Edge AI Accelerator Market Size, Share, Trends, Industry Analysis Report

: By Processor [Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Array (FPGA)], Device, End Use, Function, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5632

- Base Year: 2024

- Historical Data: 2020-2023

Edge AI Accelerator Market Overview

Edge AI accelerator market size was valued at USD 7.60 billion in 2024. The edge AI accelerator industry is projected to grow from USD 9.92 billion in 2025 to USD 110.21 billion by 2034, exhibiting a CAGR of 30.7% during 2025-2034.

An edge AI accelerator is a specialized hardware component designed to efficiently process artificial intelligence (AI) workloads, particularly on devices located at the edge of a network, such as smartphones, IoT sensors, and smart cameras. These accelerators are crucial for edge AI, which involves running AI algorithms directly on local devices rather than relying on cloud servers. This approach allows for real-time data processing, reduced latency, enhanced data privacy, and lower bandwidth costs, making it ideal for applications requiring immediate responses and high reliability, such as autonomous vehicles and healthcare devices. Edge AI accelerators, often in the form of GPUs, TPUs, or NPUs, are optimized for parallel computation, enabling fast execution of machine learning tasks such as object detection and image classification. The usage of edge AI accelerators spans various industries and devices. They are used in smart speakers to quickly detect wake words, in wearables for real-time health monitoring, and in manufacturing for automated defect detection.

The rising focus on cloud computing across the globe is propelling the edge AI accelerator market growth. Cloud computing generates vast amounts of data that need real-time processing and analysis. Edge AI accelerators play a crucial role in this environment by enabling data processing closer to the source, reducing latency, and enhancing the efficiency of cloud operations. Moreover, edge AI accelerators enhance the reliability and security of cloud computing systems by processing data locally. This localized processing also mitigates the impact of network outages, ensuring continuous operation even when cloud connectivity is disrupted. These benefits offered by edge AI accelerators make them a critical component in cloud computing. Therefore, the demand for edge AI accelerators is increasing with the rising focus on cloud computing across the globe.

To Understand More About this Research: Request a Free Sample Report

The edge AI accelerator market demand is driven by the increasing penetration of smartphones globally. Smartphones handle complex tasks such as real-time language translation, advanced photography, and augmented reality, which require instant data analysis. Edge AI accelerators enable these features by performing computations directly on the device, reducing latency and improving user experience compared to cloud-dependent solutions. Additionally, smartphone applications increasingly rely on AI-driven features such as voice assistants, facial recognition, and predictive text, which must operate seamlessly even without internet connectivity. Edge AI accelerators ensure these functions remain reliable by providing the necessary computational power for real-time inference. Hence, the demand for edge AI accelerators is increasing with the growing penetration of smartphones globally. For instance, according to the Groupe Speciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population have smartphones.

Edge AI Accelerator Market Dynamics

Increasing Adoption of Wearable Devices

Wearables such as fitness trackers and health monitors generate continuous streams of biometric data that require instant analysis. Edge AI accelerators enable these devices to process heart rate, sleep patterns, and activity metrics locally without relying on cloud servers, ensuring faster insights and reducing latency for critical health alerts. Privacy and security concerns further drive the shift toward edge AI processing in wearables. Health and fitness data are highly sensitive, and transmitting this information to the cloud increases exposure to breaches. Edge AI accelerators allow wearables to analyze data directly on the device, minimizing data transfers and complying with strict regulations such as HIPAA and GDPR. This localized processing builds user trust and meets growing regulatory demands, making edge acceleration essential for next-generation wearables. Thus, as the adoption of wearable devices increases globally, the demand for edge AI accelerators also spurs. For instance, according to the Health Information National Trends Survey, almost 1 in 3 Americans use a wearable device, such as a smartwatch or band.

