Plate & Frame Heat Exchangers Market Share, Size, Trends, Industry Analysis Report

By Type (Welded, Gasketed, Brazed, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4506

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

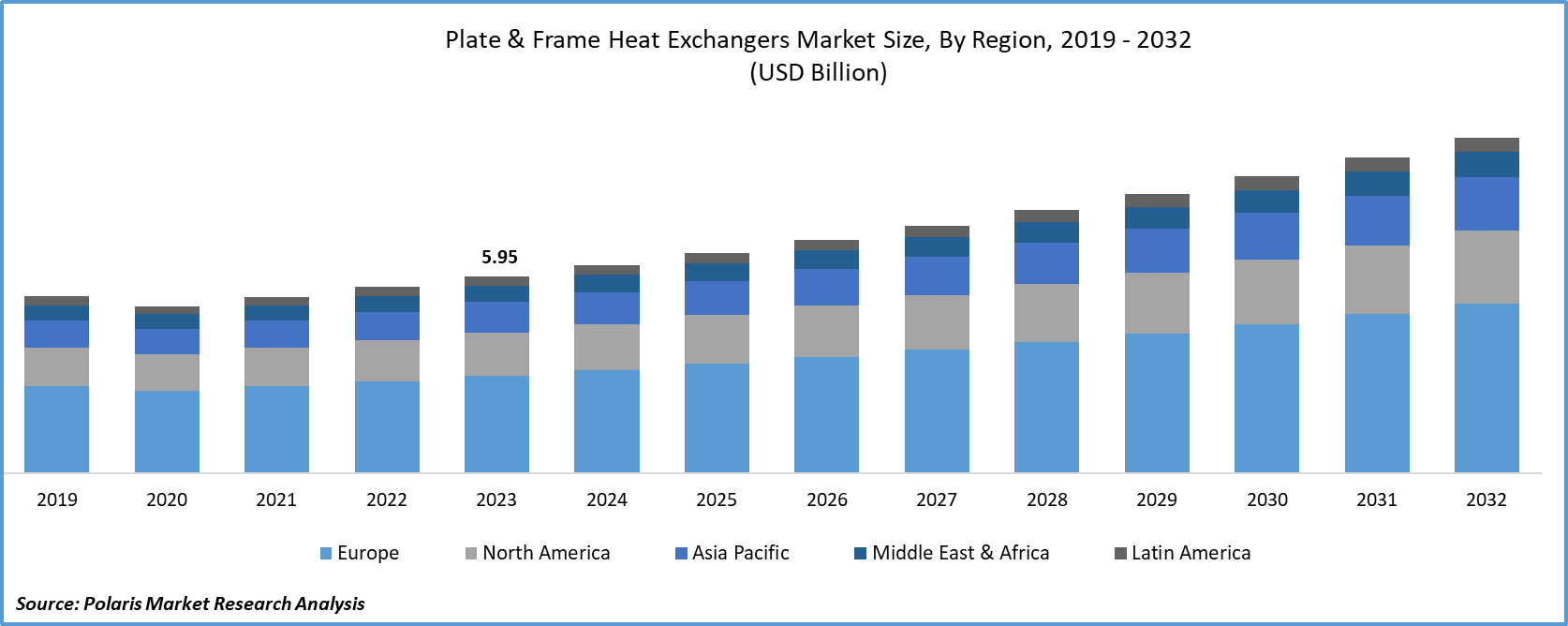

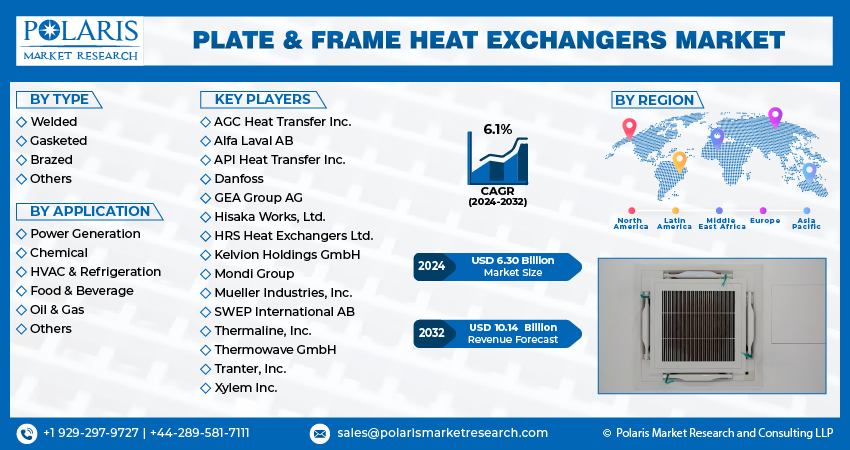

- Plate & Frame Heat Exchangers Market size was valued at USD 5.95 billion in 2023.

