Alternative Protein Market Size, Share, Trends, Industry Analysis Report

: By Source, Form (Dry and Liquid), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5111

- Base Year: 2024

- Historical Data: 2020-2023

Alternative Protein Market Overview

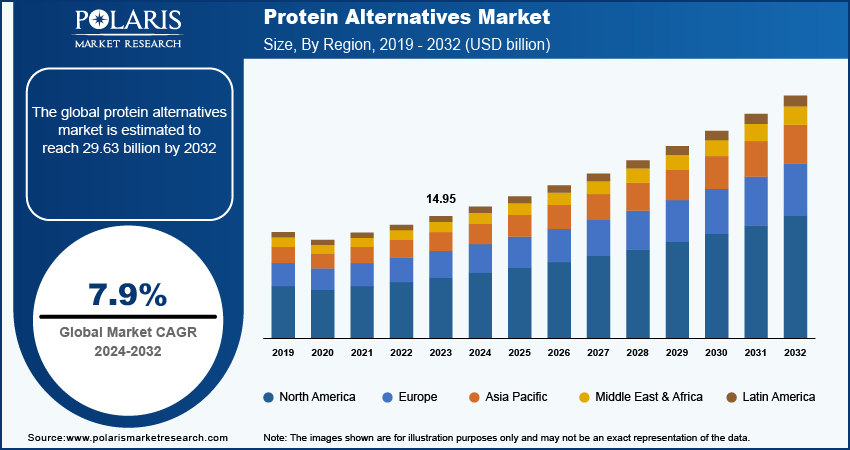

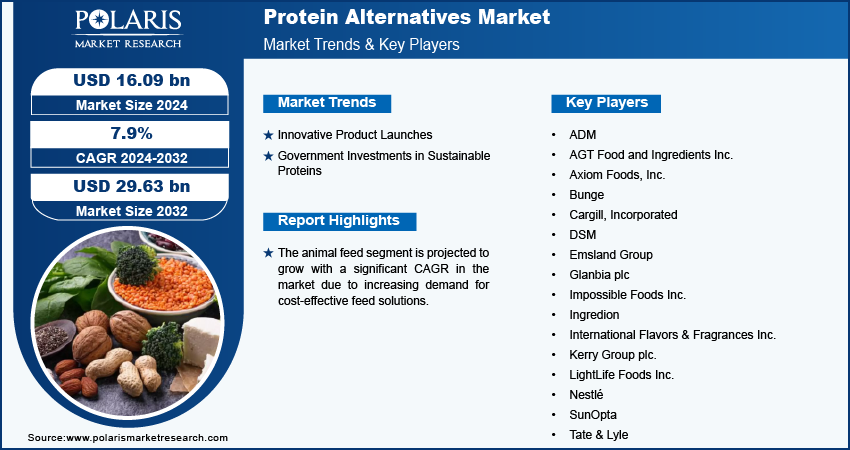

The global alternative protein market size was valued at USD 90.04 billion in 2024. The industry is projected to grow from USD 98.31 billion in 2025 to USD 220.30 billion by 2034, exhibiting a CAGR of 9.4% during 2025–2034.

Alternative protein refers to protein sources derived from plants, fungi, algae, insects, or cultivated animal cells, serving as substitutes for conventional animal-based proteins found in meat, dairy, seafood, and eggs. These proteins are incorporated into a variety of food products, including plant-based burgers, sausages, dairy-free milk, protein bars, and even seafood substitutes. They are designed to appeal to consumers seeking to reduce their environmental impact, improve their health, or avoid animal products for ethical reasons.

Alternative proteins are gaining global attention due to rising concerns about the environmental, ethical, and health impacts of traditional livestock farming. Plant-based proteins, such as those from beans, lentils, peas, and soy, are being widely used to create meat analogues and dairy alternatives that closely mimic the taste and texture of animal products. Fermentation-derived proteins, including mycoprotein from fungi and single-cell proteins from yeast or bacteria, are also being increasingly utilized for their nutritional value and sustainable production methods. In addition, insect proteins are gaining traction for their high protein content and minimal environmental footprint.

