Orthopedics Braces and Supports Market Share, Size, Trends, Industry Analysis Report

By Product (Pain Management Products, Braces & Supports Type); By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4554

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

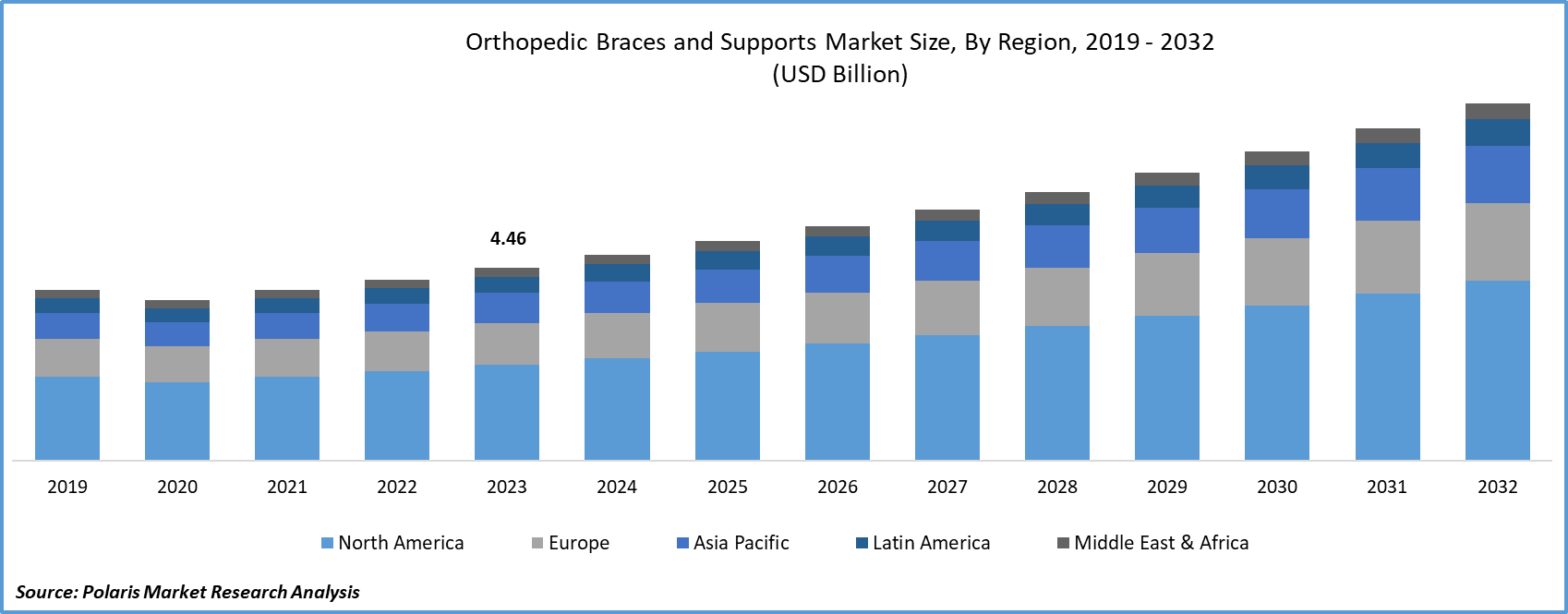

The Global orthopedics braces and supports market size was valued at USD 4.46 billion in 2023. The market is anticipated to grow from USD 4.76 billion in 2024 to USD 8.25 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period

Orthopedics Braces and Supports Market Overview

Braces and supports denote orthopedic devices extensively employed for supporting, aligning, correcting specific parts of the body, and holding. Manufactured with specialized materials and intelligent designs, these devices are recognized for delivering focused and robust support to various body parts such as the spine, ankle, shoulder, knee, and upper elbow, among others.

The growing burden of injuries related to sports and road incidents is leading to an uptick in the number of orthopedic procedures, driving the demand for braces and supports and consequently boosting market size.