- The market is anticipated to grow from USD 6.30 billion in 2024 to USD 10.14 billion by 2032, exhibiting the CAGR of 6.1% during the forecast period.

Market Introduction

The plate & frame heat exchangers market is experiencing robust growth driven by the critical need to replace aging infrastructure. In various industries, including chemical, food and beverage, and HVAC, the limitations of outdated heat exchange systems propel the demand for modern and efficient solutions. Plate & frame heat exchangers emerge as a versatile and energy-efficient alternative, addressing inefficiencies and maintenance challenges associated with aging infrastructure. Renowned for superior thermal performance, compact design, and easy maintenance, these heat exchangers are favored by industries seeking to enhance operational efficiency.

The global emphasis on sustainability further fuels the adoption of plate & frame heat exchangers, aligning with the broader initiative to upgrade infrastructure, meet contemporary standards, and adhere to environmental regulations. This trend signifies a transformative shift towards resilient, sustainable, and technologically advanced heat exchange solutions.

In addition, companies operating in the market are collaborating to expand their market reach and strengthen presence.

- For instance, in August 2022, SWEP introduced the B8DW model as the newest inclusion in their collection of double-wall heat exchangers, specifically crafted for applications that demand enhanced safeguards against leaks.

To Understand More About this Research: Request a Free Sample Report

The plate & frame heat exchangers market is experiencing significant growth driven by the expanding activities in oil and gas exploration and production. Amidst the increasing global demand for energy, there's a heightened emphasis on efficiency and cost-effectiveness in the sector. Plate & frame heat exchangers are crucial for optimizing heat transfer, improving cooling efficiency, and facilitating hydrocarbon extraction. These heat exchangers play a vital role in various stages of oil and gas production, ensuring effective thermal energy exchange.

Industry Growth Drivers

Focus on renewable energy is projected to spur the product demand

The plate & frame heat exchangers market is experiencing a notable upswing driven by the increasing emphasis on renewable energy. As nations prioritize carbon reduction and shift towards sustainable practices, plate & frame heat exchangers have become integral to efficient heat transfer in renewable energy projects such as solar and geothermal. With a heightened global focus on environmental sustainability and stringent regulations promoting clean energy, these heat exchangers play a vital role in harnessing energy from eco-friendly sources. Their significance is poised to grow as the world intensifies efforts to combat climate change, solidifying their pivotal role in the renewable energy sector.

Stringent energy efficiency requirements is expected to drive plate & frame heat exchangers market growth

Stringent energy efficiency requirements are driving a surge in the plate & frame heat exchangers market. As global industries prioritize environmental sustainability, these heat exchangers offer a compelling solution with enhanced thermal performance and reduced energy consumption. Regulatory bodies worldwide are emphasizing energy efficiency standards, compelling businesses in HVAC, chemical, food processing, and power generation to adopt these compact and efficient heat exchangers. The market's growth is fueled by the need to meet regulatory compliance while optimizing energy usage, reflecting a broader industry shift towards sustainability and cost-effectiveness.

Industry Challenges

High initial costs are likely to impede the market growth

High initial costs pose a significant obstacle in the plate & frame heat exchangers market. The substantial upfront investment required for purchasing and installing these heat exchangers acts as a deterrent, particularly for smaller enterprises with limited budgets. While plate & frame heat exchangers promise long-term efficiency benefits, the financial barrier at the outset often hampers widespread adoption. Addressing this challenge requires manufacturers to explore cost-effective solutions, highlight the long-term value proposition, and potentially offer financing options.

Report Segmentation

The plate & frame heat exchangers market analysis is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Gasketed segment held significant market revenue share in 2023

The gasketed segment held significant market revenue share in 2023. Gasketed plate & frame heat exchangers are heat transfer systems with multiple plates connected by gaskets, forming alternating hot and cold channels. Renowned for compactness and superior thermal efficiency, these exchangers find crucial applications across diverse industries. The gaskets create secure seals between plates, preventing fluid mixing for optimal heat exchange. Their versatility allows adaptation to various fluids and temperature ranges, while easy gasket maintenance ensures operational flexibility. Careful selection of gasket materials is essential for durability under specific temperature and chemical conditions. Commonly utilized in HVAC, refrigeration, and industrial processes, gasketed plate & frame heat exchangers excel in efficient and adaptable heat transfer.

