Lab-Grown Protein Products Market Size, Share, Trends, Industry Analysis Report

: By Source (Animal Cell-Based Proteins and Microbial Proteins), Technology, Product Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5506

- Base Year: 2024

- Historical Data: 2020-2023

Lab-Grown Protein Products Market Overview

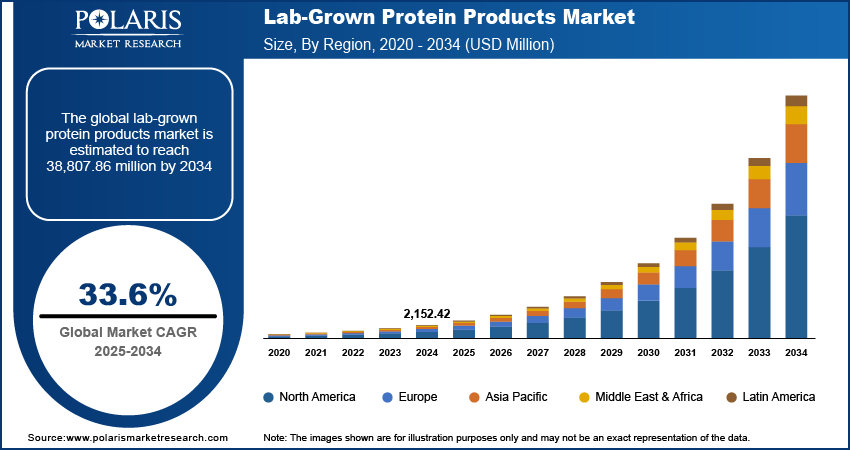

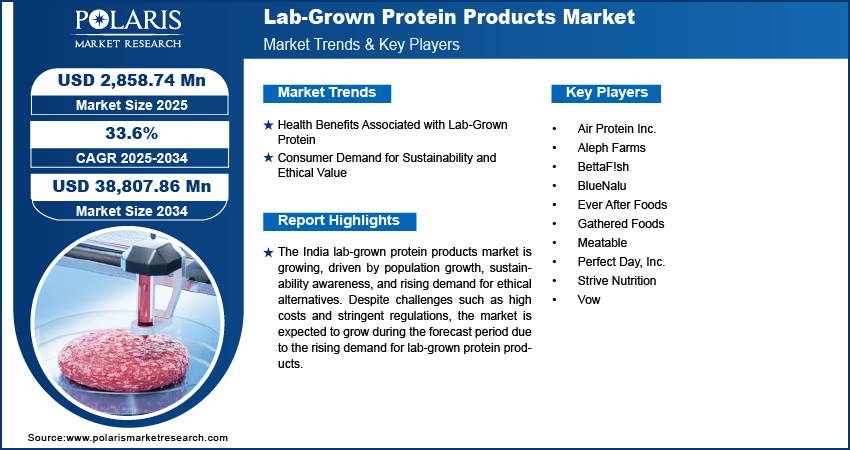

The global lab-grown protein products market size was valued at USD 2,152.42 million in 2024. The market is projected to grow from USD 2,858.74 million in 2025 to USD 38,807.86 million by 2034, exhibiting a CAGR of 33.6% during 2025–2034.

Lab-grown protein products are proteins produced through cellular agriculture, where animal or plant cells are cultivated in controlled environments to create sustainable food alternatives. These products, such as lab-grown meat and dairy, offer a more eco-friendly and ethical solution compared to traditional animal farming.

The rising environmental challenges have turned lab-grown protein products into an emerging sustainable alternative to traditional meat production. Conventional livestock farming demands large amounts of land, water, and feed, while also contributing heavily to greenhouse gas emissions. According to the Food and Agriculture Organization of the United Nations, in 2022, emissions from agrifood systems amounted to 16.2 billion metric tons of carbon dioxide equivalent (Gt CO2eq). In contrast, lab-grown proteins are produced in controlled environments, using fewer resources and generating less waste. These products help reduce the environmental footprint, offering a solution to the growing demand for protein without causing further harm to the planet, which, in turn, is driving the adoption of lab-grown protein by companies into their offerings, thereby driving the lab-grown protein products market growth.

To Understand More About this Research: Request a Free Sample Report

Advancements in biotechnology and cellular agriculture have made lab-grown proteins more feasible and cost-effective. Over the past few years, improvements in cell-culturing techniques and bioreactor technologies have enabled more efficient and scalable production of lab-grown proteins. These technological breakthroughs have substantially reduced production costs, making lab-grown meats more competitive with traditional meats. The quality and affordability of lab-grown protein products keep improving as technology continues to improve, making them more accessible to a broader audience, thereby driving the lab-grown protein products market development.

Lab-Grown Protein Products Market Dynamics

Health Benefits Associated with Lab-Grown Protein

Lab-grown proteins are often seen as a healthier alternative to traditional meat. These products contain fewer unhealthy fats, no antibiotics, and no hormones that are typically present in conventionally raised animals. Additionally, lab-grown meats can be engineered to have higher nutritional value, such as added vitamins or essential amino acids. Since they are produced in controlled environments, lab-grown proteins are less likely to carry pathogens such as bacteria and parasites, which are common concerns with traditional meats. The demand for lab-grown proteins is growing as health-conscious consumers are seeking cleaner, safer, and more nutritious options, thereby driving the lab-grown protein products market demand.

