Industrial IGBT Power Device Market Size, Share, Industry Analysis Report

By Product Type (Standard IGBT, High Voltage IGBT), By Voltage Rating, By Application, By Packaging Type, By End-User Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5871

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

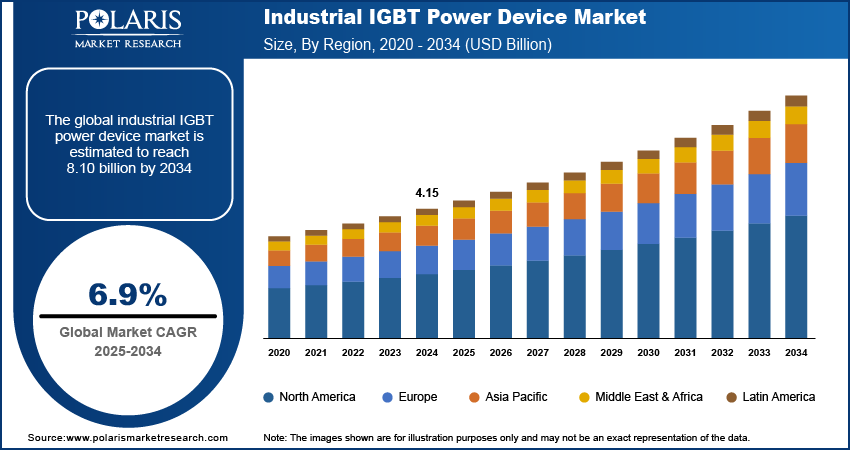

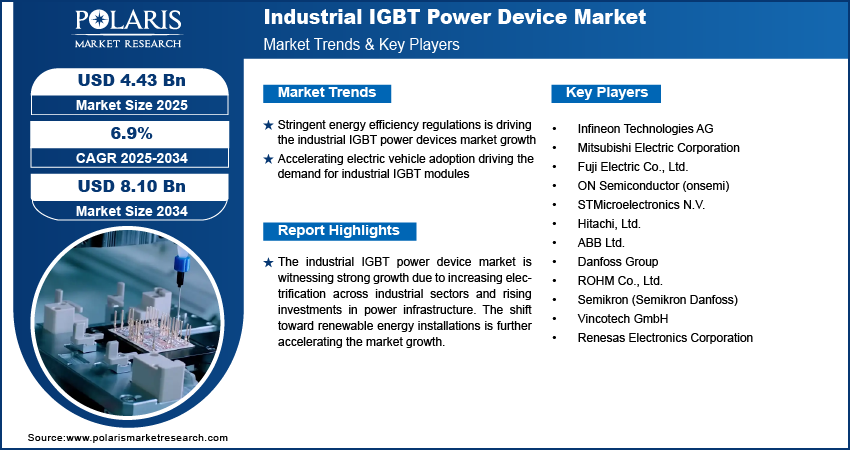

The global industrial IGBT power device market size was valued at USD 4.15 billion in 2024, growing at a CAGR of 6.9% from 2025–2034. Stringent energy efficiency regulations are driving the industrial IGBT power devices market growth. Accelerating electric vehicle adoption further driving the demand for industrial IGBT modules.

The industrial IGBT power device market focuses on insulated-gate bipolar transistors (IGBTs), which are widely used semiconductor devices designed for high-efficiency switching and energy conversion across various industrial applications. These devices combine the high-speed switching capabilities of MOSFETs with the high-current and low-saturation-voltage handling characteristics of bipolar transistors. IGBT power devices are integral to electric motor drives, renewable energy systems, uninterruptible power supplies (UPS), industrial inverter, electric locomotives, and welding material, offering reliable and efficient power control in medium to high-voltage settings.

Industrial IGBT modules are being deployed to address growing demand for energy efficiency, lower power losses, and improved thermal performance in power electronics. These devices facilitate reduced switching losses and enable compact, lightweight designs that improve system performance and lower operating costs. Additionally, advancements in packaging, thermal management, and silicon carbide-based IGBT technologies are extending the operational limits of these devices under higher temperature and voltage conditions, making them suitable for rugged industrial environments.

The industrial IGBT power device market is witnessing strong growth due to increasing electrification across industrial sectors and rising investments in power infrastructure. The growing focus on industrial electrification and the development of smart grid systems, is propelling the growth of the market. Governments and utility companies are actively investing in the modernization of power distribution infrastructure and the enhancement of grid efficiency. According to the International Energy Agency, the European Union’s action plan outlined allocates approximately USD 633 billion for electricity grid upgrades by 2030, including USD 184 billion specifically for digitalization of distribution networks. Also, China’s State Grid Corporation committed USD 77 billion for transmission upgrades in 2023 and USD 442 billion through 2025 under its Five-Year Plan. These investments are fueling increased deployment of power electronic systems equipped with IGBT modules to ensure efficient energy handling, real-time switching, and thermal stability across transmission and distribution systems.

