High Purity Sulfuric Acid Market Size, Share, Trends, & Industry Analysis Report

By Grade (PBT and PPT), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5935

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

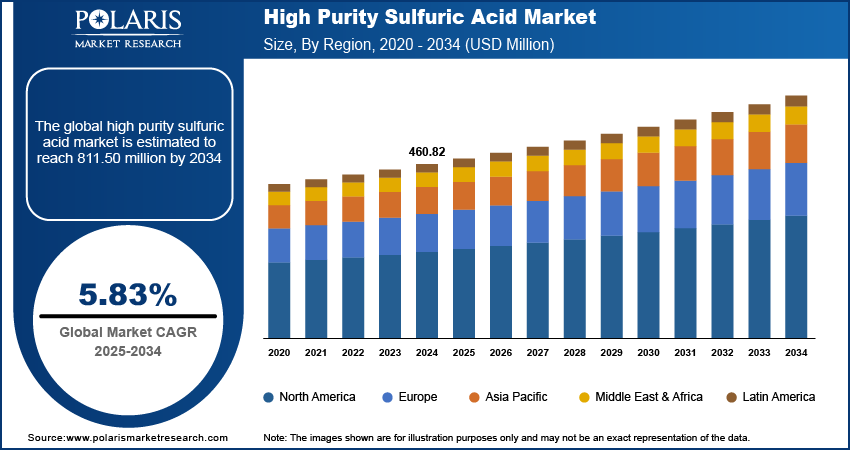

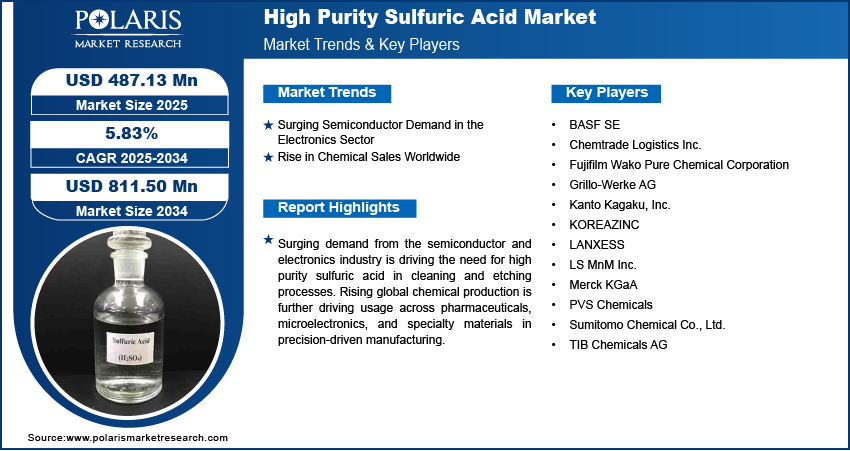

The global high purity sulfuric acid market size was valued at USD 460.82 million in 2024, growing at a CAGR of 5.83% from 2025–2034. Rising demand for high purity sulfuric acid is attributed to the rapid growth in semiconductor usage within the electronics industry along with increasing chemical sales worldwide.

High purity sulfuric acid refers to a refined chemical compound with extremely low levels of impurities, produced through advanced distillation or purification techniques. This grade of sulfuric acid is widely used in applications requiring high stability and ultra-low contamination, including semiconductor manufacturing and photovoltaic cell production to ensure precision and product integrity. It serves a crucial function in wafer cleaning, etching, and doping during integrated circuit fabrication, where high material purity is essential to ensure optimal device performance and yield.

To Understand More About this Research: Request a Free Sample Report

The acid is available in multiple concentrations and packaging formats based on end-use requirements and handled under stringent safety and quality protocols to prevent material degradation or contamination. It is used across sectors such as electronics and chemicals for precision cleaning, catalyst regeneration and battery electrolyte formulation. Additionally, high purity sulfuric acid is gaining significance in high-end industrial research and specialized chemical synthesis due to its ability to maintain consistent process conditions. Its controlled composition and compatibility with sensitive manufacturing environments continue to drive demand across global high-tech and cleanroom applications.

