Robotic Sensors Market Size, Share, Trend, Industry Analysis Report

By Sensor Type (Vision Sensors/Cameras, Proximity Sensors, Ultrasonic Sensors, Force/Torque Sensors), By Robot Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5827

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

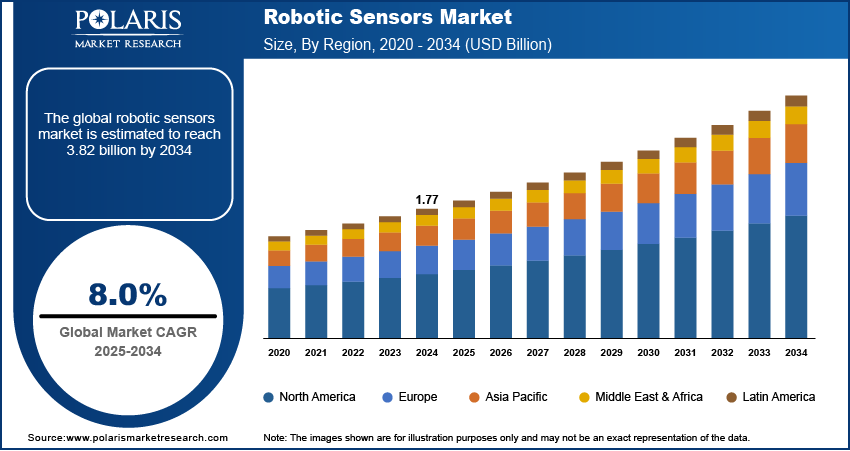

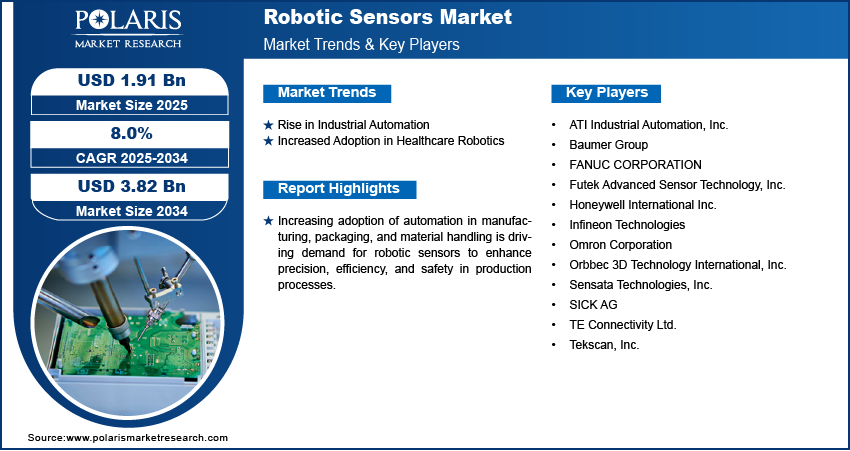

The global robotic sensors market size was valued at USD 1.77 billion in 2024 and is projected to register a CAGR of 8.0% during 2025–2034. Increasing adoption of automation in manufacturing, packaging, and material handling is driving demand for robotic sensors to enhance precision, efficiency, and safety in production processes.

The robotic sensors market refers to the industry involved in the development, manufacturing, and deployment of sensors used in robots to enable perception, navigation, interaction, and decision-making. These sensors allow robots to detect changes in their environment such as distance, temperature, pressure, motion, and vision and respond accordingly. They are essential components in industrial, service, collaborative robots (cobots), and autonomous robots across sectors such as manufacturing, healthcare, logistics, automotive, and aerospace. Integration of AI with robotic systems enhances real-time decision-making. Sensors provide the data needed for AI models to perceive and adapt to dynamic environments.