Consumer Demand for Sustainability and Ethical Value

Consumers are becoming more open to try new food products that align with their health, ethical values, and sustainability. Lab-grown proteins are seen as an exciting and innovative alternative to traditional meats, particularly among younger generations who are concerned about the environment and animal welfare. According to the World Economic Forum, 65% of consumers want to spend on healthier and more sustainable products. Additionally, the rising preference for plant-based diets and the growing interest in alternative proteins have laid the groundwork for lab-grown products to gain mainstream acceptance, thereby driving the lab-grown protein products market expansion.

Lab-Grown Protein Products Market Segment Analysis

Lab-Grown Protein Products Market Assessment by Source Outlook

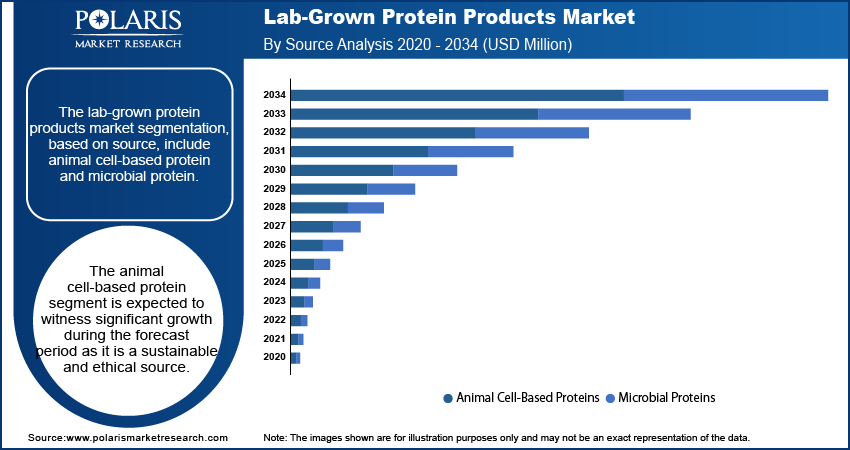

The lab-grown protein products market segmentation, based on source, includes animal cell-based proteins and microbial proteins. The animal cell-based proteins segment is expected to witness significant growth during the forecast period. Animal cell-based proteins are produced by cultivating animal cells in controlled environments, which allows for the creation of meat products without the need for traditional animal farming. This method is seen as more sustainable and ethical. The demand for animal cell-based proteins is increasing as consumers become more conscious of sustainability and animal welfare.

Lab-Grown Protein Products Market Evaluation by Product Type Outlook

The lab-grown protein products market segmentation, based on product type, includes cultured meat, lab-grown eggs, dairy alternatives, and seafood alternatives. The cultured meat segment dominated the lab-grown protein products market share in 2024. Cultured meat is produced by growing animal cells in a controlled environment. The meat offers an alternative to traditional meat without the need for raising and slaughtering animals. This product type is gaining popularity due to its sustainability, ethical benefits, and ability to address environmental concerns. Demand for cultured meat is rising as consumer awareness of the negative impacts of conventional meat production is growing.

Lab-Grown Protein Products Market Regional Insights

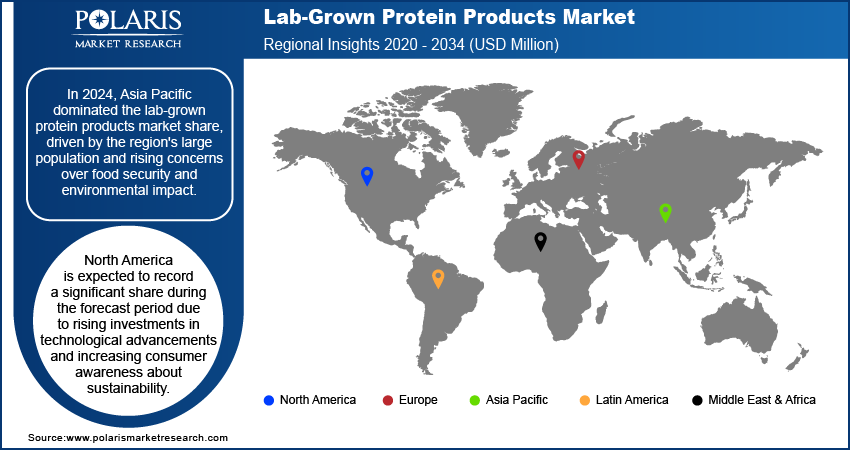

By region, the study provides the lab-grown protein products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the lab-grown protein products market revenue share driven by the region's large population and rising concerns over food security and environmental impact. Countries such as Japan, China, and Singapore are leading the way in adopting cultured meat technology. Singapore has already approved the sale of lab-grown meats, setting a global precedent. Consumers in Asia are becoming more open to sustainable food options due to rising urbanization and disposable incomes, thereby driving the Asia Pacific market expansion.