Stricter cleanroom standards in high-precision industries are fueling demand for high purity sulfuric acid, as manufacturers seek to minimize contamination during production. Sectors such as semiconductors, pharmaceuticals and advanced electronics rely on tightly controlled environments to meet quality, safety and performance benchmarks. Regulatory requirements and industry standards are driving stricter controls on particulate levels and contamination throughout the fabrication process, leading to greater demand for ultra-pure processing chemicals that support consistency, high yields and product reliability.

Additionally, the expansion of global solar photovoltaic (PV) installations is increasing the use of high purity sulfuric acid in panel manufacturing processes. Solar panel production involves precise etching, surface cleaning and doping stages, where acid purity directly impacts conversion efficiency and material performance. Manufacturers are adopting higher-grade chemical inputs to support consistent production and improve output quality to meet rising energy demand and climate targets. According to the International Energy Agency (IEA), renewable capacity including PV rose by nearly 510 GW in 2023 and is expected to hit 7,300 GW by 2028, driven by declining costs and supportive policies in developed and developing countries. This growth is pushing manufacturers to improve quality control and scale production due to which demand for low-contaminant, high purity sulfuric acid is increasing to ensure clean and stable surface processing in high-volume solar module fabrication.

Industry Dynamics

Surging Semiconductor Demand in the Electronics Sector

The rapid growth of semiconductor in electronics industry is fueling demand for high purity sulfuric acid, which is essential for precision cleaning, etching and surface preparation in advanced chip manufacturing processes. Chip manufacturing is moving toward smaller nodes and advanced packaging, leading to increasingly stringent chemical purity requirements. According to SEMI, global semiconductor equipment spending increased from USD 107.4 million in 2022 to USD 124 million in 2025, driven by increasing demand for logic, memory and sensor chips used in computing and consumer electronics. This growth is driving fabrication plants to scale up production while adhering to strict contamination controls, thereby increasing the demand for ultra-pure process chemicals. Therefore, with rising chiplet output and supply chain localization, the demand for high-grade sulfuric acid is expected to grow significantly in the coming years.

Rise in Chemical Sales Worldwide

The global rise in chemical sales is fueling demand for high purity sulfuric acid, as growing output of specialty and performance chemicals requires stable, contamination-free inputs that meet strict quality standards. According to European Chemical Industry Council (Cefic), the global chemical sale reached over USD 5.57 million in 2023 from USD 3.67 million in 2013, reflecting continued expansion in industrial production, electronics and consumer goods sectors. Manufacturers are increasing procurement of high-grade chemicals to ensure product consistency in formulations that require precise pH control, catalyst activation along with raw material purification. Rising chemical output is also driving investments in cleanroom technology, further strengthening demand for ultra-pure acid formulations across global production hubs.

Segmental Insights

Grade Analysis

The segmentation, based on grade includes, PPB and PPT. The PPB segment is projected to grow rapidly by 2034. This is due to its widespread adoption in semiconductor and electronics manufacturing where ultra-trace purity is crucial for ensuring defect-free wafer processing. PPB-grade sulfuric acid is used extensively in advanced node fabrication processes, including wafer cleaning, etching and doping, where a minimal metallic contamination impacts the yield. The increasing complexity of chip architectures and the reduction of transistor sizes below 5nm are driving a growing demand for ultra-high purity acids that meet stringent contamination thresholds. Its dominance is supported by strong demand from logic chip manufacturers and foundries that requires acid purity levels below 100 ppt for defect-free processing.

The PPT segment is projected to expand at a notable pace through 2034, as advanced semiconductor manufacturing processes demand ultra-low metal contamination levels. Its suitability for cleaning and etching applications in microelectronics, photovoltaics and pharmaceutical production broadens its relevance across high-precision industries. Thus, advancements in purification technologies are improving product consistency and purity, leading to market expansion.