Autonomous mobile robots in logistics and warehousing rely on LiDAR, ultrasonic, and vision sensors for navigation and obstacle detection, fueling market growth. Additionally, the shift toward smart factories with interconnected robotic systems increases the need for real-time monitoring and feedback through sensors.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rise in Industrial Automation

The growing shift toward industrial automation and control systems is significantly boosting the demand for robotic sensors. Manufacturing, packaging, and material handling industries are increasingly deploying robots to improve precision, reduce cycle times, and enhance worker safety. Various major companies such as Tesla and Ford are increasingly leveraging automated robotic systems to enhance production efficiency, streamline manufacturing processes, and maintain high standards of product quality. For instance, in April 2024, Tesla produced over 433,000 vehicles, with approximately 387,000 delivered in the first quarter alone, highlighting the scale and efficiency of its automated production lines, which depend heavily on advanced robotic sensors for quality assurance and process optimization. Sensors play a vital role in enabling real-time feedback, obstacle detection, and movement accuracy, which are essential in automated production lines. These sensors help machines detect variables such as position, pressure, force, and temperature, making them more responsive and adaptable to changing conditions. Industries are investing in smart factories where robotic systems equipped with advanced sensors support tasks ranging from welding and assembly to inspection and logistics. As companies seek to remain competitive through productivity and efficiency gains, robotic sensors are becoming critical components in next-generation automation strategies. The integration of robotic sensors plays a critical role in enabling seamless interoperability among automated systems, allowing real-time monitoring, precision control, and adaptive decision-making on the factory floor. This growing reliance on sensor-driven automation across industries is driving widespread adoption of robotic operating systems and intelligent sensing technologies, thereby expanding the market.

Increased Adoption in Healthcare Robotics

Healthcare robotics is seeing rapid adoption, and robotic sensors are at the core of this transformation. Medical robots used in surgery, diagnostics, and rehabilitation rely on high-precision sensors to guide movements, ensure patient safety, and deliver accurate outcomes. Sensors help in detecting proximity, force, and motion, allowing surgical robots to perform delicate procedures with minimal invasiveness. In rehabilitation, sensors assist in real-time feedback and adaptive responses based on a patient’s mobility or resistance. Robots supporting elderly care or diagnostics also use sensors for navigation and monitoring vital signs. The need for precision, safety, and personalization in healthcare is driving hospitals and research centers to adopt robotic systems, which is accelerating demand for robotic sensor technologies tailored for clinical use.

Segment Insights

Sensor Type Analysis

Based on sensor type, the segmentation includes vision sensors/cameras, proximity sensors, ultrasonic sensors, force/torque sensors, inertial sensors, and others. The force/torque sensors segment accounted for a significant revenue share in 2024, due to their critical role in enabling robots to perform delicate and high-precision tasks across industrial and collaborative environments. These sensors allow machines to measure physical interaction between tools and objects, ensuring accurate force application during assembly, polishing, and machining operations. In collaborative robotics, force/torque sensors are vital for safe human-robot interaction by detecting unexpected contact and adjusting movement in real-time. Their use in automotive, electronics, and heavy machinery manufacturing is expanding, especially in quality control and calibration applications. Continuous advancements in sensor miniaturization and multi-axis feedback capabilities are further enhancing their adoption across sectors requiring precise motion control and high safety standards.

The vision sensors and cameras segment is projected to register the highest CAGR during the forecast period, supported by rising demand for visual intelligence in robotics. These sensors allow robots to interpret their environment by capturing and analyzing visual data, which is essential for quality inspection, sorting, pick-and-place operations, and autonomous navigation. In modern production lines and logistics, vision systems improve operational flexibility by enabling robots to handle varied objects and adapt to dynamic settings. Enhanced image processing capabilities, AI integration, and declining camera sensor costs are contributing to widespread deployment. The rise in automation across retail, warehousing, and agriculture is accelerating the adoption of vision-based robotic systems that rely on accurate environmental perception.

