IGBT & Thyristor Market Size, Share, Trends, & Industry Analysis Report

By Packaging Type (IGBT Discrete and IGBT Module), By Power Rating, By Voltage, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5870

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

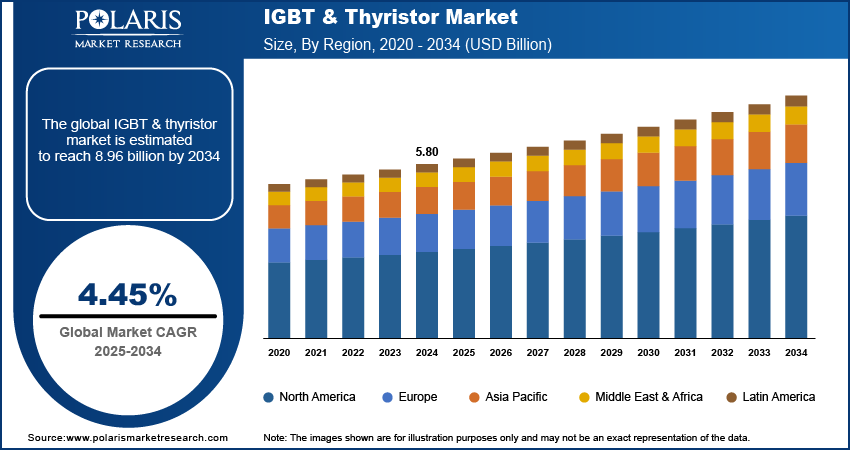

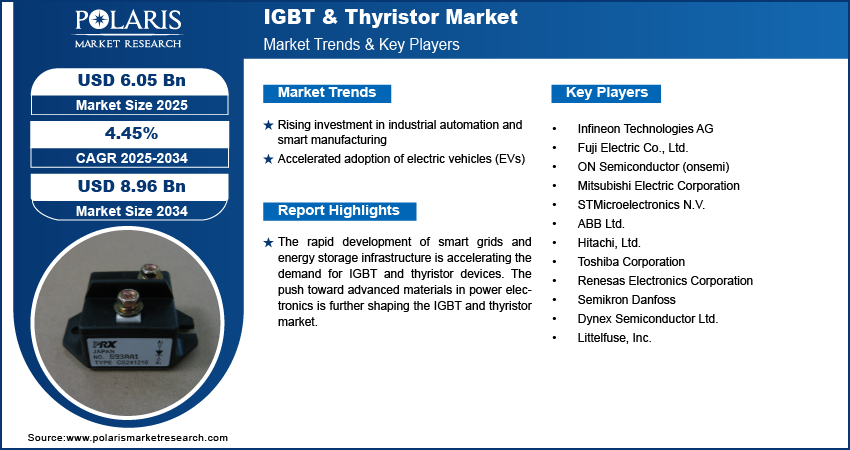

The global IGBT & thyristor market size was valued at USD 5.80 billion in 2024, growing at a CAGR of 4.45% during 2025–2034. Rising investment in industrial automation and control system and smart manufacturing are boosting IGBT & thyristor adoption. accelerated adoption of electric vehicles (EVs) is further expanding the IGBT & thyristor Market.

Insulated gate bipolar transistors (IGBTs) and thyristors are semiconductor power devices widely used in electrical systems for switching and controlling high voltages and currents with efficiency and precision. These devices are integral to power electronics applications, providing high-speed switching capabilities, thermal stability, and energy-efficient performance across a broad range of voltage and current levels. IGBTs are suitable for high-frequency operations and medium- to high-power applications, while thyristors excel in high-voltage, high-current conditions where controlled rectification and AC-to-DC conversion are required.

IGBTs and thyristors are important components in a wide spectrum of industries, including automotive, renewable energy, industrial automation, consumer electronics, railways, and utility-scale power distribution. IGBTs and thyristors are commonly deployed in electric vehicles, solar and wind power inverters, industrial motor drives, welding equipment, HVAC systems, and high-speed trains.

To Understand More About this Research: Request a Free Sample Report

The rapid development of smart grids and energy storage infrastructure is accelerating the demand for IGBT and thyristor devices. These power semiconductor are essential for high-efficiency power conversion, grid stabilization, and load balancing across distributed energy networks. Governments and utilities are upgrading traditional grids with digital systems and automated controls to meet rising electricity demand and integrate renewable energy sources. According to the International Energy Agency, the European Commission outlined its “Digitalisation of the Energy System” action plan in 2022, expecting investments of USD 633 billion in European electricity grids by 2030, including USD 184 billion for digital technologies such as smart meters and automated grid management. Also, China committed USD 442 billion toward modernizing and expanding its power grids between 2021 and 2025. These large-scale investments are creating a strong foundation for IGBT and thyristor demand across power generation, transmission, and distribution applications.