The shift toward renewable energy installations is further accelerating the market. Industrial IGBT power devices are essential for managing high-voltage, high-frequency switching operations in solar and wind inverters. The growing number of photovoltaic (PV) plants and wind farms globally is generating demand for robust and efficient semiconductor components that can operate reliably in fluctuating environmental conditions. These devices support energy conversion with minimal losses, enhancing the overall efficiency of grid-connected renewable systems.

Industry Dynamics

Stringent Energy Efficiency Regulations is Driving the Industrial IGBT Power Devices Market Growth

Global energy transition policies are accelerating the adoption of energy-efficient semiconductor technologies such as industrial IGBT power devices. These devices are essential for optimizing power conversion and minimizing energy losses across industrial and utility-grade systems. Governments are introducing stricter emissions regulations, carbon neutrality goals, and clean energy mandates to combat climate change, that in turn boost the demand for efficient electrical infrastructure. According to the International Energy Agency, China’s 14th Five-Year Plan for Renewable Energy aims to generate 33% of the country’s electricity from renewable sources by the end of 2025. Also, the US government introduced the Inflation Reduction Act (IRA) in August 2022, significantly boosting support for renewable energy over the next decade through tax credits and incentive mechanisms. These developments are creating sustained demand for efficient power devices such as IGBTs that align with decarbonization and energy-saving objectives.

Accelerating Electric Vehicle Adoption Driving the Demand for Industrial IGBT Modules

The growing shift toward electric mobility is further boosting the demand for high-efficiency power electronics, thus driving the growth of the market. According to the International Energy Agency, around 11 million battery electric vehicle (BEVs) and 6.5 million plug-in hybrid electric vehicles (PHEVs) were sold globally in 2024, marking a 16% increase compared to 2023. Industrial IGBT power devices are widely used in electric vehicle powertrains, traction inverters, onboard battery chargers, and high-capacity DC fast-charging stations. The ability to support high-voltage switching, minimize conduction losses, and withstand thermal stress under continuous operation makes such devices highly suitable for electric mobility applications. This consistent growth in EV’s is pushing automakers and EV component suppliers to invest in robust semiconductor platforms that offer improved power density and operational stability.

Additionally, the expansion of public and private investments in EV vehicle charging station particularly in North America, Europe, and Asia-Pacific is driving installation of IGBT-enabled charging systems. These infrastructure enhancements, coupled with rising consumer preference for zero-emission vehicles, are propelling the need for reliable, scalable, and cost-efficient IGBT devices across automotive and energy ecosystems.

Segmental Insights

Product Type Analysis

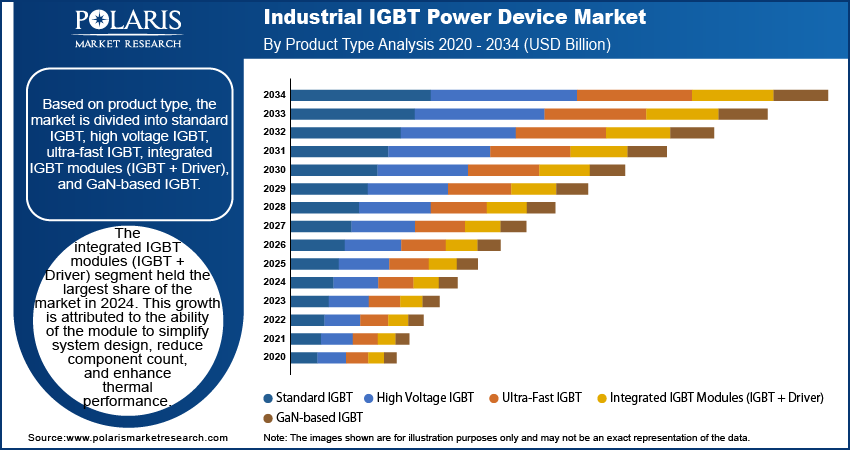

The global segmentation, based on product type includes, standard IGBT, high voltage IGBT, ultra-fast IGBT, integrated IGBT modules (IGBT + Driver), and GaN-based IGBT. The integrated IGBT modules (IGBT + Driver) segment held the largest share of the market in 2024. This growth is attributed to the ability of the module to simplify system design, reduce component count, and enhance thermal performance. These modules are increasingly being adopted in high-power industrial applications where compactness, system reliability, and reduced switching losses are prioritized. Their ease of integration and suitability for high-current operations makes them a preferred choice across heavy-duty motor drives, HVAC systems, and renewable energy installations. The growing trend toward modular power electronics in smart grid systems is also propelling the demand for integrated modules. According to the International Energy Agency's Tracking Clean Energy Progress 2023 report, Canada invested USD 100 million through its Smart Grid Program to support the rollout of smart grid technologies and integrated smart systems.