For instance, according to StatBel statistics released in June 2022, there were 34,640 road traffic accidents in 2021, and total of 42,566 casualties, comprising 38,952 minor injuries and 3,098 severe injuries in Belgium. Furthermore, as highlighted in an article published in Translational Pediatrics in February 2022, approximately 8.6 million athletes experience sports-related injuries each year in the United States.Plaster casts exhibit greater malleability and a slower setting time compared to fiberglass when used in casting and splinting. The material takes an extended period to solidify after application and molding. Notably, Plaster of Paris generates less heat, reducing patient discomfort and the risk of burns. Indoor athletes face a heightened risk of ligament tears, creating a substantial demand for ankle braces. Athletes commonly employ orthopedic braces to shield themselves from further injury during sports activities. According to the American Academy of Orthopedic Surgeons (AAOS), approximately 25% of sports injuries involve the lower extremities, such as the foot and ankle. Moreover, the increasing incidence of accidents is a pivotal factor propelling the market's growth.

To Understand More About this Research: Request a Free Sample Report

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Orthopedics Braces and Supports Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Orthopedics Braces and Supports Market Dynamics

Market Drivers

Elevated Occurrence of Orthopedic Conditions and Ailments Bolstering the Growth of the Orthopedics Braces and Supports Market Size

The increased prevalence of obesity and related lifestyle issues is expected to lead to a rise in the incidence of orthopedic illnesses and disorders in the forecasted years, as individuals with obesity are at a higher risk of orthopedic and musculoskeletal injuries, along with diabetes. Orthopedic braces and supports provide numerous advantages over traditional solutions, including improved effectiveness, greater patient comfort, lower costs, and ease of use. Owing to these benefits, leading companies are rapidly innovating and developing specialized solutions to address various orthopedic illnesses and cater to unmet market demands.

The demand for orthopedic braces is on the rise in both established and emerging economies, driven by their cost-effectiveness and easy market accessibility. Musculoskeletal injuries, including ligament tears, sprains, and fractures, are common outcomes of sports and other physical activities. The increasing participation of the public in such activities contributes to the prevalence of these injuries. Orthopedic braces and supports are emerging as a successful clinical alternative to orthopedic surgery for conditions like osteoporosis, rheumatoid arthritis, gout, and fractures. Various public-private sports groups and medical professionals are organizing workshops, conferences, and symposiums to enhance public awareness regarding the therapeutic management of orthopedic injuries.

Market Restraints

More Qualifications are Likely to Hamper the Growth of the Market

Orthopedic braces and support products play a crucial role in effectively managing orthopedic conditions and diseases, often deemed clinically necessary by physicians and orthopedic surgeons. However, there are instances where patients may not meet the criteria for using these products, depending on factors such as the severity of the condition, its side effects, and the patient's physiology and age.

In developed countries like the United States, Germany, the United Kingdom, and Japan, innovative orthopedic braces are gaining popularity among major end-user institutions, including hospitals, surgical centers, and orthopedic clinics. Conversely, in emerging and less-developed markets, end-user facilities need more awareness and affordability to adopt innovative products. These consumers also show a preference for traditional or established items that have clinical evidence supporting their therapeutic or diagnostic role.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Orthopedics Braces and Supports Market Segmental Analysis

By Product Analysis

The braces and supports category emerged as the dominant segment in the market in 2023, driven by the surge in arthritis cases. It is further categorized into ankle, knee, walking boots, and back. The increased prevalence of knee, ankle, and upper issues and injuries has significantly heightened the demand for support products and braces. Such injuries may result in accidents, physical exertion, medical conditions, and sports activities, including sprains, knee ankle, and ligament tears, like shoulder instability or wrist fractures.

Moreover, the Braces and supports market growth is anticipated to experience the fastest-growing CAGR over the forecasting period, attributed to the increasing number of people grappling with knee-joint issues. Additionally, as awareness about the significance of proper support and early interposing in the management and healing of these injuries grows, individuals are actively seeking effective and reliable support and braces. These products offer compression, stability, and support to the injury, facilitating reducing inflammation and promoting healing and pain relief.