The push toward advanced materials in power electronics is further shaping the IGBT and thyristor market. Innovations in wide-bandgap semiconductors, particularly silicon carbide (SiC) and gallium nitride (GaN), are enhancing the performance of conventional power devices. These materials offer superior efficiency, lower switching losses, and better thermal conductivity compared to traditional silicon-based components. This technological shift is redefining product development strategies, pushing manufacturers to invest in hybrid modules and next-generation architectures that meet the evolving efficiency standards and thermal management requirements.

Industry Dynamics

Rising Investment in Industrial Automation and Smart Manufacturing

The increasing adoption of industrial automation and smart manufacturing technologies is significantly driving the IGBT and thyristors market. These power devices are essential in factory automation systems, robotics, and motor drives enabling precise, efficient control of electricity in high-load industrial operations. According to the Smart Automation Certification Alliance, China, the US, and India are among the global leaders in smart manufacturing adoption, with respective adoption rates of 70%, 60%, and 57%, driven by rising investments in automation technologies and infrastructure upgrades. This surge is boosting the use of IGBTs and thyristors in a wide range of industrial applications, from high-frequency welding to intelligent conveyor systems, where power quality, safety, and efficiency are critical.

The shift toward Industry 4.0 is also increasing the need for real-time power control and energy optimization. Manufacturers in sectors such as automotive, electronics, and food processing are increasingly upgrading their facilities with interconnected machines and AI-driven production systems, leading to sustained growth in demand for high-performance semiconductors. These devices help manufacturers achieve better energy efficiency, reduce equipment wear, and improve process consistency, therefore fueling the market growth.

Accelerated Adoption of Electric Vehicles (EVs)

The global rise in electric vehicle adoption is accelerating the deployment of IGBT and thyristor technologies across the automotive sector. These power semiconductors are very important in the efficient functioning of EV systems such as traction inverters, onboard chargers, DC-DC converters, and power control units. According to the International Energy Agency, global electric car sales reached over 17 million units in 2024, reflecting a 25% increase compared to the previous year. This upward momentum in EV adoption is substantially boosting the demand for IGBTs and thyristors. These devices help to improve energy efficiency, extend battery life, and support consistent performance even under varying load conditions or challenging thermal environments.

Strict emission regulations, carbon neutrality goals, and financial incentives for clean mobility introduced by governments worldwide are pushing automakers to rapidly scale up their electric vehicle production pipelines. Additionally, investments in EV charging infrastructure and battery development are further accelerating the shift away from internal combustion engines. The expanding electric mobility landscape encompass personal vehicles, along with public transit, last-mile delivery fleets, and commercial trucks creating new avenues for semiconductor manufacturers to innovate. IGBTs and thyristors are essential for enabling energy-efficient, compact EV designs and ultra-fast charging systems that reflects the evolving consumer and regulatory demands.