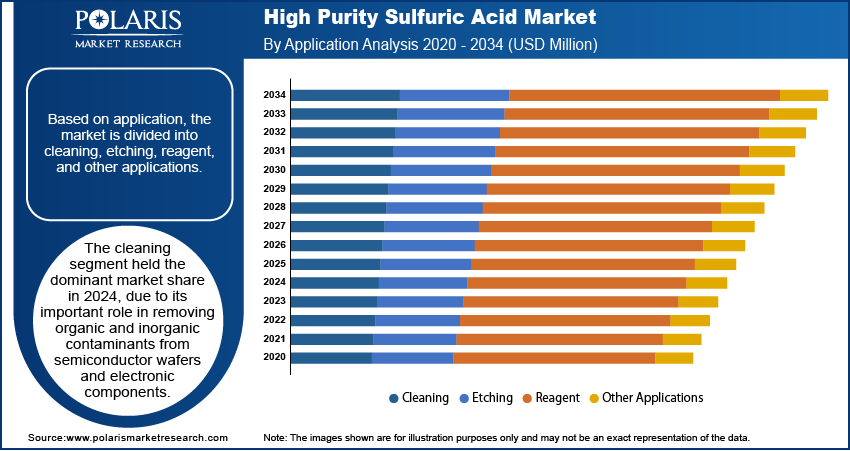

Application Type Analysis

The segmentation, based on application includes, cleaning, etching, reagent, and other applications. The cleaning segment held the dominant market share in 2024, due to its important role in removing organic and inorganic contaminants from semiconductor wafers and electronic components. It is widely adopted in wafer fabrication and microelectronic assembly processes, where strict control over trace impurities is essential to maintain device performance and manufacturing precision. The cleaning application also benefits from stringent regulatory standards and the increasing miniaturization of electronic devices necessitate ultra-clean production environments.

The etching segment is estimated to hold a significant market share in 2034, fueled by the growth of power management IC production and the use of advanced lithography methods in precision etching, which allow for the creation of detailed circuit patterns on silicon wafers. Its compatibility with other etchants and ability to deliver consistent results across various process nodes make it indispensable for foundries and device manufacturers. The growing complexity of semiconductor architectures and the push toward sub-5nm technologies are expected to further elevate demand for high-purity etching solutions.

End User Analysis

The segmentation, based on end user includes, semiconductor & electronics, pharmaceutical & healthcare, chemical processing, energy & power, and other end user. The semiconductor & electronics segment captured substantial share of the market in 2024, due to the increasing need for contamination-free chemical inputs in wafer cleaning, etching and photolithography. These chemicals are essential in front-end processes, where removing particles, metal ions and organic matter helps improve chip yield. The growing production of advanced chips below 5nm, along with the expansion of fabrication facilities in multiple regions is boosting the demand for ultra-clean process chemicals used in manufacturing. For example, in June 2025, Texas Instruments planned to build two new semiconductor fabrication plants, reflecting the industry’s push for advanced, contamination-free manufacturing environments. This trend underscores the segment’s dominance in driving demand for high purity chemicals essential for next-generation semiconductor manufacturing.

The pharmaceutical & healthcare segment is estimated to grow at a significant CAGR from 2025-2034, fueled by the increasing reliance on ultra-pure reagents in drug formulation, quality control and laboratory-scale synthesis. This acid is used to prepare analytical-grade solutions and catalyze reactions under sterile conditions, where chemical consistency is crucial to meet health authority standards. The rise in biologics production, sterile injectable formulations along with precision-based diagnostics is expanding application demand across pharmaceutical cleanrooms and R&D centers. Additionally, the expansion of bio-manufacturing and regulated lab environments is driving suppliers to scale up the supply of ultra-clean acid formulations specifically designed to meet pharmaceutical industry standards.