Rising Investment in Smart Home

Smart home ecosystems rely on real-time decision-making for tasks such as security monitoring, energy management, and voice-controlled automation. Edge AI accelerators enable devices like smart cameras, thermostats, and speakers to analyze data locally, reducing dependence on cloud servers and minimizing latency, offering real-time decision-making. Energy efficiency and cost savings further fuel demand for edge AI solutions in smart homes. Cloud-based processing requires constant connectivity and increases operational expenses for manufacturers and users. Edge AI accelerators optimize power usage by handling computations locally, extending device battery life, and reducing bandwidth costs. Hence, the rising investment in smart homes is propelling the edge AI accelerator market revenue.

Edge AI Accelerator Market Assessment by Segment

Edge AI Accelerator Market Evaluation by Processor

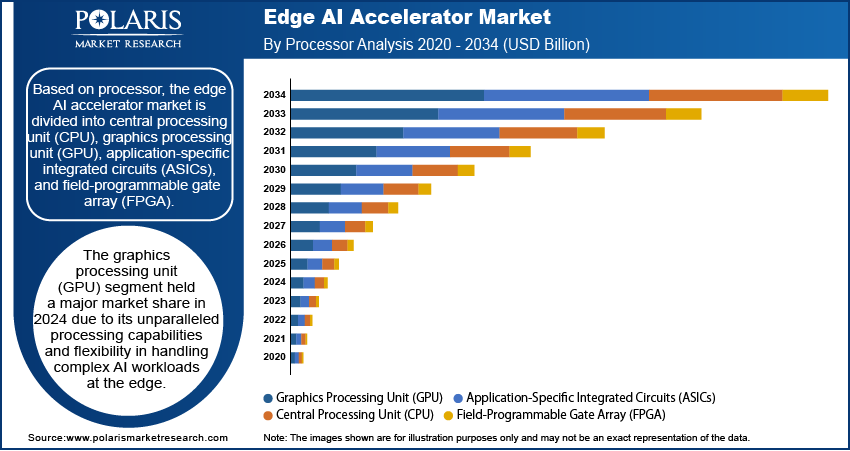

Based on processor, the edge AI accelerator market is divided into central processing unit (CPU), graphics processing unit (GPU), application-specific integrated circuits (ASICs), and field-programmable gate array (FPGA). The graphics processing unit (GPU) segment held a major market share in 2024 due to its unparalleled processing capabilities and flexibility in handling complex AI workloads at the edge. GPUs are highly efficient in processing multiple data streams simultaneously, which makes them ideal for running deep learning algorithms and neural networks required in edge computing scenarios. The broad compatibility of GPUs with AI frameworks such as TensorFlow and PyTorch further accelerated their adoption across industries such as autonomous vehicles, smart surveillance, and robotics. Companies increasingly favored GPUs for their ability to deliver high throughput and low latency, crucial for real-time inference at the edge. Additionally, advancements in power efficiency and thermal design allowed GPUs to meet the stringent requirements of edge environments without compromising performance.

The application-specific integrated circuits (ASICs) segment is expected to grow at a robust pace in the coming years owing to their optimized architecture for specific AI tasks and unmatched energy efficiency. ASICs significantly reduce inference time and power consumption by eliminating the overhead of general-purpose hardware, making them ideal for deployment in power-sensitive and space-constrained devices such as smart cameras, wearables, and industrial IoT devices. Major tech firms are heavily investing in custom AI chips tailored for edge inference, enabling faster processing, lower costs, and improved scalability, thereby boosting demand for application-specific integrated circuits (ASICs).

Edge AI Accelerator Market Insight by Device

In terms of device, the edge AI accelerator market is segregated into smartphones, IoT devices, robots, and cameras. The smartphone segment dominated the edge AI accelerator market share in 2024 due to the widespread integration of AI features and the proliferation of 5G technology. Manufacturers embedded advanced neural processing units (NPUs) into mobile chipsets, enabling on-device inference for tasks such as real-time language translation, facial recognition, and camera scene detection. Consumers increasingly demanded enhanced user experiences powered by AI, prompting smartphone manufacturers to prioritize edge computing capabilities. The rapid global adoption of 5G further accelerated the demand for smartphones, contributing to edge AI accelerator market expansion.