The India lab-grown protein products market is experiencing substantial growth due to the country’s growing population and increasing awareness of sustainability issues. Lab-grown proteins provide an ethical and sustainable alternative to traditional meat products, with a large number of people adopting plant-based diets and raising concerns about animal welfare. India’s government has also begun to focus on alternative protein sources, which is fueling the market growth across the country.

According to the lab-grown protein products market statistics, North America is expected to record a significant share during the forecast period driven by the high focus on technological advancements and increasing consumer awareness about sustainability. The US and Canada are home to some of the largest companies in the sector, and the region has made significant investments in research and development. North American consumers are increasingly seeking ethical and environmentally friendly food options, boosting the demand for lab-grown meats and proteins, thereby contributing to the lab-grown protein products market opportunities in North America.

Lab-Grown Protein Products Market – Key Players & Competitive Analysis Report

The lab-grown protein products market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the lab-grown protein products market trends by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major market players are Air Protein Inc.; Aleph Farms; BettaF!sh; BlueNalu; Ever After Foods; Gathered Foods; Meatable; Perfect Day, Inc.; Strive Nutrition; and Vow.

Air Protein Inc. is a food technology company based in California, USA, established in 2019. It utilizes air fermentation technology to produce protein, a method inspired by NASA research from the 1960s. This process involves converting carbon dioxide, oxygen, and nitrogen into a protein-rich substance using microbes, which do not require arable land. The company has secured significant funding from investors such as ADM, the Ford Foundation, Barclays Sustainable Impact Capital, and GV (formerly Google Ventures). Air Protein's primary product is a protein powder derived from air fermentation technology, which can be used in various applications. It is used to create meat alternatives, enhance the nutritional content of foods such as pasta and cereals, and serve as a supplement. The protein powder contains all essential amino acids and is fortified with vitamins, including B12. This makes it a complete protein source suitable for different dietary needs. Air Protein operates mainly in the US but has the potential for broader reach due to its scalable technology. The company's production method allows for the setup of facilities in diverse locations, independent of traditional agricultural constraints.

Strive Nutrition Corp. is a company based in Wichita, Kansas, US, that focuses on producing nutritional beverages. Founded by the Cohlmia family, it utilizes over 40 years of experience in aseptic food processing and packaging to develop its products. The company aims to meet consumer demand for nutritious and sustainably produced beverages while addressing environmental challenges. Strive Nutrition develops dairy food alternatives using precision fermentation technology. Its products include FREEMILK, which incorporates animal-free whey protein, offering a similar taste and nutritional profile to cow's milk. The company also offers Strive Oat and Strive Almond, which have higher protein content. Strive plans to expand its product range into areas such as protein shakes, sports nutrition and hydration beverages, and functional foods such as immunity support drinks and protein powders. These products contain a complete protein profile with all nine essential amino acids, making them appealing to consumers seeking health-focused options. Strive Nutrition primarily operates in North America but is exploring opportunities to expand globally.

List of Key Companies in Lab-Grown Protein Products Market

- Air Protein Inc.

- Aleph Farms

- BettaF!sh

- BlueNalu

- Ever After Foods

- Gathered Foods

- Meatable

- Perfect Day, Inc.

- Strive Nutrition

- Vow

Lab-Grown Protein Products Industry Development

In February 2025, Meatly's cultivated meat for pet food was launched as the first of its kind globally. In collaboration with THE PACK, "Chick Bites" was made available at Pets at Home, Brentford, London.

Lab-Grown Protein Products Market Segmentation

By Source Outlook (Revenue USD Million, 2020–2034)

- Animal Cell-Based Proteins

- Microbial Proteins

By Technology Outlook (Revenue USD Million, 2020–2034)

- Cellular Agriculture

- Fermentation-Based Processes

- Scaffold-Based Techniques

- Other

By Product Type Outlook (Revenue USD Million, 2020–2034)

- Cultured Meat

- Lab grown Eggs

- Dairy Alternatives

- Seafood Alternatives

By Application Outlook (Revenue USD Million, 2020–2034)

- Food Industry

- Beverages

- Dietary Supplements

- Animal Feed

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lab-Grown Protein Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,152.42 million |

|

Market Size Value in 2025 |

USD 2,858.74 million |

|

Revenue Forecast in 2034 |

USD 38,807.86 million |

|

CAGR |

33.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 2,152.42 million in 2024 and is projected to grow to USD 38,807.86 million by 2034.

The global market is projected to register a CAGR of 33.6% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Air Protein Inc.; Aleph Farms; BettaF!sh; BlueNalu; Ever After Foods; Gathered Foods; Meatable; Perfect Day, Inc.; Strive Nutrition; and Vow.

The cultured meat segment dominated the market share in 2024 as it offers an alternative to traditional meat without the need for raising and slaughtering animals.

The animal cell-based protein segment is expected to witness significant growth during the forecast period as it is a sustainable and ethical source.