The rising vegan population globally is propelling the alternative protein growth. For instance, according to data published by the World Population Review, India has the highest percentage of vegans at 9% of the population and is projected to increase in the future. The vegan population looks for protein-rich foods that align with their dietary choices. This drives innovation and investment in alternative protein products such as soy, lentil, and pea proteins, as well as cultured meat and fermentation-derived options, leading to market expansion.

Increasing awareness of the environmental impact of animal agriculture, such as greenhouse gas emissions and resource depletion, has encouraged consumers to switch to sustainable and alternative protein sources. This shift not only increases demand but also accelerates research and development, improving the quality and affordability of alternative proteins and making them more appealing to a broader audience.

To Understand More About this Research: Request a Free Sample Report

The market demand is driven by the rising advancements in protein manufacturing. Innovations such as precision fermentation, cell-culture techniques, and enhanced plant-protein extraction are significantly improving the taste, texture, and nutritional value of alternative proteins, making them more competitive with traditional animal-based products. These technological breakthroughs are also allowing large-scale production at lower costs, which helps bring alternative protein products to a wider audience. Additionally, advanced techniques such as 3D printing, 3D imaging, and AI-driven protein optimization have enabled the creation of customizable alternative proteins, attracting not only vegans and vegetarians but also flexitarians and environmentally conscious consumers.

Market Dynamics

Growing Disposable Income Worldwide

Increasing disposable income globally is propelling people to prioritize healthier lifestyles, sustainability, and ethical consumption. This has led to greater interest in alternative proteins, which are often perceived as cleaner, more environmentally friendly, and better for long-term health. Additionally, as disposable incomes rise, particularly in emerging economies, dietary preferences shift toward diverse and protein-rich diets, creating demand for alternative proteins beyond traditional Western vegan demographics. Food companies are also capitalizing on this trend by expanding product availability in the retail and food service sectors, thereby contributing to market growth.

Increasing Urbanization Globally

Urban areas usually have greater access to supermarkets, restaurants, and food delivery services that offer alternative proteins, such as plant-based and lab-grown, making them more visible and accessible. The fast-paced urban lifestyle also fuels demand for ready-to-eat and processed foods, prompting food companies to innovate with alternative protein-based snacks, meals, and convenience products. Additionally, urban consumers are generally more exposed to global food trends, health awareness campaigns, and environmental concerns, leading to a higher willingness to reduce meat consumption in favor of sustainable protein alternatives. The concentration of younger and environmentally conscious populations in urban areas further fuels the demand for alternative proteins. Hence, the increasing urbanization worldwide is propelling the demand for alternative proteins. For instance, United Nations Development Programme in 2024 stated that urban areas host more than half of the global population and are projected to double by 2050.

Market Segment Insights

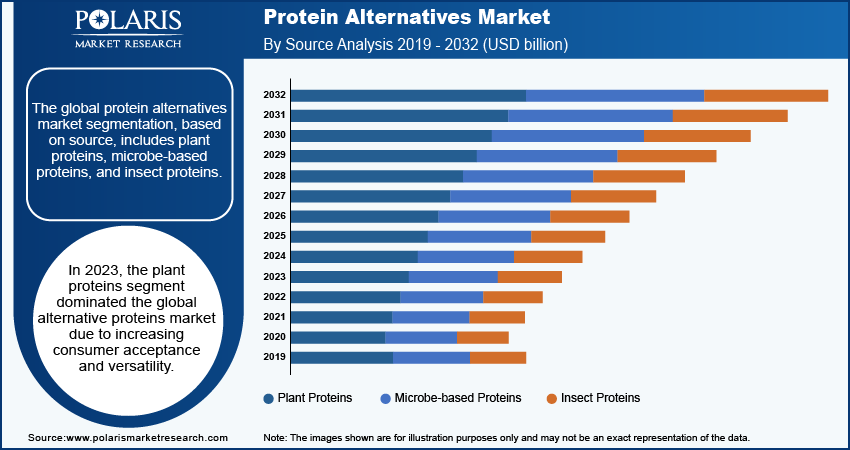

Alternative Protein Market Evaluation by Source

Based on source, the market is divided into plant-based and insect-based. The plant-based segment held the largest market share in 2024 due to increasing consumer awareness of sustainability, health, and animal welfare. Consumers across North America and Europe favor plant-derived protein options such as soy, pea, and rice protein due to their wide availability, functional versatility, and favorable nutritional profiles. The expansion of retail and foodservice channels offering plant-centric menus has further boosted adoption. Additionally, strong investment activity from both traditional food companies and startups has fueled rapid scaling and improved product quality of plant-based protein.