Segmental Insights

Packaging Type Analysis

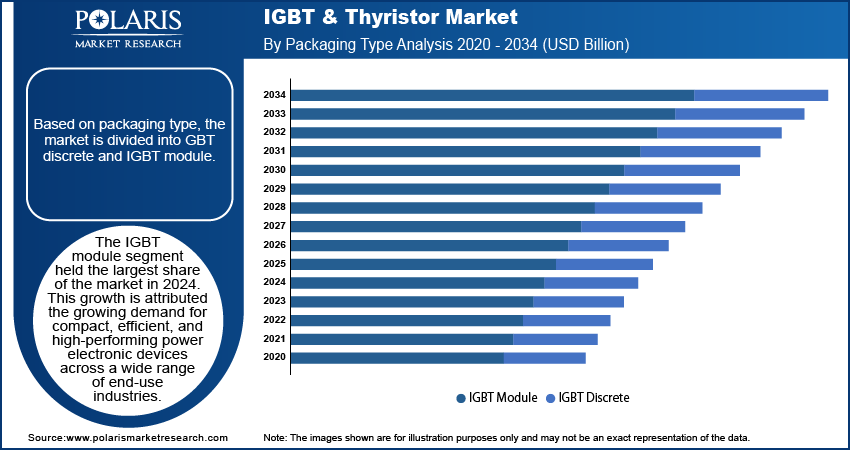

The segmentation, based on packaging type includes, IGBT discrete and IGBT module. The IGBT module segment held the largest share of the market in 2024. This growth is attributed the growing demand for compact, efficient, and high-performing power electronic devices across a wide range of end-use industries. Sectors such as electric vehicles (EVs), renewable energy systems, and industrial automation increasingly rely on IGBT modules for superior power density, enhanced thermal conductivity, and reduced system complexity. These modules integrate multiple components into a single package, improving operational reliability and simplifying thermal management. Power electronics are advancing toward integrated, compact designs, driving stronger demand for modular solutions that offer consistent performance under varying load conditions. For instance, in April 2025 Infineon introduced a new generation of powerful and energy-efficient IGBT and RC-IGBT devices EDT3 (for 400 V & 800 V systems) and 1,200 V RC-IGBT to optimize electric vehicle powertrains.

The discrete IGBT segment is projected to grow at a robust pace in the coming years, owing to the low cost, ease of integration, and flexibility that are suitable for cost-sensitive markets and decentralized installations. Discrete IGBTs are favored in lower-power applications including consumer appliances, uninterruptible power supplies (UPS), and general-purpose industrial drives. Regions dominated by small and medium-sized enterprises adopt discrete devices as a scalable and easily replaceable solution in power electronics. The growing use of compact, energy-efficient appliances and machinery continues to drive steady demand for discrete IGBTs.

Power Rating Analysis

The segmentation, based on power rating, includes low, medium, and high. The medium power segment accounted for second largest revenue share in 2024 due to its broad applicability across transportation, manufacturing, energy, and automation sectors. Power devices in this category are essential in systems operating between 1 kW to 100 kW, offering the right balance of power handling, thermal performance, and efficiency. Applications such as electric rail propulsion, robotics, and medium-voltage industrial motors benefit from the robust capabilities of medium power devices, particularly in terms of fast switching, low conduction losses, and fault tolerance.

The high-power segment is projected to grow at a significant pace during the assessment phase, driven by the need for reliable and loss-minimizing semiconductors in high-voltage, high-capacity environments such as HVDC systems, wind turbines, and utility-scale solar inverters. Devices in this range typically exceeding 100 kW offer superior voltage blocking capabilities and rugged construction, ideal for handling large electrical loads over extended durations. Government investments in renewable energy and large-scale transmission projects are driving strong growth in demand for high-power semiconductors across developed and emerging markets. For instance, in November 2023, the Australian Government, through its Department of Climate Change, Energy, the Environment and Water, expanded the capacity investment scheme to support 32 GW of new national capacity comprising 23 GW of renewable energy and 9 GW of clean dispatchable power attracting an estimated USD 67 billion in total investment. Also, by February 2024, the Government of India initiated Tranche-II of the production linked incentive (PLI) scheme under the national programme on high efficiency solar PV modules, allocating USD 2.35 billion to boost gigawatt-scale domestic manufacturing capacity.

Voltage Analysis

The segmentation, based on voltage, includes <400 V, 600–650 V, 1,200–1,700 V, 2,500–3,300 V, and >4,500 V. The 1,200–1,700 voltage segment growth is driven due to their wide use in electric vehicles, industrial automation, elevators, and traction systems, offering a reliable solution for mid-range power applications. Devices within this bracket support fast switching speeds, enhanced operational efficiency, and moderate insulation requirements, making them ideal for balancing performance and cost. The rising electrification of transportation and the growing demand for mid-voltage drives in industrial plants is boosting the adoption of 1,200–1,700 voltage IGBTs and thyristors.

The >4,500 voltage segment is estimated to hold a substantial market share in 2034. These ultra-high-voltage components are indispensable in power grids, steel plants, hydropower stations, and other large-scale industrial installations where consistent energy transfer and minimal losses are crucial. This voltage class supports applications that demand extreme durability, high thermal stability, and long-term reliability. Growing emphasis on grid upgrades, long-distance power transmission, and large-scale infrastructure is fueling the deployment of >4,500 voltage IGBTs and thyristors, particularly across Asia Pacific, Europe, and the Middle East.

Application Analysis

The segmentation, based on application, includes power transmission systems, renewable energy, rail traction systems, uninterrupted power supply, electric vehicles and hybrid electric vehicles, motor drives, consumer electronics, and others. The electric and hybrid electric vehicle (EV/HEV) segment is projected to witness fastest growth during the forecast period. This rapid growth is attributed to the rapid acceleration of global EV adoption, supported by emission regulations, climate goals, and incentives for clean mobility. IGBTs and thyristors are integral to power electronics in EVs, particularly in inverters, onboard chargers, DC-DC converters, and battery management systems. It facilitates high-speed switching, efficient power flow, and thermal stability, enhancing overall drivetrain performance and extending vehicle range. Automakers investing in advanced EV platforms featuring fast charging and high-voltage systems are driving strong demand for these components.