By End-Use Analysis

The orthopedic clinic's segment led the orthopedic braces and supports market in 2023, driven by the growing number of orthopedic surgeons. Orthopedic clinics play a crucial role as providers of primary healthcare for individuals dealing with musculoskeletal pain. For instance, in October 2023, the U.S. alone had over 27,000 active orthopedic surgeons.

The Non-prescription (OTC) Outlets segment is anticipated to experience rapid growth throughout the forecasting period. This market growth is attributed to the convenient availability of OTC orthopedic braces in retail pharmacies. Individuals facing acute muscle pain often prefer OTC products, aiding in reducing recovery time and offering swift relief to injured joints and muscles. The market's expansion is expected to be driven by various initiatives from major leading players in the industry.

Orthopedics Braces and Supports Market Regional Insights

The North American Region Dominated the Global Market with the Largest Market Share in 2023

It is driven by the expanding availability of favorable reimbursement and insurance policies, coupled with government regulations that facilitate the commercialization of orthopedic braces and supports.

The increasing prevalence of musculoskeletal disorders and a rise in sports-related injuries are key factors propelling the demand for orthopedic braces and supports in the region. Furthermore, the market benefits from the presence of major companies holding a substantial market share, contributing to the increased sales of knee braces, especially for conditions like osteoarthritis and ligament injuries.

Significantly, the upward trend in sales of knee braces and supports in Spain, the growing demand for over-the-counter (OTC) braces and supports in Germany, and the escalating need for orthopedic braces and support systems in the U.K. collectively play a crucial role in augmenting the global market growth prospects for orthopedic braces and support systems.

The Asia-Pacific region is anticipated to exhibit the most substantial growth rate in the orthopedic braces and supports market. This growth is attributed to the escalating government expenditure on the healthcare sector and the implementation of advanced technologies and government initiatives.

Competitive Landscape

The Orthopedics Braces and Supports market player is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Bauerfeind

- BREG, Inc.

- DeRoyal Industries, Inc.

- DJO, LLC (Enovis)

- Frank Stubbs Company Inc.

- McDavid

- ÖssurFillauer LLC

- Ottobock

- Weber Orthopedic LP

Recent Developments

- In January 2024, Enovis Corporation successfully acquired LimaCorporate S.p.A., a company specializing in orthopedic implant solutions. This strategic acquisition enhances Enovis' standing in the global orthopedic reconstruction market, as LimaCorporate brings a diverse range of orthopedic medical devices, including braces, to its portfolio.

- In October 2023, OrthoPediatrics Corp. introduced the DF2 Brace designed to address musculoskeletal injuries in children. Specifically crafted for femur fracture fixation, this brace is intended for pediatric patients ranging from six months to 5 years of age.

Report Coverage

The Orthopedics Braces and Supports market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market growth while focusing on various key aspects such as competitive analysis, product, end-use, and futuristic growth opportunities.

Orthopedics Braces and Supports Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.76 billion |

|

Revenue Forecast in 2032 |

USD 8.25 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By End-Use, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Get in Touch Whenever You Need Us

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Orthopedics Braces and Supports Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Biobased Polycarbonate Market Size, Share 2024 Research Report

Demulsifiers Market Size, Share 2024 Research Report

Stress Relief Supplements Market: Size, Share 2024 Research Report

Gaze Detection Technology Market Size, Share 2024 Research Report

Desalination Technologies Market Size, Share 2024 Research Report

FAQ's

The global Orthopedic Braces And Supports market size is expected to reach USD 8.25 billion by 2032

Key players in the market are Bauerfeind, BREG, Inc., DeRoyal Industries, Inc., DJO, LLC (Enovis), Frank Stubbs Company Inc

North American contribute notably towards the global Orthopedics Braces and Supports Market

The Orthopedics Braces and Supports Market exhibiting the CAGR of 7.1% during the forecast period

The Orthopedics Braces and Supports Market report covering key segments are product, end-use, and region.