Alternative Protein Market Insight by Form

In terms of form, the market is segregated into dry and liquid. The dry segment accounted for a major market share in 2024 due to its extended shelf life, ease of transportation, and compatibility with a wide range of food formulations. Manufacturers favor dry protein powders and concentrates due to their stability and lower storage costs, making them ideal for both large-scale food production and direct consumer use in protein bars, baked goods, and dietary supplements. The growing popularity of at-home cooking and fitness-focused lifestyles has also increased demand for dry protein products. Additionally, the dry form has allowed producers to offer high-protein content in compact sizes without compromising taste or nutritional value, fueling its widespread adoption.

The liquid segment is expected to hold a significant share in the coming years. Consumers are increasingly seeking convenient, on-the-go nutrition, and liquid protein forms provide an easy and fast way to meet daily nutrition needs. Advances in emulsification and stabilization technologies have improved the texture, flavor, and shelf stability of liquid proteins, making them more appealing to mainstream consumers. Furthermore, beverage companies are continuously investing in new formulations that incorporate plant and fermentation-derived proteins into smoothies, coffee drinks, and milk alternatives, expanding the range of liquid proteins.

Regional Analysis

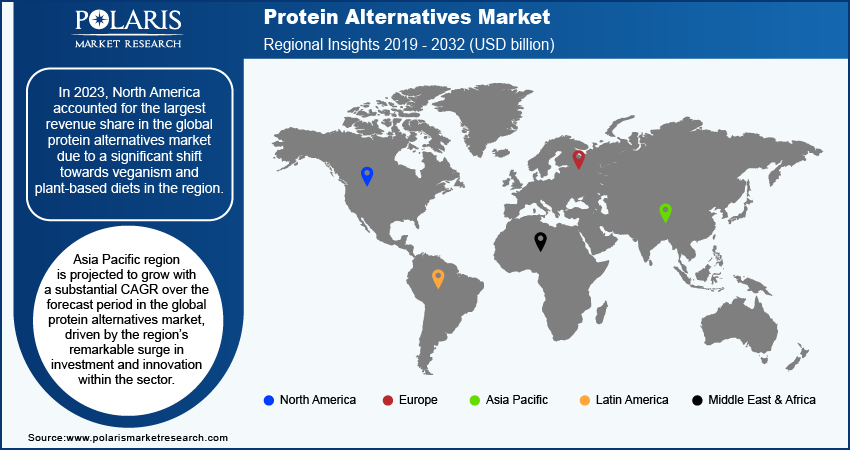

By region, the market report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major alternative protein market share in 2024 due to its strong consumer demand, advanced food processing infrastructure, and high level of investment in food innovation. American consumers are increasingly prioritizing health, sustainability, and ethical food choices, which has boosted demand for protein alternatives across retail and foodservice channels. The region’s robust startup ecosystem and partnerships between legacy food companies and biotech firms have accelerated the development and commercialization of alternative proteins. Furthermore, favorable regulatory frameworks and rising environmental awareness has contributed to the widespread adoption of plant- and fermentation-derived protein products. The availability of diverse product offerings has contributed to North America’s dominant position in the global market.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period, owing to the rapid urbanization, population growth, and rising incomes. For instance, as per the data published by the World Population Review, Asia comprises 60% of the world’s population, and the number is expected to increase in the future.

The increasing concerns over food security and environmental sustainability are prompting both consumers and the government to support the development of alternative protein in the region. Companies are investing heavily in research and production capabilities, while regulatory authorities are creating supportive policies for alternative protein ingredients, such as pea and soy protein ingredients. Additionally, increasing openness to a variety of protein sources, including insect and algae-based options, is driving the Asia Pacific alternative protein market revenue.