The renewable energy segment is estimated to hold a significant market share in 2034. Global energy transition toward renewables is boosting the role of IGBTs and thyristors in ensuring efficient energy conversion and grid stability in solar and wind installations. These semiconductors ensure seamless conversion of DC to AC power, voltage regulation, and fault mitigation in energy inverters and power conditioning systems. The scalability and high efficiency make them essential for utility-grade and distributed renewable projects. National clean energy targets coupled with favorable investment environments, the renewable segment is rapidly expanding worldwide.

Regional Analysis

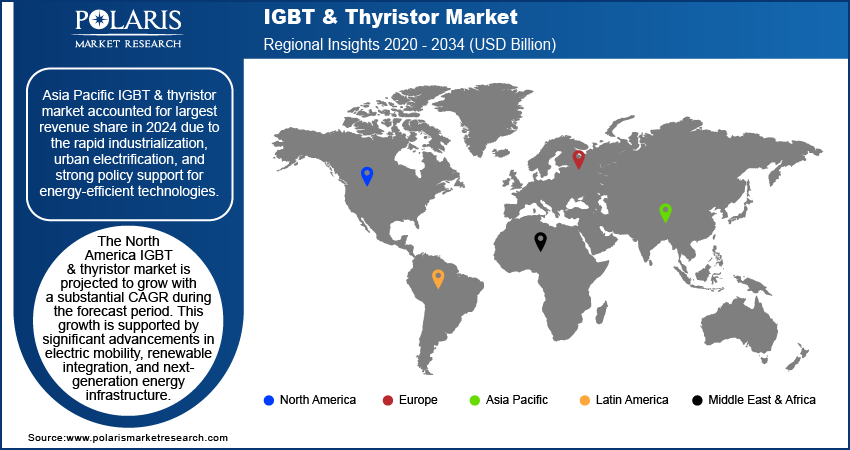

Asia Pacific IGBT & thyristor market accounted for largest revenue share in 2024 due to the rapid industrialization, urban electrification, and strong policy support for energy-efficient technologies. Countries such as China, India, and Japan are leading in the deployment of smart grids, electric vehicles (EVs), and high-capacity renewable energy systems. Investments in high-speed rail, interregional transmission lines, and smart manufacturing infrastructure are further accelerating the adoption of high-voltage IGBTs and thyristors across sectors. In addition, the rise in EV production and deployment of ultra-fast charging networks is contributing significantly to the market growth in the region.

China IGBT & Thyristor Market Insight

China, in particular, dominated the regional market in 2024. This dominance is owing to its leadership in renewable deployment, EV production, and industrial automation. The government’s ambitious energy transition plans accelerated deployment of grid-tied solar PV systems, wind farms, and energy storage infrastructure all heavily reliant on IGBT and thyristor modules. For instance, in June 2025, China initiated the "Solar Great Wall" project in the Kubuqi Desert, a 400 km long solar installation with a planned capacity of 100 GW, projected to generate 180 billion kWh of electricity annually. Designed to supply power to Beijing and surrounding areas, the project also addresses desertification by boosting vegetation growth beneath the solar panels. China's well-established EV ecosystem, supported by national subsidies and technology mandates, continues to expand fast-charging infrastructure and high-voltage vehicle platforms. These developments are driving demand for compact, energy-efficient power semiconductor solutions, thus boosting the market growth.

North America IGBT & Thyristor Market

The North America IGBT & thyristor market is projected to grow with a substantial CAGR during the forecast period. This growth is supported by significant advancements in electric mobility, renewable integration, and next-generation energy infrastructure. The rapid expansion of electric vehicle (EV) manufacturing in the US and Canada, supported by federal incentives such as the Inflation Reduction Act is accelerating the growth of the market. For example, the US Building Department of Energy’s Office of Manufacturing and Energy Supply Chains (MESC) offers grants of up to USD 500 million through the domestic manufacturing conversion grants program to support domestic production of hybrid vehicles, plug-in hybrid electric vehicles, electric drive vehicles, and hydrogen fuel cell vehicles, along with their key components. These developments are driving large-scale deployments of IGBT modules in EV powertrains, onboard chargers, and high-capacity DC fast-charging stations.

In addition, the region is witnessing increased adoption of power semiconductors in aerospace and defense electrification, including applications such as electric propulsion, radar systems, and autonomous vehicle platforms. Moreover, ongoing grid modernization programs, driven by public and private investment, are creating new opportunities for high-voltage thyristors and IGBTs in power conversion systems, microgrids, and energy storage installations.