The GaN-based IGBT segment is projected to grow at a robust pace in the coming years, driven by the increasing preference for wide-bandgap semiconductors in high-frequency and high-efficiency applications. Gallium nitride (GaN) devices offer advantages such as lower switching losses, higher power density, and compact design over traditional silicon-based IGBTs. These characteristics are gaining traction in electric vehicles, fast-charging stations, and aerospace applications, thus boosting the market growth.

Voltage Rating Analysis

The global segmentation, based on voltage rating includes, low voltage (Up to 600V), medium voltage (600V to 1700V), and high voltage (Above 1700V). The medium voltage (600V to 1700V) IGBT devices segment accounted for substantial market share in 2024, attributed to the widespread use of medium voltage IGBT devices across industrial automation, motor control systems, renewable power converters, and commercial-grade UPS systems. These IGBTs offer the right balance between power handling capacity and efficiency, making them suitable for a broad range of mid-range voltage operations in industrial facilities and distributed power networks.

The high voltage (above 1700V) IGBTs segment is projected to grow at a significant pace during the forecast period. Increasing investment in high-voltage direct current (HVDC) systems, railway electrification, and utility-scale energy storage is accelerating demand for robust power devices that can handle extreme operating conditions. These high-voltage IGBTs are essential for grid infrastructure upgrades, long-distance power transmission, and large-scale renewable integration.

Packaging Type

The global segmentation, based on packaging type includes, discrete packages, module packages, embedded packages, and power modules. The module packages segment is projected to grow at a significant CAGR during the forecast period. This rapid growth is attributed to the high-power density, thermal reliability, and suitability of module packages for industrial and energy applications. These modules integrate multiple IGBT chips and include protective circuitry, allowing for compact and rugged configurations that simplify design and improve system efficiency. The adoption of these module packages particularly strong in heavy machinery, solar and wind inverters, and railway traction systems, where high thermal stability and mechanical durability are essential. The increasing adoption of these modules in power transmission networks and utility-scale converters further boost the adoption in modern high-load environments. For instance, in May 2025, Infineon launched new CoolGaN EasyPACK 650 V power modules, designed for applications in high-voltage grid infrastructure, EV charging stations, and data centers.

The embedded packages segment is estimated to hold a significant market share in 2034. These packages are increasingly used in advanced automotive electronics, high-end consumer devices, and compact power supplies, where space-saving and efficiency are top priorities. Embedded packaging also provides better heat dissipation, making it suitable for applications that require continuous high-speed switching. The growing demand for embedded IGBT packages in telecom and mobile electronics is increasing the need for better thermal materials and connection technologies, therefore driving the growth of embedded packages.

Application Analysis

The global segmentation, based on application includes, renewable energy, industrial drives, consumer electronics, rail transportation, electric vehicles (EVs) and charging infrastructure. The industrial drives segment dominated the market in 2024. This dominance is attributed to the continued electrification and automation of manufacturing operations across the globe. These systems require precise motor control and efficient power conversion, both of which are enabled by IGBT devices due to their high-speed switching and ability to handle large currents. Industrial drives powered by IGBTs are extensively used in sectors such as oil & gas, cement, mining, and metal processing. Moreover, the push for process optimization and sustainability in heavy industries is increasing the need for advanced variable frequency drives (VFDs) and motion control systems, further strengthening the demand for IGBT-based power solutions.

The electric vehicles (EVs) and charging infrastructure segment is estimated to witness fastest growth during the forecast period due to the global shift towards decarbonizing transportation and the introduction of stricter emission norms are compelling automotive manufacturers to scale up EV production. For instance, in September 2024, India launched the PM E-DRIVE scheme to promote electric vehicle adoption. It offered purchase incentives for electric two-wheelers, three-wheelers, and buses, and supported charging infrastructure. The government also introduced a separate scheme to attract global EV manufacturers to set up passenger car production facilities in the country. IGBTs serve as the backbone of EV powertrains by enabling efficient DC-AC conversion in inverters, regulating voltage in onboard chargers, and managing current in fast-charging stations. Additionally, government incentives, policy mandates, and rising consumer awareness are contributing to higher EV adoption rates, which in turn is boosting the deployment of high-performance IGBT modules.