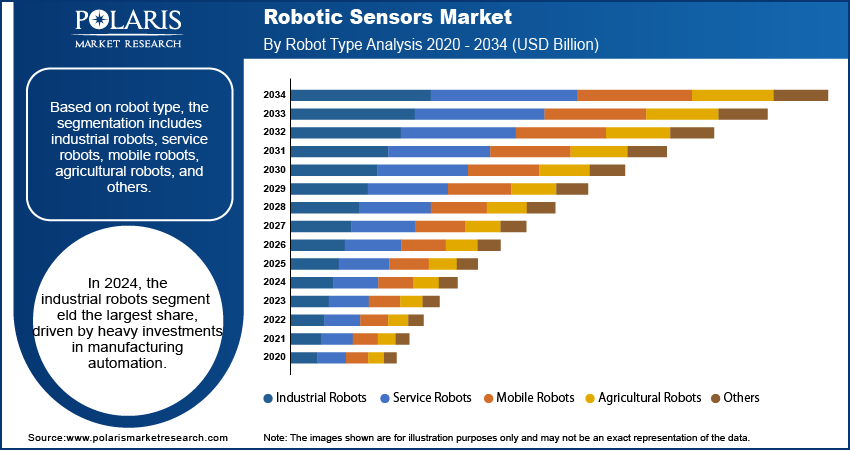

Robot Type Analysis

Based on robot type, the segmentation includes industrial robots, service robots, mobile robots, agricultural robots, and others. In 2024, the industrial robots segment held the largest share, driven by heavy investments in manufacturing automation. Robots used in automotive, electronics, and metalworking industries require a range of sensors to perform tasks with precision and repeatability. These robots are increasingly integrated with force, proximity, and vision sensors to ensure consistent performance in high-volume production environments. The demand for automation in welding, painting, assembly, and inspection continues to grow, leading to widespread use of sensor-equipped robotic arms. The focus on reducing human error, improving quality, and optimizing cycle times is pushing manufacturers to adopt intelligent sensor technologies. Customization of robots for specific industrial tasks is further enhancing the demand for diverse and high-performance sensor modules.

The service robots segment is expected to register the highest CAGR over the forecast period, driven by expanding applications in domestic, commercial, and healthcare environments. These robots rely heavily on sensors for navigation, interaction, and safety. Force sensors assist in handling delicate objects, vision systems guide object recognition, and ultrasonic or proximity sensors prevent collisions. The growing use of robots in delivery, cleaning, surveillance, and assisted living is creating strong demand for adaptive sensor systems that enable autonomous operation in unstructured environments. Enhanced sensor capabilities are also enabling service robots to function safely around humans, an essential factor in healthcare and hospitality applications. Increasing focus on human-robot collaboration and convenience-driven automation is propelling the demand for compact, intelligent sensor technologies in this segment.

Application Analysis

Based on application, the segmentation includes object detection & recognition, navigation & mapping, collision avoidance, environmental monitoring, and others. In 2024, the object detection & recognition segment accounted for a significant share, fueled by its foundational role in enabling robotic decision-making and automation. Robots across manufacturing, logistics, and service sectors use object recognition to identify components, differentiate materials, and make task-specific adjustments. Vision sensors, 3D cameras, and AI-driven algorithms are commonly used to process visual inputs and extract information needed for real-time actions. Whether it’s picking items from a conveyor belt, identifying surgical tools, or scanning retail products, object recognition enables more flexible and context-aware automation. Enhanced accuracy, faster processing speeds, and better environmental adaptability are making object detection systems more reliable and scalable across industries, resulting in broader deployment of sensor-driven robotics.

The navigation and mapping segment is projected to register the highest CAGR during the forecast period, driven by increased demand for autonomous systems in logistics, agriculture, and security. Robots used in these applications must navigate complex and changing environments, relying on sensors such as LIDAR, ultrasonic, inertial, and visual odometry tools. Accurate mapping allows for safe path planning, real-time location tracking, and obstacle avoidance, which are critical for mobile and service robots. Growth in autonomous warehouse robots, agricultural drones, and delivery bots is fueling the need for advanced sensing solutions that support simultaneous localization and mapping (SLAM). Real-time data fusion, AI-assisted route optimization, and advances in edge processing are further driving the adoption of navigation-focused sensor systems.