The IoT devices segment is estimated to grow at a robust pace during the forecast period, owing to their growing presence in smart homes, industrial automation, and connected healthcare. Developers are designing IoT devices with energy-efficient AI chips capable of handling inference tasks such as anomaly detection, predictive maintenance, and environmental monitoring without relying on cloud connectivity. Governments and enterprises are heavily investing in smart infrastructure, further boosting demand for intelligent edge devices, including IoT devices.

Edge AI Accelerator Market Regional Analysis

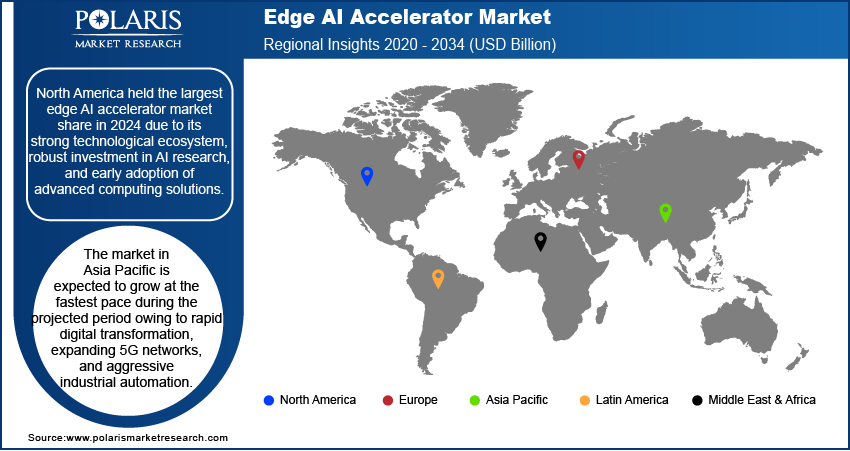

By region, the edge AI accelerator market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America held the largest edge AI accelerator market share in 2024 due to its strong technological ecosystem, robust investment in AI research, and early adoption of advanced computing solutions. The US led the region, driven by the presence of major semiconductor companies such as NVIDIA, Intel, and AMD, along with prominent cloud and AI service providers. These firms continuously innovated to deliver high-performance, low-latency edge computing solutions tailored for applications in autonomous vehicles, smart cities, and defense systems. Government initiatives promoting AI development, such as the National AI Initiative Act, also played a crucial role in accelerating the deployment of edge AI accelerators. Furthermore, an established infrastructure and high penetration of connected devices such as smartphones in the region allowed enterprises across industries to adopt edge AI accelerators. For instance, according to data published by the Pew Research Center in November 2024, 91% of Americans own a smartphone.

The market in Asia Pacific is expected to grow at the fastest pace during the projected period owing to rapid digital transformation, expanding 5G networks, and aggressive industrial automation. China is estimated to dominate the region, supported by substantial government funding, a vast manufacturing base, and the strategic focus of companies such as Huawei, Alibaba, and Baidu on AI and edge technologies. The country has integrated smart surveillance systems, autonomous mobility platforms, and AI-driven manufacturing at a large scale, contributing to market expansion. Countries such as South Korea, Japan, and India are further making substantial advancements in edge AI accelerators by investing in smart infrastructure and localized AI innovation.

Edge AI Accelerator Key Market Players & Competitive Analysis Report

The edge AI accelerator market is highly competitive, driven by the rapid adoption of AI technologies in various industries and the growing demand for real-time data processing at the edge. Key players are leveraging strategic mergers, acquisitions, partnerships, and collaborations to strengthen their market position and expand their product portfolios. These moves not only enhance their technological offerings but also enable them to cater to diverse industry needs, from autonomous vehicles to smart cities. Meanwhile, startups such as Hailo and Mythic are gaining traction through innovative architectures and securing funding via strategic alliances with automotive and consumer electronics giants.

The edge AI accelerator market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Apple Inc.; EdgeCortix Inc.; Google LLC; Hailo Technologies Ltd.; Huawei Technologies Co., Ltd.; IBM; Intel Corporation; Infineon; Mythic; NVIDIA Corporation; Qualcomm Technologies, Inc.; and Rapidus Corporation.