End-User Industry Analysis

The global segmentation, based on end-user industry includes, automotive, telecommunications, aerospace & defense, and oil & gas, and manufacturing. The manufacturing segment growth is driven due to the growing reliance on energy-efficient systems in industrial environments. The evolution of smart factories and the growing use of robotics, machine tools, and real-time control systems made IGBT power devices essential for meeting performance goals and reducing operational costs. Additionally, industries are increasingly prioritizing carbon emission reduction and energy optimization, which is driving strong demand for intelligent power modules across both developed and emerging economies. For instance, the Government of India aims to achieve 500 GW of total non-fossil fuel electricity generation capacity by 2030, with plans to increase the share of renewable electricity to 50%. Additionally, the country has committed to reaching net-zero carbon emissions by 2070.

The automotive segment is estimated to grow at a significant CAGR from 2025-2034, owing to the rapid electrification of vehicles and the emergence of power-dense, modular electronic architectures. The need for high-efficiency propulsion systems, coupled with rising investments in autonomous and connected vehicles, is amplifying the requirement for durable and efficient power devices such as IGBTs. For instance, in October 2024, Alphabet's autonomous vehicle unit Waymo closed a USD 5.6 billion funding round, accelerating the expansion of its Waymo One autonomous ride‑hailing service across multiple US cities including Austin and Atlanta. Furthermore, the ongoing transition to 800V EV architectures and the deployment of solid-state battery technologies are further expanding IGBT usage in the automotive sector, marking it as a primary industry for future market growth.

Regional Analysis

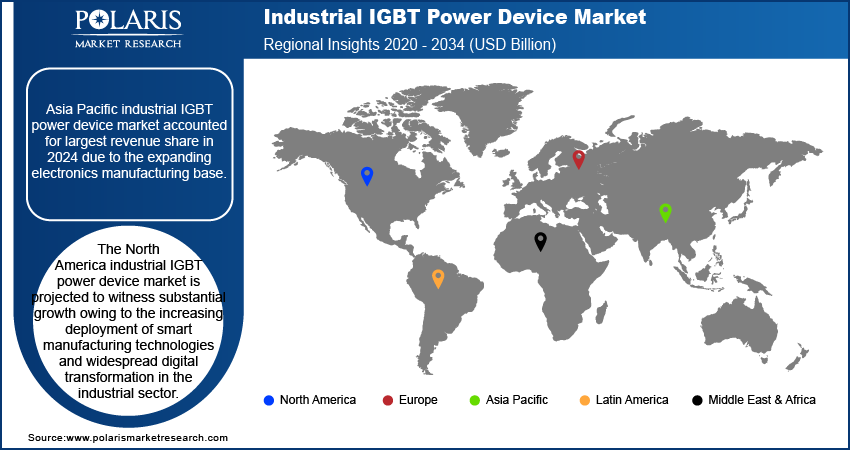

Asia Pacific industrial IGBT power device market accounted for largest revenue share in 2024 due to the expanding electronics manufacturing base. The region’s major economies including China, Japan, South Korea, and India are leading adopters of industrial power electronics, where IGBT modules serve as a key component in ensuring reliable, high-efficiency energy conversion and motor control. Furthermore, the accelerating electrification of transportation in the region is fueling demand for IGBT modules in EV inverters, battery chargers, and power control units. Automakers across China, Japan, and South Korea are scaling up EV output and relying on advanced IGBT-based systems for energy efficiency and thermal stability.

China Industrial IGBT Power Device Market Insight

China, in particular, dominated the regional market in 2024 due to the country's dominance supported by its extensive electronics manufacturing ecosystem and growing consumption of semiconductor components. According to the Semiconductor Industry Association’s June 2025 report, year-over-year semiconductor sales in the Asia Pacific grew by 23.1%, with China contributing 14.4% to that growth. Moreover, month-over-month sales in China increased by 5.5%, reflecting a robust domestic demand for industrial and consumer power devices such as IGBTs. China’s strong focus on leadership in EV production and solar inverters is propelling its position as a critical hub for IGBT consumption.

North America Industrial IGBT Power Device Market Trend

The North America industrial IGBT power device market is projected to witness substantial growth owing to the increasing deployment of smart manufacturing technologies and widespread digital transformation in the industrial sector. The rising investments on industrial automation and energy-efficient smart manufacturing is significantly fueling the market growth in the region. For example, the US Department of Energy’s Advanced Materials and Manufacturing Technologies Office (AMMTO) in 2024 announced a USD 33 million funding initiative to accelerate the development of smart manufacturing systems aligned with clean energy goals. This initiative aims to foster innovation in power electronics, including IGBT-based systems, to reduce energy waste and increase factory throughput.