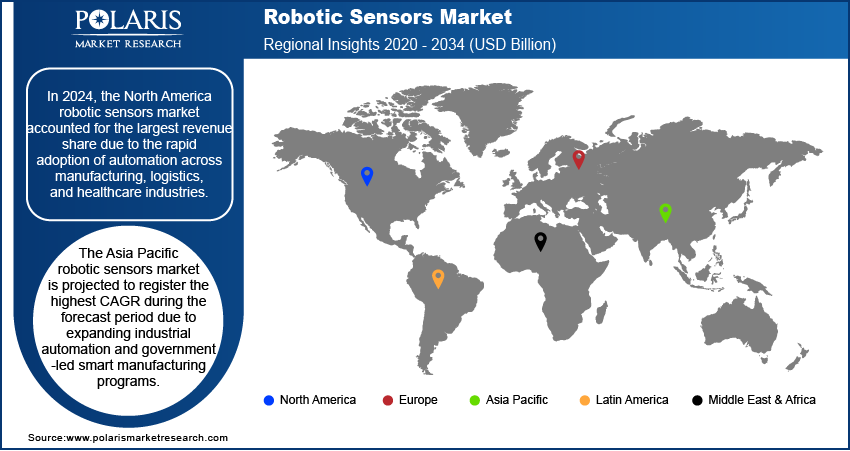

Regional Overview

In 2024, the North America robotic sensors market accounted for the largest revenue share due to the rapid adoption of automation across manufacturing, logistics, and healthcare industries. Strong investments in smart factory initiatives and industrial robotics propel demand for sensors that support precision, safety, and adaptive functionality. The International Federation of Robotics (IFR) reported that in 2023, Canada saw its deployment of industrial robots surge by 37%, reaching a total of 4,311 units. This trend in robot installations is heavily influenced by the cyclical nature of investments within the automotive sector. Notably, the automotive industry accounted for 58% of total installations in 2023. Robotics companies are partnering with sensor technology providers to develop advanced solutions tailored to high-performance environments. The growing use of collaborative robots in warehouse automation, especially in e-commerce and automotive sectors, is further strengthening the region’s market leadership. Government support for innovation in robotics and well-established infrastructure for technology development are also contributing to sustained growth.

US Robotic Sensors Market Trends

The US market held the dominant share in North America in 2024, driven by strong industrial base and high demand for automation in sectors such as aerospace, electronics, and food processing. Companies are increasingly adopting robotic systems equipped with advanced sensors for quality inspection, material handling, and high-precision tasks. Startups and established players alike are developing application-specific sensors that support machine vision, force feedback, and navigation. The presence of major R&D hubs and the growing integration of AI and IoT in robotics is encouraging innovation in sensor technology. Additionally, the rising deployment of medical and service robots across hospitals and public spaces is creating new sensor application areas.

Asia Pacific Robotic Sensors Market Insights

The Asia Pacific market is projected to register the highest CAGR during the forecast period, due to expanding industrial automation and government-led smart manufacturing programs. Rapid development of of industrial automation and smart manufacturing infrastructure in countries such as South Korea, Japan, China, and India is fueling demand for intelligent robotic systems across the automotive, electronics, and logistics industries. The State Council of the People's Republic of China reported that in 2022, the China Federation of Logistics and Purchasing observed a 3.4% year-on-year increase in social logistics, amounting to USD 50.4 trillion. Local manufacturers are focusing on upgrading production capabilities using robots integrated with vision, force, and inertial sensors. Cost-effective sensor manufacturing in the region is allowing for wider adoption, even among mid-sized enterprises. Rising interest in AI-enabled robotics and increasing cross-border collaborations in robotics R&D are pushing further innovation and adoption of sensor-integrated systems.

China Robotic Sensors Market Assessment

China accounted for the largest revenue share in Asia Pacific in 2024, fueled by aggressive automation efforts across the manufacturing and logistics sectors. Domestic industries are investing heavily in sensor-equipped robots to boost productivity, reduce dependency on labor, and improve product quality. Leading robotics manufacturers are scaling operations, offering competitively priced systems embedded with multi-functional sensors. High-volume production of mobile robots, coupled with growing use in smart warehouses, is driving the demand for navigation and obstacle detection sensors. Government policies encouraging advanced manufacturing, coupled with increased funding for robotics innovation, are supporting rapid sensor integration in both industrial and service robotics segments.