Key Players and Competitive Insights

The market is highly competitive, driven by strategic partnerships, and collaborations as key players expand their product portfolios and market reach. Major companies are aggressively pursuing mergers and acquisitions to enhance production capabilities and enter new markets. Additionally, companies are diversifying their portfolios with innovative products like cultured meat, fermented proteins, and hybrid plant-meat blends. Investments in R&D and sustainability further intensify competition as firms differentiate through eco-friendly branding.

The market is fragmented, with the presence of numerous global and regional market players. Major players in the market are AB Mauri, AMCO Proteins, Angel Yeast, Archer Daniel Midland Company, Axiom Foods, Calysta Inc., Cargill Incorporation, Darling Ingredients, Griffith Foods, Hamlet Protein, Ingredion, Innovafeed, Lallemand Inc., Royal DSM NV, and Ynsect.

Archer Daniels Midland Company (ADM) is a global powerhouse in the food processing and nutrition industry, renowned for its extensive legacy and ongoing innovation in the alternative protein sector. Founded in 1902 and headquartered in Chicago, ADM has evolved into one of the world’s major suppliers of plant-based proteins, leveraging its deep expertise and global reach to shape the future of food. ADM’s approach to alternative protein innovation is holistic and forward-looking. The company is not only scaling up production but also investing heavily in research and development to diversify its protein sources. Beyond soy, ADM’s portfolio now includes pea, wheat, chickpea, sunflower, algae, and other emerging plant-based proteins.

Cargill Incorporated is one of the largest privately held corporations in the US, with a legacy spanning over 150 years in food, agriculture, and nutrition. Cargill has strategically positioned itself at the forefront of the alternative protein revolution. The company’s approach to alternative protein is characterized by robust investments in research, partnerships, and technological innovation, all aimed at meeting the growing demand for diverse, sustainable, and nutritious protein sources. Cargill’s alternative protein efforts extend well beyond mycoprotein. The company is also a leader in plant-based protein innovation, developing ingredients and finished products that mimic the taste, texture, and nutritional profile of animal-derived foods. Cargill’s broad ingredient portfolio includes pea, soy, and wheat proteins.

List of Key Companies in Alternative Protein Market

- AB Mauri

- AMCO Proteins

- Angel Yeast

- Archer Daniel Midland Company

- Axiom Foods

- Calysta Inc.

- Cargill Incorporation

- Darling Ingredients

- Griffith Foods

- Hamlet Protein

- Ingredion

- Innovafeed

- Lallemand Inc.

- Royal DSM NV

- Ynsect

Alternative Protein Industry Developments

December 2024: Griffith Foods, a global food product development partner that specializes in providing food ingredients, announced the launch of its first alternative proteins portfolio.

August 2024: Imperial College London launched the National Alternative Protein Innovation Centre (NAPIC) to develop tasty, planet-friendly animal protein alternatives.

May 2021: Unilever, a global consumer goods company, announced entering into a partnership agreement with food-tech company ENOUGH. According to Unilever, the partnership aims to bring new plant-based protein to the market.

Alternative Protein Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Plant-Based

- Soy Protein Isolates

- Soy Protein Concentrates

- Fermented Soy Protein

- Duckweed Protein

- Others

- Insect-Based

- Microbial-Based

- Bacteria

- Yeast

- Algae

- Fungi

- Others

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Dry

- Liquid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverage

- Meat Analogs

- Bakery

- Dairy Alternatives

- Cereals & Snacks

- Beverages

- Others

- Animal Feed

- Poultry

- Broiler

- Layer

- Turkey

- Aquaculture

- Salmon

- Trout

- Shrimps

- Carp

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Alternative Protein Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 90.04 billion |

|

Market Size Value in 2025 |

USD 98.31 billion |

|

Revenue Forecast by 2034 |

USD 220.30 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 90.04 billion in 2024 and is projected to grow to USD 220.30 billion by 2034.

The global market is projected to register a CAGR of 9.4% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are AB Mauri, AMCO Proteins, Angel Yeast, Archer Daniel Midland Company, Axiom Foods, Calysta Inc., Cargill Incorporation, Darling Ingredients, Griffith Foods, Hamlet Protein, Ingredion, Innovafeed, Lallemand Inc., Royal DSM NV, and Ynsect.

The plant-based segment dominated the market in 2024.

The liquid segment is expected to grow at the fastest pace in the coming years.