In addition, growing EV sales and investment in charging infrastructure are driving IGBT module usage in traction inverters and fast chargers, boosting the growth of the market market.

Europe Industrial IGBT Power Device Market Overview

Europe Industrial IGBT power device market accounted for substantial in 2024, owing to the increasing government initiatives on smart grid infrastructure and renewable integration. The European Commission’s REPowerEU Plan proposes to increase the renewable energy share to 45% by 2030, requiring over 1,200 GW of installed capacity, according to the International Energy Agency (IEA). This massive scale-up necessitate the deployment of power-efficient inverters and control systems based on IGBTs for grid balancing and storage integration.

Moreover, the region’s strict regulatory frameworks, including RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, are compelling manufacturers to adopt high-efficiency, low-loss IGBT modules in both industrial and consumer electronic applications. The drive toward sustainable manufacturing and green building certifications is further propelling the use of IGBTs in heating, ventilation, and smart energy systems.

Key Players & Competitive Analysis Report

The industrial IGBT power device industry is highly competitive, characterized by intense rivalry among key players focusing on expanding their product portfolios, enhancing production capacities, forming strategic partnerships, and pursuing mergers and acquisitions (M&A) to strengthen their market positions. Established players are focusing on product differentiation and technological advancement to gain a competitive edge, also exploring new growth avenues through mergers, acquisitions, and joint ventures. Surging demand for high-efficiency and thermally stable power solutions across EVs, renewables, and industrial automation is pushing companies to increase R&D investments aimed at enhancing switching performance, boost energy efficiency, and to enable greater integration in compact form factors.

Prominent companies operating in the industrial IGBT power device market include Infineon Technologies AG, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., ON Semiconductor (onsemi), STMicroelectronics N.V., Hitachi, Ltd., ABB Ltd., Danfoss Group, ROHM Co., Ltd., Semikron (Semikron Danfoss), Vincotech GmbH, and Renesas Electronics Corporation.

Key Players

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- ON Semiconductor (onsemi)

- STMicroelectronics N.V.

- Hitachi, Ltd.

- ABB Ltd.

- Danfoss Group

- ROHM Co., Ltd.

- Semikron (Semikron Danfoss)

- Vincotech GmbH

- Renesas Electronics Corporation

Industry Developments

April 2025: Infineon introduced its next-generation EDT3 power modules, designed for enhanced performance in electric drive train applications. These modules achieved up to 20% lower total losses under high load conditions compared to the previous EDT2 series, improving energy efficiency in demanding industrial environments.

March 2025: Magnachip launched two new 650 V Gen6 IGBTs tailored for solar inverters and industrial motor drive applications. These devices offered up to 25% lower conduction losses and delivered approximately 15% higher overall system efficiency in standard inverter configurations. .

January 2025: Mitsubishi Electric began shipping samples of its 1.2 kV LV100‑type industrial IGBT module, model CM1800DW‑24ME. The module incorporated 8th-generation IGBTs, which reduced power loss by around 15% and increased the current rating to 1,800 A.

Industrial IGBT Power Device Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Standard IGBT

- High Voltage IGBT

- Ultra-Fast IGBT

- Integrated IGBT Modules (IGBT + Driver)

- GaN-based IGBT

By Voltage Rating Outlook (Revenue, USD Billion, 2020–2034)

- Low Voltage (Up to 600V)

- Medium Voltage (600V to 1700V)

- High Voltage (Above 1700V)

By Packaging Type Outlook (Revenue, USD Billion, 2020–2034)

- Discrete Packages

- Module Packages

- Embedded Packages

- Power Modules

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Renewable Energy

- Industrial Drives

- Consumer Electronics

- Rail Transportation

- Electric Vehicles (EVs) and Charging Infrastructure

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Telecommunications

- Aerospace & Defense

- Oil & Gas

- Manufacturing

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial IGBT Power Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.15 Billion |

|

Market Size in 2025 |

USD 4.43 Billion |

|

Revenue Forecast by 2034 |

USD 8.10 Billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.15 billion in 2024 and is projected to grow to USD 8.10 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Infineon Technologies AG, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., ON Semiconductor (onsemi), STMicroelectronics N.V., Hitachi, Ltd., ABB Ltd., Danfoss Group.

The integrated IGBT modules (IGBT + Driver) segment dominated the market share in 2024.

The electric vehicles (EVs) and charging infrastructure segment is estimated to witness fastest growth during the forecast period.