By Application Analysis

HVAC & refrigeration segment held significant market revenue share in 2023

The HVAC & refrigeration segment held significant revenue share in 2023. Plate & frame heat exchangers thrive in HVAC and refrigeration applications driven by their efficiency, space-efficient design, and adaptability. These exchangers excel in optimizing heat transfer, ensuring precise temperature control in HVAC and efficient heat removal in refrigeration. Their compact footprint is advantageous for installations with limited space. Versatility allows them to accommodate diverse fluids and adapt to varying temperature requirements. Contributing to energy efficiency, plate & frame heat exchangers comply with industry standards, ensuring reliability. Despite potential initial costs, their long-term benefits, including reliability, ease of maintenance, and adaptability, underscore their cost-effectiveness in enhancing the overall performance of HVAC and refrigeration systems.

Regional Insights

Asia-Pacific region expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience significant growth during the forecast period. Asia's expanding industrial sector, encompassing manufacturing, chemical processing, and power generation, is driving demand for advanced heat exchange solutions. The rapid pace of infrastructure development across Asia-Pacific demands cutting-edge heating and cooling technologies. Plate & frame heat exchangers are increasingly sought after for their efficiency in construction projects and HVAC applications.

Europe region accounted for significant market share in 2023. The plate & frame heat exchangers market in Europe is expanding dynamically, driven by stringent environmental regulations favoring energy-efficient solutions. Europe's diverse industrial sector, including chemical processing and HVAC applications, fuels the demand for versatile heat exchange technologies. The integration of renewable energy sources amplifies the role of plate & frame heat exchangers in optimizing thermal processes.

Continuous technological advancements, particularly in materials and design, enhance the reliability and performance of these exchangers. The emphasis on energy efficiency, coupled with growing urbanization and infrastructure projects, positions plate & frame heat exchangers as pivotal components in Europe's evolving energy landscape, aligned with environmental sustainability goals.

Key Market Players & Competitive Insights

The plate & frame heat exchangers market consists of diverse participants, and the expected entry of numerous newcomers is poised to intensify rivalry. Leading players in the market consistently enhance their technologies to maintain a competitive advantage, emphasizing efficiency, reliability, and safety. These entities prioritize strategic actions like forging partnerships, improving products, and participating in collaborative ventures, aimed at surpassing their industry counterparts. Their goal is to secure a substantial plate & frame heat exchangers market share.

Some of the major players operating in the global plate & frame heat exchangers market include:

- AGC Heat Transfer Inc.

- Alfa Laval AB

- API Heat Transfer Inc.

- Danfoss

- GEA Group AG

- Hisaka Works, Ltd.

- HRS Heat Exchangers Ltd.

- Kelvion Holdings GmbH

- Mondi Group

- Mueller Industries, Inc.

- SWEP International AB

- Thermaline, Inc.

- Thermowave GmbH

- Tranter, Inc.

- Xylem Inc.

Recent Developments

- In March 2023, Alfa Laval introduced the AlfaNova GL50, marking the inaugural heat exchanger designed explicitly for fuel cell systems. This innovative AlfaNova GL50 is an asymmetrical gas-to-liquid plate heat exchanger, constructed entirely from stainless steel. Capable of managing gas flows reaching 250 m3/h and accommodating inlet gas temperatures of up to 750°C, it exhibits outstanding performance in challenging conditions.

- In March 2023, Xylem's Bell & Gossett manufacturing unit introduced high-efficiency 'X' plates to improve its recently enhanced gasketed plate and frame heat exchanger (GPX) models, namely P45, P55, P86, and P110.

Report Coverage

The plate & frame heat exchangers market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, and their futuristic growth opportunities.

Plate & Frame Heat Exchangers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.30 billion |

|

Revenue forecast in 2032 |

USD 10.14 billion |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Get in Touch Whenever You Need Us

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Plate & Frame Heat Exchangers Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

U.S. Garden Planter Market Size, Share 2024 Research Report

Alexipharmic Drugs Market Size, Share 2024 Research Report

Cleaning and Hygiene Products Market Size, Share 2024 Research Report

FAQ's

The Plate & Frame Heat Exchangers Market report covering key segments are type, application, and region.

Plate & Frame Heat Exchangers Market Size Worth $10.14 Billion By 2032

Plate & Frame Heat Exchangers Market exhibiting the CAGR of 6.1% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in Plate & Frame Heat Exchangers Market are Focus on renewable energy is projected to spur the product demand