EdgeCortix Inc., founded in July 2019, is a fabless semiconductor company headquartered in Tokyo, Japan, with a global presence spanning Singapore, India, and the United States. The company specializes in developing energy-efficient AI accelerators for edge computing, addressing the growing need for near cloud-level performance with significantly reduced power consumption and cost. EdgeCortix's innovative approach integrates software-driven hardware design, exemplified by its proprietary dynamic neural accelerator (DNA) architecture and MERA Compiler framework. These technologies enable real-time processing of complex AI models, including Generative AI and Large Language Models (LLMs), in low-power environments. EdgeCortix's focus on co-developing software IP and chip design has positioned it as a major player in the edge AI market, solving critical challenges such as energy efficiency and latency.

Intel Corporation, a global comapny in semiconductor technology, has been actively advancing its presence in the edge AI market through innovative solutions and strategic partnerships. Intel's edge AI offerings are designed to empower enterprises to integrate AI into existing infrastructure seamlessly, leveraging its extensive experience in edge computing. The company's Edge Platform is a modular and open software platform that enables businesses to build, deploy, manage, and scale edge and AI applications efficiently. This platform supports heterogeneous components, reducing total cost of ownership (TCO) and providing zero-touch, policy-based management across a fleet of edge nodes with a unified interface

Key Companies in the Edge AI Accelerator Market

- Apple Inc.

- EdgeCortix Inc.

- Google LLC

- Hailo Technologies Ltd.

- Huawei Technologies Co., Ltd.

- IBM

- Intel Corporation

- Infineon Technologies

- Mythic

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Rapidus Corporation

Edge AI Accelerator Market Developments

September 2024: Intel announced the launch of Xeon 6 with Performance-cores (P-cores) and Gaudi 3 AI accelerators to enable a new era of high-performance enterprise AI systems and solutions.

May 2024: EdgeCortix Inc., a major fabless semiconductor company specializing in energy-efficient AI processing, announced the launch of its next-generation SAKURA-II Edge AI accelerator. SAKURA-II empowers users to seamlessly manage a wide range of complex tasks, including Large Vision Models (LVMs), Large Language Models (LLMs), and multi-modal transformer-based applications.

October 2024: Infineon, a global semiconductor manufacturer, introduced the DEEPCRAFT brand for Edge AI software solutions.

Edge AI Accelerator Market Segmentation

By Processor Outlook (Revenue, USD Billion, 2020-2034)

- Central Processing Unit (CPU)

- Graphics Processing Unit (GPU)

- Application-Specific Integrated Circuits (ASICs)

- Field-Programmable Gate Array (FPGA)

By Device Outlook (Revenue, USD Billion, 2020-2034)

- Smartphones

- IoT Devices

- Robots

- Cameras

By End Use Outlook (Revenue, USD Billion, 2020-2034)

- Healthcare

- Natural Language Processing (NLP)

- Retail

- Manufacturing

- Security and Surveillance

- Others

By Function Outlook (Revenue, USD Billion, 2020-2034)

- Training

- Interference

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Edge AI Accelerator Market Report Scope

|

Report Attributes |

Details |

|

Edge AI Accelerator Market Value in 2024 |

USD 7.60 Billion |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 9.92 Billion |

|

Revenue Forecast in 2034 |

USD 110.21 Billion |

|

CAGR |

30.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global edge AI accelerator market size was valued at USD 7.60 billion in 2024 and is projected to grow to USD 110.21 billion by 2034.

The global market is projected to grow at a CAGR of 30.7% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Apple Inc.; EdgeCortix Inc.; Google LLC; Hailo Technologies Ltd.; Huawei Technologies Co., Ltd.; IBM; Intel Corporation; Infineon; Mythic; NVIDIA Corporation; Qualcomm Technologies, Inc.; and Rapidus Corporation.

The graphics processing unit (GPU) segment dominated the edge AI accelerator market revenue in 2024.

The IoT devices segment is expected to grow at the fastest pace in the coming years.