infrastructure development. Drones capture detailed, high-resolution aerial images that offer a comprehensive overview of landscapes, topographical features, and structures. This visual data is pivotal for the creation of intricate maps and the execution of surveys. Drones can produce precise 3D models of terrain, buildings, and objects. These models play a fundamental role in architectural design, land development, and the visualization of construction projects. Drones exhibit rapid response capabilities for disaster assessment and management. They can swiftly survey areas affected by disasters, thereby bolstering emergency response endeavors. The incorporation of drones in mapping and surveying processes significantly reduces costs in comparison to traditional surveying methods. This results in resource and time savings.

By Platform Analysis

- Operator software emerged as the largest segment in 2022

The operator software segment emerged as the largest segment in 2022. Operator software platforms allow for the efficient management and storage of drone-generated data. This includes images, videos, and other sensor data collected during flights. These platforms often provide real-time monitoring of drone operations. Operators can track the drone's location, status, and performance while it's in flight. They enable operators to plan and customize drone flights. This includes defining flight paths, setting waypoints, and establishing geofencing for safe and controlled operations. Many platforms include data analysis tools that process and interpret the data collected by the drone. This can range from simple image analysis to more complex tasks like creating 3D models. Operator software platforms often integrate with various sensors and payloads, allowing drones to be equipped with the necessary tools for specific tasks, such as thermal imaging cameras or LiDAR sensors.

By End Use Industry Analysis

- Construction and real estate segment to experience considerable growth during the forecast period

The construction and real estate segment is expected to experience considerable growth during the forecast period. Drones conduct comprehensive aerial surveys of construction sites, delivering an all-encompassing perspective for effective site planning, design, and terrain evaluation. Aerial drones undertake safety inspections at construction sites, mitigating the inherent risks associated with manual inspections conducted at elevated or challenging locations. Equipped with cutting-edge cameras and LiDAR technology, drones generate meticulously detailed topographic maps and three-dimensional models, elevating the accuracy of surveying. Drones contribute to environmental impact assessments, aiding construction firms in adherence to environmental regulations and minimizing their ecological footprint. Aerial drones capture striking visual content of real estate properties, elevating property listings and captivating the interest of potential buyers or renters. Aerial images garnered from drones provide invaluable data for property appraisals, enhancing the accuracy of real estate asset valuation.

Regional Insights

- North America emerged as the largest region in 2022

North America emerged as the largest region in 2022. The region's diverse sectors, ranging from agriculture to construction and energy, have embraced drone technology for data collection, analysis, and surveillance. The United States, in particular, has established well-defined regulations governing commercial drone operations, providing a structured framework that fosters the growth of service providers and businesses in the sector. Companies in North America are at the forefront of drone technology development. They manufacture sophisticated drones equipped with advanced sensors, cameras, and software for data acquisition and analysis. The region has witnessed significant growth in the application of data analytics and artificial intelligence (AI) in drone data services. These technologies are harnessed to extract valuable insights from the data collected, thereby enhancing decision-making.

Asia-Pacific is expected to experience significant growth during the forecast period. The drone data services industry in Asia-Pacific is marked by rapid growth and diverse applications. This growth is driven by the increasing adoption of drone technology for various purposes, including agriculture, construction, environmental monitoring, and disaster management. Governments in Asia-Pacific are progressively developing and refining regulations related to drone operations. Although regulatory structures differ from country to country, there is a noticeable trend towards greater comprehensiveness and supportiveness, which results in a well-organized framework for the commercial use of drones. Furthermore, businesses in the area are deeply engaged in advancing drone technology, fabricating drones equipped with custom sensors, cameras, and software that cater to the specific requirements of various industries.

Key Market Players & Competitive Insights

The drone data services sector exhibits a fragmented landscape, and competition is expected to intensify due to the active participation of numerous players. Prominent firms in this industry consistently introduce innovative strategies to bolster their market position. These key players prioritize strategies like forming partnerships and fostering collaborations to gain a competitive edge over their peers and establish a significant market presence.

Some of the major players operating in the global market include:

- 4DMapper

- Agribotix.com

- Airware Limited

- Cyberhawk

- Deveron UAS

- Dronecloud

- DroneDeploy

- DRONIFI

- Phoenix Drone Services

- Pix4D SA

- PrecisionHawk Inc.

- Sentera

- SenseFly

- Skycatch, Inc.

- Terra Drone

Recent Developments

- In February 2021, Delta Drone International expanded its operations in Africa for effective delivery of services to its client, Syngenta.

Drone Data Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1846.09 million |

|

Revenue forecast in 2032 |

USD 15,386.50 million |

|

CAGR |

30.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Platform, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Uncover the dynamics of the drone data services sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Surgical Dressing Market Size, Share 2024 Research Report

Solar Inverters/Pv Inverters Market Size, Share 2024 Research Report

Powder Coatings Market Size, Share 2024 Research Report

Lecithin Market Size, Share 2024 Research Report

Fitness App Market Size, Share 2024 Research Report