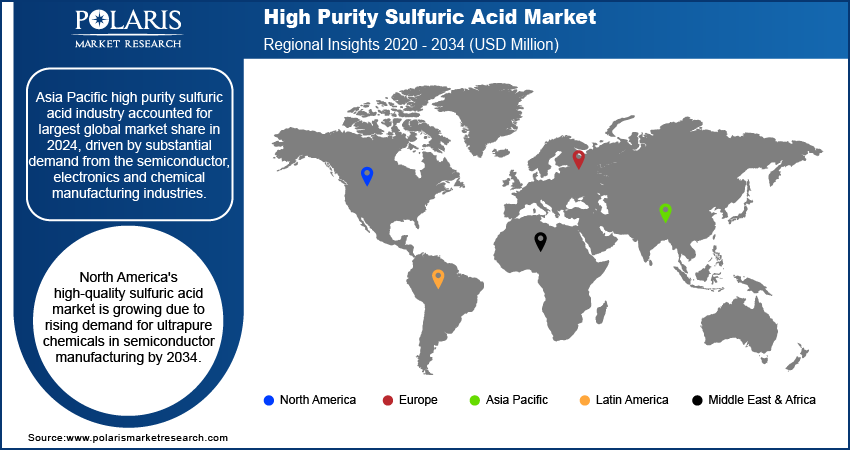

Regional Analysis

Asia Pacific high purity sulfuric acid industry accounted for largest global market share in 2024, driven by substantial demand from the semiconductor, electronics and chemical manufacturing industries. Countries such as China, Japan, South Korea and Taiwan maintain high-volume production capacities for integrated circuits and advanced batteries that requires ultra-pure chemical input. The region benefits from a well-established supply chain, low production costs as well as increasing government focus that strengthens domestic chip manufacturing and electric mobility. Additionally, rising investment in pharmaceutical synthesis and high-performance materials is contributing to sustained demand for reagent-grade sulfuric acid across key industrial zones.

China High Purity Sulfuric Acid Market Insight

The China dominated the regional share of the North America high purity sulfuric acid market insight market in 2024. This growth is primarily driven by the rapid expansion of semiconductor fabrication facilities, which require ultra-clean and contamination-free chemical environments. Local manufacturers are scaling up production of semiconductor-grade sulfuric acid to support domestic chip manufacturing to meet rising demand. According to the Semiconductor Industry Association, China’s share of global semiconductor fabrication capacity reached 11% in 2019 and is projected to occupy 19% by 2030. Additionally, the country’s growing investment in purification technologies and acid recovery systems is further strengthening its position in the regional market.

North America High Purity Sulfuric Acid Market

The North America high quality sulfuric acid industry is projected to reach at a significant revenue share by 2034. This is due to the growing demand for ultrapure processing chemicals that is driving companies to enhance their production capabilities to meet evolving semiconductor requirements. For instance, in May 2025, Chemtrade Logistics announced a major upgrade to its ultrapure sulfuric acid plant that aims to meet the quality requirements for next generation semiconductor nodes. The nodes involve advanced design rules and reduced geometries, which require tighter control over contamination in wafer cleaning and etching stages. The upgrade highlights the increasing material precision required in modern semiconductor production, where purity directly impacts line yield and process efficiency. Enhancements in purification systems and process control are helping producers deliver consistent quality at scale, driving the industry's shift toward advanced node technologies and higher throughput manufacturing.

US High Purity Sulfuric Acid Market Assessment

The US market for high-quality sulfuric acid is primarily driven by robust demand from the semiconductor and electronics industries, where ultra-pure sulfuric acid is essential for wafer cleaning and etching processes. Strict environmental regulations have further accelerated the adoption of high-purity grades, as manufacturers aim for compliant solutions, for industrial applications. Additionally, technological advancements in purification processes have also enhanced product quality, meeting the exacting standards of advanced manufacturing sectors.

Europe High Purity Sulfuric Acid Market Overview

The Europe high purity sulfuric acid market is expected to grow substantially by 2034, driven by the increasing focus on clean energy and the rise in solar module production, which is generating steady demand for high purity sulfuric acid used in critical photovoltaic processes to ensure efficiency and product reliability. Manufacturers are prioritizing high-efficiency cell designs that rely on ultra-pure chemical inputs to maintain performance standards and reduce defect rates. According to the Solar Power Europe, the cumulative installed solar PV capacity across the EU-27 reached 269 GW by the end of 2023 and is expected to hit 671 GW solar capacity by 2028. This accelerated deployment of residential and utility-scale solar projects is accompanied by rising performance and quality standards, driving steady demand for high-grade processing chemicals in solar manufacturing facilities across Europe.