Europe IGBT & Thyristor Market Overview

Europe IGBT and thyristor market accounted for significant share in 2024, owing to the aggressive sustainability targets, clean energy deployment, and a shift toward electrified industrial systems. Countries across the region are scaling up renewable energy capacities and mandating higher efficiency standards under initiatives such as the European Green Deal and the “Fit for 55” climate package. These programs are accelerating the use of IGBT-based power converters, thyristor modules, and energy control devices in solar PV systems, wind farms, battery storage solutions, and electric heating technologies such as heat pumps. Also, Europe's industrial sector is undergoing a significant digital transformation, particularly in Western and Northern European economies. Smart factories are increasingly adopting medium-voltage drives, intelligent motor control systems, and energy-efficient HVAC units, which rely on robust semiconductor components to ensure reliable performance and reduced energy consumption.

Key Players & Competitive Analysis Report

The insulated-gate bipolar transistor (IGBT) and thyristor industry is highly competitive, with leading players continuously innovating to gain a technological edge and strengthen market share. Companies are focusing on expanding their semiconductor portfolios, increasing manufacturing capacities, and establishing strategic partnerships to meet the rising demand across automotive, industrial, and energy sectors. In addition, mergers and acquisitions (M&A) are being actively pursued to broaden product capabilities, enhance geographic reach, and reinforce supply chain integration. Rapid advancements in applications such as electric vehicles, smart grids, industrial automation, and renewable energy systems are intensifying the competitive landscape, pushing manufacturers to integrate innovations in packaging, heat management, and wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN).

Prominent players in the IGBT and thyristor market include Infineon Technologies AG, Fuji Electric Co., Ltd., ON Semiconductor (onsemi), Mitsubishi Electric Corporation, STMicroelectronics N.V., ABB Ltd., Hitachi, Ltd., Toshiba Corporation, Renesas Electronics Corporation, Semikron Danfoss, Dynex Semiconductor Ltd., and Littelfuse, Inc.

Key Players

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor (onsemi)

- Mitsubishi Electric Corporation

- STMicroelectronics N.V.

- ABB Ltd.

- Hitachi, Ltd.

- Toshiba Corporation

- Renesas Electronics Corporation

- Semikron Danfoss

- Dynex Semiconductor Ltd.

- Littelfuse, Inc.

Industry Developments

March 2025: Magnachip launched two new Gen6 650V IGBTs aimed at solar energy applications. This launch expanded the company’s product lineup and supported efficient energy conversion in solar inverters, contributing to IGBT innovation.

March 2023: Toshiba launched 650V IGBT devices with fast switching and low saturation voltage in compact surface-mount packages. These devices helped enhance power density and thermal performance, supporting compact IGBT and Thyristor applications.

March 2023: MCC launched four new 1200V IGBT power integrated modules targeting motor drives and inverters. These modules enabled efficient high-voltage switching, advancing the design and performance of IGBT and Thyristor-based systems.

IGBT & Thyristor Market Segmentation

By Packaging Type Outlook (Revenue, USD Billion, 2020–2034)

- IGBT Discrete

- IGBT Module

By Power Rating Outlook (Revenue, USD Billion, 2020–2034)

- Low

- Medium

- High

By Voltage Outlook (Revenue, USD Billion, 2020–2034)

- <400 V

- 600–650 V

- 1,200–1,700 V

- 2,500–3,300 V

- >4,500 V

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Power Transmission Systems

- Renewable Energy

- Rail Traction Systems

- Uninterrupted Power Supply

- Electric Vehicles and Hybrid Electric Vehicles

- Motor Drives

- Consumer Electronics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

IGBT & Thyristor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.80 Billion |

|

Market Size in 2025 |

USD 6.05 Billion |

|

Revenue Forecast by 2034 |

USD 8.96 Billion |

|

CAGR |

4.45% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.80 billion in 2024 and is projected to grow to USD 8.96 billion by 2034.

The global market is projected to register a CAGR of 4.45% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Infineon Technologies AG, Fuji Electric Co., Ltd., ON Semiconductor (onsemi), Mitsubishi Electric Corporation, STMicroelectronics N.V., ABB Ltd., Hitachi, Ltd., Toshiba Corporation, Renesas Electronics Corporation, Semikron Danfoss, Dynex Semiconductor Ltd., and Littelfuse, Inc.

The IGBT module segment dominated the market share in 2024.

The electric and hybrid electric vehicle (EV/HEV) segment is projected to witness fastest growth during the forecast period.