Europe Robotic Sensors Market

The market in Europe is experiencing steady growth, driven by the strong emphasis on safety, quality assurance, and energy-efficient automation. Advanced manufacturing hubs across Germany, France, and Italy are expanding their use of robotic systems embedded with high-precision sensors for assembly, inspection, and packaging. The growing popularity of collaborative robots in medium-scale enterprises is creating demand for tactile and proximity sensors that ensure human-robot safety. Strict regulatory frameworks around workplace automation are encouraging investments in compliant sensor technologies. Robotics companies in the region are forming partnerships with sensor developers to build integrated platforms for mobility, environmental sensing, and adaptive performance in dynamic industrial environments.

Key Players and Competitive Analysis

The competitive landscape of the robotic sensors market is shaped by a mix of global sensor manufacturers, robotics integrators, and emerging startups focused on advanced automation technologies. Industry analysis reveals strong momentum in strategic alliances between robotics firms and sensor developers to accelerate innovation in fields such as machine vision, tactile sensing, and environmental monitoring. Market expansion strategies include geographic diversification, customized sensor offerings, and vertical integration into smart manufacturing ecosystems. Mergers and acquisitions are driving portfolio enhancement and facilitating access to new application domains such as healthcare, logistics, and defense. Post-merger integration efforts often focus on harmonizing product lines and scaling production capabilities. Technology advancements in AI-driven sensing, sensor miniaturization, and edge computing are intensifying competition, particularly in autonomous navigation and precision control. Companies are investing in R&D to improve sensor responsiveness and interoperability, strengthening their position across fast-growing segments such as collaborative robots, mobile robots, and autonomous systems.

List of Key Companies

- ATI Industrial Automation, Inc.

- Baumer Group

- FANUC CORPORATION

- Futek Advanced Sensor Technology, Inc.

- Honeywell International Inc.

- Infineon Technologies

- Omron Corporation

- Orbbec 3D Technology International, Inc.

- Sensata Technologies, Inc.

- SICK AG

- TE Connectivity Ltd.

- Tekscan, Inc.

Robotic Sensors Industry Developments

In February 2025, Orbbec launched the Gemini 335LE, a stereo vision 3D camera with Ethernet connectivity, expanding its lineup of industrial 3D vision systems for robotics and warehouse automation.

In January 2025, SICK AG acquired Accerion, a Dutch startup specializing in AI-based image processing and infrastructure-free localization for AMRs. The acquisition led to the formation of SICK Accerion B.V., aimed at boosting AMR navigation and localization capabilities.

In May 2024, ABB introduced its next-generation AMR with Visual SLAM and AI, along with the AMR Studio software suite, enabling robots to operate in dynamic environments without fixed infrastructure.

Robotic Sensors Market Segmentation

By Sensor Type Outlook (Revenue USD Billion, 2020–2034)

- Vision Sensors/Cameras

- Proximity Sensors

- Ultrasonic Sensors

- Force/Torque Sensors

- Inertial Sensors

- Others

By Robot Type Outlook (Revenue USD Billion, 2020–2034)

- Industrial Robots

- Service Robots

- Mobile Robots

- Agricultural Robots

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Object Detection & Recognition

- Navigation & Mapping

- Collision Avoidance

- Collision Avoidance

- Environmental Monitoring

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Robotic Sensors Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.77 billion |

|

Market Size in 2025 |

USD 1.91 billion |

|

Revenue Forecast by 2034 |

USD 3.82 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.77 billion in 2024 and is projected to grow to USD 3.82 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

In 2024, North America accounted for the largest revenue share due to rapid adoption of automation across manufacturing, logistics, and healthcare industries.

A few of the key players include ATI Industrial Automation, Inc.; Baumer Group; FANUC CORPORATION; Futek Advanced Sensor Technology, Inc.; Honeywell International Inc.; Infineon Technologies; Omron Corporation; Sensata Technologies, Inc.; TE Connectivity Ltd.; Tekscan, Inc.; SICK AG; and Orbbec 3D Technology International, Inc.

The force/torque sensors segment accounted for a significant revenue share in 2024 due to their critical role in enabling robots to perform delicate and high-precision tasks across industrial and collaborative environments.

In 2024, the industrial robots segment held the largest share in the robotic sensors market, driven by heavy investments in manufacturing automation.