UK High Purity Sulfuric Acid Market

The UK market benefits from strong research and development initiatives in specialty chemicals, particularly for pharmaceutical and fine chemical production. The presence of leading semiconductor fabrication plants and a well-established chemical processing industry sustains demand for high-purity sulfuric acid. Government incentives for sustainable chemical manufacturing further encourage the use of refined sulfuric acid grades. Collaborative efforts between academia and industry continue to drive innovations in acid recovery and recycling, reinforcing the market’s growth trajectory.

Key Players & Competitive Analysis Report

The high purity sulfuric acid market is moderately consolidated, with a combination of global chemical manufacturers and specialized regional suppliers competing on purity levels, production technology and supply reliability. Companies are focusing on refining processes such as double distillation and wet purification to meet the stringent quality requirements of end-use sectors including semiconductors, pharmaceuticals and batteries. The rising demand from electronics are enabling players to invest in capacity expansion, cleanroom packaging and contamination-free logistics to maintain product integrity. Furthermore, strategic initiatives such as technology licensing, long-term agreements and vertical integration are helping key participants secure competitive advantages. Additionally, partnerships with semiconductor fabs and pharmaceutical firms, along with regional manufacturing hubs are expected to drive market leadership and operational agility.

Key companies in the industry include Sumitomo Chemical Co., Ltd., Kanto Kagaku, LS MnM Inc., Fujifilm Wako Pure Chemical Corporation, BASF SE, PVS Chemicals, KOREAZINC, Chemtrade Logistics Inc., LANXESS, Grillo-Werke AG, Merck KGaA, and TIB Chemicals AG.

Key Players

- BASF SE

- Chemtrade Logistics Inc.

- Fujifilm Wako Pure Chemical Corporation

- Grillo-Werke AG

- Kanto Kagaku, Inc.

- KOREAZINC

- LANXESS

- LS MnM Inc.

- Merck KGaA

- PVS Chemicals

- Sumitomo Chemical Co., Ltd.

- TIB Chemicals AG

Industry Developments

May 2025: BASF SE announced the construction of a new semiconductor-grade sulfuric acid plant in Ludwigshafen to expand its production capacity and strengthen its position in the global electronics materials market. This investment is expected to improve the availability and supply of high-purity sulfuric acid for the semiconductor industry, ensuring reliable access to this critical material for advanced chip manufacturing.

October 2023: Fujifilm acquired the electronic chemicals business from Entegris to expand its portfolio of high-purity process chemicals and strengthen its position in the global semiconductor materials market. This acquisition is expected to improve the availability and range of high-purity chemicals used in semiconductor manufacturing, ensuring a more consistent supply of essential materials for advanced chip production.

May 2023: Sumitomo Corporation expanded its sulfuric acid business in the U.S. with the acquisition of Saconix LLC to strengthen its market presence and logistics capabilities in North America. This acquisition is expected to improve the availability and distribution of sulfuric acid, ensuring a more reliable supply of this essential chemical for various industrial applications.

High Purity Sulfuric Acid Market Segmentation

By Grade Outlook (Revenue, USD Million, 2020–2034)

- PPB

- PPT

By Application Outlook (Revenue, USD Million, 2020–2034)

- Cleaning

- Etching

- Reagent

- Other Applications

By End User Type Outlook (Revenue, USD Million, 2020–2034)

- Semiconductor & Electronics

- Pharmaceutical & Healthcare

- Chemical Processing

- Energy & Power

- Other End User

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Purity Sulfuric Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 460.82 Million |

|

Market Size in 2025 |

USD 487.13 Million |

|

Revenue Forecast by 2034 |

USD 811.50 Million |

|

CAGR |

5.83% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 460.82 million in 2024 and is projected to grow to USD 811.50 million by 2034.

The global market is projected to register a CAGR of 5.83% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Sumitomo Chemical Co., Ltd., Kanto Kagaku, LS MnM Inc., Fujifilm Wako Pure Chemical Corporation, BASF SE, PVS Chemicals, KOREAZINC, Chemtrade Logistics Inc., LANXESS, Grillo-Werke AG, Merck KGaA, and TIB Chemicals AG.

The cleaning segment held the dominant market share in 2024.

The PPT segment is projected to expand at a notable pace through 2034.